In this Amana Capital review, we will discuss the pros and cons, trading fees, available assets, and trading platforms, customer service, and license information of Amana Capital.

Amana Capital

Best ForForex & CFDs

Recommended ForUAE Based Traders, Algo Traders, Automated Traders

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForForex & CFDs

Recommended ForUAE Based Traders, Algo Traders, Automated Traders

- Trader Level Beginner+

- FX Fees Low

- FX Pairs 54+

- Max Leverage 1:500

-

Web trading platform3.0

-

Fees4.5

-

Mobile App3.0

-

Deposit and withdrawal 2.5

-

Available assets3.2

-

Account opening5.0

-

Education and Research 3.2

-

Support3.5

-

Overall rating3.5

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

About Amana Capital

Amana Capital is a popular Dubai-based forex and CFD trading platform, founded in 2010 with offices in London, Limassol, and Beirut. With Amana Capital, you can trade forex, indices, commodities, cryptocurrencies, and shares CFDs.

License Information

Amana Capital is licensed in the UAE by the Dubai Financial Services Authority (DFSA) and in other countries by the FCA, CySEC, CMA, LFSA, and FSC. Their DMSA license number is F003269 and you can check all license information here.

Is Amana Capital Reliable?

Yes, Amana Capital is a safe, secure, and reliable broker. Multiple organizations regulate them, their website is secured with military-grade SSL encryption technology and the FCA and CySEC offer clients a compensation scheme that protects their invested funds with Amana Capital.

Fees and Commissions

Amana Capital charges spreads, deposit, and withdrawal fees. The spreads on forex, stocks, and CFDs are very low, whilst the spreads on indices and commodities are a bit higher. Overall, Amana Capital’s spreads are competitive and lower than the industry average.

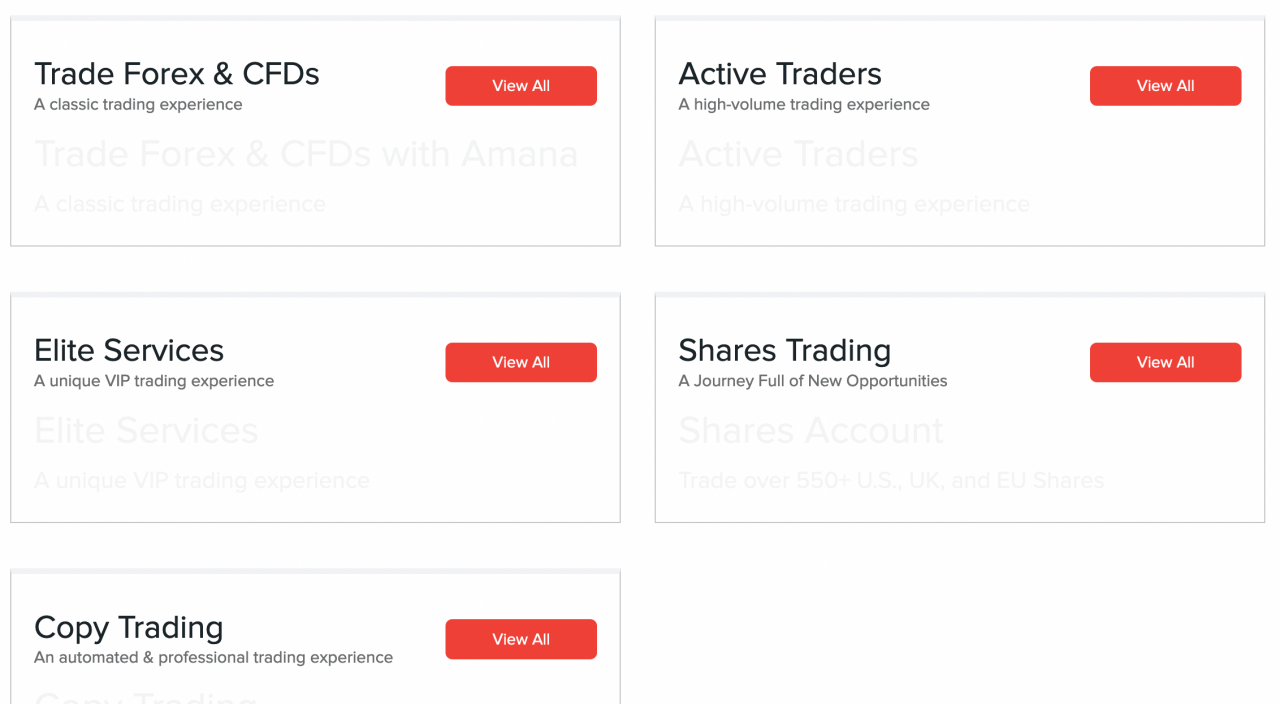

Account Types

Amana Capital has four main account types available: Shares Account, Amana Active, Amana Classic, and Amana Elite. You can open an Amana Classic Account from $50, an Amana Active Account from $25,000, and an Amana Elite Account from $250,000. There is no minimum deposit required for the Shares Account.

Apart from these account types, Amana Capital has special accounts available like swap-free Islamic accounts, joint accounts, and corporate accounts. All accounts are compatible with MetaTrader 4 and 5.

Opening an Account

You open an Amana Capital account by going to their website, filling in your personal details in the signup form, clicking on the confirmation link sent to you by email, verifying your identity by providing a copy of your passport, national ID card, or driver’s license, answering the questions about your trading knowledge and experience, providing details on the source of funds used to deposit, and making your first deposit. Amana Capital will ask UAE traders for their NIN numbers during the account opening process. Opening an account with this broker takes about 30 minutes.

Deposit and Withdrawals

You can fund your Amana Capital account by bank transfer, credit cards, e-wallets, e-currency payment systems, and several other payment methods. Withdrawing money via the same methods is possible. In the table below you can see the available payment methods and their associated banking fees.

Amana Capital Deposit and Withdrawals

| Payment Method | Deposit Fees | Withdrawal Fees |

| Wire transfer | £6 | None |

| Amana Prepaid Card | $3 | 1,5% |

| Credit and debit cards | 1,5% | None |

| Union Pay | None | 0,5% |

| Neteller | 3,9% + $0,29 | 2% max $30 |

| Skrill | 3,9% + $0,29 | 1% |

| E Pay | None | None |

| Perfect Money, Payeer, AdvCash | 5% | None |

| WebMoney | 2,8% | 2,8% |

| Moneta | 4,95% | 4,9% |

| Qiwi | 6,5% | 2% |

| Fast Bank Transfer | 2,5% or $2 | None |

| FasaPay | None | 0,5% max $5 |

Available Assets

With Amana Capital you can trade CFDs on forex, indices, stocks, ETFs, commodities, and cryptocurrencies. They have 64 forex pairs available, 20 indices, 286 stocks and ETFs, 18 commodities, and 4 cryptocurrencies. You are allowed to hedge, scalp, and change leverage levels. In the table below you can see the leverages offered by Amana Capital offered to UAE traders.

Amana Capital Available Assets

| Asset Class | Leverage offered by Amana Financial Services Dubai Limited |

| Forex | 400:1 |

| Gold | 200:1 |

| Other commodities | 50:1 |

| Indices | 200:1 |

| Stocks | 10:1 |

| Cryptocurrencies | 20:1 |

Copy Trading

Amana Capital allows copy trading with ZuluTrade, a third-party social trading platform. With copy trading, you copy other traders’ trades with your own trading account.

Trading Platforms

With Amana Capital you can trade on both the MetaTrader 4 and MetaTrader 5 trading platforms via web trader, desktop trading software, and on your mobile devices. All trading platforms give you access to dynamic charting tools, market research via RiskPulse, trading signals via Autochartist and Trade Captain, an economic calendar, and forex VPS. Amana Capital has educational resources available in the form of trading guides, webinars, and a demo account.

Open Amana Capital Demo Account

Customer Service

Amana Capital has excellent customer support available in English and Arabic that you can contact 24/7 by live chat, email, and by phone. The UAE phone number of Amana Capital is +971 4 276 9525 and their email addresses are support@amanacapital.com and dealing@amanacapital.com.

Amana Capital Review – Our Verdict

Amana Capital is a great broker for UAE traders that offers forex, commodity, stock, ETFs, and cryptocurrency trading at low trading fees with excellent customer service and multiple trading platforms and account types available. We highly recommend UAE traders to trade with this broker and open an account with them.