The cTrader platform integration has gained popularity among UAE forex and CFD traders as it offers access to various investment features, including premium charting tools, copy trading features, automated trading options, and APIs. With the numerous local and offshore brokers in the UAE offering different integration options and conditions, selecting the best forex broker for their needs can be tough.

To guide users confidently through the selection process, we have researched, compared and evaluated the different providers and their services to create a list of top choices. To satisfy the needs of beginners searching for easy-to-use trading features or advanced traders looking for customisation posibilities, our analysis considers spreads & commissions, reliability of connections, availability of currency pairs, demo account availability, customer support, deposit & withdrawals, research & education and regulation.

This guide assesses 54 online brokers available in UAE to help users review and find the top options for their needs. A list of the best cTrader brokers in UAE is shared below, followed by in-depth reviews, comparison and FAQ.

5 Best cTrader Brokers in UAE

- IC Markets – Best For Active Traders

- FXPro – Best For Experienced Traders

- Pepperstone – Top For Professionals

- RoboForex – Ideal For Algorithmic traders

- Axiory – Optimal For Beginners

Top 5 cTrader Brokers in UAE Reviewed

The top brokers in UAE with cTrader platforms integration are reviewed in more detail below.

1. IC Markets – Best For Active Traders

Min Deposit: $200

Fees: 4.7

Assets available: 3.6

Total Fees:

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IC Markets is an ASIC and CySEC-regulated broker operating globally. With IC Markets you can trade forex, CFD, and crypto with up to 1:500 leverage. IC Markets has over 2,000 tradable assets and charges low, floating spreads from 0,0 pips.

IC Markets has multiple trading platforms available and is compatible with MetaTrader, cTrader, myfxbook AutoTrade, and ZuluTrade. Professional traders can open a Raw Spread, Standard or Islamic account at IC Markets, whilst beginners can practice trading with their unlimited demo paper trading account.

You can fund your IC Markets account by bank transfer, credit card, or e-wallets like PayPal at 0% commission and receive access to a free VPS server after opening an account with them.

Pros

- cTrader is available for both web and mobile app

- Social/Copy trading service is available with cTrader

- Competitive trading fees

Cons

- Only Raw Spread account available for cTrader

Key features

- Access to over 2,000 CFDs on stocks, bonds, indices, commodities, forex, and digital currencies

- Islamic swap-free accounts available on request

- Compatible with MetaTrader 4, 5, cTrader, ZuluTrade, and Myfxbook AutoTrade

- Raw spreads from 0,0 pips

- Well-suited for both beginner and experienced traders

- Expert Advisors and other forms of automated trading allowed

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

2. FXPro – Best For Experienced Traders

FxPro is an FCA-regulated forex and CFD broker where retail, professional, and institutional traders can trade forex, futures, indices, shares, metals, and cryptocurrencies with up to 1:30 leverage at low trading fees. FxPro provides access to over 2,100 assets, supports micro lot trading, and has ultra-fast order execution.

Traders can use FxPro’s proprietary trading platform or trade with MetaTrader 4, MetaTrader 5, or cTrader instead. FxPro provides an extensive range of educational material for beginners and daily forex news, all kinds of calculators, and an economic calendar.

For high-frequency traders, FxPro has a free VPS available to run Expert Advisors and other automated trading software on. FxPro has no minimum deposit requirement to open an account and offers an unlimited paper trading demo account for those who want to familiarize themselves with the platform before trading with real money.

FxPro offers 24/7 support by email, live chat, and phone in English, Arabic, and over 20 other languages.

Pros

- cTrader is available for both web and mobile app

- Good choice for automated trading

- Competitive trading fees

- Market depth available

Cons

- Offers fewer CFDs than other trading platforms

Key features

- Provides access to over 2,100 different stock, metal, forex, indices, and crypto CFDs

- Integrated forex technical analysis by Trading Central

- Low, competitive trading fees with no hidden commissions

- Fast order execution with most orders filled within 14ms

- Trade on the go on both Android and iOS devices with the FxPro trading app

- Regulated by the FCA, CySEC, FSCA, and SCB

75.18% of retail CFD accounts lose money

3. Pepperstone Review UAE 2025 – Best Professional Traders

Pepperstone is a trusted Forex and CFD broker well know for its support of multiple copy trading platforms, great variety of tradable assets and a enormous research and education section. The combined offering of cTrader, MetaTrader and various social trading features makes this broker s great fit for copy traders and algorithmic traders.

Pepperstone is available through 24/5 phone and online chat support plus offers an extensive FAQ web section and e-mail.

Pros

- cTrader is available for both web and mobile app

- Competitive trading fees

- Fast trade execution

Cons

- Stock CFDs not available

Key features

- 600 + stocks as CFDs available

- Great variety of trading platforms (MetaTrader + cTrader)

- Multiple advance trading add-ons

- Social trading features

- Competitive pricing for active traders

74-89% of retail CFD accounts lose money

4. RoboForex – Best For Algorithmic traders

RoboForex is an FSC-regulated broker that provides traders access to over 12,000 stocks, futures, indices, cryptocurrencies, and forex pairs. It has multiple trading platforms available like its own proprietary platform RoboForex Terminals, MetaTrader 4, MetaTrader 5, and cTrader.

For traders that only want to trade stocks, RoboForex has the R StocksTrader platform available whilst the broker also provides True ECN and Pro Cent accounts to test Expert Advisors and other automated trading software. For beginner traders, RoboForex has an unlimited free demo account available whilst Islamic traders can open an Islamic swap-free account.

RoboForex allows traders to set the base currency of their account in either EUR, USD, CNY, or GOLD, offers micro trading from 0,01 lot size at tight spreads from 0 pips and guarantees the fastest order execution available to retail traders. The maximum leverage at RoboForex is 1:2000 and all clients get access to a free VPS server.

Apart from all these features, RoboForex doesn’t charge any hidden commissions, allows traders to deposit and withdraw funds without paying any fees, and offers negative balance protection.

The RoboForex customer support is 24/7 available by email, phone, and live chat in English, Arabic, and over 10 other languages.

Pros

- cTrader available for both web and mobile app

- Offers 2 account types for cTrader

- Leverage up to 1:1000 for cTrader accounts

- Trading account minimum initial deposit $10

Cons

- Fewer Forex pairs available on cTrader than other brokers

Key features

- Access to over 12,000 different financial instruments including stocks, commodities, and cryptos

- All new traders receive welcome and profit share bonuses whilst existing traders receive cashback rebates and up to 10% interest on account balance

- Generate trade ideas with forex analysis, forecasts, and an economic calendar provided by RoboForex

- Build your own EA with the R StocksTrader Strategy Builder or connect third-party ones

- Take part in social trading via CopyFX

- Trade on the go on MetaTrader 4, MetaTrader 5, cTrader, or Robo WebTrader on both Android and iOS devices via the RoboForex trading app

79.43% of retail investor accounts lose money when trading CFDs

5. Axiory – Best For Beginners

Axiory is a globally operating MSFC, FCA, and IFSC-regulated forex, CFD, and stock broker that offers traders the opportunity to trade thousands of different financial instruments including stocks, forex pairs, commodities, and precious metals at low costs. Axiory is compatible with MetaTrader 4, MetaTrader 5, and cTrader and provides copy trading services via its recently released Axiory CopyTrade platform.

All traders have access to historical price data of all tradable assets, AutoChartist, Strike Indicator, economic calendars, and custom indicators. For new traders, Axiory has a trading academy available with webinars, how-to guides, and tutorial videos.

Advanced traders can make use of Axiory’s daily market news updates, technical analysis, and Axiory Intelligence, which is a premium signal-providing service. Apart from these tools and features, Axiory offers Islamic swap-free accounts and demo accounts for those who want to familiarize themselves with the trading platform first or trade according to Sharia law.

Axiory allows traders to trade with up to 1:777 leverage, offers negative balance protection, and has a wide range of funding options available. Its flagship product, the MT 5 Alpha account, enables investors to buy stocks via MetaTrader 5 and receive dividend payments into their Axiory brokerage accounts.

Axiory offers 24/7 support by email and live chat in English, Arabic, Russian, Vietnamese, Simplified Chinese, and Russian.

Pros

- cTrader available for both web and mobile app

- Offers 3 account types for cTrader

- Trading account minimum deposit $10

Cons

- Account currency only EUR and USD

Key features

- Access to thousands of financial instruments including stocks, commodities, and forex pairs

- Built-in technical indicators, dynamic charting features, and compatible with EAs

- Deposited funds are held in segregated accounts and insured via an investor compensation scheme

- Managed account services available

- Regular bonuses and promotions for both new and existing traders

How To Select The Ideal Brokers in UAE With cTrader Integration?

Criteria to consider for finding the optimal online broker in UAE with cTrader platforms integration are listed below.

- Regulation

You should only trade with brokers supervised by the DFSA, CySEC, ASIC, FCA, or BaFin. - Available Assets

As a trader, you want to have access to as many asset classes as possible. This allows you to diversify your portfolio and trade all kinds of markets. Most cTrader brokers don’t offer stocks because their clients are mostly forex traders. There are cTrader brokers that offer share trading. - Fees and Commissions

It is important that you choose a cTrader broker with low, competitive fees. Some brokers charge commissions, whilst others charge spreads. Spreads are the difference between the buy and sell price. When a broker advertises with commission-free trading, they usually charge higher spreads than other brokers. - Trading Tools and Features

As a trader you should always use trading tools and features available to you. This gives you a bigger chance of beating the markets. Most cTrader brokers offer trading tools and features like market analytics and plugins. Pepperstone offers the Smart Trader Tool and AutoChartist plugin for example. This provides you with real-time trading patterns. There are many users offering indicators and tools via the cTrader trading community. Most of these trading tools are free to use, but some cost money. We recommend trying out user-created trading tools on a demo account first. - Copy and Automated Trading

The cTrader trading platform allows you to use automated and copy trading software and services. You can develop your own automated trading robots via C# API scripts. It is also possible to develop custom indicators. cMirror is cTrader’s Copy platform and allows traders to become signal providers. Other traders can then follow and copy their trades from their own trading accounts. - Customer Service

You want your cTrader broker to have excellent customer service. If you have any problems with your trading account, you get in touch with them. Most brokers offer 24/7 or 24/5 support via live chat and email.

The Top cTrader Brokers Compared

Key features of online brokers offering cTrader platform integration are compared in the table below.

| Broker | Available Assets | Server Connection Reliability | Commission & Fees | Trade Execution Speed | Demo Account | Deposit & Withdrawals | Customer Service | Regulators |

|---|---|---|---|---|---|---|---|---|

| IC Markets | Forex, CFDs, Commodities, Indices, Stocks, Bonds, Futures, Cryptocurrencies | Highly Reliable | Low spread, commission from $3.50 per lot | Fast | Available | Bank Transfer, Credit Card, PayPal, Skrill, Neteller, etc. | Live Chat, Email, Phone | ASIC, CySEC, FSA |

| FXPro | Forex, CFDs, Stocks, Indices, Futures, Cryptocurrencies | Highly Reliable | Spread + commission, commission from $4.5 per lot | Fast | Available | Bank Transfer, Credit Card, PayPal, Skrill, Neteller, etc. | Live Chat, Email, Phone | FCA, CySEC, FSCA, SCB |

| Pepperstone | Forex, CFDs, Cryptocurrencies, Commodities, Indices, Stocks | Highly Reliable | Low spread, commission from $3.76 per lot | Fast | Available | Bank Transfer, Credit Card, PayPal, Skrill, Neteller, etc. | Live Chat, Email, Phone | ASIC, FCA |

| RoboForex | Forex, CFDs, Stocks, Indices, Cryptocurrencies | Highly Reliable | Varies depending on account type, commission from $2 per lot | Fast | Available | Bank Transfer, Credit Card, PayPal, Skrill, Neteller, etc. | Live Chat, Email, Phone | IFSC, CySEC |

| Axiory | Forex, CFDs, Metals, Energies, Indices | Highly Reliable | Low spread, commission from $6 per lot | Fast | Available | Bank Transfer, Credit Card, Skrill, Neteller, SticPay, etc. | Live Chat, Email, Phone | IFSC |

Advantages and Disadvantages of cTrader platform

cTrader is one of the most popular trading platforms, in line with MetaTrader 4 and MetaTrader 5. Not all brokers offer cTrader integration, and from the cTrader brokers that offer it, not all offer the right features. To get the most out of cTrader it is mandatory that you use it in conjunction with a good cTrader broker.

The cTrader trading platform is designed by Spotware and is compatible with Windows, Mac, Android, and iOS operating systems. This means that you can use cTrader on your smartphone and tablet.

cTrader is a solution for brokers that want to offer their clients forex, CFD, and spread betting. The cTrader platform contains many trading features and tools for both beginners and experienced traders. The most popular tools cTrader offers are the cTrader Copy investment service, cTrader Automate algorithmic trading package, and the cTrader FIX API.

- Simple to understand

- Tabs and features easy to understand

- More than 20 languages supported

- Accessible from any multiple platforms, desktop, mobile, etc…

- Demo accounts for learning

- Stop loss orders slip

- Unreliable API

- Better alternatives from brokers

What Are The Main cTrader Features?

- Access to cTrader Trade – This is a premium charting and manual trading platform. It offers advanced charting tools, order types, and fast order execution.

- 54 Different timeframes which are viewable in Candlesticks, Bars, HLC, Lines, Heikin Ashi, Dots, Renko, Range, and tick charts.

- Over 70 built-in technical indicators.

- cTrader Copy investment service. Follow other traders and copy their trading strategies.

- cTrader Automate – With cTrader Automate you can write automated trading strategies or deploy trading scripts from others.

- cTrader Open API – This is a free API you can use to build upon the cTrader web and mobile infrastructure.

- cTrader FIX API – Communicate directly with the cTrader server for super-fast execution speeds.

- Access to market sentiment information, live news feeds, market depth information, and trade statistics.

- cTrader supports traders with numerous languages, more than 20 supported so trade in any language you want.

- Low latency, does not wait to connect with servers, trades executed fast.

- cTrader supports bots across asset classes, trades automatically in macro asset classes like indices, bonds, ETFs, and more.

What Are The Differences Between cTrader and MetaTrader 4?

Most new traders use MetaTrader 4 and professional traders use cTrader, which has more advanced charting and market depth features than the MT4 trading platform. In the table below you find the most important differences between the two trading platforms.

cTrader and MetaTrader Comparison

| Feature | cTrader | MetaTrader 4 |

| Order Execution Model | ECN+STP | ECN |

| Trader community | Small | Big |

| Amount of EA’s | 300+ | 15,000+ |

| Number of technical indicators | 860 | 7000+ |

| Programmed in | C# | MQL4 |

Getting Started with the Best cTrader Broker in the UAE

Now that you know what to look for when choosing the best cTrader broker it is time to get started. Follow the steps below to open an account at IC Markets, the best overall cTrader broker.

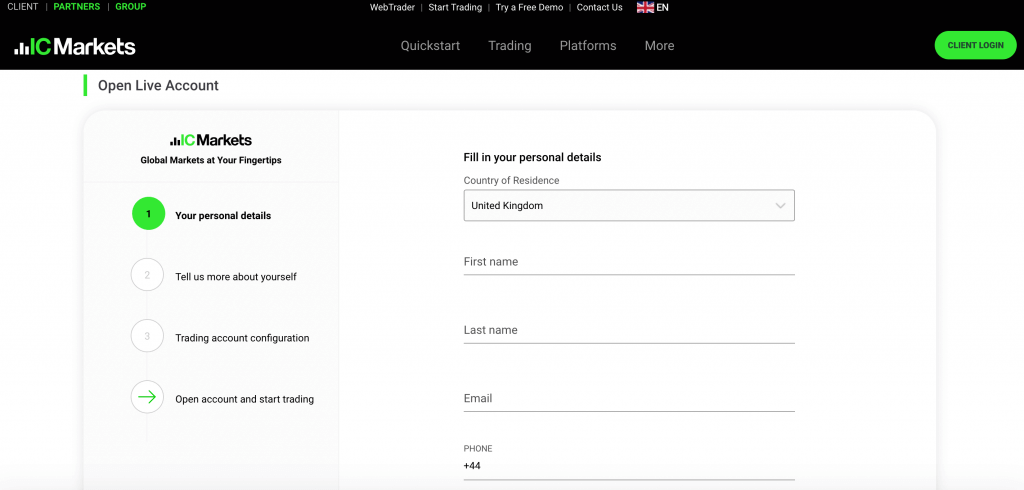

1. Register

The first step for traders in the United Arab Emirates is to open an IC Markets account. Navigate to the broker’s official website, click on the sign-up button, submit your personal details, and click on ‘Create New Account.’

2. Verify your Identity

IC Markets is a trustworthy broker. It follows strict Know Your Customer (KYC) rules and has licenses from industry-leading regulators. All UAE traders need to pass this account verification process. A copy of a valid I.D., like a passport or driver’s license, is necessary.

3. Funding your account

After having passed account verification, you have to make your first deposit. UAE traders have different funding options, including bank transfers and credit card deposits.

4. Download cTrader

Download cTrader from your IC Markets secure client portal area. Once you have done this, log in to cTrader with the credentials IC Markets provides you.

5. Trade

You can now trade the markets with cTrader. Search for the asset you want to trade and open your first position by selecting an order type and entering the amount you want to invest.

Conclusion

With the various online brokers in UAE offering different cTrader integrations at different conditions, finding the ideal choice for individual needs can be tough. Comparing and evaluating the services of different providers requires time and effort.

This guide does the hard part by evaluating top brokers and their services. The results of our analysis of the best cTrader brokers in UAE are wrapped up in the table below.

| RANK | BROKER | PLATFORM SCORE | BEST FOR | WEBSITE |

| #1 | IC Markets | 4.0 / 5 | Active Traders | Official website |

| #2 | FXPro | 3.8 / 5 | Experienced Traders | Official website |

| #3 | Pepperstone | 4.8 / 5 | Professional Traders | Official website |

| #4 | RoboForex | 3.2 / 5 | Algorithmic traders | Official website |

| #5 | Axiory | 4.6 / 5 | Beginners | Official website |

Based on the findings from our review and comparison, IC markets is the top rated brokers for trading with cTrader platform in UAE. It offers low spreads and commissions, high trade executions speed and reliability, wide range of currency pairs and automated trading capabilities.

FAQ

Is cTrader better than MetaTrader 4 or 5?

Most experienced traders prefer cTrader over MetaTrader 4 and 5 because it offers more advanced charting features and trading tools.

What is the difference between cTrader and MetaTrader (MT4 and MT5)?

While cTrader has a more intuitive trading interface, Level II Market Depth and a wider range of order types of trade execution, the MetaTrader suite offers better EA’s for algorithmic trading, wider range of third-party integrations and add-ons. Both platforms offer a great variety of charting tools and indicators.

Can I switch from cTrader to MetaTrader or vice versa?

Switching from MetaTrader to cTrader and vice versa is only possible on online brokers that offer access to both trading platforms. These brokers include Pepperstone, Avatrade and IG.

Is cTrader available for free?

Yes, cTrader is free of charge for the trader. However, the broker providing access to cTrader might charge fees in the form of spreads, commissions and non-trading fees for trades executed on cTrader.

Is cTrader legal in UAE?

Yes, the cTrader platforms is legal and allowed to trader and investors in the UAE.

Can beginners use cTrader?

cTrader is recommended for beginners because of its intuitive trading interface, wide range of tutorials and demo account testing capabilities.

Is cTrader a good trading platform for automated trading?

The cTrader cAlgo tools allows users to create (using the C# language) and implement automated trading strategies (robots) to the cTrader platform. This makes cTrader a great platforms for automated trading.

Is cTrader available for mobile?

Yes, cTrader is available for mobile devices running on iOS and Android.

Does cTrader allows copy trading?

Yes, cTrader allows access to copy trading through its cTrader Copy feature.

Are cTrader market depth data reliable?

cTrader provides market depth data through Level II Market Depth, which provider market data in real time and is therefore considered reliable.

What are technical analysis tools available on cTrader?

Technical analysis tools available on cTrader include charting tools ( candlestick, bar, line charts, multiple time frames), 60 technical indicators (Bollinger Bands, MACD, Moving Averages, RSI), drawing tools, price alerts, market depth (Level II) and detachable charts.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.