This guide helps users find the best UAE platforms for trading with gold. Various reliable and unreliable online brokers in the UAE offer gold investment options. It is often hard to separate the “wheat from the chaff” when choosing the suitable platform for certain individual needs and goals.

Missing out on research and comparing different brokers could impact investors to select a platform with limited trading tools, availability of assets, transparency, or regulation.

This guide assesses 43 online brokers in UAE for users to review and find the ideal platform for their needs. To help them make an informed decision, a list of the best gold trading platforms in UAE is shared below.

This guide assesses 43 online brokers in UAE that offer trading with gold. To help users make an informed decision and find the ideal option for their needs and goals, the best gold trading platforms are listed, reviewed and compared considering number of gold markets, customer support, gold trading fees, mobile trading apps, deposits & withdrawals, research & education on gold, regulation, and islamic account availability

7 Best Gold Trading Platforms in UAE

- eToro – Best For Beginners

- ActivTrades – Choice of trading platforms

- IC Markets – Lowest fee platform for gold trading

- Pepperstone – Best For Advanced traders

- Interactive Brokers – Ideal for active traders

- IG Trading – Optimal for Mobile trading

- AVAtrade – Top for Research and Education

Top 7 Gold Trading Platforms in UAE Reviewed

7 Online brokers with the highest rated platforms for gold trading in UAE are reviewed below.

1. eToro Review UAE 2025 – Best For Beginners

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is a reputable global brand and industry leading broker for copy trading. Their robust and cutting edge copy trading platform and social trading features allow users to copy trades and portfolios from professional traders and investors.

As a CFD multi asset broker, eToro allows users to trade on over 3075 different symbols including stocks, forex, cryptos, indices and commodities. Trading spreads are wide, deposits are free and account minimum is low. There are conversion and inactivity fees. eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Their customer support is available through email and live chat in Arabic and English.

eToro is a well established market maker broker with a clean history record, regulated by top tier regulators.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Pros

- Social trading service (Gold traded by following successful traders)

- Gold traded as CFD and as ETF

- Good Research and Educational tools for Gold trading, helps for less experienced traders

Cons

- Gold CFD trading fees are higher than competitors

Key features

- Sophisticated social-copy trading features

- Multiple different payment options

- Crypto exchange and brokerage services on the same dashboard

- Super fast registration and KYC on-boarding process

- Zero commission stock trading

- Great ease of use level

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. ActivTrades Review UAE 2025 – Choice of trading platforms

Min Deposit: $0

Fees: 3.6

Assets available: 3.8

Total Fees:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ActivTrades is a multi-asset broker that lets users trade or invest in over 1,000 CFDs, gold, stocks, forex pairs, options, and futures. ActivTrades is one of the few brokers that allows a $0 minimum deposit and offers trading in various assets, including Stocks, Forex, ETFs, Commodities, Cryptocurrencies, and Bonds.

ActivTrades is a UK CFD and forex broker that has won over 65+ global awards. With over 20+ years of experience and over 1624 CFDs available, ActivTrades is among the top. ActivTrades is regulated by the Financial Conduct Authority (FCA), providing traders with high financial integrity and transparency standards.

ActivTrades offers traders access to popular platforms like MetaTrader 4, MetaTrader 5, ActivTrader, and Tradingview. It also provides different types of accounts for different needs, such as professional accounts, individual accounts, demo accounts for beginners, and Islamic accounts.

ActivTrades has an award-winning support system for traders, available 24/7 in English via live chat, free calls, and messages. The UK customer support number is +44 (0) 207 6500 567, +44 (0) 207 6500 500.

| Broker | IC Markets | ActivTrades | Interactive Brokers | eToro | AvaTrade |

| Gold Trading Options | CFDs | CFDs | Spot, Futures, CFDs, Options | CFDs | CFDs |

| Trading Platform(s) | MT4, MT5, cTrader | MT4, MT5, TradingView, ActivTrader | TraderWorkstation, Client Portal, IBKR Global Trader, IBKR Mobile | eToro (Proprietary) | MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, AvaSocial, AvaMac |

| Gold CFD Fees | 4,1 pips | 3,4 pips | $0,005 per contract | 4,5 pips | 3,9 pips |

| Research Tools | Market Insights, Daily News | Educational Webinars, Seminars, Economic Calendar, Market Analysis | Market Insights, Daily News, Webinars | Market Insights, Daily News | Market Insights, Daily News |

| Customer Support | 24/7 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone |

Pros

- Provides seamless gold trading

- Beginner-friendly and feature-rich trading platform

- Excellent education and research materials

Cons

- Customer care is not available in Arabic

- Currency Conversion Fee

Key features

- Gold trading in the form of CFDs

- $0 minimum deposit requirement for live accounts

- MetaTrader 4, MetaTrader 5, ActivTrader, and Tradingview trading platforms

- Zero withdrawal fee

- Access to thousands of other financial instruments

- Various materials and learning sources

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

3. IC Markets – Best fees for gold trading

Min Deposit: $200

Fees: 4.7

Assets available: 3.6

Total Fees:

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IC Markets is an ASIC and CySEC-regulated broker operating globally. With IC Markets you can trade forex, CFD, and crypto with up to 1:500 leverage. IC Markets has over 2,000 tradable assets and charges low, floating spreads from 0,0 pips.

IC Markets has multiple trading platforms available and is compatible with MetaTrader, cTrader, myfxbook AutoTrade, and ZuluTrade. Professional traders can open a Raw Spread, Standard or Islamic account at IC Markets, whilst beginners can practice trading with their unlimited demo paper trading account.

You can fund your IC Markets account by bank transfer, credit card, or e-wallets like PayPal at 0% commission and receive access to a free VPS server after opening an account with them.

Pros

- MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader platforms are available for Gold trading

- Leverage up to 1:200 for Gold; tight spreads

- Offers trading signals for Gold market

Cons

- Gold traded only as CFD

Key features

- Access to over 2,000 CFDs on stocks, bonds, indices, commodities, forex, and digital currencies

- Islamic swap-free accounts available on request

- Compatible with MetaTrader 4, 5, cTrader, ZuluTrade, and Myfxbook AutoTrade

- Raw spreads from 0,0 pips

- Well-suited for both beginner and experienced traders

- Expert Advisors and other forms of automated trading allowed

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

4. Pepperstone Review UAE 2025 – Best For Advanced Traders

Pepperstone, an Australian-based broker, is regulated by the Australian Securities and Investment Commission (ASIC) and the UK’s Financial Conduct Authority (FCA). They have professional indemnity insurance through Lloyd’s of London.

Their $0 minimum deposit and the various Trading platforms—MT4, MT5, TradingView, cTrader, and Pepperstone Trading platform —have made it the best choice for advanced traders.

Pepperstone’s cTrader platform offers four basic order types. You can attach “take profit” and/or “stop loss” orders to these. Plus, there’s an option to make the stop loss a trailing stop loss. However, it doesn’t provide a guaranteed stop-loss option.

Pros

- Gold traded as CFDs

- Low trading fees on gold CFDs

Cons

- No derivative trading for gold

Key features

- Margin loan rates on stocks of 1.3%

- Advanced order types, tools, and features 24/7 Live Chat, Email, Phone customer support

74-89% of retail CFD accounts lose money

5. Interactive Brokers Review UAE 2025 – Best for active traders

Interactive Brokers is a highly trusted global broker with a well-rounded offer of tradable markets, great educational content and sophisticated order type configuration. It is a high trusted and well capitalize company with an industry leading trading platform, a competitive fee structure and great global market access. Their low entry level and the Global Trader platform, which is intuitive and easy to use trading station, make this broker s great choice for beginners and advanced forex traders.

Professional and seasoned traders will appreciate the great selection of advanced trading tools and order type configurations available on their proprietary Trader Workstation desktop platform (TWS).

Pros

- Gold traded as futures contract, options, and ETF

- Low trading fees on gold derivatives

- Over 100 different order types and algos available for gold trading

Cons

- Spot gold trading only available to US citizens

Key features

- Margin loan rates on stocks of 1.3%

- Access to 135+ global markets

- Advanced order types, tools and features

- Access to frictional shares

- Lowest commissions in the industry

63.3% of retail investor accounts lose money when trading CFDs with IBKR.

6. IG Trading – Best for Mobile trading

IG is one of the largest and most popular regulated forex and CFD brokers globally. Traders can trade thousands of markets using IGs trading platforms like L2 Dealer and ProRealTime or connect their IG brokerage account with MetaTrader 4.

IG offers educational material, daily market update videos, and both technical and fundamental analysis case studies. If you are new to online trading, you can practice with IG’s free demo paper trading account first. For experienced traders IG offers spread rebates and access to more advanced financial instruments like digital options.

Pros

- MetaTrader 4 (MT4) and ProRealTime (PRT) trading platforms are available for Gold trading

- Gold traded as futures contract, CFDs and ETFs

- Good trading fees on Gold CFDs and Gold Futures

Cons

- Higher margin requirements for retail CFD and futures trading on Gold

Key features

- Trade over 17,000 markets with a broker that has been in business since 1974

- Access to Turbo24s, and CFDs and options on forex, indices, crypto, stocks, and commodities

- Unlimited free demo paper trading account

- Advanced research and analysis tools like L2 Dealer and ProRealTime

- Access to APIs to set up Expert Advisors and other automated trading software

- Receive trading signals and alerts to find excellent entry and exit points

75% of retail CFD accounts lose money

7. AvaTrade Review UAE 2025 – Best for Research and Education

AVAtrade is a well trusted global online broker for forex and CFD trading. Their multi-asset trading platform and mobile trading app enable traders to access 1365+ tradable symbols overall, including 1200+ CFD’s, major currency pairs with low forex spreads and premium options.

Beside their proprietary platform AVAtradeGo and MetaTrader, AVAtrade has great selection of copy trading solutions including ZuluTrade, DupliTrade and AVAsocial.

Account opening is fast, deposits and withdrawals are free of charge. The minimum deposit is $100.

Choose AVAtrade if you are a beginner or semi advanced forex trader, looking to trade major forex currency pairs, options or CFDs as stocks, cryptos, indices or commodities with premium services.

Pros

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms are available for Gold trading

- Gold traded by using social trading services (ZuluTrade, DupliTrade)

- Low spreads on Gold CFDs

Cons

- Gold only traded as CFDs

Key features

- Access to 1250 CFDs and 44 forex options

- Excellent copy trading features

- Advanced mobile trading app (AvaOptions)

- Industry average pricing

- Perfect for casual and advanced traders

- Access to the full meta trader suite

71% of retail CFD accounts lose money

Top Brokers For Gold Trading Compared

Key features of online brokers with the highest ranked gold trading platforms are compared below.

| Broker | Gold Trading Options | Trading Platforms | Research & Analysis Tools | Customer Support |

| eToro | Gold trading through CFDs and ETFs | eToro web and mobile | eToro Trading School, Market Analysis | 24/5 Live Chat, Support Ticket |

| ActivTrades | Gold CFDs | MT4, MT5, TradingView, ActivTrader | Educational Webimars, Seminars, Economic Calendar, Market Analysis | 24/5 Live Chat, Email, Phone |

| IC Markets | Gold (spot and futures) trading on standard and micro contracts | MetaTrader 4/5, cTrader | Trading Central, Economic Calendar, Forex News | 24/7 Live Chat, Email, Phone |

| Pepperstone | Gold CFDs | MT4, MT5, TradingView, cTrader, Pepperstone Trading platform | Educational Webimars, Economic Calendar, Market Analysis | 24/7 Live Chat, Email, Phone |

| Interactive Brokers | Gold spot, futures, and options trading | Trader Workstation, Client Portal, IBKR Global Trader, IBKR Mobile | Wide variety of tools, including PortfolioAnalyst and Risk Navigator | 24/5 Live Chat, Email, Phone |

| IG Trading | Spot gold and gold futures trading, options and ETFs that track gold prices | IG Trading platform, ProRealTime, L2 Dealer, MetaTrader 4 | IG Academy, Technical Analysis, Fundamental Analysis | 24/5 Live Chat, Email, Phone |

| AvaTrade | Spot gold trading and gold futures trading | MetaTrader 4/5, AvaTradeGO, AvaOptions, Avasocial, DupliTrade, Capitalise.io | AvaTrade Education, Economic Calendar, Market Analysis | 24/5 Live Chat, Email, Phone |

| Broker | IC Markets | ActivTrades | Interactive Brokers | Pepperstone | eToro | AvaTrade |

| Gold Trading Options | CFDs | CFDs | Spot, Futures, CFDs, Options | CFDs | CFDs | CFDs |

| Trading Platform(s) | MT4, MT5, cTrader | MT4, MT5, TradingView, ActivTrader | TraderWorkstation, Client Portal, IBKR Global Trader, IBKR Mobile | MT4, MT5, TradingView, cTrader, Pepperstone Trading platform | eToro (Proprietary) | MetaTrader 4, MetaTrader 5, AvaTradeGO, AvaOptions, AvaSocial, AvaMac |

| Gold CFD Fees | 4,1 pips | 3,4 pips | $0,005 per contract | 1.5 pips | 4,5 pips | 3,9 pips |

| Research Tools | Market Insights, Daily News | Educational Webimars, Seminars, Economic Calendar, Market Analysis | Market Insights, Daily News, Webinars | Market Insights, Daily News, Webinars | Market Insights, Daily News | Market Insights, Daily News |

| Customer Support | 24/7 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone | 24/5 Live Chat, Email, Phone |

How To Find The Best Gold Trading Platforms in UAE?

Criteria that help finding online brokers with the best suited gold trading platforms are listed below.

- Assets: You can trade gold as CFDs, ETFs, gold futures and physical gold (gold bullions, bars and coins) . We have considered how many options for gold trading is offered by each broker.

- Mobile Trading: Brokers offer mobile trading for spot gold and other commodities. Make sure your broker’s mobile platform has the trading tools you need.

- Fees: Trading fees for precious metals vary depending on the broker. Getting the best rates means more profit from winning trades. Brokers that offer 0% trading fees are the best, as long as the spread is competitive.

- Trading platforms: Commodity traders need fast execution, and a breaking news feed. Historical data should also be easy to access, especially if your broker uses a proprietary trading platform.

- Deposit & Withdrawal: Deposits and withdrawals need to be easy and cheap. Don’t choose a broker that charges to receive or send money. Bank fees may apply, but you can opt for an online payment method that is free.

- Regulation: Brokers regulated by the FCA, CySEC, and the ASIC deliver top-notch service. There are loads of brokers that are compliant in leading markets to choose from in the UAE.

- Research & Education: Trading gold is not for noob traders, and the gold markets are volatile. Anyone who isn’t experienced in the gold markets should choose a broker with good educational resources.

- Customer support: Choose a broker that has customer support staff in the language and timezone you need. Even better if it offers support 24/7.

Quick Facts About Gold?

Gold is a shiny metal made from the chemical Aurum that has been precious to mankind for a long time. It is one of the world’s most expensive metals associated with wealth and beauty.

Learn What Gold Investing And Trading Are

Gold is one of the oldest investment asset classes; maybe it was one of the few options available to your great-grandfathers and mine, too. Gold has been both actively traded and a good investment asset. Gold investing and trading are two different ways to take a position on the future price movement of gold markets.

You can trade the gold or use it for investment purpose also. When you invest in gold, you’ll take ownership of the asset upfront and profit if the precious metal rises in price, this is good if you want something tangible and hope its value goes up. When you trade gold, you’re taking a position on the underlying price rising or falling, meaning you won’t be taking ownership of the asset itself.

There are various gold assets you can choose to trade or invest in:

Gold Bullion: I like gold coins as a collectible; they work for both my hobby and investment. Physical gold in the form of coins or bars, often held as a value store by individuals and banks, is known as gold bullion. However, the high costs of safekeeping and insurance can make it less attractive to active investors.

Spot Gold: If you don’t want to own physical gold, you can trade it at a spot price. The spot price of gold is how much it would cost to buy upfront or on the spot. It is usually the price of one troy ounce of gold.

Gold Futures: These is mainly an instrument for traders. I use it often for trading purpose. These contracts allow you to agree on a price to trade gold at a future date, it is a derivative of the gold. They are standardized in quality and quantity, but their prices fluctuate with the market.

Gold Options: Similar to futures, options give you the right, but not the obligation, to buy or sell gold at a future date. ‘Call options’ allow you to buy, while ‘put options’ allow you to sell. As I said, for the futures, options are also the derivative of the gold spot.

Gold ETFs: Understand it as a simple group of stocks related to gold mining, refining, and production. ETFs are investing instruments; investing in an ETF gives you broader exposure to the gold market, so instead of investing just in gold, you can diversify with these gold-related companies, which will be directly affected by the gold price. ETFs are passive investments that replicate market returns rather than seeking to outperform them.

Gold Stocks: Trading on or investing in stocks can be a great way to get indirect exposure to gold. This can include elements of the industry like mining, production, and sales. It’s important to note that gold stocks may not always follow the direct movements of gold due to other influencing factors in the market.

Understand what moves the price of gold.

The price of gold is determined by supply and demand, just like any other asset. There are a huge range of factors that can impact the market price, including:

Global demand

Since the 1970s, the demand for gold has quadrupled every year, raising the price. This is because gold is widely used for jewelry technology and is even stored by countries and investors as a valuable asset. In fact, half of all the gold demanded globally goes towards jewelry, making around 50%, with another big chunk (around 29%) being bought by large investment funds. Interestingly, a lot of this demand comes from the growing middle class in places like India, China, and Southeast Asia.

Mining production

There’s a limited amount of gold on Earth, and most of it has probably already been mined. Production declined by approximately 26% between 2011 and 2019 because companies cut down on exploration to preserve cash.

To find new sources, scientists are creating and using new technologies to detect hidden gold deposits and even exploring space mining! Even though new gold is limited, all the gold ever mined is still around. A lot of it gets recycled to meet the ongoing demand. If more and more people demand gold (demand rises) and less new gold is found (supply falls), the price goes up.

Interest rates

Interest rates play a very important role in every industry, and so does gold, too. When interest rates go up, people tend to invest in things like stocks and bonds that offer a return on their money. This leads to less demand for gold, pushing its price down. Conversely, when rates fall, the price of gold rises as economic uncertainty causes investors to turn to gold as a safe haven to protect their wealth.

The US dollar

The relationship between gold and the US dollar is a bit complex but usually inverse. When the dollar weakens, investors might buy gold as an alternative, causing the price of gold to rise. A weaker dollar can also make gold more affordable for people using other currencies, further increasing demand.

Financial stress and political insecurities

In times of financial crisis or political instability, gold is often seen as a safe investment. This is because gold tends to hold its worth even when markets tumble, unlike stocks or other assets that can lose value. I have seen the price of gold not getting hurt very much over the years. For Example, during the early months of 2020, gold prices jumped due to fears surrounding the COVID-19 pandemic and its impact on the economy.

Gold as a safe haven

Gold is not an aggressive investment. You cannot expect huge returns from it, so its downside is capped too. Investors often rely on gold during uncertain economic or political times. They might use it as a hedge against inflation (rising prices) or a weakening currency. However, too many investors jumping on the gold bandwagon could create a price bubble. This bubble could burst and send gold prices crashing, so some investors choose to spread their investments around or use tools to manage their risk.

Things You Should Consider Before Trading Gold

You should know that gold investments are speculative, have a bad long-term performance, and that you shouldn’t invest in them because they are easy to understand. All assets including gold are volatile. There are assets that out-perform gold. Investing in new technologies like cryptocurrencies can be more profitable than gold.

Long-Term Gold Investing

You should invest in gold over the long-term as a hedge against inflation and to preserve your wealth. Gold doesn’t out-perform other asset classes but is a storage of value. Unlike currencies that are subject to inflation, gold keeps its value. You can diversify your portfolio by investing in gold along stocks, cryptocurrencies, and other financial instruments.

Short-Term Gold Investing

You should invest in gold over the short-term to profit from its price movements. Gold doesn’t generate dividend or interest like stocks.

Risks of Investing in Gold

The risks of investing in gold are security and purity concerns, fees, and not earning passive income. When you invest in physical gold you don’t know its purity and thieves can steal it. Commissions on gold are high, especially when you buy gold end products. Gold doesn’t generate a passive income like investing in dividend stocks, peer-to-peer lending, and other forms of investing do.

Tax Rules on Gold Investments in the United Arab Emirates

Dubai charges 5% VAT on gold, which is the lowest tax rate on gold worldwide. For this reason, people call Dubai the city of gold. You don’t have to pay any capital gains tax when investing in gold stocks, gold ETF’s, or other forms of ‘paper gold’.

Getting Started with Trading on Gold Trading Platforms in UAE

You get started with trading on gold trading platforms in the United Arab Emirates by opening a gold trading account, verifying your identity, depositing funds into your account, and opening your first gold trade.

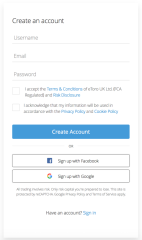

- Opening an eToro Gold Trading Account

You open an eToro gold trading account by going to the eToro website, clicking on ‘Sign Up’, and filling in your personal details.

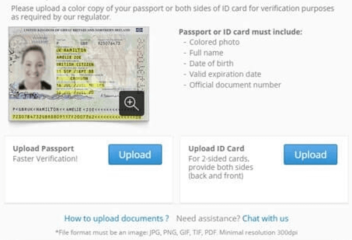

- Verifying Your Identity

All traders will need to verify their identity before they can trade gold at eToro. You do this by uploading a photo of your passport, national ID card, or driver’s license.

- Depositing Funds to Trade Gold

You will need to deposit funds into your gold trading account at eToro before you can start trading. eToro has multiple banking options available like credit/debit cards, PayPal, and bank transfers. - Open a Gold Trade

Search for ‘SPDR’ or ‘GLD’ in eToro’s asset search bar to find all available gold investment options, select one, click ‘Trade’, and ‘Open Position’ to open a gold trade. A pop-up will show, where you fill in the amount you want to invest, choose whether you want to go long or short (buy/sell), and set your risk parameters.

Conclusion

The increasing number of online brokers in UAE offering different platforms and features makes it hard to find the ideal option for individual needs. Reviewing and evaluating the services of numerous providers requires time and expertise.

This guide helps users to make the optimal selection for their investment goals by comparing and evaluating top providers. The results of our analysis of the best gold trading platforms in UAE are wrapped up in the table below.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

| RANK | BROKER | PLATFORM SCORE | BEST FOR | WEBSITE |

| #1 | eToro | 4,9/5 | Beginners | Official website |

| #2 | ActivTrades | 4,9/5 | Choice of trading platforms | Official website |

| #3 | IC Markets | 4,8/5 | Low fees | Official website |

#4 | Pepperstone | 4,7&5 | Advanced traders | Official website |

| #5 | Interactive Brokers | 4,9/5 | Active traders | Official website |

| #6 | IG Trading | 4,4/5 | Mobile trading | Official website |

| #7 | AVAtrade | 4,9/5 | Research and Education | Official website |

FAQ

How to trade gold in the UAE?

There are different ways to invest in gold in UAE including physical gold, gold ETFs and gold futures contracts.

What are the biggest gold exchanges in UAE?

The biggest gold exchanges in UAE include Dubai Gold & Commodities Exchange (DGCX), Dubai Multi Commodities Centre (DMCC), Dubai Gold Souk and the Abu Dhabi Securities Exchange (ADX).

Are profits made with gold trading and investing taxed in UAE?

Profits of UAE citizens made with gold trading and investing are subject to 0% income and corporate tax in the UAE.

How much should I invest in gold as a beginner?

There is no general rule on how much beginners should invest in gold. A typical rule of thumb recommended by financial advisors advise is to invest a maximum of 10% of their net worth.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.