This guide helps users to find the best MT4 forex brokers in UAE. MetaTrader 4 is a popular trading platform among UAE retail and institutional forex traders because of its advanced charting features, multiple order types, range of custom indicators and automated trading capabilities. Due to its popularity, there are various online brokers with MT4 platform integration, making it tough for traders to select the ideal provider for their trading goals and preferences.

By conducting proper research, comparison and background checks on different providers, traders can avoid selecting a broker with limited customisation options, charting features, order execution options and trading tools.

This guide assesses 78 online brokers in UAE for users to review and find the ideal provider for their needs. To help them make an informed decision, a list of the best MT4 forex brokers in UAE is shared below, followed by detailed reviews and comparisons.

Best MetaTrader 4 Brokers in UAE

- Capital.com – Best for Mobile Trading

- AVAtrade – Ideal For Forex and CFDs

- IG Trading – Optimal For Beginners

- IC Markets – Best Suited For Active Traders

- Swissquote – Best For Investors

Top MT4 Forex Brokers in UAE Reviewed

The 5 highest rated online brokers in UAE with MT4 platform integration are reviewed below.

1. Capital.com Review – Best for Mobile Trading

Min Deposit: 20 USD/EUR/GBP or 80 AED (bank cards)

Fees: 4.8

Assets available: 4.7

Total Fees:

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

Capital.com is a top choice for traders looking for a discount broker with great educational content and resources, advanced research tools and a premium trading interface. They offer a wide range of tradable assets including CFDs on cryptos, stocks, indices, commodities and forex pairs.

Founded in 2016, Capital.com is an international fintech company which has group of entities authorised and regulated by the Financial Conduct Authority (“FCA”), the Australian Securities and Investments Commission (“ASIC”), the Cyprus Securities and Exchange Commission (“CySEC”), and the Securities and Commodities Authority (“SCA”) in the UAE. It does not operate a bank and is not publicly traded.

Choose Capital.com if you are looking for a great mobile trading experience, professional web trading interface, day trading features. Beginner traders will like the low minimum deposit ($20), industry leading commission structure, and award winning education section.

Pros

- Wide choice of trading instruments for MT4

- MT4 available for mobile and web app

- Fast trade execution with MT4 accounts

Cons

- Two-step (safer) login only available on mobile and web platform

Key features

- Access to 4.100 trading instruments

- High quality research and educational content

- Patented AI trade bias system

- $20 minimum deposit

- No inactivity fees

CFD trading carries risk. Capital.com is regulated by the Securities and Commodities Authority.

2. AvaTrade Review UAE 2025 – Best For Forex and CFDs

AVAtrade is a well trusted global online broker for forex and CFD trading. Their multi-asset trading platform and mobile trading app enable traders to access 1365+ tradable symbols overall, including 1200+ CFD’s, major currency pairs with low forex spreads and premium options.

Beside their proprietary platform AVAtradeGo and MetaTrader, AVAtrade has great selection of copy trading solutions including ZuluTrade, DupliTrade and AVAsocial.

Account opening is fast, deposits and withdrawals are free of charge. The minimum deposit is $100.

Choose AVAtrade if you are a beginner or semi advanced forex trader, looking to trade major forex currency pairs, options or CFDs as stocks, cryptos, indices or commodities with premium services.

Pros

- MT4 available for all account types

- Mobile version of MT4 available

- Fast trade execution with MT4 accounts

- Supports automated trading using MT4

Cons

- Offers less trading instruments than other brokers

- MT4 not available for web platform

Key features

- Access to 1250 CFDs and 44 forex options

- Excellent copy trading features

- Advanced mobile trading app (AvaOptions)

- Industry average pricing

- Perfect for casual and advanced traders

- Access to the full meta trader suite

71% of retail CFD accounts lose money

3. IG Trading – Best For Beginners

IG is one of the largest and most popular regulated forex and CFD brokers globally. Traders can trade thousands of markets using IGs trading platforms like L2 Dealer and ProRealTime or connect their IG brokerage account with MetaTrader 4.

IG offers educational material, daily market update videos, and both technical and fundamental analysis case studies. If you are new to online trading, you can practice with IG’s free demo paper trading account first. For experienced traders IG offers spread rebates and access to more advanced financial instruments like digital options.

Pros

- Wide choice of trading instruments for MT4

- Mobile version of MT4 available

- Competitive trading fees for Forex

- Offers free tools for MT4

Cons

- Higher fees on stock CFDs than other brokers

Key features

- Trade over 17,000 markets with a broker that has been in business since 1974

- Access to Turbo24s, and CFDs and options on forex, indices, crypto, stocks, and commodities

- Unlimited free demo paper trading account

- Advanced research and analysis tools like L2 Dealer and ProRealTime

- Access to APIs to set up Expert Advisors and other automated trading software

- Receive trading signals and alerts to find excellent entry and exit points

75% of retail CFD accounts lose money

4. IC Markets – Best For Active Traders

Min Deposit: $200

Fees: 4.7

Assets available: 3.6

Total Fees:

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IC Markets is an ASIC and CySEC-regulated broker operating globally. With IC Markets you can trade forex, CFD, and crypto with up to 1:500 leverage. IC Markets has over 2,000 tradable assets and charges low, floating spreads from 0,0 pips.

IC Markets has multiple trading platforms available and is compatible with MetaTrader, cTrader, myfxbook AutoTrade, and ZuluTrade. Professional traders can open a Raw Spread, Standard or Islamic account at IC Markets, whilst beginners can practice trading with their unlimited demo paper trading account.

You can fund your IC Markets account by bank transfer, credit card, or e-wallets like PayPal at 0% commission and receive access to a free VPS server after opening an account with them.

Pros

- Competitive trading fees for MT4 accounts

- MT4 available for web and mobile apps

- MT4 available for all account types: Standard, Raw Spread, and Swap-Free

- Fast trade execution with MT4 accounts

- Supports automated trading using MT4

Cons

- Low number of trading instruments

Key features

- Access to over 2,000 CFDs on stocks, bonds, indices, commodities, forex, and digital currencies

- Islamic swap-free accounts available on request

- Compatible with MetaTrader 4, 5, cTrader, ZuluTrade, and Myfxbook AutoTrade

- Raw spreads from 0,0 pips

- Well-suited for both beginner and experienced traders

- Expert Advisors and other forms of automated trading allowed

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71,65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

5. Swissquote – Best For Investors

Min Deposit: 0

Fees: 3.0

Assets available: 4.9

Total Fees:

84.5% of retail investor accounts lose money when trading CFDs with this provider.

Swissquote is a low risk forex and CFD online broker, regulated by 4 top-tier financial regulators. It is a great choice for traders who are looking for high quality research, daily market updates, a great variety of tradable assets and account security on a Swiss bank.

Their Advance Trader proprietary trading platform suite is available as desktop, web and mobile version. Together with the MetaTrader platform suite, it delivers an excellent trading experience for traders and investors at all levels. Minimum deposit is $1000 and trading fees are above industry average. Swissquote operates a bank.

Choose Swissquote if you are looking to trade physical cryptos with a highly trusted online broker that also offers great banking services.

Pros

- MT4 available for web and mobile app

- Offers Master Edition MT4 suite with advanced tools and indicators

- Autochartlist available

Cons

- Higher trading fees

Key features

- Access to over 3,000,000 financial instruments

- Cash dividends paid out monthly into your account

- Trade with a FINMA-regulated and Swiss stock exchange-listed broker (SIX:SQN)

- Receive the Swissquote magazine monthly for free

- Set up your own algorithmic trading bot with Swissquote Robo-Advisory services

- Low, fixed fees capped at 0,75% of your invested amount

84.5% of retail investor accounts lose money when trading CFDs with this provider.

How To Find The Ideal MetaTrader 4 Broker and Trading Platform in the UAE?

Factors that need to be considered when choosing an online broker with MetaTrade 4 platforms for forex trading are listed below.

- Regulation

You should only consider trading at a regulated broker. There are many jurisdictions and regulatory bodies that oversee brokers. The most respected financial regulators are:

UAE: Dubai Financial Services Authority (DFSA)

Europe: Cyprus Securities and Exchange Commission (CySec), UK Financial Conduct Authority (FCA)

Asia: Australian Securities and Investment Commission (ASIC), Financial Services Agency of Japan (FSA)

USA: National Futures Association (NFA), Commodity Futures Trading Commission (CFTC) - Available Financial Instruments and Asset Classes

MetaTrader 4 allows you to trade asset classes like forex, stocks, commodities, indices, ETFs, and cryptos. Good traders diversify their portfolios by investing across many asset classes. We recommend trading with a broker that offers many asset classes. With the best MetaTrader 4 brokers, you have access to thousands of financial instruments. Use this to your advantage to spread your risks and investments. You can view all available assets by logging in to your MetaTrader 4 account and clicking Market Watch at the top of your screen. - Trading Commissions and Fees

You should always be aware of the commissions and fees your broker charges. These commissions and fees hurt your profits so it’s best if they are as low as possible. You want your broker to be transparent in their pricing and not overcharge you for their services. Most of the time you can check the fees your broker charges on their website. Note that some brokers offer commission-free trading, but they will charge higher spreads on your trades. - Trading Tools and Features

As a trader, you want access to as many trading tools and features as possible. This helps you beat the market and grow your portfolio. We have considered that all of the brokers from our list of recommended platforms offer trading tools and features that you can use on MT4. MetaTrader 4 itself also offers all sorts of tools and features you can use. Some of them are free, but most of them you need to buy on the MetaMarket. Brokers like AvaTrade and PepperStone offer free MT4 plugins like Autochartist and Alarm Manager. We recommend you make use of these free plugins to enhance your trading. - Automated Trading and Copy Trading

The best MetaTrader 4 brokers offer copy trading and allow you to use auto trading software. These trading systems work with the MetaTrader 4 trading platform. MetaTrader 4 offers signal provider services itself as well, but not all these features are free. We recommend trying out copy trading and automated trading systems on a demo account. This way you can check if they work before you apply them to your real money trading account. - Customer Service

It is important that you trade with a broker that offers top-notch customer service. You want someone to be able to talk to when you have any questions about your trading account. The best MetaTrader 4 brokers all offer 24/7 customer service. Traders can access these customer services by live chat, email, and by phone. We recommend trading with brokers that have customer service available in your own language. This removes any language barriers and makes it easy to solve problems.

Top MetaTrader 4 Brokers Compared

Key features of the top rated online brokers with MT4 integration are compared in the table below.

| Broker | Capital.com | AVA Trade | IG Trading | IC Markets | Swissquote |

| Forex | 125 | 59 | 205 | 61 | 80 |

| CFDs | 4100+ | 150+ | 12000+ | 800+ | 380+ |

| Account | |||||

| Min deposit | $20,00 | $200 | 5500 | $200 | $0 |

| Swap free account | No | Yes | Yes | Yes | Yes |

| Max leverage | 1:30 | 1:400 | 1:500 | 1:500 | 1:400 |

| Cent Account | No | No | No | No | No |

Fees Compared

Fees of the top rated MT4 online brokers are compared in the table below.

| Broker | Capital.com | AVA Trade | IG Trading | IC Markets | Swissquote |

| Std. Account Spread (in points) | From 6 | From 6 | From 10 | From 6 | From 14 |

| ECN Account Commision | – | – | $1,20 | $3,00 | – |

| Inactivity Fee | No | Yes | Yes | No | No |

| Funding Fees | No | No | No | No | Yes |

Tools Compared

Trading tools of the top rated MT4 online brokers are compared in the table below.

| Broker | Capital.com | AVA Trade | IG Trading | IC Markets | Swissquote |

| MT4 mobile | Yes | Yes | Yes | No | Yes |

| MT4 web | Yes | Yes | Yes | No | Yes |

| Social Trading | Mql5.com | Ava Social, DupliTrade, Mql5.com | Mql5.com | IC Social, ZuluTrade, Myfxbook AutoTrade, Mql5.com | Myfxbook AutoTrade, Mql5.com |

| VPS | No | Yes | Yes | Yes | No |

Research Options Compared

Research tools of the top rated MT4 online brokers are compared in the table below.

| Broker | Capital.com | AVA Trade | IG Trading | IC Markets | Swissquote |

| Trading Signals | No | No | Yes | No | No |

| Educational Resources | Yes | Yes | Yes | Yes | Yes |

| Webinars | Yes | Yes | Yes | Yes | Yes |

| In-depth Market analysis | Yes | Yes | Yes | Yes | Yes |

Advantages and Disadvantages of the MetaTrader 4 Trading Platform

MetaQuotes launched the MetaTrader 4 trading platform in 2005. After that, they released MetaTrader 5 in 2010, but that didn’t take off as much as MT4. MetaTrader 4 is still the most popular trading platform worldwide today. It is available on Windows, Mac, and Linux systems and iOS and Android mobile devices.

Pros:

- Indicators – MetaTrader 4 offers traders 30 indicators to help spot investment opportunities.

- Timeframes – Traders can view charts in 9 different timeframes ranging from 1 minute to 1 year.

- Real-time prices – The prices of all tradable assets are live.

- Signals and Algorithmic Trading – MetaTrader 4 allows traders to use signal providers, expert advisors, and automated trading systems.

- MetaTrader Market – Traders can shop the MetaTrader market for over 1,500 auto-trading scripts and technical indicators. It is also possible to sell your own trading scripts and bots.

Cons:

- Hard for Beginners – MetaTrader 4 offers loads of customization options, and anyone who wants to use it will have to set it up themselves. When you start using the platform, it won’t have all the tradable assets listed, and you will also have to create your own layout. Even veteran traders complain about charting features, like the Fibonacci charts, and that it is difficult to change their preferences.

- Lacks Support – The support offered for MetaTrader 4 is lacking, and it is an old platform. While brokers do offer some support to traders using MT4, the proprietary platform brokers use is better supported. Also, MT4 is decades old, and this limits features, like interfacing with modern trading algos.

Getting Started with the Best MetaTrader 4 Broker

Now you know everything about the best MetaTrader 4 brokers for UAE traders, it is time to get started trading. Follow the steps below to get started with Capital.com, the best MetaTrader 4 broker in the UAE.

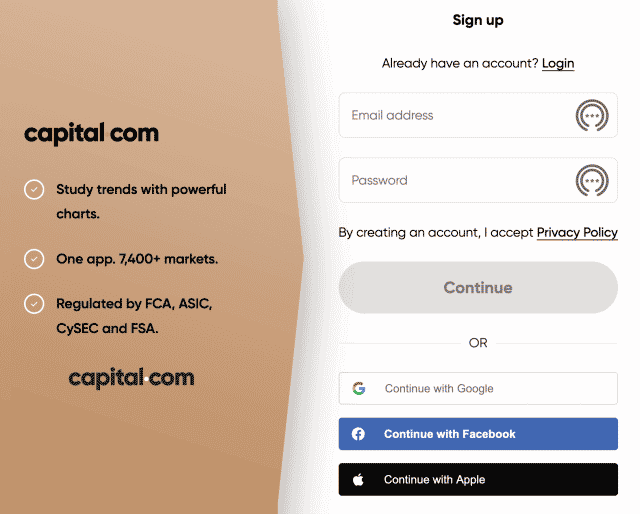

1.Open a Capital.com Trading Account

Go to the Capital.com website and click on the ‘Trade Now’ button in the middle of the screen. Now you fill in your email, choose a password and click ‘Register an Account’.

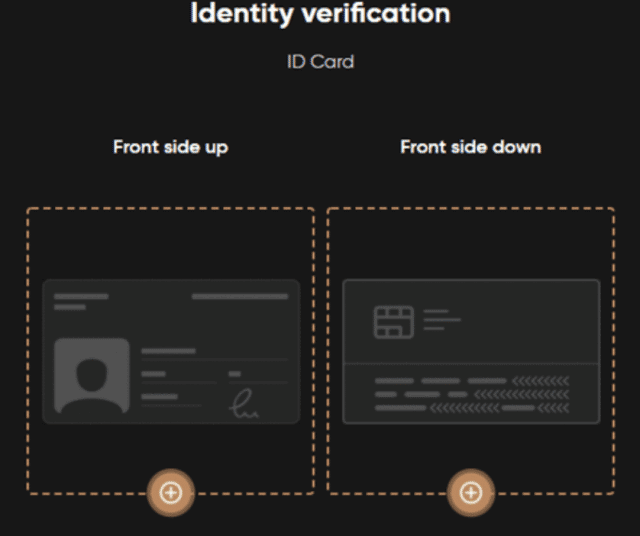

2. Verify your Identity

Capital.com will ask you to verify your identity. Upload a photo of your driver’s license, passport, or national ID card. You will also need to prove your residency by uploading a recent utility bill or bank statement.

3. Fund your Account

After you verified your identity you can fund your Capital.com account. You can use a wide variety of payment methods like credit cards, e-wallets, and bank transfers to fund your account. The minimum deposit at Capital.com is only $20 or 75 AED.

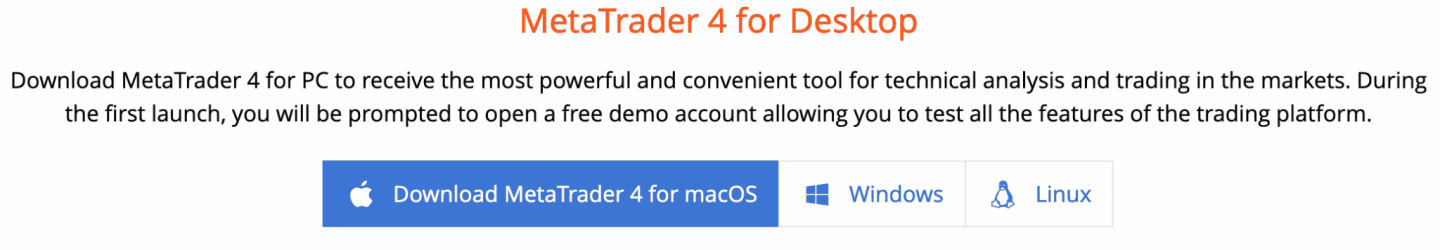

4. Download MetaTrader 4

Open the Capital.com client portal area by clicking on your account icon. From here you select MetaTrader 4 under the available software to download. Make sure you download MT4 for the right operating system. You will be able to see your MT4 login credentials on this page.

5. Trade

You can now log in to MetaTrader 4 with your credentials and open your first trade.

Conclusion

The various online brokers in UAE offering different MT4 features and add-ons make finding the ideal choice for individual needs difficult. Comparing and evaluating the services of different providers requires time and effort.

In this guide, our experts worked hard by evaluating top brokers for different types of traders preferences. The results of our analysis of the best MT4 forex brokers and platforms in UAE are wrapped up in the table below.

| RANK | BROKER | BEST FOR | PLATFORM SCORE | OFFICIAL WEBSITE |

| #1 | Capital.com | Overall | 4.9 / 5 | Official Website |

| #2 | AVAtrade | Beginners | 4.9 / 5 | Official Website |

| #3 | IG Trading | Institutional & Day Traders | 4.8 / 5 | Official Website |

| #4 | IC Markets | Professional Traders | 4.8 / 5 | Official Website |

| #5 | Swissquote | Research & Education | 4.6 / 5 | Official Website |

Based on the findings from our reviews and comparison, we consider Capital.com as the best MT4 broker in UAE. They offer access to the full MT4 trading platform suite for desktop and mobile, extensive research tools, and great educational content.

FAQ

Why MT4 should be used for forex trading?

MetaTrader 4 is a great forex trading platform offering a wide range of charting tools, customisation options, automated trading possibilities (EA’s) and customer support.

Can MetaTrader 4 be used directly without a broker?

No, MT4 can only be used through a online brokers that offer access to the MetaTrader 4 platform.

How much does MetaTrader4 costs?

MetaTrader 4 can be downloaded and used free of charge. Users may get charged by online brokers in the form of trading fees (spreads and commission), as well as additional fees for certain add-ons (EA’s, custom indicators).

Does MetaTrader 4 charge trading fees or commission?

MetaTrader 4 does not charge any trading fees from the user. However, trading fees might be charges by the broker which offers MT4 integration.

Is MetaTrader 5 better than MetaTrader 4?

MetaTrader 5 is newer (upgraded) version of MetaTrader 4 offering better executions speed and additional features including market depth. It is important to note, that many traders still prefer using MetaTrader 4 over MetaTrader 5.

Can I use auto trading systems with MetaTrader 4?

MetaTrader 4 supports automated trading systems like DupliTrade and ZuluTrade. Users also have access to stomated systems developed by other traders. MetaTrader 4 is among the top choices for algorithmic trading in UAE.

Is it possible to use MetaTrader 4 for copy trading?

Copy trading with MT4 is available through third-party plugins (DupliTrade, ZuluTrade) and their own Signals feature.

Can I make my own trading script with MetaTrader 4?

Users can generate their own trading scripts by using the MetaEditor and coding in MQL4.

Is MetaTrader 4 available in Arabic?

No, at the moment MetaTrader 4 is available in English, Spanish, French, Japanese, Portuguese, Russian and simplified Chinese.

Is MetaTrader 4 regulated in the UAE?

MetaTrader 4 is a trading platforms and charting provider and is therefore not subject to regulation in UAE. Online brokers that offer access to MT4 are regulated by the SCA, DFSA and ADGM.

How does the MetaTrader 4 suite differs between brokers?

Online brokers offer different set of features and add-on for the MetaTrader platform.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.