This guide, written by our expert team, covers the best short term investments in the UAE for 2024. It allows users to make a well-informed decision about whether or not to invest. It compares the different investment options UAE-based traders and investors have when it comes to short term investing.

Note that as individual needs differ, each user’s best short-term investment in the UAE is different.

In this guide, our experts will cover twelve asset classes and the best brokers or platforms to invest in these financial instruments. The table below details the best short-term investment options for UAE investors.

| Interactive Brokers | Emirates NBD | Mashreq Bank | OKX | ByBit | |

| Bank / Broker / Crypto Exchange | Broker | Commercial Bank | Digital Bank | Crypto Exchange | Crypto Exchange |

| Bitcoin (Spot) | Yes | No | No | Yes | Yes |

| Etherium Staking | No | No | No | Yes | Yes |

| National bonds | Yes | Yes | Yes | No | No |

| Precious Metals (Spot) | Yes | Yes | Yes | No | No |

| Money Mutual Fonds | Yes | Yes | Yes | No | No |

| Certificates of Deposit | No | Yes | Yes | No | No |

| Deposit fee | 0$ | 0$ | 0$ | 0$ | 0$ |

| Withdrawal fee | 0$ | 0$ | 0$ | 0$ | 0$ |

| Inactivity fee | No | No | No | No | No |

| Deposit Apy | N/A | Up to 3.5% | Up to 2.67% | N/A | N/A |

| Mutual fund fee | $15 | 1.575% – 3.1% | 2%-5% | N/A | N/A |

| Bond Fee | $5 | 0.125% | 0.125% | N/A | N/A |

| Gold fees | 0.015% | 1.05%-2.1% | 0.125% | N/A | N/A |

| Crypto fees | 0.12% – 0.18% | N/A | N/A | 0.024%-0.1% | 0.01%-0.1% |

| BTC Apy | N/A | N/A | N/A | 0.29% | 1%-5% |

| ETH APY | N/A | N/A | N/A | 1.09%-3.4% | 0.5%-3% |

Page Summary

Top 12 Short-Term Investments For UAE Residents

- Precious Metals (Gold & Silver)

- Bitcoin

- Certificate of Deposit (CD)

- Money Market Mutual Funds

- National Bonds

- Crypto Staking

- High-yield Savings Accounts

- Fixed Deposits

- Recurring Deposits

- Equity Derivatives

- FMPs Fixed Maturity Plans

- Pay Off or Consolidate High-interest Debt

The Best Short Term Investment Options Reviewed

Now that we have provided you with a detailed overview of different short term investment options, our experts will cover each option in the section below.

1. Precious Metals (Gold & Silver)

Gold, silver, and other precious metals have proven reliable investment options over the long term. Although they are primarily long-term investment options, their volatility can be significant in the short term, allowing for trading and investing opportunities for those looking to cash in on their price movements.

Gold is more expensive than silver but less volatile, making silver a better short-term investment option than gold.

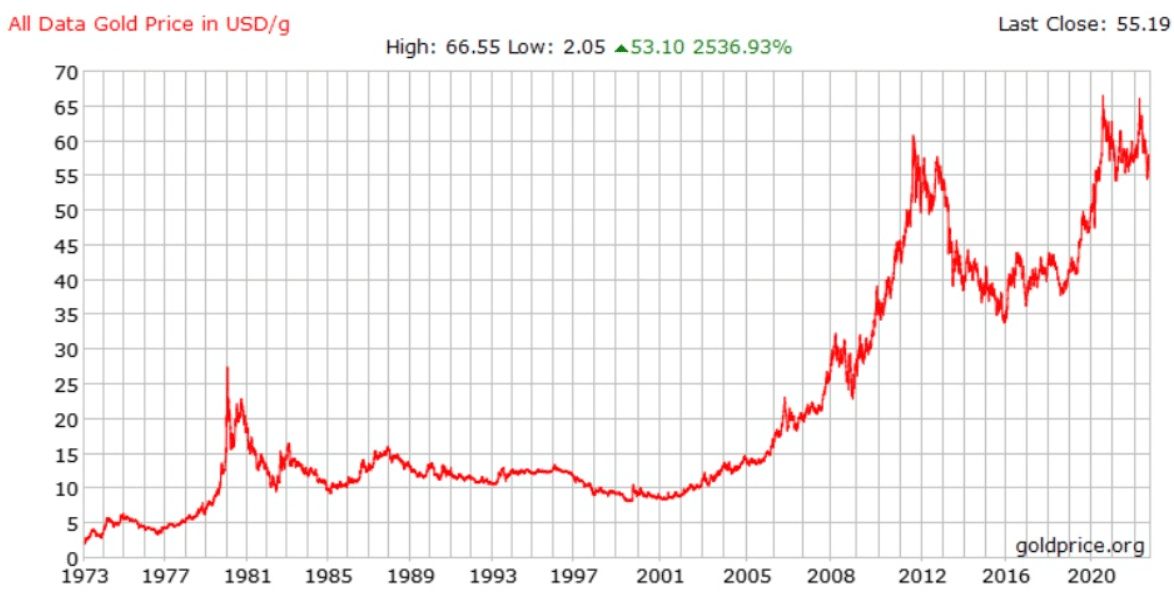

The chart below shows the historical price of gold in USD per gram and its volatility since the early 2020s.

Historical Price of Gold in USD/g

The chart below shows that silver’s price movements over the same time span are similar to those of gold, but they are more volatile.

Historical Price of Silver in USD/kg

Whether the price of silver, gold, or other precious metals goes down or up, traders always have short-term investment options. UAE traders seeking to speculate on precious metals can go long or short via the spot market, futures, options, or by buying physical gold or silver coins or bars. Additionally, one could invest in silver or gold-linked ETFs. This guide at Forbes covers all the ins and outs of investing in precious metals.

- Easy to sell

- Proven historical anti-inflation hedge

- Limited supply

- Always in demand

- No dividends or interest

- High short-term volatility, making it difficult assets to trade

- Highly dependent on the strength of the US dollar

- Difficult to transport (in the case of physical gold and silver)

Risk Level: MEDIUM

- Traders and investors with a solid strategy and mindset who are willing to go both long and short as the markets move can profit from the short-term volatility of precious metals.

Difficulty Cashing Out: LOW

- Gold, silver, and other precious metals are relatively easier to liquidate than other asset classes.

Fees: LOW

- Trading and non-trading fees for online precious metal trading are low.

2. Bitcoin

Bitcoin is one of the most popular short term investment options for UAE traders and investors because of its high volatility, decentralized nature, and limited supply. One of the more crucial moments when Bitcoin is traded the most and is the most volatile is when it is halved.

With every Bitcoin halving, the decentralized digital asset becomes twice as hard to mine. These Bitcoin halvings happen roughly every four years, and the so-called “Block Reward” of each newly mined block on the blockchain is halved. Historically, these events all had a significant effect on the Bitcoin price.

The next Bitcoin halving will occur in April 2024. Below, our experts provide a detailed overview of the Bitcoin price before and after the halving event.

Bitcoin Halving Events – Price Volatility

Bitcoin Halving Events – Price Volatility

| Bitcoin Halving Event | Event Date | Price at Bitcoin Halving | Post-Halving Bitcoin Highest Price |

| First | 28 November 2012 | $12,20 | $1,217 (28 November 2013) |

| Second | 9 July 2016 | $626,87 | $19,800 (15 December 2017) |

| Third | 11 May 2020 | $8,7544 | $64,400 (12 November 2021) |

| Fourth | Expected around April 2024 | ? | ? |

Bitcoin Halvings are the most critical events in the cryptocurrency space. With its new supply rate cut in half, these are definitely the moments for Bitcoin to shine as the best short-term investment. Historical data shows that traders and investors consistently predict the price of Bitcoin will rise several months before the actual halving.

- Easy to send, receive, and transport

- Past trends support both short-term and long-term investment opportunities

- It has a built-in deflationary mechanism

- Requires some technical knowledge to avoid losing funds during incorrect transactions

- Self-custody necessary

- Crypto exchanges may not release your coins easily or quickly

Risk Level: MEDIUM

- If your investment horizon is 1-2 years, there is a chance Bitcoin’s price will decline. However, if you plan to ‘’buy and hold’’ for a period of at least 3 years, your Bitcoin investment will likely be profitable. Note that this is a guide on the best short-term investments in the UAE 2024; therefore, there may be better short-term investment opportunities, which our experts shall outline below.

Difficulty of cashing out: LOW

- Bitcoin is relatively easy to cash out, but dealing with a cryptocurrency broker or exchange requires some technical knowledge and optional KYC and anti-money laundering checks.

Fees: LOW

- Most cryptocurrency brokers and exchanges have very low Bitcoin trading and investing fees of around 0,1-0,2% per transaction. Note that so-called ‘’fiat onramp’’ and peer-to-peer exchanges may charge significantly more for Bitcoin transactions.

3. Certificate of Deposit (CD)

Certificates of deposits (CDs) are high-yield savings accounts that provide fixed interest rates on the funds held within them over time but don’t allow the investor to withdraw any funds from the account during the duration. A Certificate of Deposit is issued by a bank or credit union, not a broker or exchange.

Although certificates of deposits provide stable returns over longer periods of time, they may not be the ideal investment vehicle for those looking to grow their capital in the short term.

If you are still interested in investing in certificates of deposits, you should compare the following between available options:

- APYs (Annual Percentage Yield) offered

- Minimum deposit required to invest

- Optional early withdrawal penalties

- Whether the CD renews automatically

- Halal investment opportunities

- Higher interest rates than traditional savings accounts

- Fixed and predictable returns

- Issued by a government, bank, or credit union instead of private companies

- Often comes with hefty early withdrawal penalties

- The funds are ‘’frozen’’ for the duration of the CD

- Relatively lower returns than stocks and other financial instruments

Risk level: LOW

- Certificates of Deposits are among the least risky investment vehicles. You invest your funds in them and wait for them to expire.

Difficult of cashing out: HIGH

- It is very hard to cash out a certificate of deposit before it expires. In most cases, you will be subject to significant early withdrawal penalties, making it not the ideal short-term investment in 2024.

Fees: LOW

- The fees for certificates of deposits are from nonexistent to minimal.

4. Money Market Mutual Funds

Money market mutual funds allow investors to invest in short-term financial instruments, such as treasuries, municipal and corporate debt, and bonds. Mutual funds and their managers manage the assets held by the fund, and their clients are subject to a so-called ‘’expense ratio’’. One of the most significant advantages of money market mutual funds is that investors can withdraw their invested funds at any time without being subject to additional fees.

Comparison of the Best Mutual Funds

Use the table below to choose the right mutual fund to invest in for a timeframe of up to 5 years. All options have a performance ratio of higher than 95%.

Comparison of the Top Mutual Funds

| Mutual Funds | Ticker | Max Rating | 1 year | 3 year | 5 year | Minimum investment |

| Shelton NASDAQ-100 Index Direct | NASDX | 98 | -7.4% | 21.7% | 17.2% | $1000 |

| Voya Russell Large Cap Growth Index Fund | IRLNX | 100 | -3.7% | 19.9% | 16.9% | 0 |

| Fidelity NASDAQ Composite Index | FNCMX | 95 | -11.4% | 18.4% | 15.2% | 0 |

| Fidelity 500 Index Fund | FXAIX | 98 | 0.3% | 16.13% | 13.4% | 0 |

| Schwab Fundamental U.S. Large Company Index Fund | SFLNX | 97 | 4.2% | 18.14% | 13.4% | 0 |

| Vanguard Dividend Growth Inv | VDIGX | 97 | 5.8% | 14.6% | 13.5% | $3000 |

| DFA US Large Company I | DFUSX | 99 | -0.4% | 16.4% | 13.3% | 0 |

| Northern Stock Index | NOSIX | 98 | -0.4% | 16.3% | 13.3% | $2500 |

| T. Rowe Price Equity Index 500 | PREIX | 95 | -0.5% | 16.2% | 13.2% | $2500 |

Risk Level: LOW

- The risks of investing in mutual funds in the money market are relatively low when you choose a reliable provider.

Difficulty of Cashing Out: LOW

- You can cash out money market mutual funds at any time without paying any additional fees.

Fees: LOW

- The trading and non-trading fees of money market mutual funds are very low.

5. National bonds

National bonds are one of the safest short-term investment options available in the UAE because the interest rate is agreed upon upfront and because they are only issued by the UAE government. Additionally, the interest rates on bonds often outperform those offered by banks.

One can invest in UAE national bonds through exchange houses, banks, and an organization founded by the Dubai government, which also holds a 50% stake, National Bonds. Before you can buy bonds through this organization as an Emirati, you will have to provide a copy of your identity document (passport, Emirates ID, or driver’s license). UAE expats must provide a copy of their passport with a valid UAE visa and entry stamp.

Investing in national bonds from 100 AED is possible. The goal is to save money and benefit from decent returns at the same time. It is possible to buy a bond and earn interest on it until its maturity, at which point the total invested amount is returned, together with all interest earned meanwhile.

Returns for UAE National Bonds

Returns for UAE National Bonds

| Bond | Profit |

| Over AED 1 million | 3.27% |

| Between AED 350k and 1 million | 2.7% |

| Between AED 150k and 350k | 2% |

| Between AED 100k and 150k | 1.36% |

| Between AED 50k and 100k | 1.11% |

| Between AED 5k and 50k | 1.1% |

| Regular savings bonds | 1.5% |

- Relatively safe investment

- Investments available from 100 AED

- Community-orientated investment product

- Relatively low rates of return

- Must be held until maturity to benefit the most

- Not sold online

Risk Level: LOW

- If the interest rates of the issuing bank or government go up, bonds keep the interest rate they were issued with. For this reason, most investors keep bonds until their maturity.

Difficulty of Cashing Out: MEDIUM

- If you cash out your bonds before their maturity dates, you will usually be subject to a penalty fee.

Fees: LOW

- The upfront fees involved with national bond trading are negligible.

6. Crypto Staking

Crypto staking rewards are approximately 4% APR, depending on the token or digital asset staked. Most ERC-20 tokens (digital assets on the Ethereum Blockchain) can be staked, which refers to the staking process where you commit your tokens for a specific timeframe, not being able to withdraw or trade them.

In return, you will receive additional tokens as ‘’staking rewards’’. Although these terms can be confusing initially, crypto staking is simple as soon as you get the hang of it.

Use this calculator to calculate your expected crypto staking returns.

- Guaranteed or variable returns

- Self-custody possible

- Hedge against market volatility

- Not your keys, not your coins

- Chance for the token to decline in value while being unable to unstake

- Rates may vary while being unable to unstake

Risk Level: MEDIUM

- Staking cryptocurrencies can be risky when using third-party platforms or exchanges. Additional risks include the chance for the token to decline in value or the interest rate to increase while being unable to unstake.

Difficulty of Cashing Out: MEDIUM

- With fixed staking, you must stake your tokens for the period set for your crypto staking account.

Fees: MEDIUM

- Most platforms, brokers, and exchanges offering staking services will keep a commission of the total interest earned.

7. High-yield Savings Accounts

High-yield savings accounts allow UAE traders and investors to earn a higher-than-normal stable annual percentage yield (APY). Regular banks often offer their users savings accounts with lower interest rates.

In most cases, these savings accounts yield below 1,00% APY. On the other hand, high-yield savings accounts have high variable or fixed APY and typically earn compound interest, meaning that the user will earn interest on both the principal and the interest earned over time.

Note that sometimes your deposited funds are locked for a certain amount of time. In these scenarios, the longer you cannot access your funds, the higher the rate of return will probably be.

- High interest on cash balance

- Relatively safe compared to other investment options

- Invested funds are often covered

- Funds are locked for the duration of the loan

- Requires a significant amount of capital to gain decent returns

- Not many options for UAE investors

Risk Level: LOW

- The risk of investing in High-yield savings accounts is low because banks offer them, and these aren’t more likely to default than traditional companies.

Difficulty of Cashing Out: MEDIUM

- Most high-yield savings accounts require users to ‘’freeze’’ their funds for a specific time to receive the offered interest rates. Sometimes, users are penalized for withdrawing early or cannot withdraw their funds before this time frame elapses.

Fees: LOW

- Banks often charge their clients low or no fees for opening high-yield savings accounts.

8. Fixed Deposits

Fixed Deposits are investments made in lump sums by individuals and corporations for specific timeframes at a bank or other financial institution. The funds deposited within the Fixed Deposit earn fixed interest rates, agreed upon at account opening. The interest on Fixed Deposits is paid out monthly, quarterly, half-yearly, or yearly.

Fixed Deposits are a popular type of investment among UAE investors. The returns are always guaranteed, and the risk of capital loss is minimal. Additionally, they usually provide higher returns than high-yield savings accounts, making them attractive for those looking for stable and fixed returns and potentially saving taxes.

Fixed Deposits are great investments, but extensive due diligence is required before opening an account. Compare the interest rates of available options and choose the one that best suits you.

- Fixed interest rates

- The longer the duration of the Fixed Deposit, the higher the interest rate earned

- Minimal risk of capital loss

- Relatively low returns compared to other investment opportunities

- Funds are ‘’frozen’’ until the Fixed Deposit matures

- Extensive due diligence is required

Risk Level: LOW

- Fixed Deposits are among the safest investment options as they are often offered by banks, which are unlikely to default.

Difficulty of Cashing Out: MEDIUM

- Fixed Depositers cannot withdraw funds until the Fixed Deposit matures or expires.

Fees: LOW

- Banks and other financial institutions often charge low fees on Fixed Deposits or none.

9. Recurring Deposits

Recurring Deposits, also called CDs, are specific-term deposits offered by banks and other financial institutions. These investments allow users to deposit regular sums of money for a specific timeframe and earn interest in return.

As users can deposit regularly and earn interest accordingly, Recurring Deposits provide more flexibility than other investment types discussed in this guide.

Recurring Deposits differ from Fixed Deposits because Recurring Deposit account holders can invest a fixed amount monthly, while Fixed Deposit account holders invest in lump sums.

Most UAE banks offer Recurring Deposit accounts with terms ranging from 6 months to 20 years. Our experts recommend choosing the timeframe of your Recurring Deposit account wisely, as it cannot be changed after account opening. Additionally, the interest rates determined are fixed.

- Fixed interest rate earned for the duration of the Recurring Deposit account

- Time frames ranging from 6 months to 20 years

- The ability to spread one’s investment over time

- Regular additional investments are required

- Funds cannot be withdrawn until the time frame of the Recurring Deposit account is finished

- The interest rates offered on Recurring Deposit accounts are usually lower than those offered by other investment opportunities

Risk Level: LOW

- Recurring Deposit accounts come with little to no risk as the funds within them are often covered by some investment compensation scheme. Additionally, the chance of a bank or financial institution offering Recurring Deposits defaults is minimal.

Difficulty of Cashing Out: HIGH

- Recurring Deposit accounts can only be cashed out when the term agreed upon at account opening has expired.

Fees: LOW

- Banks and other financial institutions that offer Recurring Deposits often charge low to no fees on Recurring Deposit accounts.

10. Equity Derivatives

Equity Derivatives are investment vehicles with values based on the price movements of their underlying assets. An example of an Equity Derivative is a stock option. This is because its value is based on the price movements of the underlying stock. Investors often use Equity Derivatives to hedge the risks of their long and short positions or to speculate on financial market price movements.

Additionally, equity derivatives act as an insurance policy. Investors receive potential payouts by paying the premium of the derivative contract in question. Stock investors can hedge their long positions by buying put options. On the other hand, short sellers can hedge their short positions by buying call options on the same stock.

Equity Derivatives can also be bought for speculation purposes. Investors who invest in equity options instead of real shares generate profit from the underlying asset’s price movements.

This is often cheaper than buying options (which come with premiums). Examples of Equity Derivatives include stock index futures, convertible bonds, and equity index swaps.

- Acts as an insurance policy or hedging tool

- Value is based on the price movements of the underlying asset

- Equity Derivatives have a high-profit potential

- Comes with additional premiums

- Equity Derivative contracts are advanced investment vehicles not suitable for all types of investors

- The usage of leverage may backfire

Risk Level: HIGH

- The risks associated with Equity Derivatives trading are relatively high compared to other investment types. The main reason is that they offer the concept of leverage to investors, which they sometimes misuse.

Difficulty of Cashing Out: LOW

- Cashing out an Equity Derivative contract is easy and seamless, as investors only need to close their position(s) with their broker, exchange, or trading platform.

Fees: HIGH

- The premiums charged on Equity Derivatives are often higher than trading and non-trading fees involved with other investment types.

11. FMPs Fixed Maturity Plans

Fixed Maturity Plans (FMPs) are debt-based and closed-ended mutual funds. This means one invests in a debt-based mutual fund with a fixed tenure. These FMPs invest mainly in fixed-income products with maturity periods that synchronize with the fund’s maturity date.

Additionally, FMPs invest in fixed-income instruments like corporate bonds, commercial papers, certificates of Deposit, and non-convertible Deeds (NCDs) from reputable businesses.

The maturity dates of FMPs are often the same as the maturity periods of the underlying assets. For this reason, FMPs usually offer fixed rates of returns on maturity.

The approximate rate of return of an FMP is known in advance during the so-called New Fund Offer stage of the FMP, making them ideal investments for those looking for predictable returns in both the short and long term.

FMPs have fairly predictable returns and lesser exposure to interest rate risk. Additionally, they often invest in high-rated financial instruments, which further lowers the risks of default and credit risk.

- Maturity dates are the same as the underlying assets

- Predictable returns and less exposure to interest rate risk

- Invest in fixed-income products

- Lower returns compared to other investment vehicle instruments

- Funds are ‘’frozen’’ until maturity

- Extensive due diligence is required to find the right plan to invest in

Risk Level: MEDIUM

- The returns of Fixed Maturity Plans are known beforehand and follow the value of their underlying assets. Therefore, these products could have a better risk level.

Difficulty of Cashing Out: HIGH

- Most FMPs are only redeemable when the maturity date has passed, making it somewhat difficult to cash out (early).

Fees: MEDIUM

- Banks and other financial institutions charge relatively low management fees on FMPs compared to the fees and commissions involved with other investment opportunities.

12. Pay Off or Consolidate High-interest Debt

One of the best short-term investments is paying off or consolidating high-interest debts. By paying these debts off first, you gain a decent APY by saving on interest costs. Debt consolidation is done by taking out a new loan or applying for a new credit card to pay off your existing loans and debts.

Additionally, combining several debts into a single loan often leads to lower interest rates, installments, and other benefits. Debt consolidation also leads to fewer bills to pay and better financial oversight.

Debt consolidation can be done on both secured and unsecured loans, of which secured loans have assets backing them up as collateral, and unsecured loans not being backed by anything.

The caveat with unsecured loans is that they typically come with high-interest rates and shorter timeframes to pay the loan off. Although it might not sound like a viable short-term investment option, paying off or consolidating your debt can have a significant effect on both your short term cash flow and long-term capital growth.

Choosing the Best Short Term Investment Option in the UAE

Below, our experts will list the best short-term investments in the UAE for 2024 and the most crucial aspects to look for.

- Risk Level – Ideally, short-term investments are not volatile and only move slightly in price, unlike stocks, cryptocurrencies, and options.

- Difficulty Cashing Out: The best short-term investment options should be easy to cash out and liquid. An example of an illiquid good is a house, office building, or other form of real estate.

- Costs: The best short-term investments should have low costs and fewer third parties involved.

One of the most important things to consider when comparing multiple short-term investment options is the following:

- Would you risk losing the principal or want the principal investment amount to be safe and only earn interest?

- Would you want to be able to terminate agreements and cash out early, or don’t you mind waiting for your investments to mature, expire, or become withdrawable again?

- How volatile do you want your investments to be?

- How short is short-term to you?

Best Investment in UAE

Consider investing in stocks, bonds, REITs, mutual funds, ETFs, gold, and Bitcoin in the UAE. For successful investing, focus on long-term goals, diversify your portfolio, choose passive investments, and use a robo advisor.

How to Create a Short-term Investment Plan

With the right short-term investment plan or strategy, one can benefit from significant returns within a short time frame, usually from a few days up to several months or years. Short-term investment plans are required by those wishing to grow their capital quickly and consistently or have substantial financial targets in mind that they want to achieve soon.

Characteristics of Great Short-term Investments

The best short-term investments are liquid, have low risks, are suited for specific financial goals or timelines, and can be used to harvest tax losses.

- Liquidity – The best short-term investments are very liquid, making them easy to withdraw or convert to cash. Investors who want to always access their funds desire a high level of liquidity.

- Lower Risks – Short-term investments usually provide lower returns than long-term investments. The main reason is that they aren’t as exposed to volatility as their long-term counterparts.

- Investment Type – The most popular short-term investment options include certificates of deposits (CDs), high-yield savings accounts, money market mutual funds, corporate and national bonds, precious metals, Bitcoin and other cryptocurrencies, Fixed and Recurring deposits, and equity derivatives. Additional short-term investment strategies include stock and forex trading.

- Investment Horizon – Short-term investment options are usually tied to specific timeframes or periods. Our experts recommend investors set a clear timeline before choosing any investment option.

- Tax Considerations—The best short-term investments may offer tax benefits, such as lower capital gains taxes and tax loss harvesting opportunities.

When considering any of these short-term investment strategies, it is important to consider the potential returns, liquidity, and risk level of the particular investment and your own financial targets and horizon.

| Interactive Brokers | Emirates NBD | Mashreq Bank | OKX | ByBit | |

| Bank / Broker / Crypto Exchange | Broker | Commercial Bank | Digital Bank | Crypto Exchange | Crypto Exchange |

| Bitcoin (Spot) | Yes | No | No | Yes | Yes |

| Etherium Staking | No | No | No | Yes | Yes |

| National bonds | Yes | Yes | Yes | No | No |

| Precious Metals (Spot) | Yes | Yes | Yes | No | No |

| Money Mutual Fonds | Yes | Yes | Yes | No | No |

| Certificates of Deposit | No | Yes | Yes | No | No |

| Deposit fee | 0$ | 0$ | 0$ | 0$ | 0$ |

| Withdrawal fee | 0$ | 0$ | 0$ | 0$ | 0$ |

| Inactivity fee | No | No | No | No | No |

| Deposit Apy | N/A | Up to 3.5% | Up to 2.67% | N/A | N/A |

| Mutual fund fee | $15 | 1.575% – 3.1% | 2%-5% | N/A | N/A |

| Bond Fee | $5 | 0.125% | 0.125% | N/A | N/A |

| Gold fees | 0.015% | 1.05%-2.1% | 0.125% | N/A | N/A |

| Crypto fees | 0.12% – 0.18% | N/A | N/A | 0.024%-0.1% | 0.01%-0.1% |

| BTC Apy | N/A | N/A | N/A | 0.29% | 1%-5% |

| ETH APY | N/A | N/A | N/A | 1.09%-3.4% | 0.5%-3% |

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.