Page Summary

There’s a reason the word “gold” is part of the phrase “gold standard” – for thousands of years, gold has been a reliable investment that doesn’t suffer the unpredictable ups and downs of the regular investment market. Let us take you through 5 essential steps for making sure your gold investment is safe and easy.

1. Find a Trustworthy Dealer

Your dealer will be your bridge to all your gold investments, so choose wisely. When it comes to selecting your gold dealer you should always keep in mind that: the company should be well insured, have a system in place that detects and prevents fraud, and have a valid gold dealing license.

Ideally, you’ll be able to work off a recommendation but, if not, make sure to check out reviews and testimonials. Try to talk to the dealer in person, as you can tell a lot from their mannerisms and, as with everything else in life, listen to what your gut is telling you.

Our recommended dealers for UAE and Dubai:

There are two companies we can give our highest recommendations to:

A company we can give our stamp of approval and fits the criteria is Regal Assets. They have been ranked #20 by INC 500 and have been featured in Forbes, Bloomberg, Market Watch, Reuters and many other publications. With over 1000 positive reviews on Trustlink, an A+ rating on BBB, AAA Rating at BCA – something very few companies EVER achieved in the precious metals industry. A few days ago Regal Assets became the first company in UAE to be accredited with the DMCC license to trade cryptocurrencies which adds a lot of trust to the brand and makes it a real authority in the investment sector.

Regal Assets is the world’s biggest online gold dealer, which has a great reputation for delivering the perfect customer experience when it comes to purchasing gold online. Their support team not only guides you through every simple step of the rollover process, but they also make sure to answer all of your questions by being fully transparent and upfront. You basically get your own representative who becomes your “go-to” person for any educational and investment questions you will have during the rollover process or later on.

You can get more information about Regal Assets by clicking on the picture below:

When it is time to liquidate your assets, they offer a buyback policy, 7 days a week and guarantee to have the funds in your possession within 24 hours of sale.

You can request the free gold investment kit here.

Compared to Regal Assets which is the “go-to” source if you simply want to make a wise, long-term investment to protect your savings from inflation, Bullion Vault is a trading platform for professional traders who are looking to make a profit by trading precious metals.

You can get more information about Bullion Vault by clicking on the picture below.

2. Do your research

Carrying out proper research will make your gold investment much easier, safer, and more profitable. Find out the many differences between bullion and coins. Ensure you keep up to date with gold market movements. Make sure you choose a trustworthy gold dealer like Regal Assets or Bullion Vault.

Ask lots of questions, and assess the answers in terms of customer service and information provided. Also take a long look at your own finances, and find out how much you can afford to safely invest.

3. Understand the different types of gold

Gold is usually traded in either bullion or coins, also known as numismatic coins. They are quite different, so ensure you understand the differences. Gold bullion is probably the image of gold you have in your head – gold bars and high-tech security. It is a very solid investment, but not very flexible, as it requires high initial investment sums and you must look after the storage and security of your bullion.

Numismatic coins are much more manageable, as they are exactly that – a special type of coin. Their price fluctuates more than gold, but they are easier to buy into – and sell.

4. Be careful

Like any investment, there are some risks involved with buying gold. Firstly, make sure you can afford to invest. There’s always a risk you might lose your money (although this risk is less with gold that with other types of investments). Make sure to employ all the security measures you normally use, like doing research (below) making sure your dealer is reputable (below) and, above all, trust your instinct. If something seems off, it probably is.

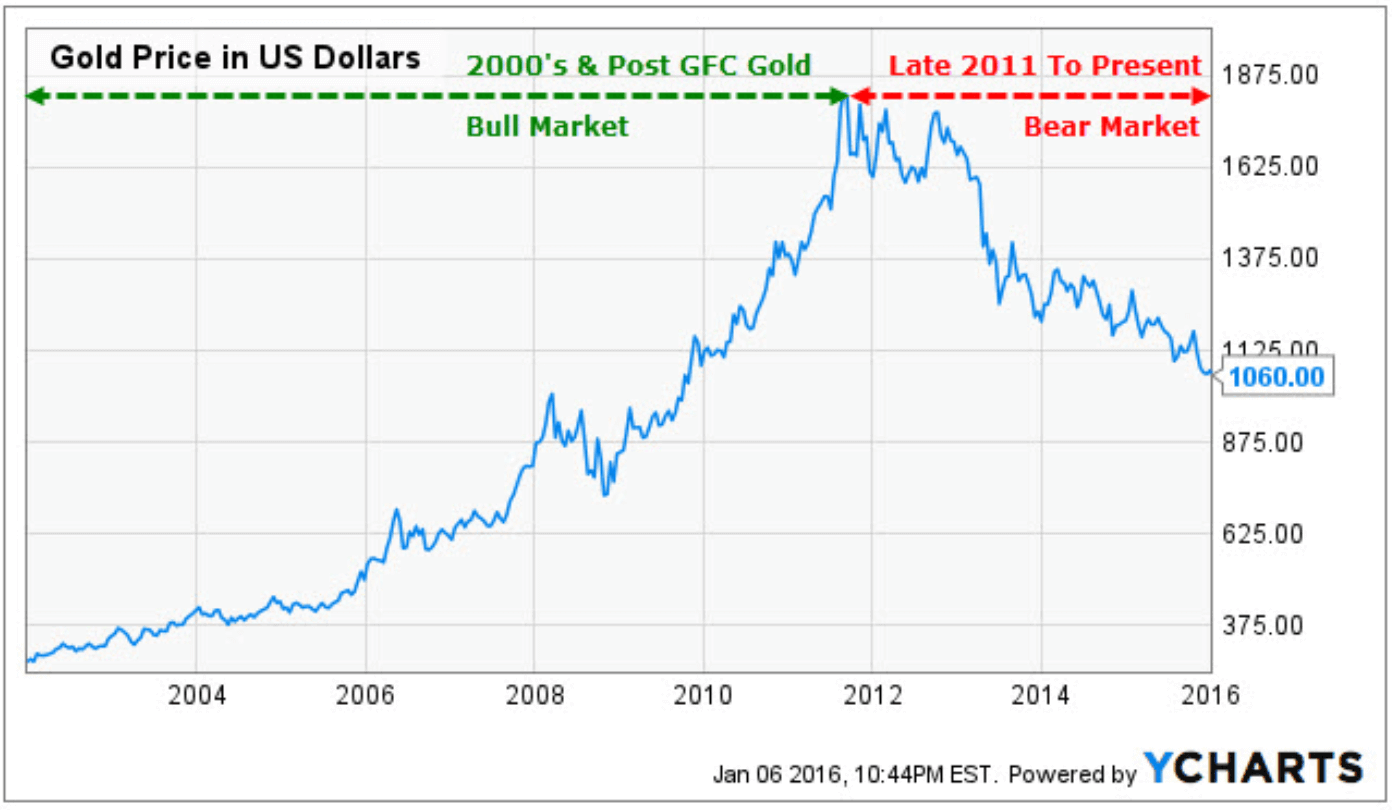

5. Constantly check the current market price

Although one of the more steady investments, the price of gold does indeed vary. The good news is that gold almost always increases in value, while the downside is that on any given day, the spot value – as opposed to the futures value – can be lower or drop. You’ll be able to find these spot and futures prices online, and you should make sure to investigate them frequently so you can build up a “feel” for your new investment market.

Once you take care of these aspects, you should feel much more confident about taking your first steps in the world of gold investment. With adequate personal funds, gold is an investment for the long-term and, many feel, one of the safest places you can keep your money.

Buy Gold Online In Dubai

With the world’s economy becoming more and more unstable, buying and storing precious metals offshore has gained popularity. Dubai is one of the biggest trading ports in the world, having a beneficial strategic position, tax-free benefits, combined with low storage costs, it is a “go to” location for investors worldwide and possible online buyers of that precious metal. We have put together a guide where you will learn why and where to buy gold in Dubai

Here are the main reasons to buy gold online in Dubai:

- Tax Benefits

- Political Insurance

- Security

- Anonymity

- Litigation Protection

The government has very strict regulations bagged by a certification process (by the DCLM) which ensures only the highest standard and purity gold to be purchased in Dubai via online forms. The price range of this precious metal in Dubai is still among the best in the world, but you also need to know that different sellers attach different handling and storage fees so make sure you choose the right one to handle your purchase. However, if you want to buy gold online in Dubai, you should only do so from a reputable gold dealer and by the current gold rates in Dubai. This will save you from any unnecessary headaches in the future.

Here are some of the key factors you should consider, before buying gold online:

- History of the company

- Safety of their storage

- Customer service

- Online Reviews

- Company policies

- Fees

- Reputation

- Buyback policy

How To Store The Gold You Have Bought Online?

You should always go for segregated storage with low fees that don’t eat up your value of precious metals. Always make sure your metals are stored apart from others (segregated) and that you have an exclusive storage box. This way you can ensure that the metals you buy, are the same as purchased. On top of that, you can go and audit them at any given time.

On the other hand, commingled or allocated storage is where your precious metals are stored with others and only documented as yours.

If you would like to store your metals in Dubai or Singapore, get in touch with an expert.

Storing your Metals in a Bullion Vault

This is still the best and safest way of storage for your precious metals because of the following reasons:

Insurance – Regal Assets offer you insurance for the market value by the worlds leading investment insurance company Lloyd’s of London.

Safety – The metals you purchase with Regal, are stored in one of the top 5 safest bullion vaults under the Almas Towers operated by Brinks and holding high volumes of precious metals. You can read more about the storage in the Almas Towers here.

Costs – many investors don’t know that the ETF managed metals are expensive and the cheaper and arguably safer alternative is a bullion vault.

When buying precious metals online, make sure you do your due diligence and buy from a reputable company like Regal.

If you have any questions, make sure you visit their website or request the free offshore investment kit.

How and Where To Buy Gold Off-line in Dubai and UAE?

It’s pretty clear to all of us that the United Arab Emirates are the hub of gold trading in the world as it is home to gold refineries, bullion dealers, bullion investment firms and traders of gold coin and jewelry.

Your question shouldn’t be where to buy gold in Dubai instead, it should be how much can I invest because there are so many options for buying gold in the whole UAE.

Let’s suppose you can invest up to $5000. In that case, your best bet would be small dealers. Fortunately, all dealers in UAE charge nationally set prices for precious metals. However, sometimes, there is a premium added to the price which is also known as the maker’s fee. These premiums are low as compared to the western prices of bullion bars, especially the ones that are produced locally.

If you want to make a large investment in gold, then it is fair to reach out the large dealers or maybe even the gold investment houses like Regal Assets or Bullion Vault. There are also local dealers in Dubai like Kaloti and others mostly located in the Dubai Multi-commodities Center.

You can also choose digital bullion trading offered by the new bullion traders via the Dubai Gold and Commodities Exchange.

Best Offline Gold Dealers in UAE

Here are some of the best bullion dealers in UAE:

- Al Bahrain Jewellers

- Emirates Gold

- Al Etihad Gold

- Kaloti Precious Metals

- Gold Standard DMCC

- Dhab DMCC

- National Metal DMCC

- National Bullion House

Buying Gold from Gold Souks

Ask anyone about the best gold souks in the UAE or probably in the entire Middle East and they name Deria Gold Souk. They have the largest collection of jewelry and gold bullion. The City of Gold says that this Souk holds ten tons of gold on average at a given time. It is visited by investors and tourists alike. It is home to multibillion Dollar dealers of bullion and some of the finest gold refineries. On top of this, the prices are reasonable and the premium ranges from 0.5 to 1 percentage.

You can find the current Gold rates in Dubai on our website: business24-7.ae

The New Gold Souk, Al Raffa, and The Gold Diamond Park, Sheik Zayed Road, also fall in the category of the largest gold Souks in the city.

Bullion Manufacturers in UAE

There are plenty of local bullion bar producers and large-scale gold refineries in UAE that sell gold at a low premium. You can also find exotic bullion manufactured in the USA, UK, Switzerland and Australia.

The most notorious local bullion bars are produced by Kaloti, the largest gold refinery in the city. Then we have 24K reproductions of UK gold monarchs that are sold in most of the souks. PAMP, the Swiss manufacturer of bullion is also building its credibility in UAE.

Here is the list of the major UAE gold refineries and bullion producers:

- PAMP Gold

- Emirates Gold

- Al Etihad Gold

- Kaloti Precious Metals

- Gulf Golf refinery

- Precious Metal Refiners

- Gold Standard DMCC

- Nadir Gold DMCC

Are There any Risks in Buying Gold Online in UAE?

When buying bullion in UAE, always watch out for counterfeit gold. Although the Emirates authorities identify fake bars and coins through a tough evaluation process, still some dealers manage to sell fake gold. No matter where you are buying gold from, always carry out the basic testing.

We say this because even the biggest dealers of gold bullion can be selling you counterfeit gold since this happened in December 2015 in the UAE Bullion Market. It also happened in the USA which is why Tulving and Merit Gold are out of business.

A gold dealer giant Gold AE was caught in a counterfeit and they owe alleged money of 25 million dollars to the victim. Even though the authorities are doing what they can to get the victim their refund and there are multiple civil suits against Gold AE too, but from what it appears, the money is lost.

So, whenever you are buying gold, for safe purchase, take delivery. If you have to build a large digital bullion account or an account for the bullion allocated in UAE, make sure you do so at multiple locations to spread the risk.

Our Guide To Buy Gold In Dubai (Online and Offline)

Have you ever wondered about the benefits of investing in gold bullion?

Before we talk about buying gold in Dubai we will cover some of the historical insights.

Gold was used as a form of money long before we started to create our own diverse currencies. Indeed, there’s something inherently valuable about gold, thanks to its finite supply and luxurious nature. Many experts agree that gold is a valuable investment because it’s one of the world’s most stable assets, less likely to suffer from common problems with inflation than things like traditional bonds, or stock investments.

Gold can be a safe haven for investors, and a unique way to diversify your portfolio. After all, when the financial markets and stocks go down, gold moves independently, often rising in worth. Additionally, it’s worth noting that physical bullion in silver and gold are currently the only assets on the market that are not exposed to problems like counterparty risk, and consistently hold onto their historical value and purchasing power. Everyone from central banks to retail collectors and institutional investors tout the benefits of gold.

Different Types of Gold Investment

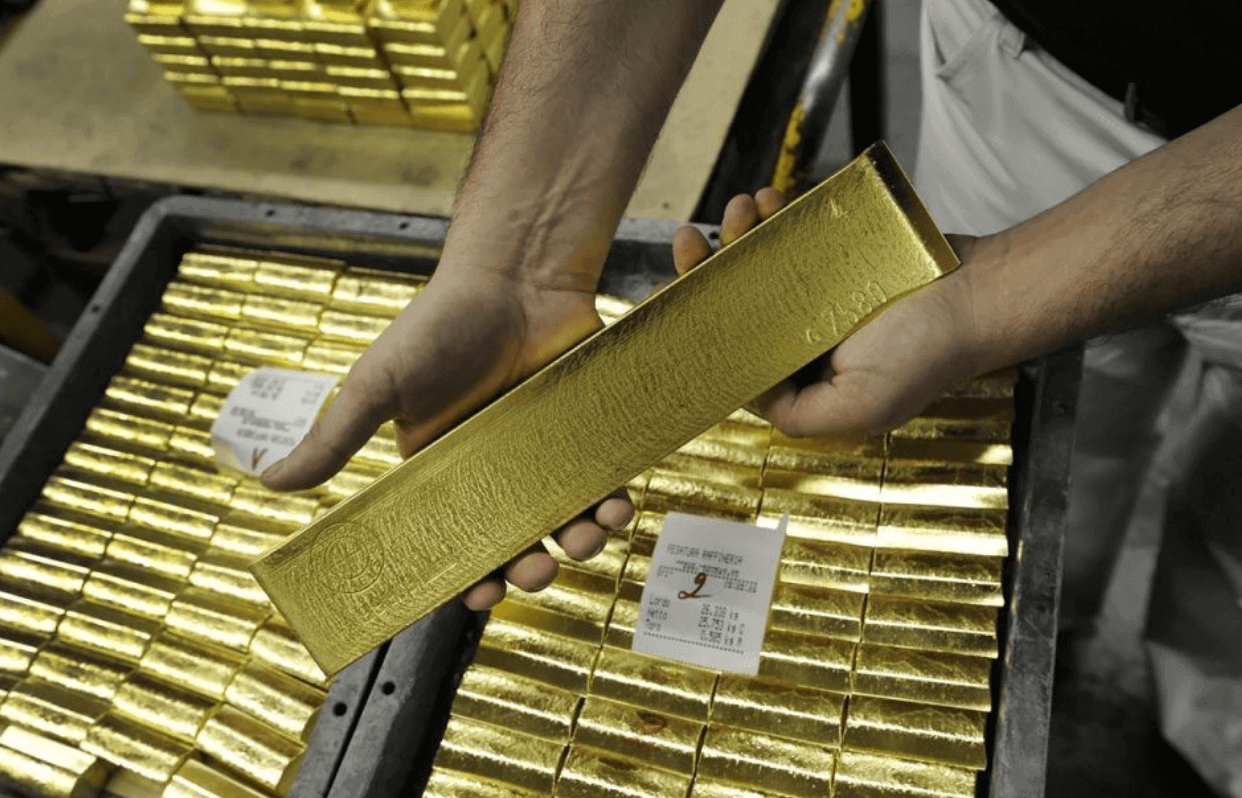

Gold Bars

Gold bars are the investments that you associate with banks vaults in movies. Gold bars are produced by private and government mints and can range in sizes all the way from those as small as a single gram, to those as large as 400 ounces. Gold bars usually come with specific serial numbers, and some come in tamper-proof cards that contain information about assets, and the signature of a Chief Assayer. Serial numbers are often useful if golden bars are held in a segregated storage space or trust. The low fabrication costs associated with gold bars mean that it’s often cheaper to get your hands on this form of gold than it is to invest in rounds or coins. This ensures that you can begin to accumulate more gold for your investments at a lower price per ounce.

Gold Rounds

Gold rounds are the coin-shaped golden investments produced primarily by private minting companies. These rounds come with beautiful craftsmanship that rivals government mints, though they don’t have any face value, which means that you won’t be able to use them as legal tender. Private mints can come with many unique and beautiful designs for their rounds, and you can purchase these coin-shaped gold pieces in many different sizes.

Gold Coins

Perhaps the most common way to invest in gold is with coins, government mints that are distinguished from rounds with a face value. The value that is printed on golden coins allows them to be used as tender within the country in which they are issued. Gold coins typically come with a higher premium than standard gold bullion because it takes extra work to fabricate these components. However, when the spot price of gold increases overall, then you can rest assured that the price of coins will rise with it. You can buy a pure gold coin in sizes that range all the way from 1 gram, to 1kg.

Understanding the Price of Gold

If you’re thinking of investing in Gold bullion, then one of the first things you’ll need to know is the price of what you’re paying for. Here are some ways to figure out the best prices of gold.

Gold Spot Prices

The spot price for gold is simply the foundation on which prices of gold are determined. Most gold providers will base the prices of their products off the gold spot price, using the latest and most accurate information available in the investor marketplace. There are plenty of websites out there that will also display the current spot price for gold on their websites as it changes so that you’re constantly aware of the latest value of your investments. Since prices can fluctuate, it’s important to look for a time to invest when spot prices are low.

Spot Price Alerts

If you want to make sure that you’re definitely getting the best price for your gold investment, then you can always set up a Spot Alert with a specialized investment company. Today’s gold sellers allow you to set alerts at levels that you’re willing to pay, so you’re ready to jump into action as soon as the value of gold drops to a price that you can afford. All you would need to do to get started is set up an account, and you can start checking out the best prices for gold immediately.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.