Page Summary

What Is CFD?

Considered to be a complex financial product, a contract for difference (CFD) is a form of derivative trading that relies on the difference between a trades’ opening price and its closing price for investors to make a profit. Unlike some other assets, a CFD is a purely financial transaction, there is no physical securities, goods or assets to be traded.

A CFD transaction is cash settled at the end of the trade, securing profits, or losses, for investors with good market knowledge. Typically, they are used as an advanced strategy by experienced traders. Investors who do rely on CFDs often do so as a means to hedge their portfolio, profit in market downturns, and amplify their earnings and losses by trading on margin.

Understanding CFD

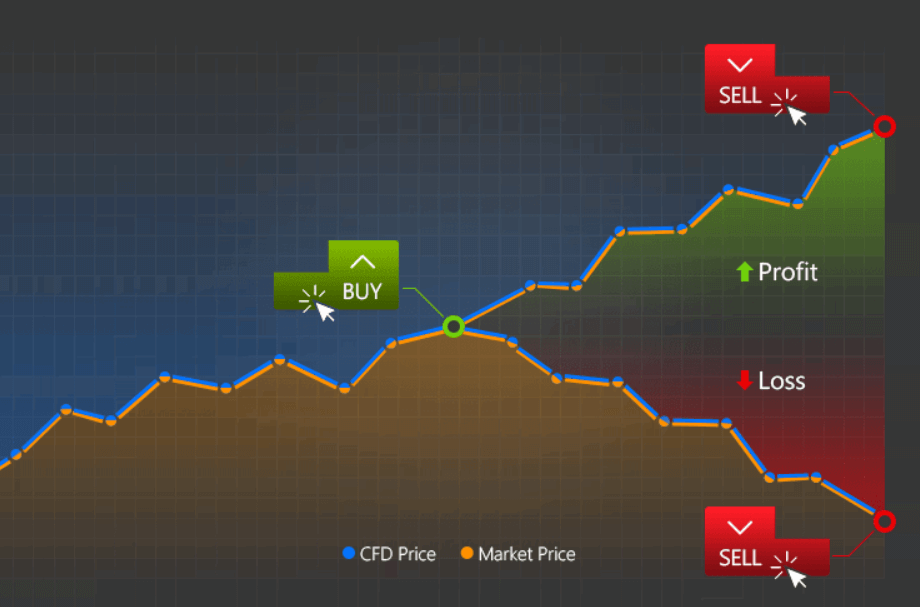

A CFD, put simply, is a product which provides traders with the ability to buy and sell units based on the financial movement of their related securities and derivatives. Investors use CFDs to predict the price movement, either up or down, of their underlying asset. Whether purchasing contracts on the asset itself, or on derivative financial products of the same asset, bold traders take out a position on whether they expect their value to rise or fall.

Purchasing a CFD on an asset is a way for a trader to predict a climb in its future price. Traders predicting a future fall will look to offload, or short, an opening position as soon as possible.

Should the price rise in-line or even greater than the buyer’s expectations, they may be expected to offer their position for sale and generate a profit from the trade. The difference between initial purchase price and final sale price represents the gains or losses brought about by the trade.

A trader who expects the price of an asset to fall may place an opening position to sell, in order to to profit from the market’s downturn. To close an opening sell position, a trader must buy an offsetting trade at the end of the deal. The difference between the price of the two trades over time represents the gains or losses made in the transaction.

Put simply, purchasing a stock that is expected to climb in value or shorting a stock that expected to fall in price are the two key methods use to profit prom CFD trading. Both come with their own high risks and rewards that make CFD trades stand out from trading assets and derivatives.

Conducting CFD Transactions

A huge number of assets and securities can be traded with CFDs. Index funds, such as the FTSE 100 and exchange-traded funds such as the SPDR S&P 500 are regularly traded by investors who make full use from CFDs.

Along with Assets, derivatives, and securities, CFDs are used for speculation on the price of futures contracts too. A futures contract, for products such as corn or crude oil, is a contract or standardized agreement with a built-in obligation to sell or purchase assets at a pre-determined price with a known expiration date. Futures contracts differ from CFDs crucially in this area.

Although a CFD allows an investor to trade in futures price movements, they are in fact not considered futures contracts by themselves. A CFD does not have an expiration date which contains pre-determined prices. A CFD trades instead in the same manner as regular securities with a purchase and selling price. Both products have their own place and their own unique use cases.

Another aspect of CFDs that make them somewhat unique in the finance world is that trading CFDs takes place over-the-counter (OTC). A brokers network organizes market demand and supply, adjusting prices accordingly.

CFDs do not trade on any of the major exchanges. CFDs are classed instead as a tradable contract placed between client and broker. Both parties exchange the price difference and complete value of the trade at the point the transaction is reversed.

Advantages of trading CFDs

Using CFDs, traders are provided with all the benefits and risk of owning securities without some of the drawbacks of regular assets. No physical delivery or ownership transfer is required because a CFD is a purely financial product.

Having the ability to trade on margin means the broker enables investors to borrow money, increase their trading leverage. By trading on margin, investors increase the size of their position beyond the amount they are able to deposit for the trade. Margin enables a trader to amplify their profits, but also their losses too.

Brokers will universally require a trader to maintain a certain account balance before they allow them to conduct these types of transactions.

Standard leverage on CFDs can be between 2% and 20%. This is a position typically much more leveraged than traditional trading markets. A lower trading margin means less capital is required to enter a trade and both the risk and return potential of the trade is much greater.

The rules and regulations which surround CFD trades are typically much more relaxed than conventional asset trading too. CFDs, as a result, require lower capital requirements to be maintained in a brokerage account. A trader may often open their account with just $1000 in many cases.

Because CFDs, in common with other assets, mirror corporate actions, a CFD owner can expect cash dividends for certain cases. A trader’s return on investment can be vastly improved with the right choice of investments.

The majority of CFD brokers today offer products in almost all major markets worldwide. Investors have unprecedented easy access to markets opened up from the platform of their chosen broker.

Typically, brokers refrain from charging fees on top of CFD trading. Instead, brokers profit from investors paying the spread, meaning purchasing at the buying price and selling at the bid price. A broker takes a spread, large or small, on every bid and sell price which they quote.

One of the primary advantages of a CFD is that it allows investors to take either a long or a short position on any given trade. The market for CFD trading has typically no short-selling rules. Instruments are free to be shorted, with minimum regulation, at any time. As a result of not owning the underlying asset, borrowing and shorting costs are avoided on the trade.

Disadvantages of a CFD

If an underlying asset is exceptionally volatile, meaning its price fluctuates wildly, the spread over the buy and sell prices can be far larger than normal. Large spreads mean that the price movement which would be required to profit from a trade goes up significantly. Investors trading in CFDs with a small spread only require small movements in prices before they can make profits.

As a result of relaxed regulations within the CFD industry, the credibility of a broker is based largely on their reputation and their financial viability. Investors must take particular care to seek out highly trusted, reputable brokers known to many. Some countries, such as the United States, do not allow CFD trading at all.

One of the largest concerns surrounding CFD trading regards their leveraged position. As well as being their largest asset, the leveraged position of a CFD means losses can exceed the margin deposited for the trade. Investors who hold a losing position may receive a dreaded margin call from the broker. The broker can require additional funds to increase the deposit on the trade in order to allow it to continue. Where a broker has lent money to a trader to cover trades, daily interest rates will be added too.

What Is CFD Trading – Example Trade

You want to purchase a CFD contract on the above mentioned SPDR S&P 500 (SPY). This exchange-traded fund tracks based on the S&P 500 index. Your broker requests a 5% margin deposit on the trade.

Purchasing 200 shares for $125 per share provides you with a position of $25,000. You require 5% or $1,250 to pay to the broker to secure your position. This comparatively small deposit creates a far bigger investment than your limited capital would conventionally allow.

After some time, SPY is trading up at $175 per share. Wishing to exit the position, you stand to gain $50 per share for a total of $10,000.

At the close of the trade, your CFD is then cash-settled with an starting position of $25,000 and a closing position of $35,000. Your $10,000 gain, minus commissions costs, is credited to your investment account.

CFD trading can be a highly lucrative enterprise, it can also be highly complex and very risky too. For experienced investors with great market knowledge and a desire to make the most of their limited capital they can provide a strong option to broaden their portfolio.

With careful research, good decisions, plenty of knowledge and a high degree of care, contract for difference skills can heighten your market advantage and enhance your ability to make profit even in the most difficult of climates. You will also need a proper platform before you start trading. You can check out our list of our personal favourite trading platforms or check out our review of Plus500 platform which is an CFD trading platform only and seems to be the best option when you are just starting out.

What Is Next?

If you like this article then you might also be interested in:

- Social trading explained

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.