In a Nutshell

Disclaimer: Since 25 March 2020, DEGIRO has imposed a temporary waiting list for new customer registrations until further notice. This restriction is in place because DEGIRO has listed several new assets in the midst of constant strong market volatility. As a result, it might take longer than expected to set up an account. Stay tuned for further updates in this review as more details come to light.

DEGIRO

Best ForStocks, ETFs, Options

Recommended ForShort-Term Traders, Day Traders, European Traders

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForStocks, ETFs, Options

Recommended ForShort-Term Traders, Day Traders, European Traders

- Trader Level Beginner-Advanced

- Stock Fees Low

- Options Fees Low

- Account Opening Speed 24 hours

-

Web trading platform3.5

-

Fees4.5

-

Mobile App5.0

-

Deposit and withdrawal 1.6

-

Available assets4.4

-

Account opening5.0

-

Education and Research 3.1

-

Support3.5

-

Overall rating3.8

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

DEGIRO Review and Insights

Based in the Netherlands, DEGIRO is an online discount broker. Privately owned, it was launched back in 2008 by 5 employees from Binck Bank, another brokerage company. Services opened up to retail investors in 2013, giving them access to security exchanges around the world.

DEGIRO is registered with the Chamber of Commerce and Industry in Amsterdam, a local organization established to further the interests of Dutch businesses. The company is also overseen by several top-tier regulators including the Dutch Central Bank and the Netherlands Authority for the Financial Markets.

We rank DEGIRO as the Best Broker For Stock Trading and the Best Discount Broker for 2020. This ranking was calculated by our team of analysts after a thorough assessment of several online brokers and stringent testing of their live accounts.

DEGIRO Good & Bad

In addition to being overseen by several top-tier regulators, DEGIRO also boasts one of the most competitive fee structures for all the assets it lists. Its mobile and web trading platforms are well optimized for UX.

There are three significant disadvantages to using DEGIRO:

- There is a waiting list for new customers.

- It is not possible to make deposits and withdrawals using debit and credit cards.

- There are no forex trading services in place.

- Competitive fee schedule

- Several top-tier licenses in place

- User-friendly mobile and web trading platform

- Customer waiting list

- Lack of educational and research resources

- No forex trading

1. Fees and Spreads

DEGIRO offers affordable non-trading and trading fees.

We have concluded that DEGIRO is the best broker on the market for most asset classes. Several ETFs are also available to trade once a month for a fee, which we can say it is an excellent deal for buy-and-hold investors.

- Low Trading Fees

- Low Non-Trading Fees

- Low ETF And Stock Fees

- Higher Fees for European And Asian Stock Exchanges

Assets

| Assets | Fee Level | Fee Terms |

|---|---|---|

| US Stock | Low | $0.004 per share + €0.5 |

| USD/EUR | – | – |

| Mutual Fund | Low | 0.1% + €7.5 and 0.2% yearly administration fee |

| Inactivity Fee | Low | No inactivity fee |

How We Assessed Fees

We evaluated DEGIRO’s fees as being low, average, or high based on how they stack up against the forex brokers we reviewed.

But what is the difference between trading and non-trading fees Here are some bullet points to better understand the distinction.

• As the name suggests, trading fees relate to trading activity specifically, including spreads, conversions, commissions, and fees for financing rates.

• Non-trading fees are those costs which do not relate specifically to trading. Examples include withdrawal and inactivity fees.

Next, we shared the most important fees at DEGIRO for each asset class. As an example, for stock investing, the main fees are commissions.

As part of our analysis of DEGIRO’s costs, we compared them to those of similar brokers (eToro, IQ Option and Plus500). The criteria evaluated included the range of products offered, the fee schedule in place, and the client profile, among others.

Here we present a summary of the main conclusions reached on our analysis of trading fees for DEGIRO.

Trading Fees At DEGIRO

Using the feeds for DEGIRO UK as the basis (since costs differ from country to country), DEGIRO has the lowest trading fees for all asset classes.

ETF And Stock Fees

DEGIRO has one of the lowest ETF and stock fees on the market.

This broker has a list of ETFs which can be traded without fees once a month (you can opt between one sell or buy transaction). Beyond that, extra ETF transactions for the same product done in the same month have no commission (it applies for the same type of transaction as the first one, while the trade must total at least $/€1,000.

ETF And Stock Fees For A $2,000 Trade At DEGIRO

Stock Fees Comparison

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| US Stock | $0.6 | $1.5 | $0.0 |

| UK Stock | $2.4 | $2.4 | $0.0 |

| German Stock | $5.4 | $2.4 | $0.0 |

The ETF, stock, and warrant fees are the same with this broker.

The trading fee is a flat fee to which a percentage of the traded volume is added. The only exception is for Canada or US customers, where the fee comes from the number of shares traded. The fee for European and Asian markets is higher.

ETF, Stock, And Warrant Fees At DEGIRO

Market

| Market | Commission | Max |

|---|---|---|

| United Kingdom | £1.75 + 0.014% | £5 |

| USA | €0.5 + $0.004/share | – |

| Germany – XETRA | €4 + 0.05% | €60 |

| Germany – Zertifikate-Börse Frankfurt | €2 + 0.11% | – |

| Germany – Frankfurt (Stocks) | €7.5 + 0.09% | – |

| Belgium, Denmark, Finland, France, Ireland, Italy, The Netherlands, Norway, Austria, Portugal, Spain, Sweden, Switzerland | €4 + 0.05% | €60 |

| Canada | €2 + CAD 0.01 per share | – |

| Australia, Hong Kong, Japan, Singapore | €10 + 0.06% | – |

| Poland | €5 + 0.16% | – |

| Hungary, Greece, Czech Republic, Turkey | €10 + 0.16% | – |

| ETFs | €2 + 0.03% | – |

| Free ETFs | 1 free trade/month | – |

If you are looking for a short sale or stock trading, take a look at DEGIRO’s financing rates.

A financing or margin rate is a fee which is charged when you short a stock or use margin. It signifies that you borrow stocks or money from your broker to trade. This borrowed capital or money comes with interest that you have to repay. Bear in mind that this can turn out to be a significant amount of your trading costs.

DEGIRO has low financing rates, but they can differ depending on the currency of your margin account.

Yearly Financing Rates for Futures, Options, and Stocks at DEGIRO

Margin Rates

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| USD Margin Rate | 3.1% | 2.6% | – |

| GBP Margin Rate | 1.9% | 2.0% | – |

| EUR Margin Rate | 0.8% | 1.5% | – |

The rates listed above are the same for futures and options trading.

Fund Fees

Overall, this broker has low fund fees.

Fees For a $2,000 Fund Purchase at DEGIRO

Mutual Fund Comparison

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Mutual Fund | $10.30 | $25.00 | – |

As is the case with stocks, DEGIRO has volume-based and flat fees for funds. The flat fees are higher for several non-listed funds.

Fund Commission Costs at DEGIRO

Mutual Funds

| Mutual Funds | Commission | Annual Fee |

|---|---|---|

| Euronext Fund Services | €7.5 + 0.10% | 0.2% |

| Non-Exchange Listed Investment Funds (STP) | €7.5 + 0.10% | 0.2% |

| Non-Exchange Listed Investment Funds (Non-STP) | €75.00 + 0.10% | 0.2% |

| FundShare Cash Funds / Morgan Stanley Liquidity Funds | Free | Free |

Bond Fees

Overall, this broker has low bond fees.

Fees for a $10,000 Government Bond Trade at DEGIRO

Bonds

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| US Treasury Bond | – | $7.50 | – |

| EU Government Bond | $10.50 | $15.00 | – |

You can look at the volume-based pricing in the table below:

Bond Commission Pricing At DEGIRO

| Market | Commission |

|---|---|

| Germany – Xetra / Frankfurt | €5 + 0.05% |

| The Netherlands, Belgium, Portugal, France | €2 + 0.06% |

| OTC Bonds (i.e. Norwegian) | €35 + 0.03% |

Options Fees

DEGIRO has low options fees. Similar brokers have higher trading commissions for this asset class.

Stock Index Options Fees Of 10 Contracts At DEGIRO

Stock Index Options Fees

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| US Stock Index Options | $5.00 | $15.00 | – |

| UK Stock Index Options | – | $18.00 | – |

| German Stock Index Options | $9.90 | $16.50 | – |

DEGIRO has volume-based options fees, meaning that the commission you pay depends on the number of contracts you purchase.

Costs For Stock Index Options At DEGIRO

Costs For Stock Index

| Market | Commission |

|---|---|

| USA – CME, CBOT, CBOE, NYMEX, COMEX | $0.50 / contract |

| Germany | €0.75 / contract |

| Spain | €1.50 / contract |

| The Netherlands, Belgium, France, Portugal | €2.00 / contract |

| Norway, Finland, Sweden, Denmark | €0.50 / contract |

| Other Countries | €2.00 / contract |

| Option Exercise / Assignment | €1.00 / contract |

Future Fees

DEGIRO has low future fees, too. When compared to TradeStation Global, they are lower in the German and US markets, but higher in the UK market.

Stock Index Futures Commission of 10 Contracts at DEGIRO

Stock Index Futures Commission

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| US Stock Index Futures | $5.00 | $17.50 | – |

| UK Stock Index Futures | $27.50 | $11.40 | – |

| German Stock Index Futures | $8.30 | $14.90 | – |

As is the case with options, the futures commissions rely on the number of contracts you purchase:

Futures commissions

| Futures | Trading Fee |

|---|---|

| NYSE Liffe – Amsterdam, Brussel, Lisbon, Paris | €2.50 / contract |

| EUREX main indices – EURO STOXX 50, DAX, DAX Mini | €0.75 / contract |

| EUREX other stock indices | €2.50 / contract |

| USA – CME, CBOT, NYMEX, COMEX | $0.50 / contract |

| MEFF (Spain) | €1.50 / contract |

| Norway, Finland, Sweden, Denmark | €0.50 / contract |

Cryptocurrency Fees

DEGIRO allows you to buy cryptocurrency exclusively through ETNs (exchange-traded notes). When we reviewed this broker, users were allowed to trade with Ethereum and Bitcoin ETNs on the Stockholm Stock Exchange. The trading fee here is 0.058% + €4, but a maximum of €60. For further information on Crypto ETNs, take a look at our crypto blog posts.

Non-Trading Fees

DEGIRO has low non-trading fees. There are no withdrawal, deposit, inactivity, account, or custody fees.

Non-Trading Fees at DEGIRO

Non-Trading Fees

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Account Fee | No | No | No |

| Inactivity Fee | No | No | Yes |

| Deposit Fee | $0 | $0 | $0 |

| Withdrawal Fee | $0 | $0 | $5 |

The disadvantage is the Exchange Connectivity Fee. This fee is for trading outside your home market. You will pay a maximum of 0.25% of the total account worth (with a maximum charge of €2.50) for the calendar year for each exchange, except for the London Stock Exchange. The connectivity fee for US options is €5 for each transaction done per calendar month.

A currency conversion fee is applied when the currency in your account is different from the one of the assets you plan to purchase. DEGIRO allows you to manage this manually or automatically. Still, the costs for these two options differ:

- DEGIRO charges 0.1% of the transaction value for automatic currency conversions.

- DEGIRO charges €10 plus 0.02% of the amount for manual currency conversions.

We advise avoiding the latter option due to the high fees for low amounts.

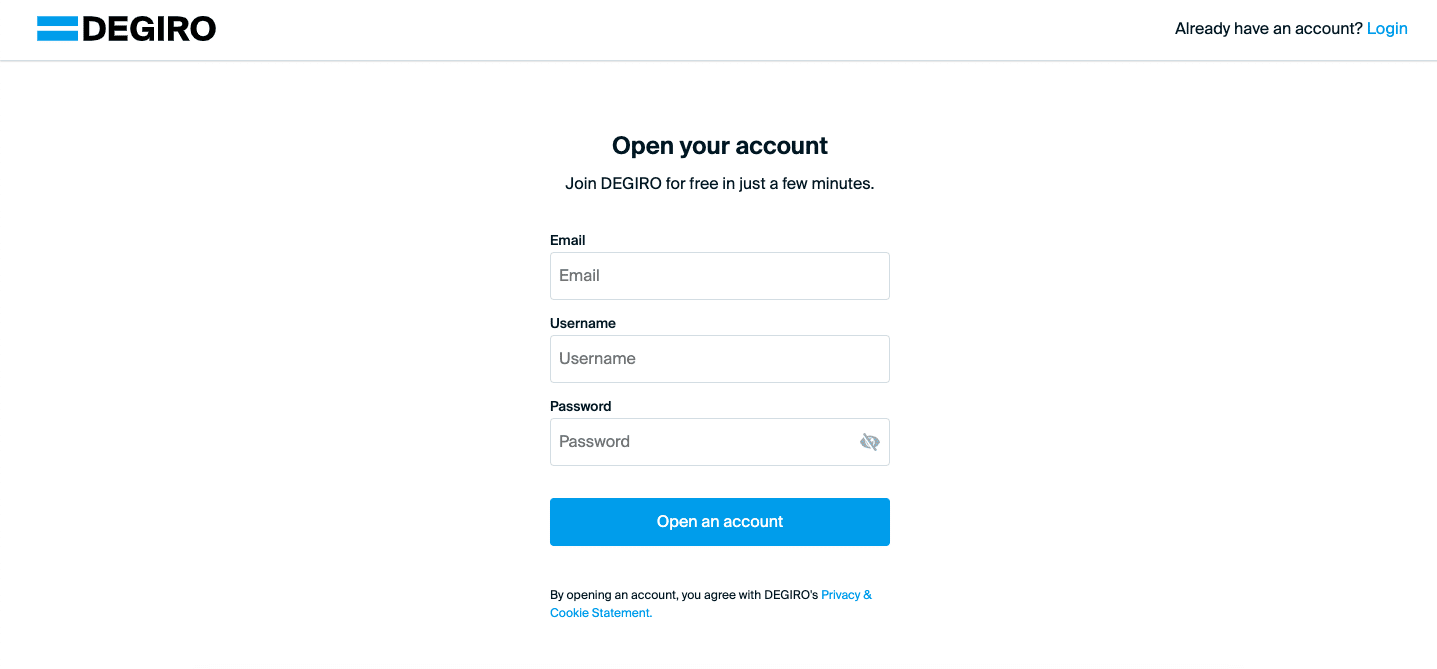

2. Account Opening

DEGIRO has no minimum deposit required.

However, since March 25, 2020, it has a waiting list for new clients. To verify this process, we applied for several accounts, but at the moment, we are still on the waiting list.

- Fully Digital

- No Minimum Deposit

- Slow

- None of the test accounts have been onboarded yet

New Accounts At DEGIRO

As mentioned above, starting with March 25, 2020, DEGIRO implemented a temporary waiting list for new accounts until further notice. This restriction appeared due to the numerous new client registrations in a heavily volatile market. As such, we concluded that opening an account at DEGIRO may take much longer, but we can’t tell how long exactly. We will continue to update this review when new information appears.

Minimum Deposit

DEGIRO has no minimum deposit. It is an excellent broker for those looking to invest smaller amounts.

Account Types

DEGIRO has several account types. These are:

- Custody

- Basic

- Active

- Trader

- Day Trader

Additional details on account types are featured below. As an example, Day Trader comes with many services, while Custody provides only a few. Trading costs are the same for each account.

Account Types At DEGIRO:

Account Types

| Custody | Basic | Active | Trader | Day Trader | |

|---|---|---|---|---|---|

| Trade: Shares, Bonds, Investment Funds, and Trackers (ETFs) | Yes | Yes | Yes | Yes | Yes |

| Trade: Leveraged Products and Warrants | No | Yes | Yes | Yes | Yes |

| Buying on margin | No | No | Yes (up to 50% of your available margin) | Yes (up to 100% of your available margin) | Yes (up to 100% of your available margin with additional margin during trading hours) |

| Going short | No | No | Yes | Yes | Yes |

| Trade Derivatives (Options and Futures) | No | No | Yes | Yes | Yes |

| Free real-time prices on Euronext exchanges | Yes | Yes | Yes | Yes | Yes |

| Free dividend and coupon processing | No | Yes | Yes | Yes | Yes |

Not all accounts are available in all countries.

When we reviewed DEGIRO, there was no tax-free account option like DEGIRO ISA or other account types in some European countries. We found two exceptions: the Netherlands, where you can create a pension account, and Sweden, where you can use an ISK account.

Opening An Account At DEGIRO

Opening an account with DEGIRO is simple, fast, and digital. Your account will be ready in up to 24 hours.

For registration purposes, you will need:

- A copy of your ID card or passport

- The bank account number from which you will fund the investment account.

After this initial stage, you will have to go through three additional verifications before your account is activated:

- Perform an appropriateness test.

- Agree to the conditions for real-time prices.

- Transfer money to your investment account.

3. Withdrawals and Deposits

DEGIRO has no fee for withdrawals and deposits if done through a bank transfer.

The downside is that you cannot deposit with a debit or credit card.

- No Withdrawal Fee

- No Deposit Fee

- Various Account Base Currencies

- Debit Or Credit Card Not Available

Account Base Currencies

DEGIRO lets you opt from 9 base currencies. These are DKK, CHF, NOK, GBP, EUR, CZK, SEK, HUF, and PLN.

DEGIRO’s Base Currencies Vs. Similar Brokers

Base Currencies

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Base Currencies | 9 | 20 | 1 |

With this broker, the base currency of your account is the currency of your home country. For example, if you create a GBP account and register it at www.degiro.co.uk as a UK citizen, you are not allowed to have more than one base currency for one account.

However, you can create another DEGIRO account in a different currency if you have a bank account in your name in the country of that currency. As an example, a UK citizen can set up a Swedish krona account if he has a bank account in Sweden. Also, he will have to sign up for a DEGIRO trading account on the local DEGIRO website.

This information is vital because trading assets or depositing funds in the same currency as your bank account won’t come with a conversion fee.

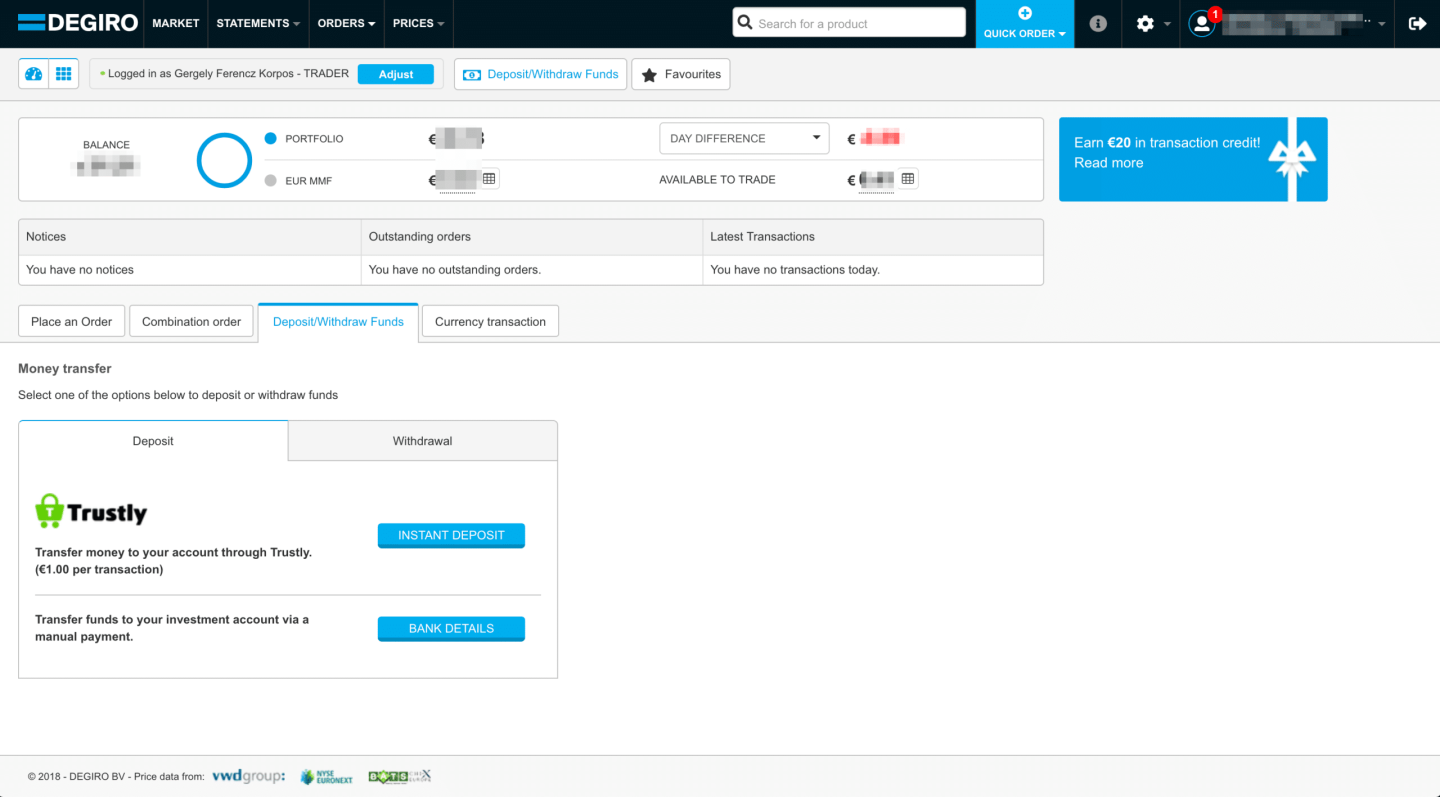

Options And Deposit Fees

You can fund your account with Trustly, an instant deposit service, or with a bank transfer. Clients from the Netherlands can use Sofort or iDEAL for immediate deposit. The disadvantage here is that debit or credit card deposits are not available.

Overall, a bank transfer takes up to 3 business days and a Trustly transfer only 30 minutes.

DEGIRO has no deposit fees.

Fees

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit Or Credit Card | No | No | Yes |

| Electronic Wallets | Yes | No | Yes |

This broker has strict rules for bank transfer deposits. It only permits transfers from bank accounts in your name from accepted countries.

Withdrawal Options And Fees At DEGIRO

DEGIRO has no withdrawal fees.

You can withdraw funds with bank transfers, as Trustly is not available for this action. This broker’s withdrawal options are the same as at its primary competitors.

Withdrawal Options

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit Or Credit Card | No | No | Yes |

| Electronic Wallets | Yes | No | Yes |

| Withdrawal Fee | $0 | $0 | $5 |

DEGIRO states that transferring funds to your bank account takes between 2 to 3 business days. When we tested this option, our funds arrived in our account within one business day.

You can transfer money to accounts in your name.

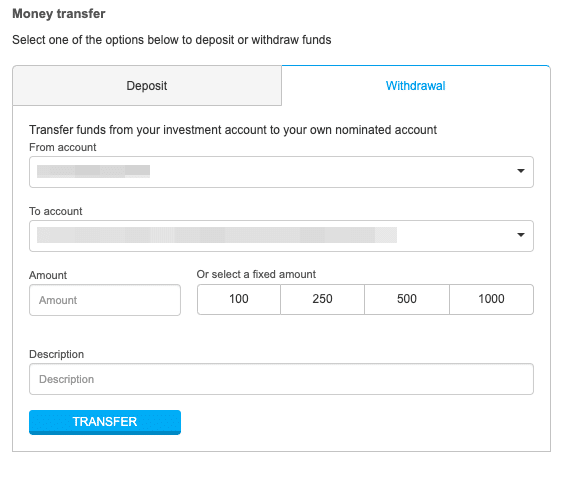

You can withdraw money only to accounts in your name by following these steps:

- Access the ‘Deposit/ Withdraw Funds’ section and click on the ‘Withdrawal’ tab.

- Choose the bank and DEGIRO account for the transfer.

- Submit the amount and a description.

- Click ‘Transfer.’

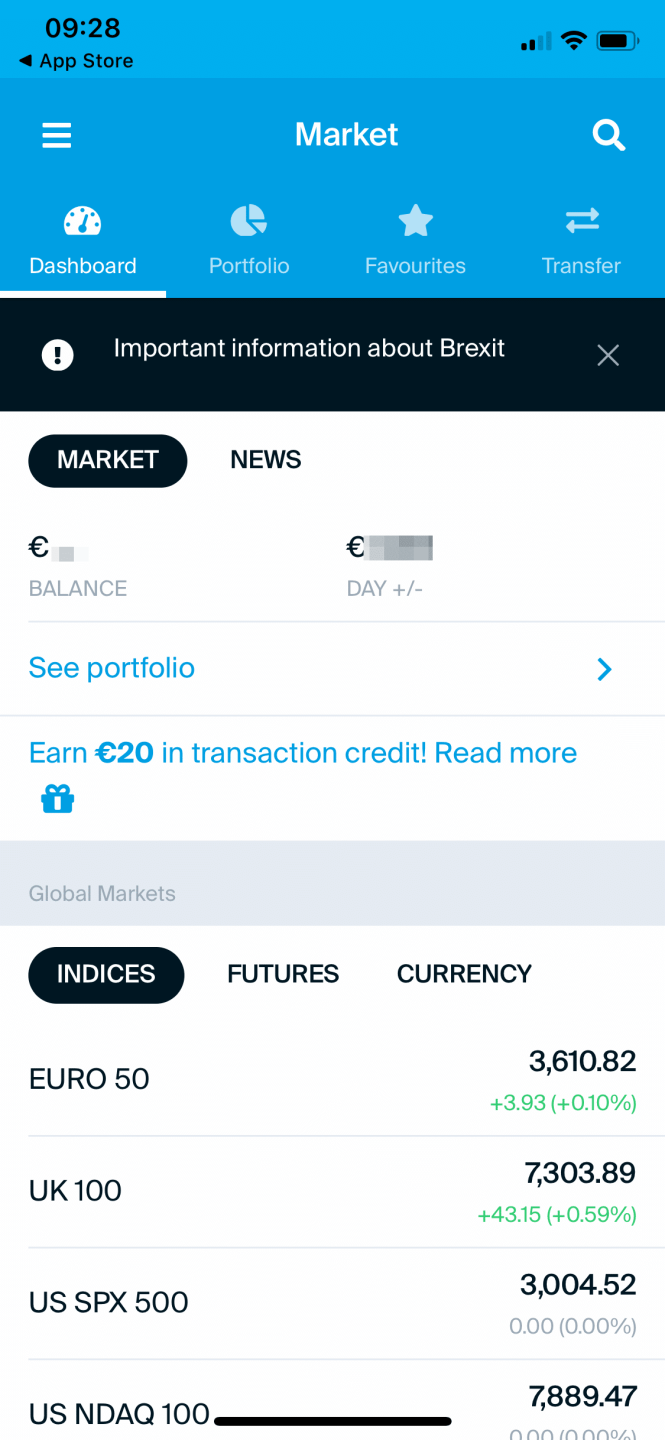

4. Trading Platform

DEGIRO has a user-friendly and easy-to-understand web platform.

It is excellent for beginners since it is easy to navigate. The downside is that there are no price alerts. For a better understanding and comparison, you can check out our best trading platforms in UAE article.

- Easy-To-Understand Web Platform

- Clear Fee Report

- Two-Step Authentication

- Limited customizability (for charts, workspace)

- No Alerts For Prices

Trading Platforms

| Trading Platform | Rating | Available |

|---|---|---|

| Web | 4/5 Stars | Yes |

| Mobile | 4.5/ 5 Stars | Yes |

| Desktop | – | No |

This web platform from DEGIRO is available in your local language. As an example, if you create an account from Germany, the platform will be German.

Look And Feel

This platform is excellent for executing trades, but it’s not the most advanced on the market.

It has a reliable and user-friendly design, but it doesn’t feature any customization options.

Security And Login

You can select between a one-step or a two-step authentication process. The two-step login is offered via Google Authenticator. We advise you to use the latter, as it is the most secure option.

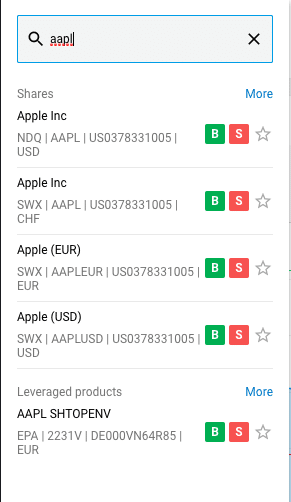

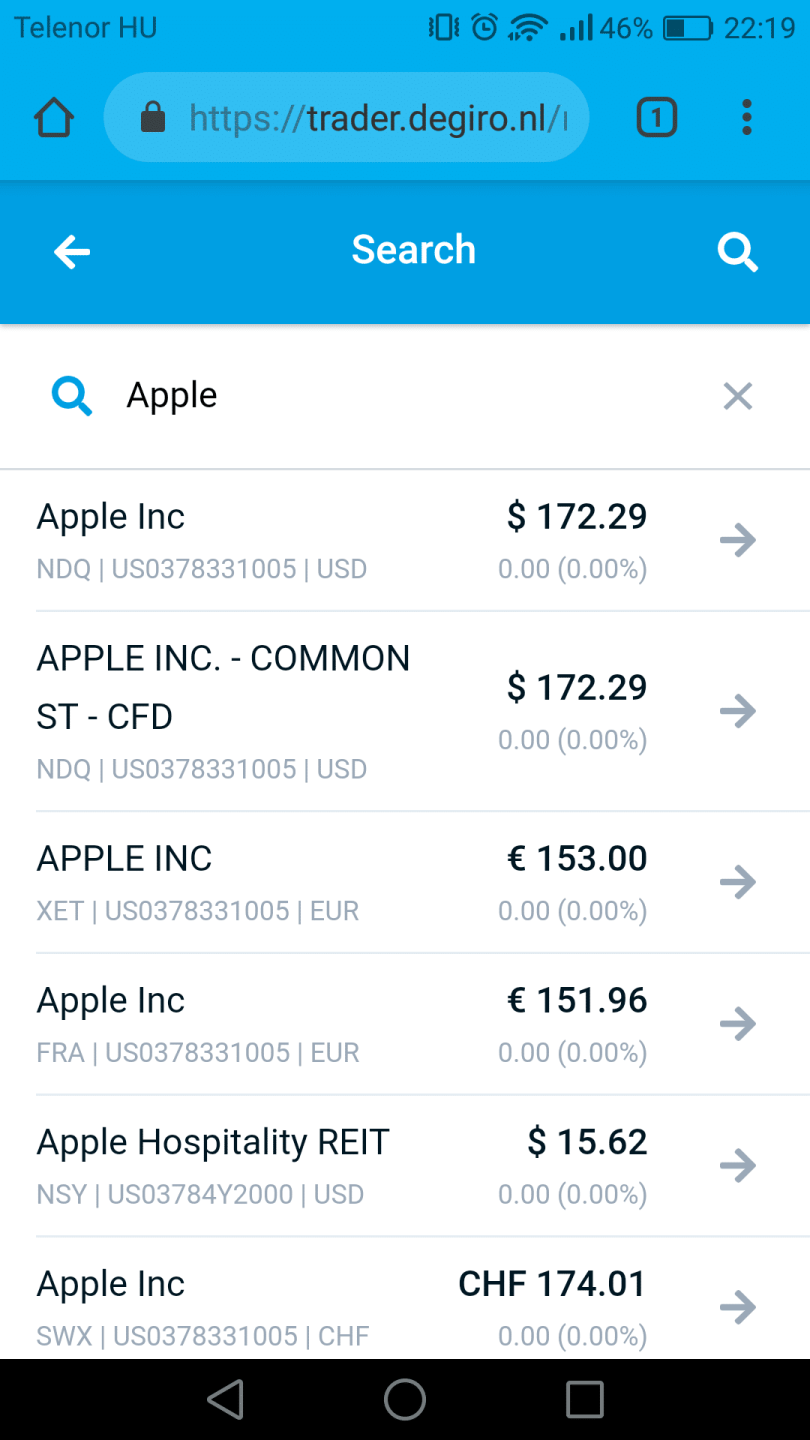

Search Features

The search functions at DEGIRO are reliable. If you submit the name of a product, you will receive a list of matching items, classified by asset class. Also, you can check the currency the product is available in and the stock market. Or you can filter the search result depending on the chosen asset class.

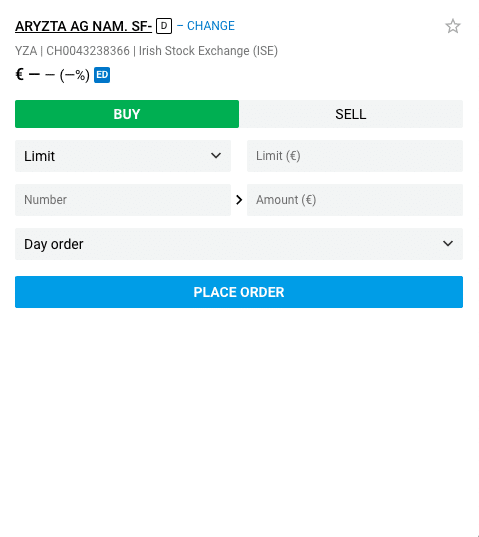

Placing Orders

You can choose between various order types, but not all are available for each tradable instrument:

- Limit

- Market

- Stop loss

- Stop limit

If you need additional information on standard order types, you can read our overview.

You can opt between two order time frames:

- Day

- Good-till-cancelled (GTC)

Notifications And Alerts

You can request order confirmation by email, but you cannot use text message alerts. Also, there is no price alert setting.

Fee Reports And Portfolio

DEGIRO has transparent and well-designed fee reports and portfolios. You can check what items you own and the fees paid for the transaction.

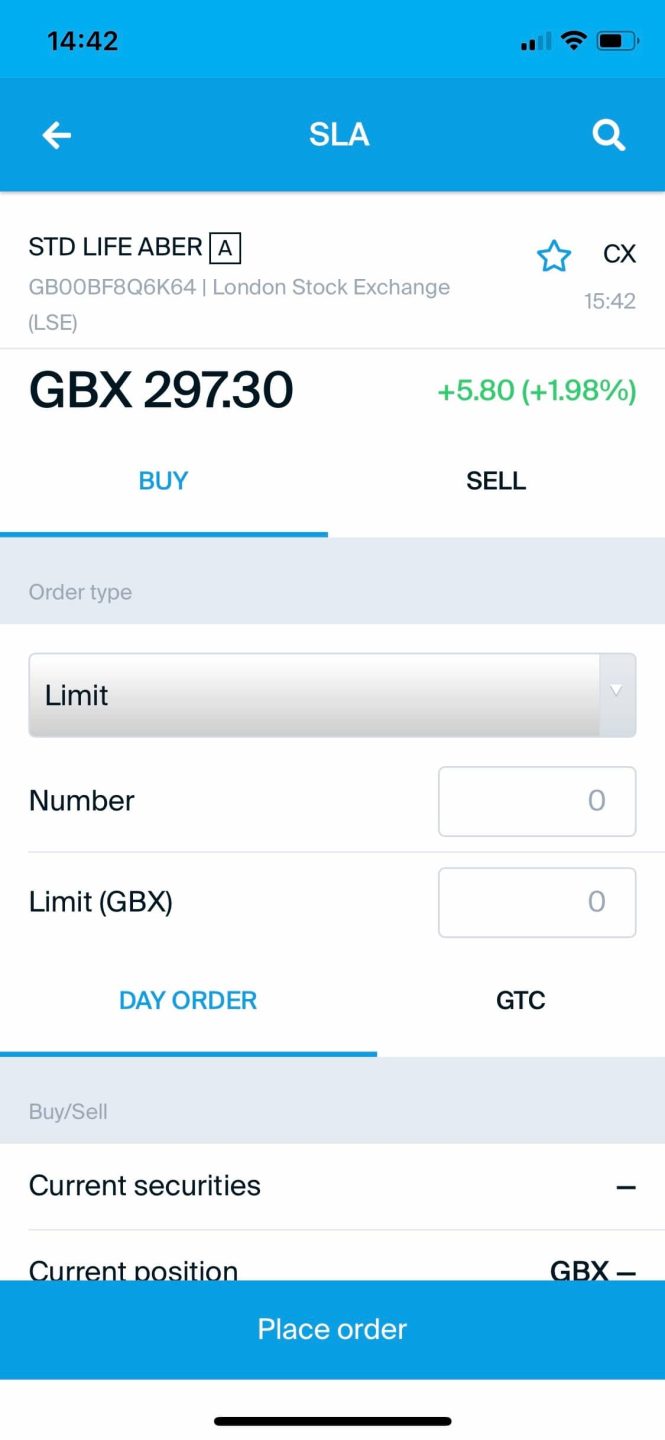

5. Mobile Trading Platform

DEGIRO has an average mobile platform with a user-friendly and simple design.

- User-Friendly

- Two-Step Authentication

- Reliable Search Function

- No Alerts For Prices

- No Biometric Authentication

The mobile trading platform is available in the same language as your account.

Look And Feel

The design for DEGIRO’s mobile trading platform is excellent and intuitive.

Security And Login

DEGIRO offers safe login, as you can opt for two-step authentication via the web platform.

However, you cannot opt for biometric authentication, even though this feature would be more convenient.

Search Features

Search features on the DEGIRO app are useful, but they represent its weakest link. You can customize search depending on the asset class. But it can get confusing if you type ‘Apple,’ as it is not clear if you’re choosing an option or equity.

Placing Orders

Placing orders is the same as on the web platform.

Notifications And Alerts

You can receive order confirmation notifications via email. There are no price alerts available.

6. Desktop Trading Platform

DEGIRO has no desktop trading platform.

7. Markets and Products

DEGIRO allows its users to trade distinct products and use many markets. Forex and CFD trading is not available.

Asset Classes At Degiro

Assets

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Stock | Yes | Yes | Yes |

| ETF | Yes | Yes | Yes |

| Forex | No | Yes | Yes |

| Fund | Yes | Yes | No |

| Bond | Yes | Yes | No |

| Options | Yes | Yes | No |

| Futures | Yes | Yes | No |

| CFD | No | Yes | Yes |

| Crypto | Yes | Yes | Yes |

DEGIRO provides a varied range of products including futures and stocks. However, it is not possible to trade CFDs or forex. This broker is competitive when it comes to futures, options, and stocks. The downside, however, is that the selectin of bond and funds is average.

ETFs And Stocks

DEGIRO allows you to use over 5,000 ETFs, along with 30 stock exchanges. You not only get access to the most prominent international markets, but also some of the smaller stock exchanges in Europe. Beyond that, you can trade with penny stocks.

There are fewer ETFs and stocks at DEGIRO than TradeStation Global but much more than at eToro.

ETFs And Stocks

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Stock Markets | 30 | 78 | 16 |

| ETFs | 5,400 | 13,000 | 145 |

Funds

Mutual fund selection with this broker is limited when compared to TradeStation Global. You can opt from mutual funds provided by market leaders such as Vanguard or BlackRock.

Funds

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Fund Providers | 68 | 260 | – |

Bonds

Government and corporate bonds are available at DEGIRO. However, when compared to TradeStation Global, the options are limited (eToro doesn’t offer bonds.)

Bonds

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Bonds | 870 | 472,900 | – |

Options

DEGIRO offers a competitive selection of 13 options markets.

Options

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Options Markets | 13 | 33 | – |

Futures

This broker has limited futures market coverage when compared to TradeStation Global.

Futures

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Futures Markets | 15 | 32 | – |

Cryptocurrency

ETN instruments allow you to buy ether and bitcoin on the Swedish stock exchange. Check our blog for more information about the cryptocurrency investing market.

Cryptocurrency

| DEGIRO | TradeStation | eToro | |

|---|---|---|---|

| Cryptocurrency | 4 | 2 | 17 |

8. Research

The range of research options available at DEGIRO is limited to a basic news feed and a standard charting tool.

- Data on asset fundamentals

- No trading ideas

Trading Ideas

DEGIRO does not provide trading ideas, but they are on the way in the near future.

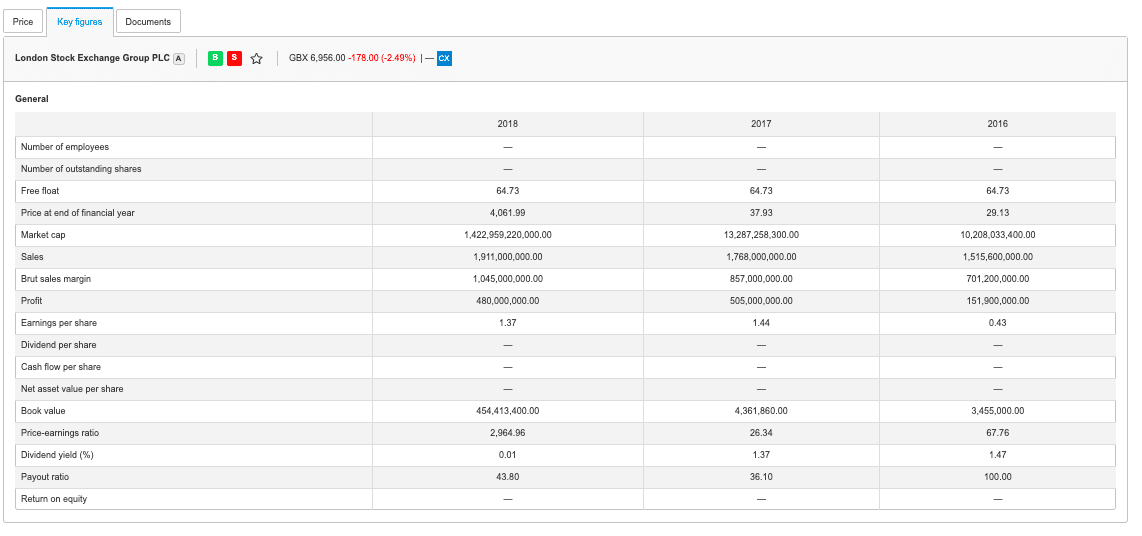

Fundamental Data

Some products come with fundamental data.

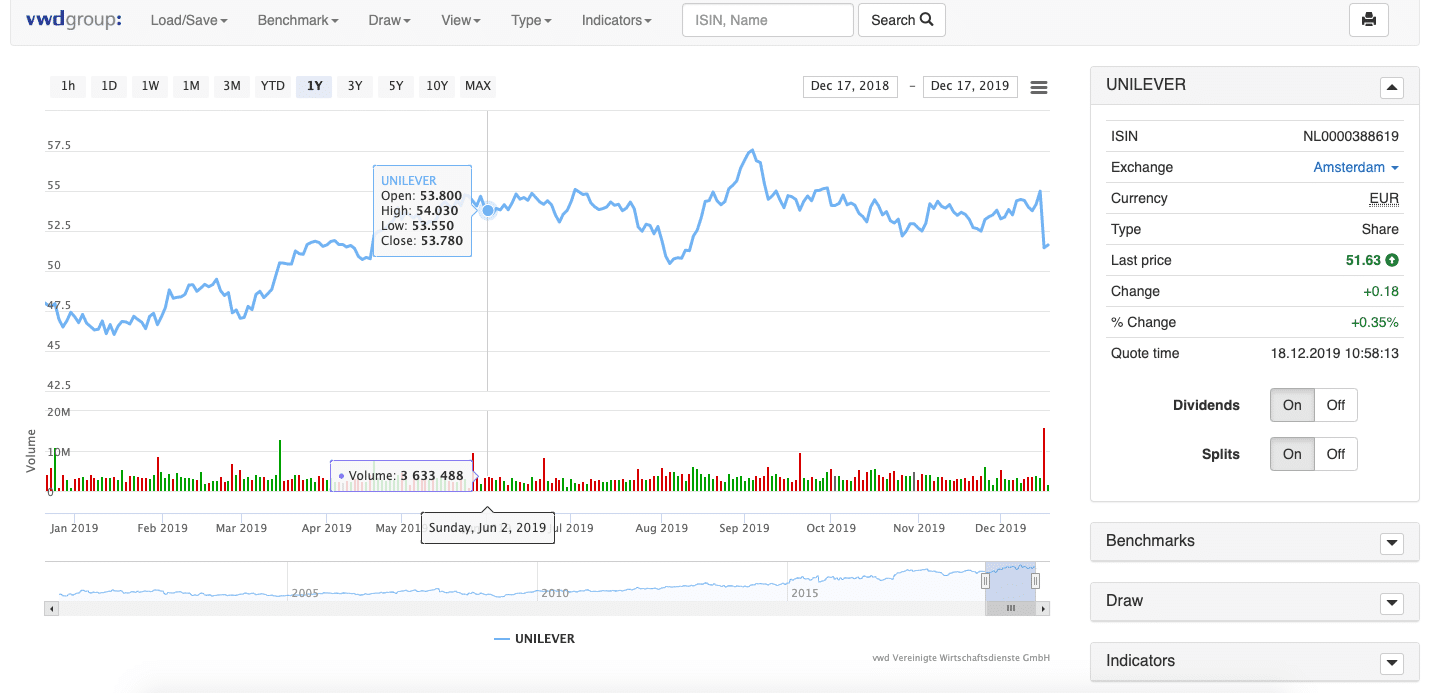

Charting

Although the charting feature available on DEGIRO is average, this is enough for an execution-only trading platform. Straightforward to use, it features over 20 technical indicators, which can be saved.

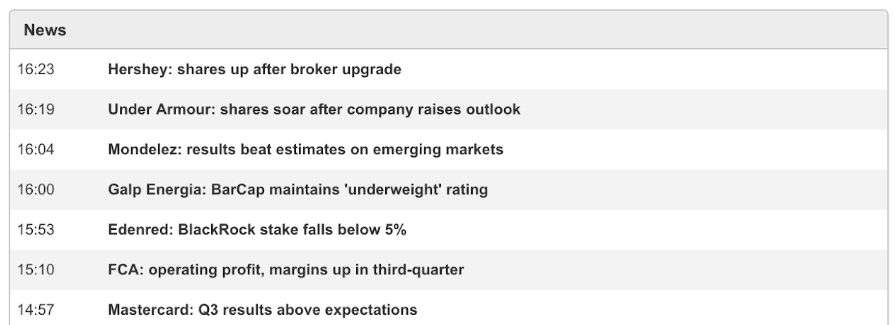

News Feed

Despite the news feed section covering only the bare essentials, the market news published on its mobile and web platforms is reliable. It can be accessed by navigating to the trading platform’s main landing page or in the product data sheet with relevant news.

9. Customer Service

Basic customer support is provided in several languages by phone. However, the disadvantage is that there is no 24/7 or live chat availability.

- Phone support

- Knowledgeable answers

- No live chat

- No 24/7 support

DEGIRO has email and phone customer service, but no live chat option.

The key benefit here is that you can contact customer support in any of the languages spoken in the 18 countries supported.

With rapid response times and comprehensive and helpful answers, we found the level of customer service at DEGIRO to be good. Nevertheless, with a standard response time of two days, the level of email support was not as impressive.

Unfortunately, there is also no customer service available at DEGIRO on weekends. Support is limited to between 07.00 hrs and 21.00 hrs, Monday to Friday.

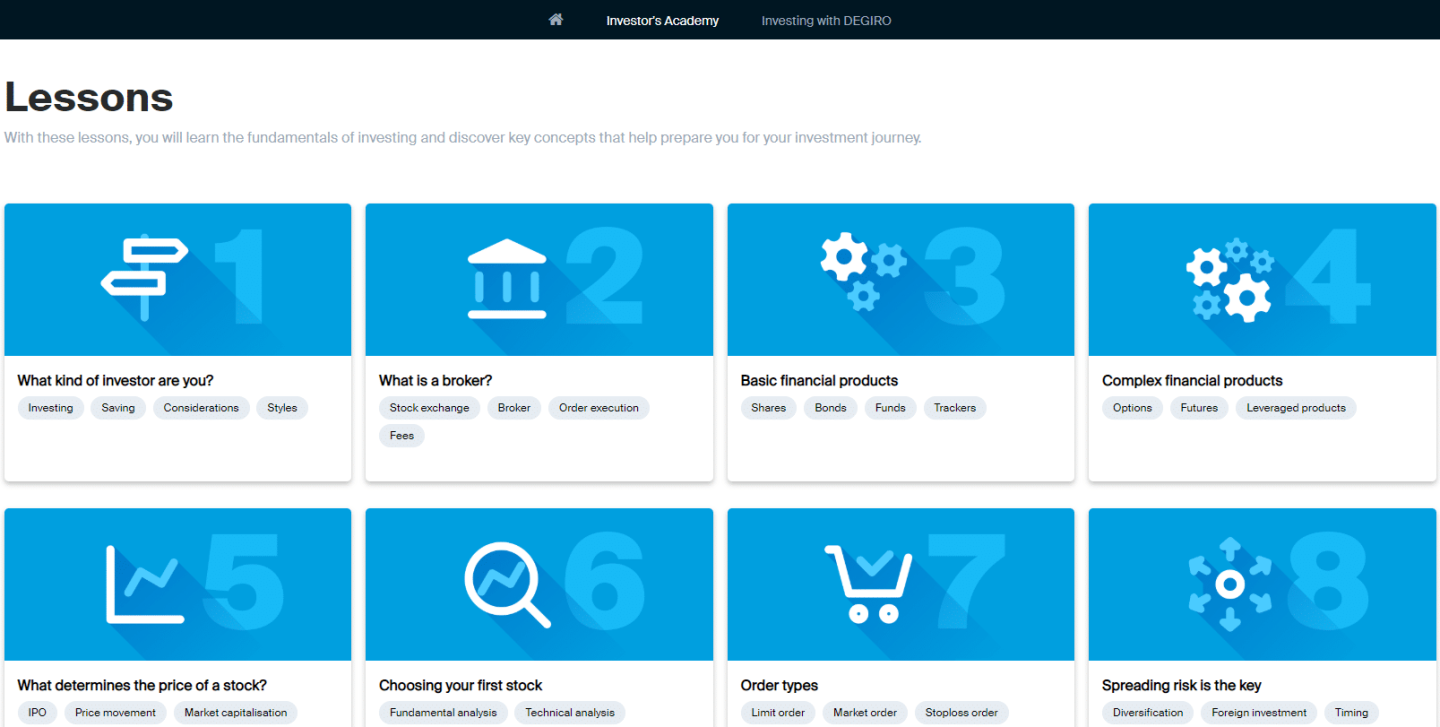

10. Education

The education services offered by DEGIRO are of average standard. There is a limited set of instruments available through the UK and Dutch websites.

- Trading platform tutorial

- Educational videos

- No demo account

- Available only in Dutch and English

You can learn with:

- Platform tutorial videos

- General educational videos

Several video tutorials teach you about standard topics such as order terms or asset classes. You can also access further information about trading at DEGIRO, such as how to buy stocks using the DEGIRO web platform.

There are several missing services, including demo accounts, webinars, and educational articles.

11. Safety

A licensed investment company, DEGIRO has several top-tier licenses in place.

- Several top-tier licenses

- No banking license

- No stock exchange listing

- Financial data is not public

DEGIRO Regulations

Headquartered in the Netherlands and founded in 2008, DEGIRO is licensed by the Dutch Central Bank (DNB) and the Netherlands Authority For The Financial Markets (AFM). There are additional regulations from countries where DEGIRO provides its services. For example, DEGIRO is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

DEGIRO Safety

When it comes to DEGIRO safety concerns, it is best to check the following:

• Protection if something goes wrong

• Background of the broker

Account Protection At DEGIRO

Creating an account at DEGIRO gets you investor protection for up to €20,000.

Account Protection

| Country | Protection | Regulator | Legal Entity |

|---|---|---|---|

| All countries | €20,000 | Dutch Central Bank (DNB) and The Netherlands Authority for the Financial Markets (AFM) | DEGIRO B.V. |

Please note that there is no negative balance protection available.

Background

DEGIRO was founded in 2008. It has several years of experience in the market. It is one of the more successful brokers and has overcome previous financial crises.

Almost all the products you can trade with DEGIRO are exchange-traded. Hence, there is no counterparty risk with DEGIRO. It signifies that if DEGIRO defaults, your assets will be safe.

Bottom Line

DEGIRO is an excellent choice for those searching for a user-friendly platform and low fees. It is more affordable than leading European competitors. Also, only TradeStation Global competes with DEGIRO’s prices closely. The account creation process is fast, and in most cases, it gets approved in 24 hours. Overall, this is the best trading platform for European clients.

On the downside, the research tools and education materials on offer are average. There are no forex trading services available, and you can only withdraw and deposit funds by bank transfer. Since March 2020, a waiting list has been imposed for all new accounts.

Overall, DEGIRO is an excellent online broker choice, as it has no inactivity fees or minimum deposit.