Page Summary

An electronic trading platform is computer software that allows users to place buy and sell orders for financial assets. Electronic trading platforms allow users to trade stocks, commodities, derivatives, options, indices, ETFs, and cryptocurrencies. The first commonly used electronic trading platform was Nasdaq. Nowadays the most popular trading platforms for retail investors are MetaTrader 4, MetaTrader 5, and cTrader. These trading platforms are mobile-friendly and let users trade using trading robots via the usage of APIs.

How did people trade stocks before trading platforms exist?

People traded stocks and other financial instruments person-to-person on physical exchanges like the NYSE and Nasdaq. Today they use sophisticated online brokers who offer intermediary services between buyers and sellers.

The importance of latency

Latency is important for trading platforms as users need to be able to trade at the right price. The transfer of data via the internet allows retail traders to trade the financial markets very quickly and at fair and up-to-date prices. Some brokers offer co-location, which are large computer databases located near a physical exchange. This reduces the latency for online trading further and is suitable for high-frequency and algorithmic trading.

Trading Platform Regulation

According to Rule 17a-23 by the U.S. Securities and Exchange Commission (SEC), trading platforms must report information about their users, orders, and trades quarterly. There are regulated and unregulated trading platforms and brokers. We recommend only trading with regulated brokers and trading platforms. This is our list of recommended trading platforms and apps in UAE.

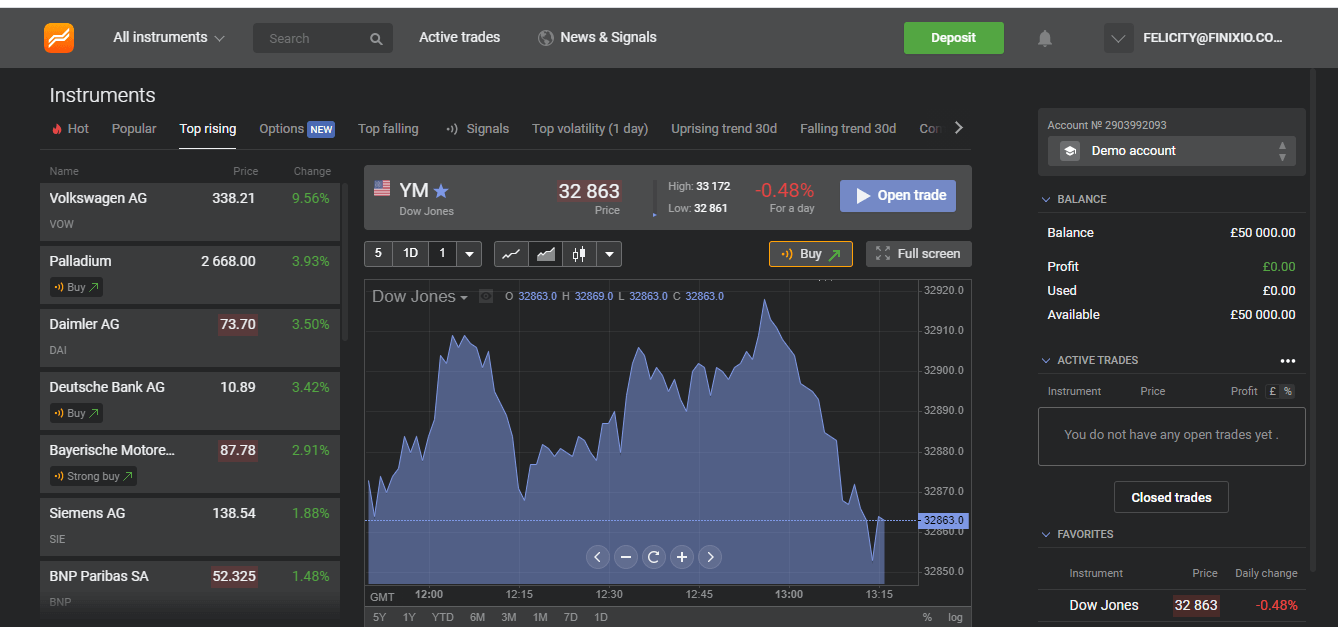

Trading Platform Features

Trading platforms feature graphs showing historical price data, current economic news, portfolio tracking, and order books. Most trading platforms provide Application Programming Interfaces (APIs) for traders who want to use robot trading software.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.