Business24-7.ae is committed to the highest ethical standards and reviews services independently. Learn How We Make Money.

Page Summary

In A Nutshell

eOption is one of the most transparent brokers on the market, and it focuses on its client’s needs. It is an online broker for options traders who already have experience in this field. Their professional platform isn’t ideal for new traders or value investors. But active options traders will enjoy fast executions and low commissions.

eOption has a vast range of offerings, which is why:

- It is one of the top brokers for low-cost options trading.

- It has a browser-based platform-based on ETNA white label program with extra tools.

- It has no extra costs for streaming news and data.

- It has a demo account to test this broker’s offering for up to 60 days without an initial deposit required.

- It focuses on transaction security, and it has Plaid to handle the funding.

eOption Review & Insights

eOption is an excellent choice for experienced equities and options traders. It lets you craft your options strategies.

It offers low options fees, which is why high-volume options traders prefer it.

Pros

- Excellent value for frequent options traders

- eOption Trader platform is user-friendly

- Newsletter subscribers can auto-trade their alerts

Cons

- Limited education tools

- Limited news feeds

- OTCBB trades must be done with a live broker

Advantages Explained

- This broker has a per-leg commission for options traders and a per-contract fee of $0.10. Clients who trade five or more contracts per order will pay lower fees.

- eOptions has a customized ETNA trading platform. It is reliable and simple to understand.

- It offers access to Auto Trading. This is an investment system that manages third party newsletter trade alerts. The downside is that the fees are higher for Auto Trades.

Disadvantages Explained

- eOptions is great for experienced options traders, but not for beginner traders.

- Market news is basic. You’ll need some extra subscriptions to receive valuable information.

- A live broker makes all OTCBB and penny stock transactions

- There are no cryptocurrency, forex, and international offerings available.

1. Fees and Spreads

The fees and spreads at eOption are among the lowest in the market. There are many trading options at eOption, including:

- options strategies in large quantities

- options

- mutual funds

- US equities

- Fixed income

But there are no futures options, futures, cryptocurrency, international assets, or currencies.

Clients can trade:

- Short and long stocks (up to 1700 on the easy-to-borrow list for short sales)

- OTCBB (penny stocks) closing only with a live broker

- Mutual funds

- Bonds (Municipal, Treasury, Corporate and CDs)

- Multi-leg and simple options

The browser-based app lets you submit several order types:

- Trailing stops

- Conditional orders

- Trailing stop limits

The mobile app has limited order types, and you can’t select a tax lot when closing a position. The default is first-in-first-out.

eOption prioritizes price improvements by sending equity orders to several venues. It can get you:

- $0.01–$0.02 per share in price improvement for equity orders

- $0.11 per contract in price movement for options

- $0.43 per contract in payment for order flow

When it comes to trading fees, eOption started a zero fees policy for equity trading back in October 2019. But there is a per-leg commission for options trades. Heavy options traders will pay a reduced price compared to competitor brokers because:

- No fees for trading ETFs or equities

- A live broker must place OTCBB/penny stock trades for $6

- Options base fee is $1.99 per leg

- Options per contract fee are $0.10

- Fee for 50 or more contracts (single leg) is $6.99

- The fee for a 4-leg order of 10 contracts per leg is $11.96

- Covered call trade of 500 shares plus five contracts is $2.49

- Mutual fund commission for funds outside the No Transaction Fee program is $5.00

- Margin interest ranges from 7.75% for $10,000 balance to 5.75% for over $100,000

- The inactivity fee is $50/year

- Account closure fee is $0

- The account transfer fee is $60 for a full transfer, $50 for partial

- The voluntary reorganization is $50, while the exercise and assignment fee is $9

- The wire transfer fee is $30, while there is no fee for sending a paper check

- Paper confirmations are $1 each

- The live broker fee is $6 per transaction

eOption aims to have a zero-fee policy. So, it has a transparent fee structure, one of the best among its competitors.

- Interest on cash balances: customers can join cash sweep programs. These have a higher interest rate than the standard interest provided for uninvested cash.

- Stock loan program: eOption doesn’t earn money loaning stocks for short sales. You won’t receive such benefits.

- Payment for order flow: this broker doesn’t have payment for order flow for equity trades.

- Price improvement: the order router on eOption’s platform prioritizes price improvement. It has a $0.01–$0.02 per share for equity trades.

- Portfolio margining: eOption customers can’t access portfolio margining. This would’ve been excellent for lowering the margin required on the calculated risk.

2. Account Types

eOption offers a free demo account along with its main options trading account. The demo trading account allows you to test the platform for up to 60 days without funding your account. The minimum deposit fee is $0, but the inactivity fee is $50 per year.

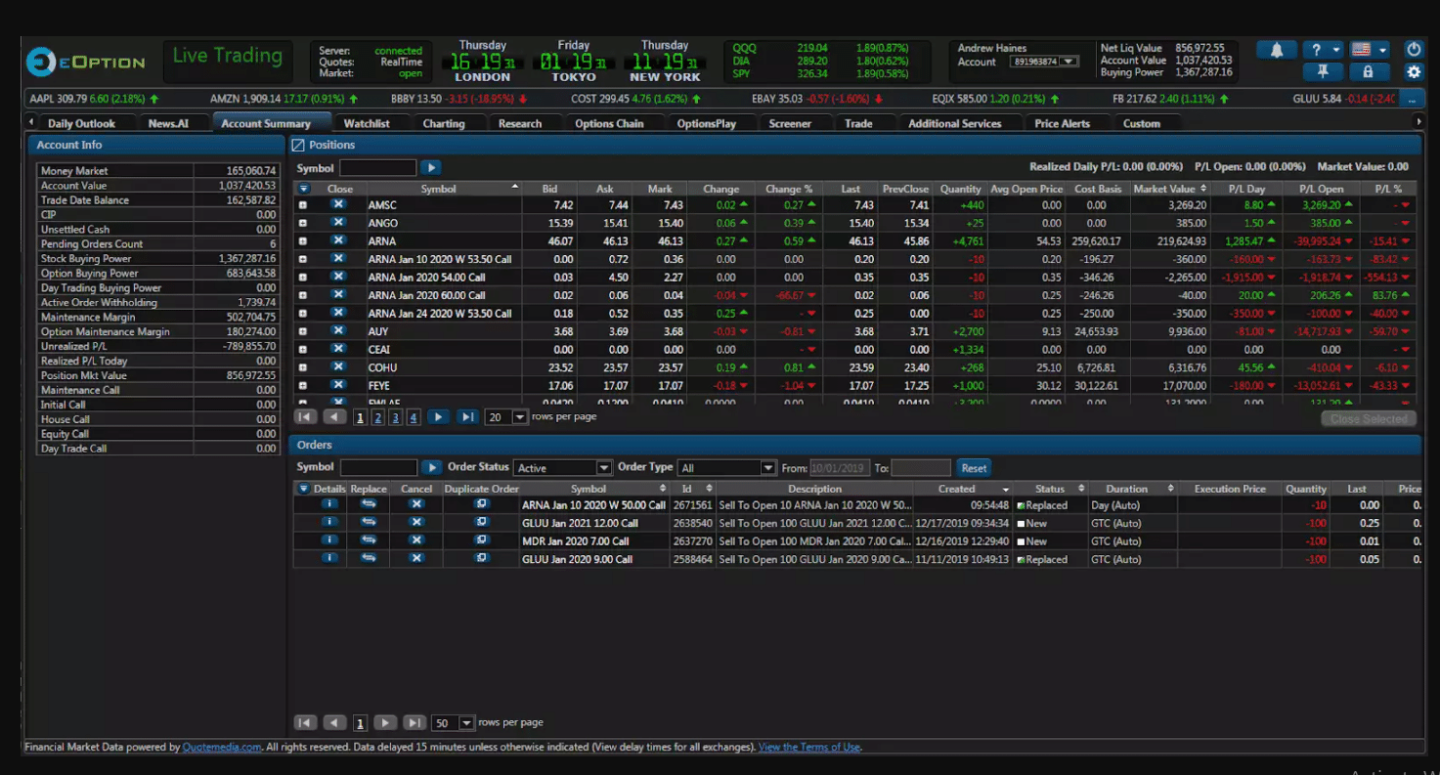

The downside is that eOption customers can’t join a stock loan program. Moreover, dividend reinvestment (DRIP) isn’t automatic. Clients need to reach out to the service desk to join the DRIP program if buying a dividend-paying stock.

The standard interest rate for cash balances is ok, and customers can join in a cash sweep program. This is great to move idle cash into money market funds that generate more revenue.

3. Trading Platforms

eOption’s premium trading platform is the browser-based Trader. Clients can also use the downloadable Sterling Trader Pro or DAS Trader. These two platforms come with extra subscription costs.

eOptions created Trader by customizing the ETNA trading platform. ETNA is a white label software solution created and licensed for online brokerages. It lets a broker customize the functionality and design to match the broker’s needs. The downside is that a third party owns the platform. So, it has the appearance of a downloadable direct-access platform, but it runs in a browser.

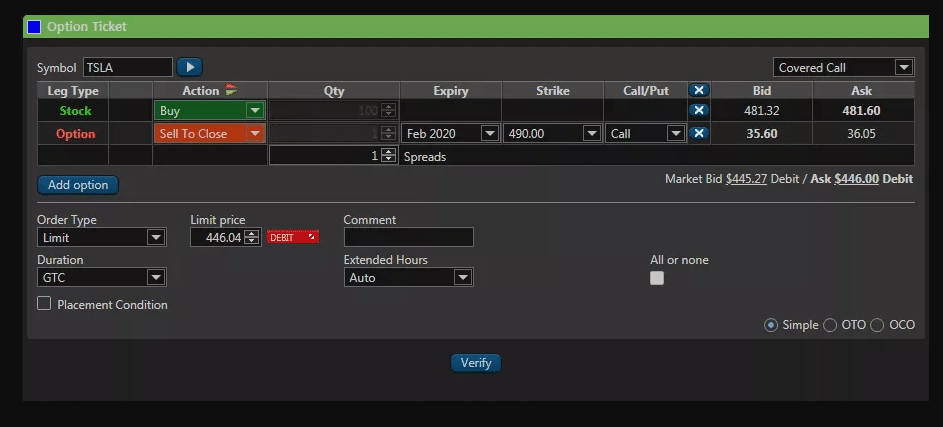

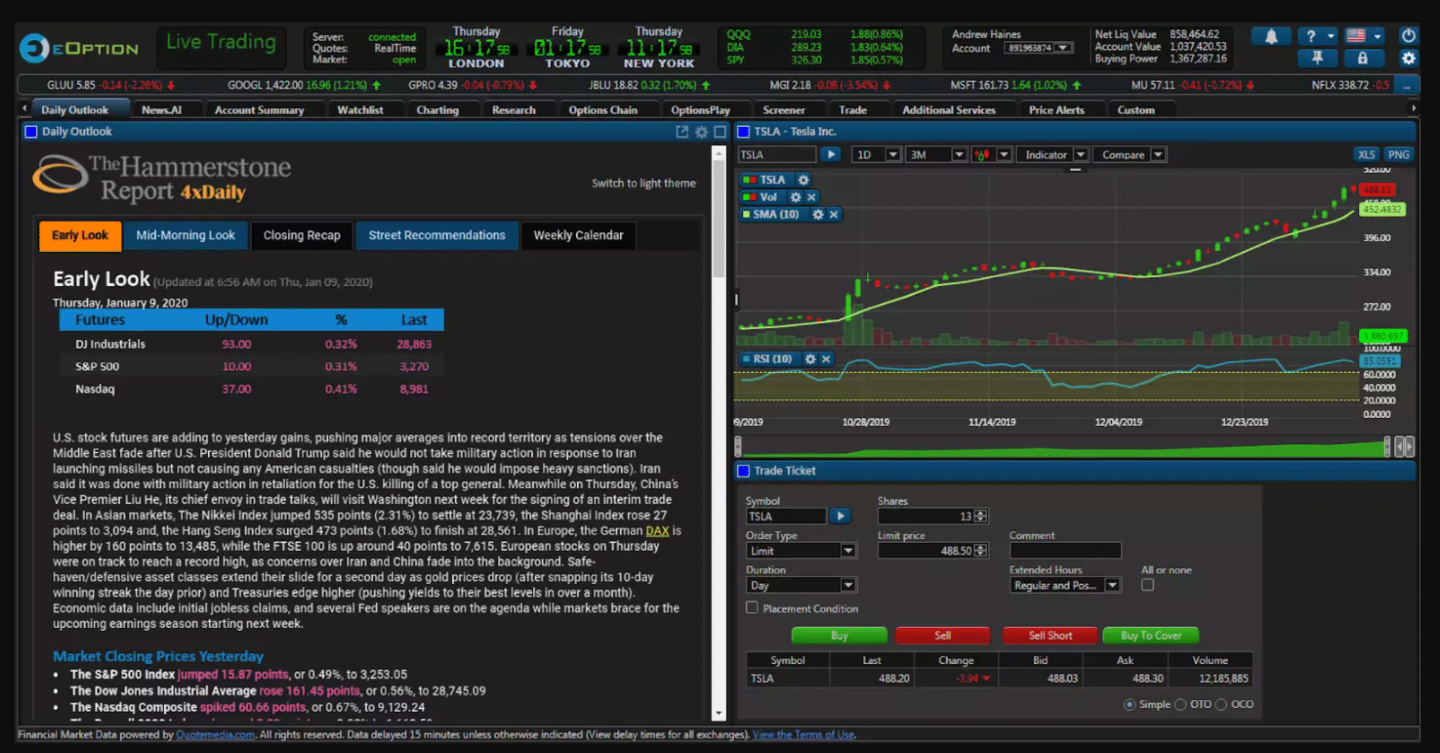

The eOption Trader allows you to submit orders from the Options Chains tab and the Trade tab. The tab layout allows you to discover each tool with ease. You can drop and drag widgets to create a page design you find pleasant. Also, OptionsPlay lets you use advanced trading tools. You can include options strategies on the watchlist, too.

Trading fees are available on the trade verification screen, a transparent business approach. You can also trade conditional orders (one cancels another, one triggers another). This feature isn’t available on the mobile app.

There is a quotes stream on the browser platform, along with a customizable ticker. But you can’t stage orders for later entry.

4. Mobile Trading

The eOption mobile app provides a high-quality trading experience. You can roll or close an existing position with a couple of taps, but you can’t limit or put a stop order at the same time. This mobile app lets you create an options strategy in the order ticket.

The downside is that the mobile app is more challenging to use than the browser-based platform. You can synchronize Watchlists between platforms. But they are difficult to identify and read on mobile. Also, the data on the app doesn’t stream, and it comes with limited research capabilities. If you need reliable research tools, you’ll have to use the browser platform.

5. Research

This broker provides excellent research features for options traders at no extra cost. Other investors might not find them useful.

The downside is that there is no ETF filter, which means ETFs might show up in the stock screener results.

There isn’t any:

- fixed-income screener

- mutual fund screener

- extra calculators

Trading idea generators work outside the screeners.

Stock Screener

The Screener tab at eOption features 16 pre-set screens, which you can customize. The downside is that you can’t save custom scans.

Options Screener

This broker has screeners from OptionsPlay. These are excellent for analyzing ideas or scanning your idea. We like that it accepts your trading idea and includes it into an eOption order ticket.

News

There are several free news feeds on the platform. But you’ll have to buy a subscription if you want access to premium sources.

The browser platform offers access to several news sites like:

- Quote Media

- PR Newswire

- ApolloNews

- Canada Newswire

- Business Wire

- UPI

- Market News Publishing

- Market Wired

- GlobeNewswire

- Fly on the Wall

You can search the news based on the ticker symbol, industry, topic, and person who offers the information.

Third-party Research

eOption has limited third-party research. You can only check links to Hammerstone research reports.

Charting

The charts available are from OptionsPlay, ETNA, Quote Media, and ChartIQ. You can connect chart displays to watchlists to receive information for your trades. Moreover, this broker has up to 30 technical studies available.

Portfolio Analysis

Performance and positions are in a heat map, which offers a fast summary of your portfolio. But you can’t merge holdings outside eOption to get a clear overview. Gains and losses, margin, and buying power are available in real-time. Interests and dividends update overnight. You can download the data to Excel for advanced analysis.

6. Education

All educational tools at eOption focus on options trading. You can access:

- Webinars organized by the Options Industry Council

- OptionsPlay and Hammerstone Research articles

But there is no life stage planning tools or long-term calculations.

7. Customer Service

Phone customer support is reliable with fast answers. It is available from Monday to Friday from 8 a.m. to 8 p.m. Eastern Time for prospective and current clients. The live broker feature is available along with the phone customer service.

Remember that you can open an account with eOption if you’re a resident of:

- Australia

- Austria

- China

- Ireland

- Germany

- Netherlands

- Luxembourg

- Mexico

- Singapore

- New Zealand

- South Africa

- United Kingdom

- Switzerland

You will pay a fee of $25,000 for US dollars and foreign exchange-traded securities.

8. Safety

eOption has one of the best security features in the industry:

- Clients can log in to the browser platform via two-factor authentication and a soft token

- The mobile app comes with a password and ID, fingerprint scanning, and face ID.

- Clients get Excess Securities Investor Protection Corporation (SIPC) insurance. It is from Lloyd’s of London with a loss limit of $150,000,000

- The Identity Theft Research Center didn’t report significant data breaches in 2019

The Bottom Line

eOption is an options broker. It doesn’t aim to be everything to all traders, like many competitor brokers. This broker provides excellent value for experienced options traders. Frequent options traders will get low costs and strategy scanning tools.

eOption isn’t the best choice if you are looking for passive investing, use a robo-advisor, or trade forex. This broker specializes in active options traders.

Disclaimer