Why pick eToro

eToro offers a user-friendly platform that suits both new and experienced traders. It boasts over 5,000 assets, from global stocks and ETFs to crypto and newly added Abu Dhabi Exchange (ADX) stocks, making it easy for UAE traders to diversify their portfolios. The account setup is fast and fully online, backed by regulation from the ADGM, which adds convenience and trust.

Please note that eToro USA LLC provides only real crypto assets, not CFDs.

eToro

Best For Stocks, ETFs & Crypto

Recommended ForCopy Traders, Crypto Traders, Social Traders

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best For Stocks, ETFs & Crypto

Recommended ForCopy Traders, Crypto Traders, Social Traders

- Trader Level Beginners+

- Islamic Account Yes

- Minimum Deposit $100 (UAE region)

- Account Opening Speed 24 hours

-

Web trading platform4.5

-

Fees4.2

-

Mobile App4.9

-

Deposit and withdrawal 4.4

-

Available assets4.0

-

Account opening4.4

-

Education and Research 4.8

-

Support4.8

-

Overall rating4.5

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

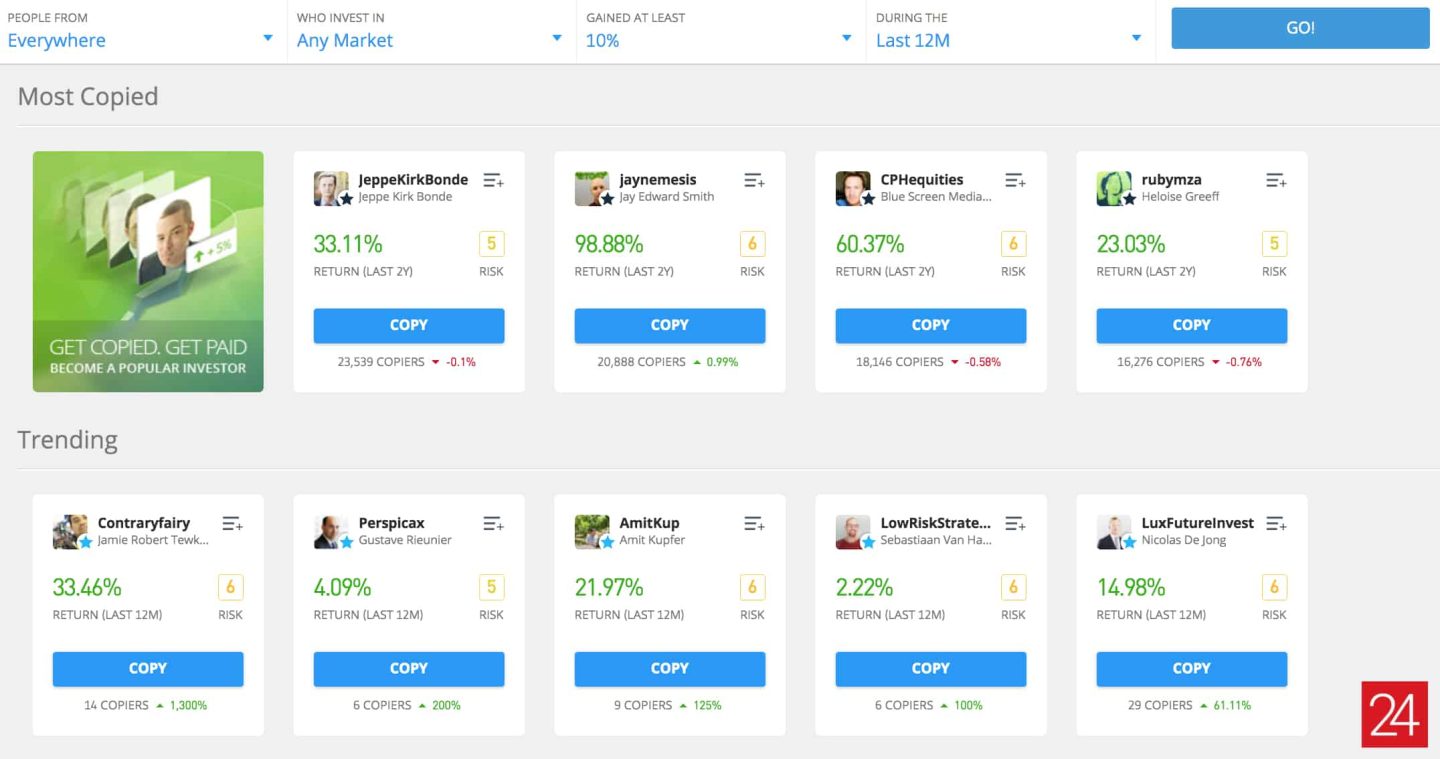

For those new to trading, eToro’s clean design and demo account provide a smooth starting point. One key feature is social trading, letting you follow and copy seasoned investors while sharpening your own skills. On the flip side, non-trading fees like withdrawal charges can stack up, and personalized account plans aren’t available. Still, with zero-commission stock trading and solid tools for beginners, eToro remains a strong choice for UAE traders. Share your thoughts in the comment section at the bottom!

Overall Pros & Cons

- Access to over 5000 assets

- Social/copy trading

- Easy and fast sign up

- Regulated by SEC, FCA, and locally by FSRA, ADGM

- Newly added ADX stocks

- Withdrawal fee

- Limited account plans

- AED base currency not available (currency conversion will apply)

See how the best brokers in United Arab Emirates compare to eToro

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Fees

4.2/5

eToro provides free stock and ETF trading, with competitive margin and forex fees. Watch for withdrawal and inactivity fees, which can be avoided with membership and regular activity.

- Commission free stocks and ETFs

- Low stock CFDs

- Cheap forex

- Withdrawal fees

- Inactivity fees

- High spot crypto fees

We compared eToro’s fees with two comparable brokers, Interactive Brokers and Saxo Bank. These competitors were chosen based on factors like available assets, target client base, and fee structures.

Stock trading with no catch

eToro offers commission-free stock and ETF trading with no extra fees on non-USD conversions and UK tax duties covered, a perk UAE traders enjoy, though leverage isn’t available for real stock buys.

Note: Fees are approximate and may vary based on market conditions or account activity.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Are there additional fees for stocks and ETFs on eToro?

In most countries, including the UAE, eToro offers commission-free stock trading, but clients in Australia, Denmark, Finland, the Netherlands, Norway, Spain, and Sweden pay $1-2 per trade for stocks. ETFs remain commission-free globally, including for UAE traders. Non-USD stocks are converted to USD at market rates with no extra fees, and eToro covers UK market tax duties. Leverage is unavailable for real stock purchases.

Forex fees stay strong

eToro’s EUR/USD spread of around 1 pip is above the 0.8-pip industry average, but with no commission, it keeps costs low for UAE traders too, beating many rivals.

Note: Spreads are approximate and may vary based on market conditions.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Index CFD fees match the pack

eToro sets S&P 500 CFDs at 0.9 points and Euro Stoxx 50 at 3.0 points with overnight fees of $0.0467 per $1,000 position, matching industry averages, while other index fees blend into the spread, a setup UAE traders also get.

Note: Spreads are approximate and may vary based on market conditions.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Stock CFD fees stay low

eToro charges a 0.15% spread per side for stock CFDs, keeping costs below the industry average of 0.2%-0.5% for UAE traders too, outpacing many rivals.

Note: Spreads are approximate and may vary based on market conditions.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Options fees favor the US

eToro offers zero-commission options trading for US clients only, leaving UAE traders and others worldwide without access, while competitors charge fees that align with industry norms.

Note: Fees are approximate and may vary based on market conditions or account activity.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Crypto fees that sit in the middle

eToro applies a 1% fee for buying or selling cryptocurrencies, added to the market price and shown upfront, a rate that lands mid-range for UAE traders compared to industry norms and competitors; note that eToro USA LLC offers only real crypto assets, not CFDs, unlike its global CFD focus.

Note: Fees are approximate and may vary based on market conditions.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Margin fees top the chart

eToro’s margin rates vary by asset and leverage, with a USD annual rate of 8.3%, higher than industry averages and competitors, impacting UAE traders using leverage too.

Note: Rates are approximate and may vary based on leverage and market conditions.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Inactivity & withdrawal fees keep it light

eToro charges a $10 inactivity fee per month after 12 months of no login, easily avoided by logging in yearly, and a $5 withdrawal fee with a $30 minimum applies for UAE traders too, though Platinum members skip it, while non-USD transactions add a 0.75% conversion fee, keeping costs lower than many peers.

Note: Fees are approximate and may vary based on account activity or currency fluctuations.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

eToro safety: Regulation and investor protection for UAE traders

4.4/5

eToro is a trusted platform for UAE traders, with regulation from top authorities like the FSRA of Abu Dhabi Global Market. It provides clear annual fees and makes its financial information easy to access. However, it’s not listed on a stock exchange, and the FSRA doesn’t offer an investor compensation scheme.

- Regulated by multiple tier-1 authorities

- Locally regulated by FSRA of ADGM

- No banking background

- Financial information on the company is publicly available

- Annual fees clear on website

- Not listed on stock exchange

- FSRA does not offer an investor compensation scheme

- Negative balance not available for UAE clients

Who is eToro regulated by?

eToro is regulated by major global authorities, including the US SEC, UK FCA, FINRA, SIPC, and CFTC. Locally, it is also overseen by the FSRA of Abu Dhabi Global Market (ADGM).

Is eToro a safe broker to use?

Yes, eToro is considered safe. It is audited by top firms like KPMG, PWC, Deloitte, and EY, provides transparency in ownership and management, has no banking background, publishes annual financial statements, and offers mobile two-step authentication for secure login.

Is there investor protection for eToro?

eToro clients receive protection based on their location. UK clients are covered by the FCA (£85,000 FSCS), US clients by the SEC/SIPC ($500,000), and EU clients by CySEC (€20,000). Australian and UAE clients have ASIC and FSRA oversight, respectively, but no guaranteed compensation.

| Broker Name | ||

|---|---|---|

| Country of registered entity: UK | ||

| Country of registered entity: US | ||

| Country of registered entity: Australia | ||

| Country of registered entity: UAE | ||

| Country of registered entity: Other countries |

Do they offer private insurance?

eToro offers private insurance up to €/AUD 1 million for Platinum+ and Diamond Club clients under eToro Europe and eToro AUS. This covers cash, securities, and CFDs in case of insolvency, with a total payout cap of €/AUD 25 million for all claims. The insurance can be withdrawn at eToro’s discretion.

eToro background

Founding: Established in 2007 in Tel Aviv, Israel, by Yoni Assia, Ronen Assia, and David Ring.

Mission: Aims to open financial markets to everyone through innovative social trading and accessible investment tools.

Global Presence: Serves over 35 million registered users worldwide, with offices in Cyprus, the UK, Australia, and the UAE.

Leadership: Yoni Assia has served as CEO since founding, leveraging his fintech expertise to drive growth.

Employee Base: Employs over 1,000 professionals globally.

Services: Offers trading in forex, indices, commodities, cryptocurrencies, shares, and ETFs via its proprietary web and mobile platforms, with standout features like CopyTrader and Smart Portfolios.

Awards: Recognized with awards such as Best Social Trading Platform from Forex Awards and Innovator in Trading from World Finance, highlighting its technology and user experience.

Sponsorships: Engaged in high-profile sponsorships, including partnerships with Premier League clubs and rugby teams like Saracens.

Recent Developments: In October 2023, received FSRA approval in the UAE, launching operations from Abu Dhabi to enhance its Middle East presence.

eToro deposit and withdrawal

4.4/5

eToro has no minimum deposit requirements making it extremely easy to start trading. We found it very user friendly and intuitive to deposit and withdraw currency. Although there are no deposit fees for bank transfers in USD, conversion fees apply if you were converting from a different currency to one of the 3 currencies available which could run quite high.

- Multiple deposit options

- No deposit fee (USD bank transfer)

- Bank card and electronic wallet available

- Easy to use

- Only 3 base currencies (EUR, GBP, USD)

- Currency conversion fees from AED to other currencies

- $5 withdrawal fee

Account base currencies

Only 3 currencies available for eToro clients, falling behind other competitors.

| Broker Name | |

|---|---|

| eToro | |

| Interactive Brokers | |

| Saxo Bank |

Fees and options for deposits

eToro charges no deposit fees.

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

Electronic wallet availability

| Broker Name | |

|---|---|

| eToro |

Deposit currency conversion fees

| Broker Name | |

|---|---|

| eToro | |

| Interactive Brokers | |

| Saxo Bank |

Fees and options for withdrawal

eToro charges a $5 withdrawal fee with a $30 minimum. You can withdraw via bank transfer, credit/debit card, or e-wallets.

Withdrawal options & fees

| Broker Name | ||

|---|---|---|

| eToro | ||

| Interactive Brokers | ||

| Saxo Bank |

eToro account opening

5/5

eToro’s account setup is quick and efficient, allowing trading to start within a day. UAE clients need a minimum deposit of $100 to begin.

- Fully online application process

- Free of charge to open

- Application process available on mobile

- Available on every continent

- Fast and easy

- Minimum deposit amount $100 for UAE clients

Account opening information

| Broker Name | ||

|---|---|---|

| eToro |

What is the minimum deposit at eToro?

Minimum deposit amount $100 for UAE clients.

Account types

eToro offers 4 different account types:

- Professional account: requires the user to pass a knowledge test to get themselves ranked as a professional trader and also requires a minimum deposit of $10,000.

- Retail account: is the standard account type that provides access to all assets and all order types including self directed and copy trading.

- Demo account: is the paper trading account that does not require any account approval and allows users to test their trading strategies before investing real money.

- Islamic swap-free account: enabled traders to trade according to Sharia law. It does not allow you to trade or invest in Haram companies or cryptocurrencies.

*Note that UGMA/UTMA/ISA and IRA accounts are unavailable to UAE traders.*

How to open an account?

- Visit the eToro website: Navigate to www.etoro.com and click on the “Join Now” or “Trade Now” button to initiate the registration process.

- Register your account: Fill in the registration form with your personal details, including your full name, email address, and a secure password. Alternatively, you can sign up using your Facebook or Google account for a quicker process.

- Agree to terms and conditions: Review eToro’s Terms & Conditions and Privacy Policy. If you agree, check the appropriate box and click the “Sign Up” button to proceed.

- Verify your email: Check your email inbox for a verification message from eToro and follow the instructions to confirm your email address.

- Complete your profile and verify your identity: As part of eToro’s Know Your Customer (KYC) requirements, upload a valid government-issued photo ID (such as a passport or driver’s license) and proof of residence, like a recent utility bill or bank statement dated within the last three months. Additionally, complete a questionnaire detailing your professional status, investment experience, financial situation, risk tolerance, and investment objectives.

- Once your account is verified, you can deposit funds using your preferred payment method and start trading on eToro’s platform.

Note: For clients adhering to Sharia law, eToro offers Islamic accounts that comply with Islamic financial principles. This option can be selected during the account setup process.

eToro Mobile app

4.9/5

eToro’s mobile app is easy to install and set up, with a clean UI, secure 2-step login, and optional biometrics. It offers full web platform functionality, including CopyTrader and Smart Portfolios. However, it lacks a dark mode, which should be a standard feature in most apps these days.

- Great UI, user friendly

- Easy to use search tool

- 2 step login

- Biometric authentication available

- CopyTrader & Smart Portfolios available

- Wide range of languages available (Arabic included

- No dark mode

Mobile app information

| Broker Name | ||

|---|---|---|

| eToro |

Languages

English, Spanish, Italian, German, Russian, Chinese (Traditional and Simplified), French, Arabic, Polish, Dutch, Norwegian, Portuguese, Swedish, Czech, Malaysian, Danish, Romanian, Vietnamese, Finnish, and Thai.

Look and feel / User Interface

- UX/UI design is the clean

- No Input lag, menu’s are fast and responsive

- Lightweight and user friendly compared to desktop platform

- Regular updates to UX/UI based on customer feedback

- Notifications and alerts can be set and customized

Security & login

- 2-step authentication

- Biometric scanner

Search

- The search function is highly intuitive, allowing searches not only for stocks and forex pairs but also for other users. You can search by either the ticker symbol or the company/asset name.

- A minor drawback is that after viewing details of a result, clicking ‘back’ clears the search box, requiring you to retype your search query.

Placing orders

- Order types available in its app: Limit, Market, Stop, Trailing Stop-loss

- single order time limit you can use: Good ’til Cancel (GTC).

Products

- On the eToro mobile app, you can trade and access stocks, ETFs, forex pairs, commodities, indices, and cryptocurrencies.

- CopyTrader: eToro’s CopyTrader feature lets you mirror the portfolios of other traders, accessible from the Discover section. With a minimum investment of $200, you can explore highlighted traders or use filters (e.g., return, risk score) to find those aligned with your investment goals.

- Smart Portfolios: eToro’s Smart Portfolios let you invest in themed asset bundles, like Renewable Energy or cryptocurrencies, with a minimum investment of $500 or $5,000. Accessed from the Discover menu, each portfolio offers performance details and allows you to set an exit rule, similar to a stop-loss.

Alerts and notifications

- The eToro app lets you create watchlists to track assets like stocks, currencies, and portfolios without purchasing. Simply save assets from their info pages, and access your lists via the Watchlist button. You can also set custom price alerts for specific price levels or volatility, receiving notifications as your chosen conditions are met.

eToro web trading platform

4.5/5

eToro’s web platform is clean, user-friendly, and offers great functionality, though most panels are fixed except the watchlist. It includes secure 2-step authentication and fee reports to track PnL easily.

- Modern UI, beginner friendly

- 2 step login via SMS or email after password entry

- Wide range of languages available

- Clear fee reports

- ProCharts with 66 indicators (e.g., MACD, RSI), 13 drawing tools, multi-chart views

- Hard to customize

- Light theme only (white background, green/red price highlights)

Web/desktop platform information

| Broker Name | ||

|---|---|---|

| eToro |

Available languages

- English, Spanish, Italian, German, Russian, Chinese (Traditional and Simplified), French, Arabic, Polish, Dutch, Norwegian, Portuguese, Swedish, Czech, Malaysian, Danish, Romanian, Vietnamese, Finnish, and Thai.

Look and feel / User Interface

- Intuitive and ideal for both beginner and advanced users, despite its many features.

Security & login

- Two-step login process via SMS or email after password entry

Search

- When searching for an asset, you can view its category, such as whether it’s a stock, stock CFD, or option.

- The search function is highly intuitive, allowing searches not only for stocks and forex pairs but also for other users. You can search by either the ticker symbol or the company/asset name.

Placing orders

- Order Types: Market, Limit, Stop-loss, and Trailing Stop-loss are available.

- Limit Order Limitation: Pending limit orders cannot be edited; you must cancel and re-create the order to change details.

- Order Time Limit: Only Good ’til Cancel (GTC) is available.

Products

- Available Assets: eToro offers trading in CFDs, forex, real stocks, ETFs, and cryptocurrencies, with unique options like CopyTrader and Smart Portfolios.

- US Clients: Can trade stocks, ETFs, options, and cryptocurrencies.

- Real Assets vs. CFDs: Non-leveraged long positions in stocks, ETFs, and cryptos are real assets; leveraged and short positions are CFDs.

- Stock Ownership: eToro does not allow stock transfers; “real” stockholders can participate in shareholder meetings but fractional holders can’t vote.

- Dividends: eToro applies a 30% US dividend tax, less favorable for long-term dividend investors.

- CFD Features: Offers CopyTrader (social trading) and Smart Portfolios, while scalping is not allowed.

- Cryptocurrency: Over 101 coins and crypto-cross pairs available. Going long is a real asset, but shorting is a CFD.

- Smart Portfolios: Themed investments in assets or traders, starting at $500 for asset bundles and $5,000 for Top Trader Portfolios.

Alerts and notifications

- eToro allows you to set price alerts and notifications on its web platform. You’ll be notified when an asset hits your target price or when an order is completed. Alerts appear as icon updates or browser notifications on the web platform and as push notifications on mobile.

Portfolio and fee report

- eToro offers clear fee reports that show portfolio performance and fees as a list or pie chart. Access the full report under the ‘Portfolio’ tab in ‘History,’ where you can download a PDF statement listing all cash flows and individual fees, though it doesn’t show a total fee summary.

eToro available assets

4/5

eToro offers a wide range of assets, including stocks, ETFs, commodities, cryptocurrencies, and forex pairs. Known for CFDs and forex, it also supports real stocks and cryptocurrencies for non-leveraged positions. The recent addition of Abu Dhabi Exchange (ADX) stocks expands access to the Middle East’s growing financial markets. Social trading features like CopyTrader and Smart Portfolios enhance the platform, with access to major global exchanges and a strong crypto selection for diverse trading needs.

Based on their vast coverage of different stocks & stocks as CFDs in combination with an easy to use platform and zero commission stock trading fees, we listed eToro as the top stock broker in UAE for beginners.

Assets & Products

- 2,000+ Stocks (available as real stocks or CFDs, fractional shares, limited penny stocks)

- 101 Cryptocurrencies (available as real assets or CFDs, with crypto-cross pairs like ETH/BTC)

- 264 ETFs (real assets and CFD options)

- 18 Indices (available as CFDs)

- 34 Commodities (CFDs only, including oil, gold, and silver)

- 55 Forex Pairs (major and minor pairs)

- Smart Portfolios (bundled thematic investments like renewable energy or Future Payments)

Education and Research

4.8/5

Besides having a beginner-friendly platform, eToro also offers an extensive research and education section that helps novice traders one their first trading steps. The education section is split up into three sections:

1. eToro Academy: offers basic educational materials and trading examples that will help beginners to read the platform’s features, charts, and trade options.

2. eToro Plus: provides traders with daily insights in the form of technical and fundamental analysis

3. The Bull Club: is a daily podcast where users can listen to financial leaders and investors discussing macro-economic topics that can help make the right trading moves. When it comes to research, eToro provides a comprehensive list of technical tools, charts, and newsfeeds. Those include analyst consensus, price targets, hedge fund sentiments, and insider trading sentiments. They are very useful research tools, but only available for a few of the best known stocks.

4. Quality of market research: With eToro, users can access daily market updates, analyst insights, and real-time news directly on the platform. The research section includes fundamental and technical analysis of various assets, helping traders stay informed about market trends, economic events, and price movements.

5. Availability of educational content and tools: eToro offers a wide array of educational resources to help traders at all levels improve their skills. The eToro Trading Academy provides webinars, video tutorials, guides, and courses ranging from basic trading principles to advanced strategies. There’s a demo account feature for new traders, allowing users to practice and develop their trading strategies with virtual funds in a risk-free environment.

Support

4.8/5

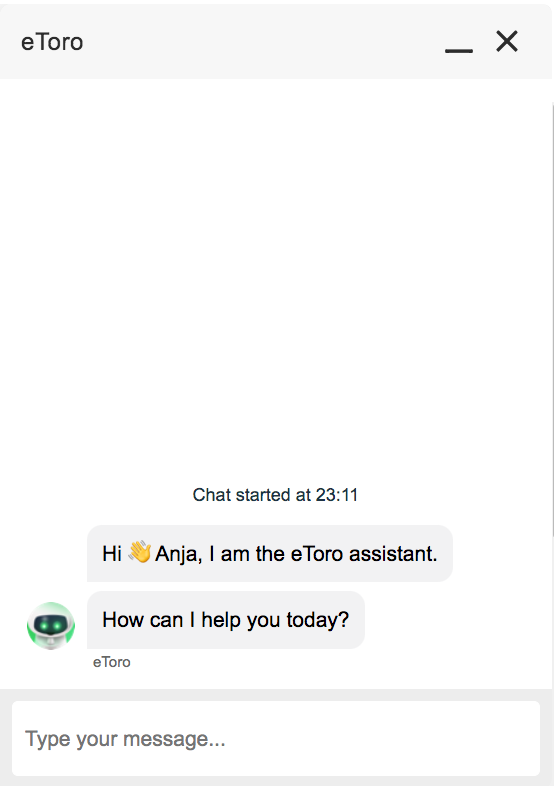

During our testing periods, the eToro customer service was responsive and available around the clock via live chat in English and Arabic. The problems we had setting up the trading dashboard were fixed in a reasonable time frame.

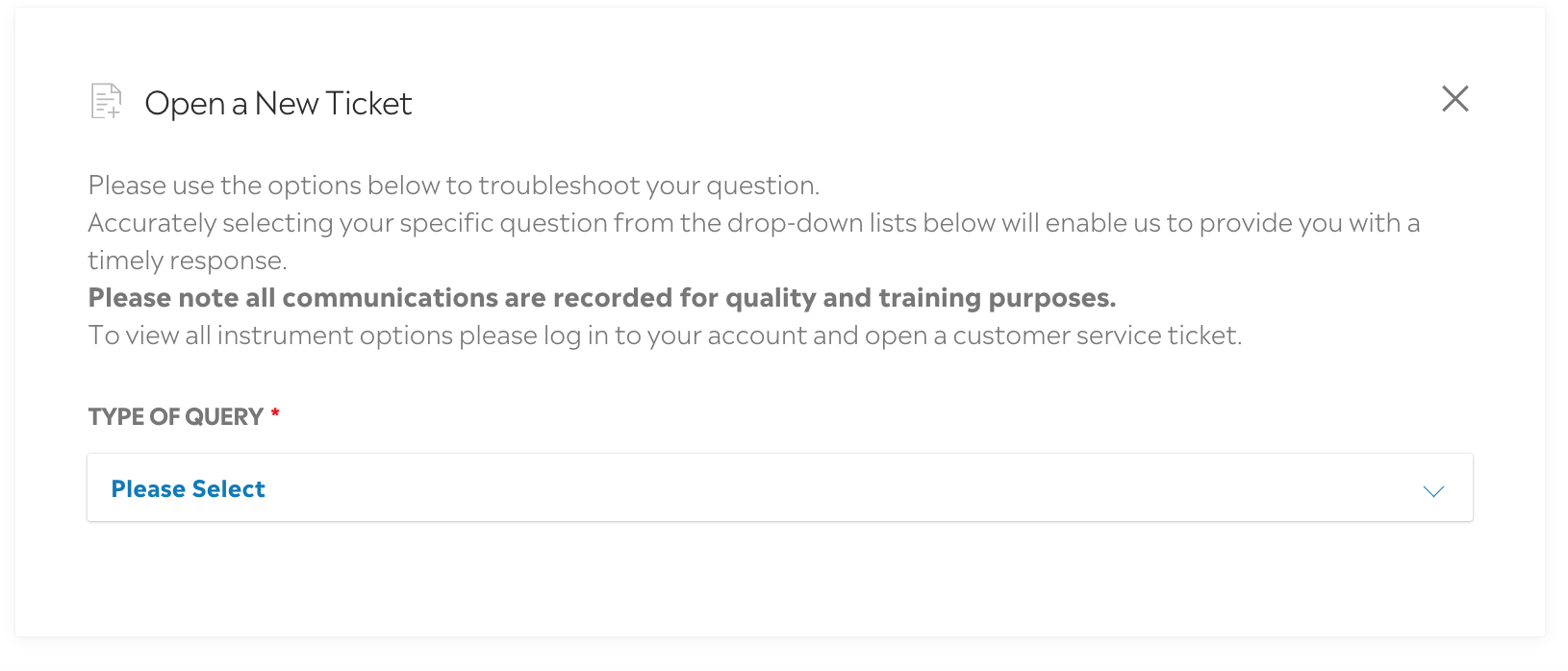

Support options available: eToro offers various customer support options to assist users with inquiries or issues. Users can access support through live chat, email, and the Help Center. While phone support is unavailable, the platform’s detailed FAQ section and online ticket system provide additional assistance.

Response times and quality of service: The live chat feature offers quicker assistance, usually within a few minutes, while email inquiries are typically addressed within 24-48 hours. The support team is generally responsive, and many users find their issues resolved efficiently. For premium users (members of the eToro Club), there is enhanced service with faster response times and dedicated account managers for more personalized assistance.

Support ticket system: Users can contact the customer service by opening a support ticket through their account dashboard.

Live chat-bot: eToros live chat feature helps resolving user questions in real time. Note that the lice chat feature is only available on weekdays (24/5).

Email: Users can get directly in touch with eToro’s customer support team via their email support@etoro.com

UAE specific features

- eToro offers Islamic accounts for UAE users, ensuring compliance with Halal and Islamic finance principles.

- UAE users cannot deposit in AED; a $50 conversion fee applies to convert AED deposits to USD.

- The minimum deposit for UAE users with Islamic accounts is USD 1,000.

- Locally regulated by the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM).

- Access to Abu Dhabi Securities Exchange (ADX)-listed stocks available since February 2025.

- Customer support offered in Arabic for enhanced accessibility.

Author comment

As an experienced trader, I consider eToro a solid pick for UAE traders, especially beginners. I signed up in under 10 minutes and found the platform’s clean layout and mobile app perfect for quick trades on the go. Fees are fair, with no commissions on stocks and ETFs, though watch the $5 withdrawal charge. The new ADGM regulation from Abu Dhabi adds a strong layer of trust, which matters here. A friend in Dubai I know grew their portfolio by 8% in three months using eToro’s copy trading, making it a great choice if you want an easy start with plenty of assets to explore.

FAQ

What is eToro?

eToro, founded in 2007 and based in Tel Aviv, Israel, is a popular online brokerage platform that lets users trade a variety of assets, including stocks, commodities, currencies, cryptocurrencies, and ETFs. What sets eToro apart is its social trading feature, allowing users to view and copy the trades of others in real-time, which creates an interactive and collaborative experience for both beginners and experienced traders. With over 35 million registered users and 3 million funded accounts as of early 2024, eToro has become a major player in the world of online trading.

Is eToro right for you?

eToro is a good fit if you’re looking for a user-friendly platform with social trading features, a variety of assets, and competitive fees. Its recent UAE regulatory approval adds security for local clients, and the quick signup makes it easy to get started.

How does eToro work?

eToro operates as a CFD and forex broker but also offers trading in real stocks, ETFs, and a broad selection of cryptocurrencies. Known for its unique social trading features, eToro allows users to follow and replicate other traders’ portfolios on its platform.

Who owns eToro?

eToro is a privately held company led by founder and CEO Yoni Assia. It is backed by venture capital firms, including Anthemis Group (UK), BRM Capital (Israel), CommerzVentures (Germany), Cubit Investments (Israel), MoneyTime Ventures (USA), Ping An (China), and Spark Capital (USA).

Who regulates eToro?

eToro is regulated by multiple authorities: CySEC in Cyprus, FCA in the UK, and ASIC in Australia. It operates through the following legal entities:

- eToro (Europe) Ltd. – Cyprus (CySEC)

- eToro (UK) Ltd – UK (FCA)

- eToro (AUS) Capital Pty Ltd – Australia (ASIC)

- eToro (USA) LLC – USA (state-regulated, crypto trading only)

How does eToro make money?

eToro earns revenue through spreads, which are the difference between buying and selling prices, overnight fees for leveraged trades, and non-trading fees, such as withdrawal fees ($5 per transaction) and conversion fees for deposits or withdrawals in currencies other than USD.

How does eToro CopyTrader work?

CopyTrader, eToro’s social trading tool, enables users to copy the trades of other traders automatically. Users can choose a trader to follow based on performance history and allocate a specific amount to replicate their trades. This tool also allows users to earn if other traders copy them.

Are profits made by trading on eToro taxable?

Yes, profits from trading on eToro may be taxable, depending on the local tax regulations of the trader’s residence. Users should consult their local tax authority for guidance.

Can I use eToro in the USA and Canada?

eToro is available in the USA but with limited services; US residents can trade real stocks, ETFs, options, and cryptocurrencies, but not CFDs. eToro is currently unavailable in Canada.

Countries eToro is not available in:

eToro is restricted in countries including Canada, Japan, Iran, Syria, North Korea, and others listed on the platform’s support page.

What is the downside of eToro?

Trading CFDs on eToro carries significant risk due to leverage, with around 68% of retail accounts losing money. CFD trading can result in substantial losses if not managed carefully.

Is eToro good for investing?

eToro offers benefits like commission-free stock trading, an easy setup process, and a top-rated social trading platform, but non-trading fees are high, making it less attractive for long-term investments.

Do you actually own stocks on eToro?

When trading real stocks on eToro without leverage, users own the underlying asset. For CFDs, which are leveraged, ownership remains with eToro. Fractional stock ownership does not include shareholder voting rights.

What are the fees to withdraw from eToro?

eToro charges a $5 withdrawal fee. As eToro accounts are USD-based, currency conversion fees apply for non-USD withdrawals.

Is eToro an Israeli company?

Yes, eToro is an Israel-based company with global offices in the UK, Australia, the US, and Cyprus. Its regulatory bodies include the FCA (UK), ASIC (Australia), and CySEC (Cyprus).

How long does it take to withdraw money from eToro?

Withdrawal times vary by method: bank transfers typically take 2-8 business days, while e-wallets take 1-2 days.

What alternatives are there to eToro?

Top competitors include XTB, Trading 212, IG, and Markets.com, offering similar products for various trader levels.

Is eToro Legal in UAE?

Yes, eToro is legal in the UAE. In October 2023, eToro (ME) Ltd received a Financial Services Permission (FSP) from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM), authorizing it to operate as a broker for securities, derivatives, and cryptoassets in the UAE. This approval allows eToro to offer its financial services within the country. https://www.adgm.com/public-registers/fsra/fsf/etoro-me-ltd

Does eToro Have Offices in UAE and Dubai?

Yes, eToro has an office in the UAE. In November 2023, eToro received approval from the Abu Dhabi Global Market (ADGM) to operate as a broker for securities, derivatives, and cryptoassets in the United Arab Emirates. Their office is located at Al Maryah Island, Abu Dhabi.

What Is eToro’s Phone Number For UAE Clients?

eToro does not provide a designated local phone number for its customers located in the UAE. eToro’s customer support is accessible through the various other channels listed below.

Is eToro trustworthy?

Yes, eToro is regulated by several financial authorities, including the FCA (UK), CySEC (Cyprus), and ASIC (Australia). Locally, it is also overseen by the FSRA of Abu Dhabi Global Market (ADGM). These regulations ensure that the platform adheres to strict guidelines for safety and transparency.

Is eToro available in the UAE?

Yes, eToro is available for users in the UAE. Residents can open an account, deposit funds, and trade various financial assets, including stocks, forex, cryptocurrencies, etc. It provides various types of accounts, including the eToro Islamic account.

How do I withdraw money from eToro in the UAE?

To withdraw money from eToro in the UAE, log into your account, go to the “Withdraw Funds” section, select the amount you’d like to withdraw, and choose your preferred withdrawal method, such as bank transfer, credit card, or e-wallet. eToro withdrawals typically take 1-3 business days to process.

Can you make money on eToro?

Yes, it is possible to make money on eToro, just like with any investment platform. However, trading involves risk, and success depends on market conditions, strategies, and risk management. Features like CopyTrader allow users to follow successful traders, potentially increasing the chances of profitability, though there are no guarantees.

What is the minimum deposit on eToro?

The minimum deposit on eToro varies depending on your country of residence but typically starts at $50 for most regions. However, the deposit requirement may be higher for some countries. ($100 for UAE clients).

What is social trading on eToro?

Social trading allows users to view, follow, and even copy the trades of other successful investors. With the CopyTrader feature, you can automatically replicate the trading strategies of top performers in real time.

Can I trade cryptocurrencies on eToro?

Yes, eToro offers many cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. Users can trade crypto directly or invest in crypto-focused portfolios.

Does eToro Work in UAE?

The answer is Yes! eToro does not have any limitations in place for customers based in the UAE. Their platform and app are available with all features, add-ons and tools. There are no restrictions, no special requirements or exceptions for United Arab Emirates users.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk

Everything you find on Business24-7 is based on trustworthy data and impartial analysis. We combine over 11 years of financial expertise with valuable reader feedback to provide accurate insights. Learn more about our methodology.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.