In A Nutshell

Firstrade is a discount stockbroker from the US, regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). It was founded in 1985 with the name First Flushing Securities.

It is considered a safe broker since it has top-tier licenses and a long track record.

We chose Firstrade as the Top Broker for Funds in 2020 after analyzing 57 online brokers and testing their live accounts.

Firstrade

Best ForStocks, ETFs, Mutual Funds, Options

Recommended ForRetirement & Long-Term Investors, Beginner Investors

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForStocks, ETFs, Mutual Funds, Options

Recommended ForRetirement & Long-Term Investors, Beginner Investors

- Trader Level Beginner-Advanced

- Options Commission $0

- Stock & ETF Commission $0

- Non-Trading Fees Low

-

Web trading platform3.6

-

Fees5.0

-

Mobile App5.0

-

Deposit and withdrawal 1.9

-

Available assets4.7

-

Account opening5.0

-

Education and Research 2.1

-

Support4.0

-

Overall rating3.9

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Firstrade Good & Bad

Firstrade has free ETF, mutual fund, stock, and options trading. Also, it offers low non-trading fees. It is a broker with several high-quality research tools, like detailed fundamental data and trading ideas.

The downside with Firstrade is that it has no electronic wallets and debit/ credit cards for transferring funds. Its portfolio covers only the US market. The customer support is available 24/5, and there is no live chat.

Good:

- Free ETF, Fund, Stock, And Options Trading

- Reliable Research Tools

- Useful Educational Tools

Bad:

- No Debit/ Credit Cards And Electronic Wallets For Funds Transfer

- You Can Trade Only On US Markets

- No 24/7 Customer Support And No Live Chat

1. Fees and Spreads

Firstrade offers low fees and free ETF, stocks, funds, and options trading. The non-trading fees are low. The downside is that it has high margin rates.

Good:

- Low Trading Fees

- Low Non-Trading Fees

- Free ETF, Stock, Fund And Options Trading

Bad:

- High Margin Rates

Fees At Firstrade

| Assets | Fee | Fee Terms |

|---|---|---|

| US Stock | Low | $0 Per Trade |

| USD/ EUR | – | Not Available |

| Mutual Fund | Low | $0 Per Trade |

| Inactivity Fee | Low | $100 Fee Applicable Only After Several Years Inactivity |

How We Assessed Fees

We assessed Firstrade’s fees as low, average, or high, depending on how they compare to those of all forex brokers we reviewed.

To help you get a broader understanding of our process, here is the distinction between trading and non-trading fees.

• Trading fees happen when you trade. These can be conversion, commission, spreads, or financing rates fees.

• Non-trading prices are not linked to trading. These can be inactivity or withdrawal fees.

We shared in this review the most important fees at Firstrade’s for each asset class. For example, commissions are the most substantial fees for stock investing.

We reviewed Firstrade’s costs in comparison with those of two competitor brokers, E-trade and Fidelity. Our assessment relies on objective factors, like client profile, fee structure, or products available.

Here are our top findings of Firstrade trading fees.

Trading Fees At Firstrade

The trading fees at Firstrade are free. Also, the fee structure is simple to understand and transparent. Only bonds need more attention.

ETF And Stock Fees

This broker provides free stock trading.

ETF And Stock Commission Of A $2,000 trade

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| US Stock | $0.0 | $0.0 | $0.0 |

It is best to look at Firstrade’s financing rates if you prefer short sale or stock trading on margin.

A margin or financing rate happens when you trade on margin or short a stock. It signifies that you can lend stocks or money from your broker to trade. The borrowed asset has an interest, which you have to pay. Overall, a financing rate can be a significant part of your trading fees.

This broker has high financing rates. These rates vary for stocks based on the base currency of your margin account.

Annual Financing Rates For Options And Stocks At Firstrade

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| US Margin Rate | 9.3% | 9.3% | 9.8% |

Firstrade has volume-tiered financing rates. It adds a base rate and a premium based on the financed amount. The broker sets this base rate by its discretion. When we reviewed Firstrade, the base rate was 7.25%.

Annual Financing Rates At Firstrade

| Debit Balance | Rate % | Base Rate +/- |

|---|---|---|

| $1,000,000 or more | 5.00% | Base rate – 2.25% |

| $500,000 – $999,999 | 5.60% | Base rate – 1.65% |

| $250,000 – $499,999 | 7.50% | Base rate + 0.25% |

| $100,000 – $249,999 | 7.75% | Base rate + 0.50% |

| $50,000 – $99,999 | 8.25% | Base rate + 1.00% |

| $25,000 – $49,999 | 8.75% | Base rate + 1.50% |

| $10,000 – $24,999 | 9.00% | Base rate + 1.75% |

| Under $10,000 | 9.25% | Base rate + 2.00% |

All the rates above apply for options trading, too.

Fund Fees

Firstrade has commission-free mutual fund investing.

Fee For A $2,000 Fund Purchase

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Mutual Fund | $0 | $37.5 | $20.0 |

If you hold mutual fund shares at Firstrade, you will be charged a $19.95 commission if you sell within 90 days of purchasing.

Bond Fees

This broker has high bond fees. These vary depending on the bond type you purchase. We calculated the costs for Treasury bonds.

Fee Of A $10,000 Government Bond Trade

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| US Treasury Bond | $40.0 | $0.0 | $0.0 |

There is a $30 minimum fee for secondary CDs and a $40 minimum fee for corporate, treasury, agencies, municipal, and zero bonds.

Options Fees

Like mutual funds, stocks, and ETFs, options trading is commission-free. This offer is better than at Firstrade’s competitors.

Stock Index Options Fees Of 10 Contracts

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| US Stock Index Options | $0.0 | $6.5 | $6.5 |

Non-Trading Fees

Non-trading fees at Firstrade are low. This broker has no inactivity or account fee. However, a $100 dormant account processing fee will be applied if you don’t use your account for several years.

Account opening costs $100 for legal entities, like LLCs, partnerships, or corporations. Also, there is a $200 yearly account fee.

Using an ACH transfer comes with no withdrawal fee. The downside is that withdrawal to domestic banks via wire transfer costs $30. Also, a foreign outgoing wire transfer is $50. We tried ACH, and we didn’t pay a withdrawal fee.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Account Fee | No | No | No |

| Inactivity Fee | No | No | No |

| Deposit Fee | $0 | $0 | $0 |

| Withdrawal Fee | $0 | $0 | $0 |

2. Account Opening

Opening an account at Firstrade is user-friendly and fully digital. This broker is available for the US and some non-US clients. The downside is that the process is slow, and we had to wait around 3 business days to open an account.

Good:

- Fully Digital

- No Minimum Deposit

- Low Minimum Deposit

Bad:

- Slow Account Verification

Firstrade is a US broker, but customers from all over the world can create an account.

Minimum Deposit At Firstrade

The minimum deposit at Firstrade is $0 for both international and US customers. It can be higher if you prefer investing in portfolios or trading on margin.

| Trading Preferences | Minimum Deposit |

|---|---|

| Brokerage Account | $0 |

| Margin Account* | $2,000 |

| Day Trading Account | $25,000 |

*You trade on leverage, with the borrowed money from the broker.

Account Types

This broker has several account types.

| Account Type | Characteristics |

|---|---|

| Individual | Account is owned by a single individual |

| Joint Accounts | Account is owned by two or more individuals |

| Retirement Accounts (Roth IRA, Traditional IRA, etc.) | Individual retirement accounts, only in the US |

| Business Accounts | Account is owned by a legal entity, only in the US |

| Education Savings Account | Savings account for quality educational purposes, only in the US |

| Custodial Account | Special accounts for custodial purposes, only in the US |

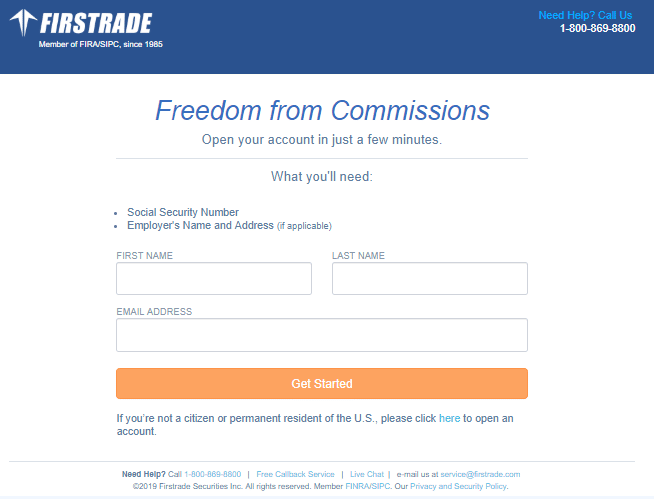

Opening An Account At Firstrade

Opening an account with this broker is simple and fully digital. The online application takes up to 15 minutes. The downside is the verification time. For this review, we waited 3 business days until our account was approved.

If you want to create an account at Firstrade, you will have to follow these steps:

- Submit personal data and an email address;

- Select an account type, along with your day trading preferences and state;

- Add more personal details for account verification, such as your Social Security Number;

- Add a personal phone number (it will be used during the registration process and as a contact point), and select a security question;

- Share details about your employment and financial status;

- Share your trading preferences and investment profile;

- Customize your connection and funding preferences;

- Review and send your application;

It is necessary to mention that there is a slight difference between non-US and US customer applications. Non-US customers have to upload the agreed W-8 Ben tax form and the Online Service Agreement, along with a passport copy. Firstrade does not share details about specific limitations concerning international account services.

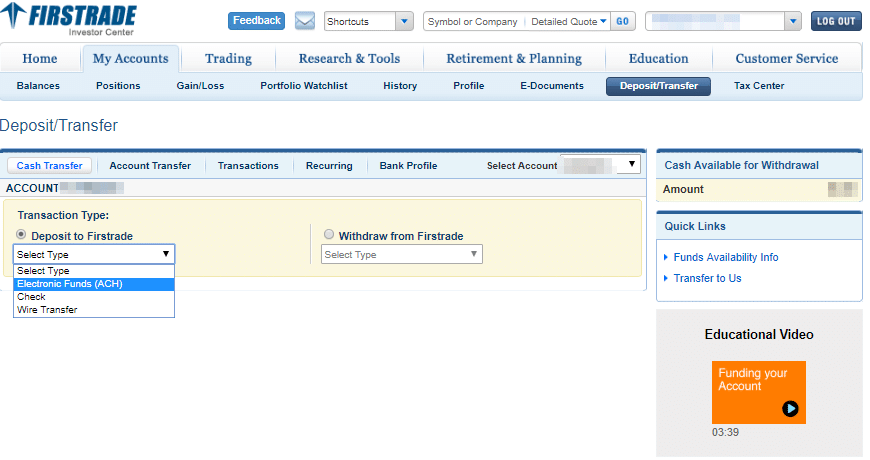

3. Withdrawals And Deposits

Firstrade has a user-friendly withdrawal and deposit process. Transferring funds is simple and free. We believe it can be improved, as there is a high fee for wire transfer withdrawal. You can only use bank transfers.

Good:

- No Deposit Fee

- User-friendly

Bad:

- No Debit/ Credit Card

- High Outgoing Wire Transfer Fee

Options And Deposit Fees

There are no deposit fees. US customers can use wire transfers and ACH for the deposit. When we tested this broker, electronic wallets and debit/credit cards were unavailable.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit/ Credit Card | No | No | No |

| Electronic Wallets | No | Yes | No |

We transferred funds with ACH, and it took 2 business days. You can only transfer money from accounts in your name linked to your brokerage account.

Options And Withdrawal Fees

There are no withdrawal fees with ACH. US domestic wire transfers have a $30 fee, and international withdrawals have a $50 fee.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Bank Transfer | Yes | Yes | Yes |

| Debit/ Credit Card | No | No | No |

| Electronic Wallets | No | Yes | No |

| Withdrawal Fee | $0 | $0 | $0 |

We tested the withdrawal via bank transfer, and it took 2 business days.

You can only transfer money to accounts in your name.

You can withdraw funds from Firstrade like this:

- Log in your account

- Access ‘My Accounts’

- Select the ‘Deposit/ Transfer’ menu and click on ‘Withdraw from Firstrade’

- Select the transfer type your previously linked external account and your Firstrade account

- Determine the amount you want to withdraw and set the date and frequency of the withdrawal

- Preview and start the withdrawal

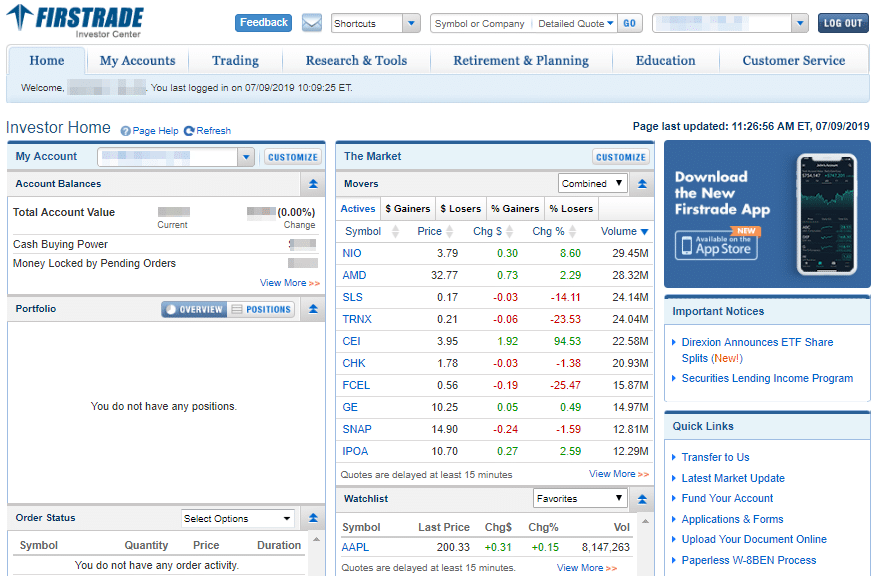

4. Trading Platform

The web platform is easy to use and understand. It is great for beginners. However, it does not come with two-step authentication, and it has limited customizability.

Good:

- User-friendly

- Transparent Fee Report

- Reliable Search Function

Bad:

- No Two-Step Authentication

Platforms Available At Firstrade

| Trading Platform | Score | Available |

|---|---|---|

| Web | 4/ 5 Stars | Yes |

| Mobile | 3/ 5 Stars | Yes |

| Desktop | – | No |

We reviewed Firstrade’s proprietary trading platform. It is available under Firstrade Investor Center.

This web trading platform is available in Cantonese, Mandarin, and English.

Look And Feel

Firstrade has a user-friendly web platform with excellent design and customer experience.

The downside is its limited customizability. You can modify the order of the tabs in the Investor Home, but you can’t customize them.

Security And Login

This web trading platform has only a one-step authentication process. As we saw in our research, two-step authentication is more secure.

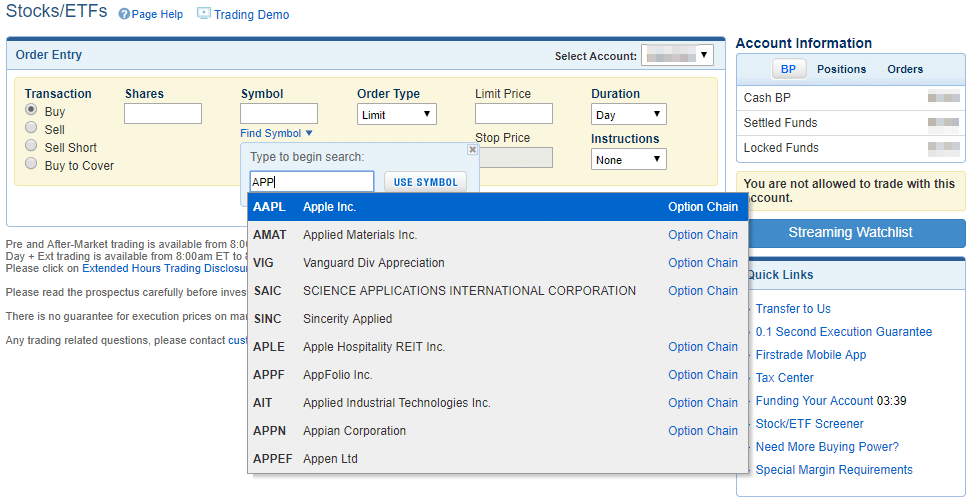

Search Features

Firstrade has useful search features. You can look up data by entering an asset’s ticker or a company’s name. All results are useful.

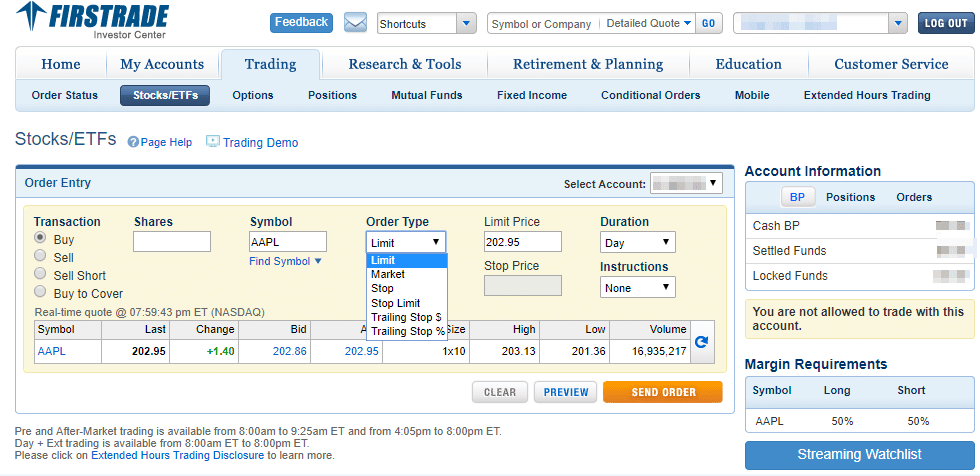

Placing Orders

Firstrade has the following order types:

- Market

- Limit

- Stop

- Stop limit

- Stop trailing ($, %)

- Stop limit trailing ($, %)

Also, you can use order time limits:

- Good Till 90 days

- Pre Market

- After Market

- Day + EXT

- All or Nothing (AON)

Notifications And Alerts

You can create alerts based on different features in the ‘Research & Tools’ menu. The platform sends alerts via email.

Fee Reports And Portfolio

This broker has transparent fee reports and portfolios. You can access this data under the ‘My Accounts’ menu, ‘Position and History.’

5. Mobile Trading Platform

The mobile platform has reliable search features and user-friendly design. However, price alerts and two-step authentication are not available. You can’t trade bonds or mutual funds.

Good:

- User-friendly

- Reliable Search Tools

- Several Order Types Available

Bad:

- No Two-Step Authentication

- No Price Alerts

- Bonds Or Mutual Funds Are Not Covered

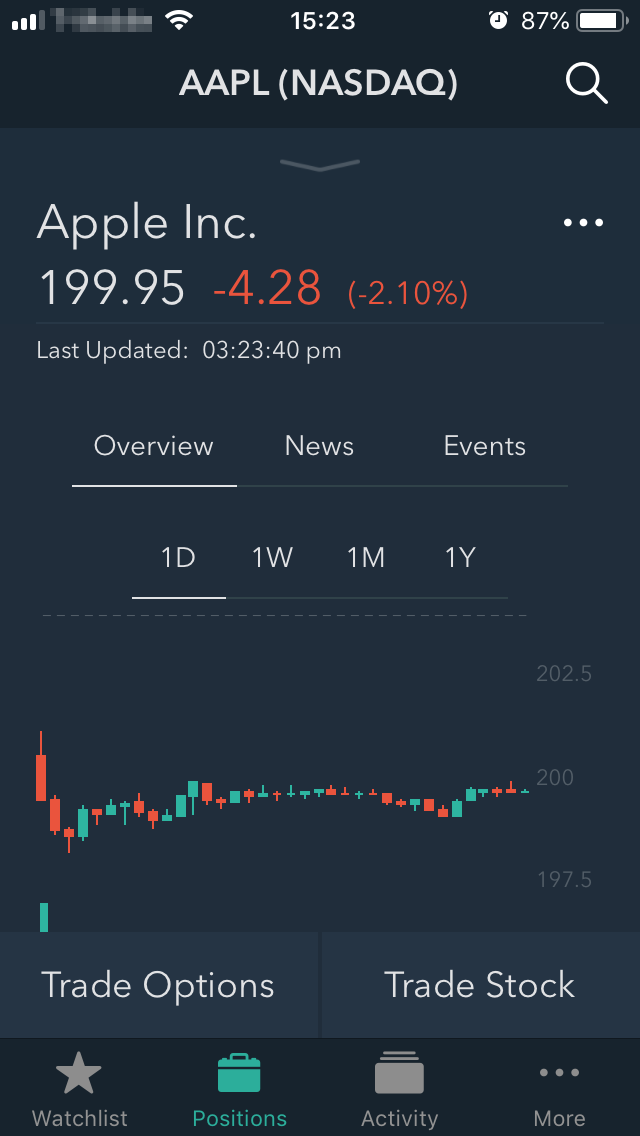

For this review, we used the iOS version of Firstrade’s proprietary mobile trading platform. The platform is available on Android, too.

Just like the web platform, the mobile trading platform is available in Cantonese, Mandarin, and English.

The mobile platform lets you trade options, stocks, and ETFs. This is a limited offer when compared to the web platform.

Look And Feel

As soon as you install it, you will discover that this mobile trading platform is well designed and simple to understand.

Security And Login

Firstrade offers only a one-step authentication. A two-step authentication would be more secure.

For iOS devices, you can use biometric authentication: touch and face ID.

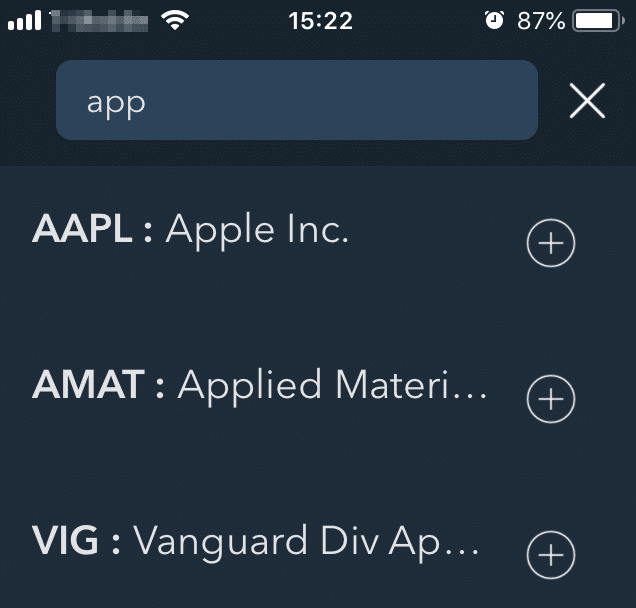

Search Features

Search functions are reliable, and you receive fast results. The news feed and integrated third-party analysis opinions are useful.

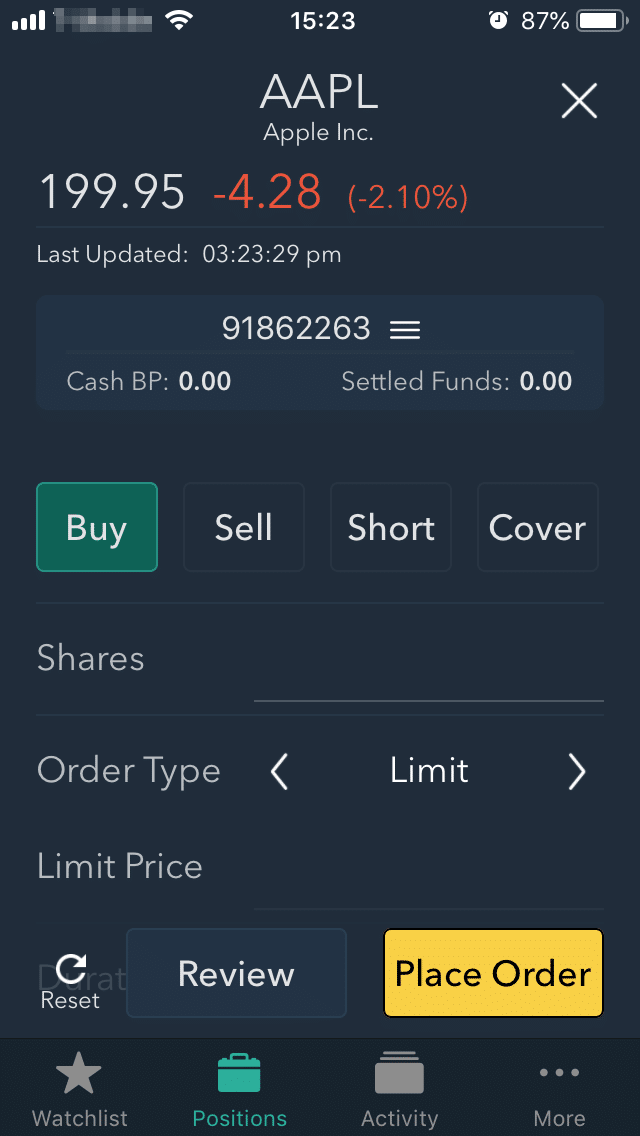

Placing Orders

You can use similar order time limits and order types as in the web trading platform.

Notifications And Alerts

The mobile trading platform has no price alerts settings.

6. Desktop Trading Platform

Firstrade does not have a desktop trading platform.

7. Markets And Products

Firstrade has an excellent portfolio with numerous asset classes ranging from options to stocks. The downside is that the products cover only the US market, and you cannot trade with forex or futures.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Stock | Yes | Yes | Yes |

| ETF | Yes | Yes | Yes |

| Forex | No | No | No |

| Fund | Yes | Yes | Yes |

| Bond | Yes | Yes | Yes |

| Options | Yes | Yes | Yes |

| Futures | No | No | Yes |

| CFD | No | No | No |

| Cryptocurrency | No | No | No |

The selection for options, bonds, and mutual funds is average. Also, it is not as broad in ETF and stocks, as it is with other reviewed brokers.

ETF And Stock

In this review, we discovered that Firstrade covers only the US market. It is less than Fidelity’s selection (it provides international stock exchanges), but it resembles well the offer at E-Trade.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Stock Markets | 5 | 29 | 5 |

| ETFs | 2,300 | 80 | 2,300 |

You can trade with stocks using the following markets: OTC Pink, NYSE, AMEX, OTCBB, and NASDAQ.

Fund

Firstrade has several mutual funds, but it is less than the number of fund providers at E-Trade and Fidelity.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Fund Providers | 415 | 560 | 530 |

Bond

The bond selection with this broker is basic. It is less than the one at E-Trade and Fidelity.

| Firstrade | Fidelity | E-Trade | |

|---|---|---|---|

| Bonds | 38,500 | 113,000 | 88,000 |

The bonds cover corporate and government bonds.

Options

Firstrade offers US options exchanges and CBOE, but it does not state clearly which ones.

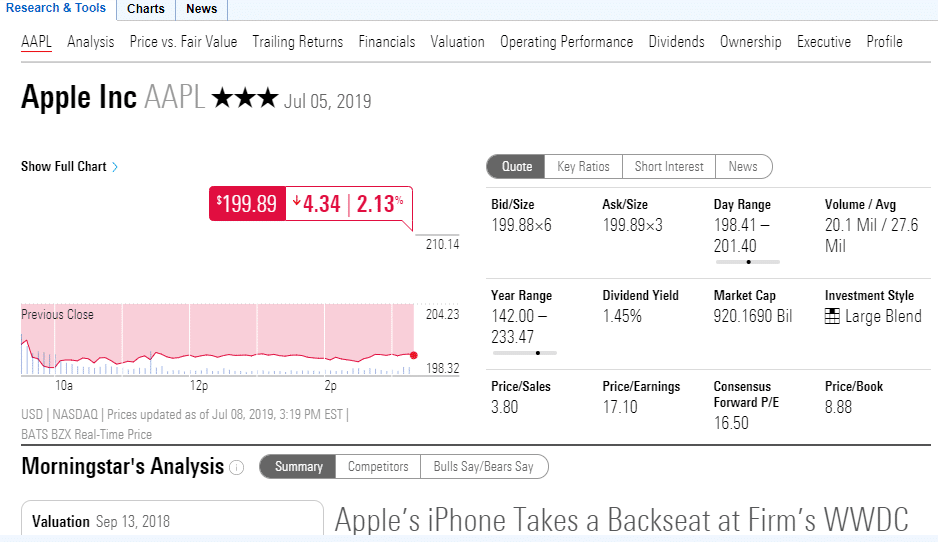

8. Research

Firstrade has reliable research tools. You can access interactive charts, detailed fundamental data, screeners, trading ideas, heatmap, an economic calendar, and P&L analysis.

Good:

- Excellent Interactive Chart

- Trading Ideas

- Asset Fundamentals Data

Bad:

- None

These tools are available under the ‘Research & Tools’ menu. They are available in Cantonese, Mandarin, and English.

Trading Ideas

Firstrade offers trading ideas for mutual funds, ETFs, and stocks. We liked the integrated features:

- Data plotting

- Preset peer group comparison

Trading ideas come from third-party providers, like Morningstar.

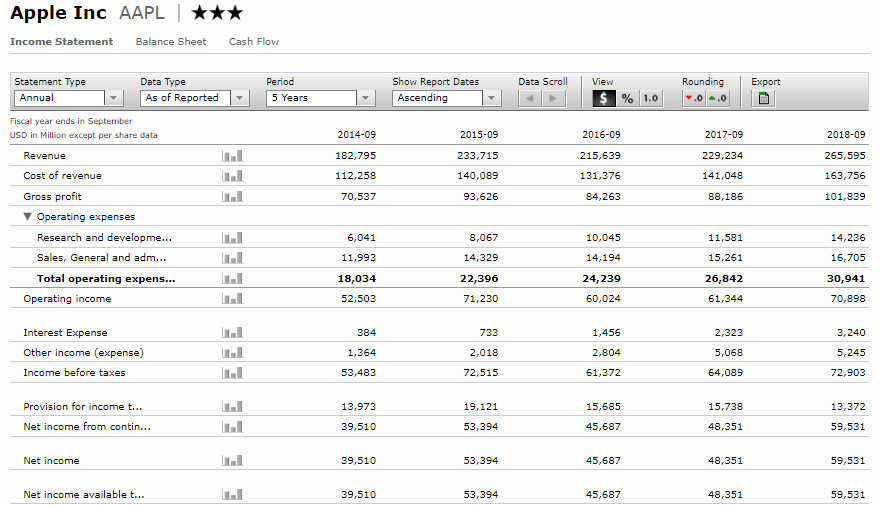

Fundamental Data

Firstrade has excellent fundamental data. You can access information for distinct assets, ranging from funds to stocks.

For example, you can see dividend calendars, peer group companies, or financial statements for 5 or 10 years.

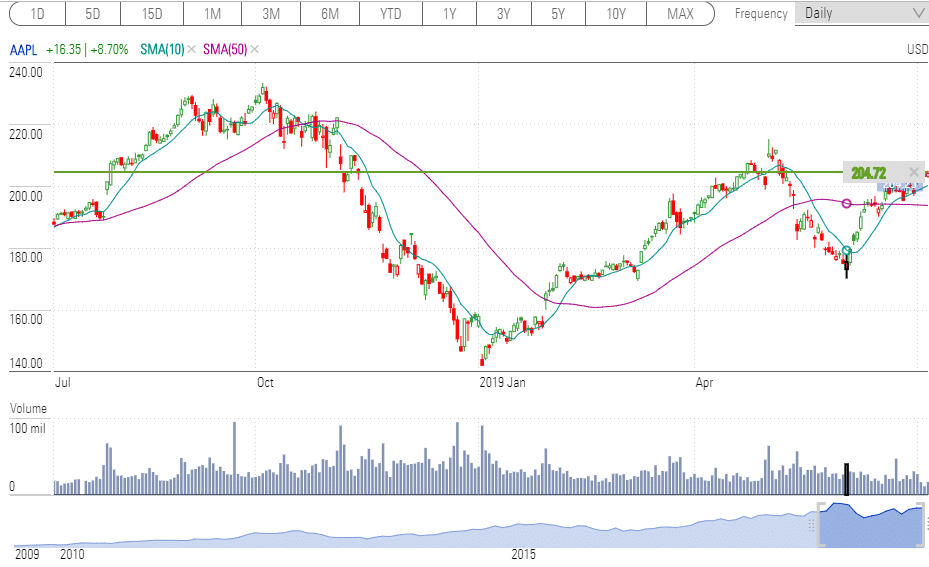

Charting

Charting tools at Firstrade are good. You can edit the charts with ease, and you can use up to 50 technical indicators.

News Feed

We believe that the news feed could use some improvements. You can read it quickly, but there are no visual cues, such as pictures or charts. If you like Zacks, Briefing.com, or Benzinga, you will be ok with Firstrade’s offer. The news feed is from the mentioned third-parties.

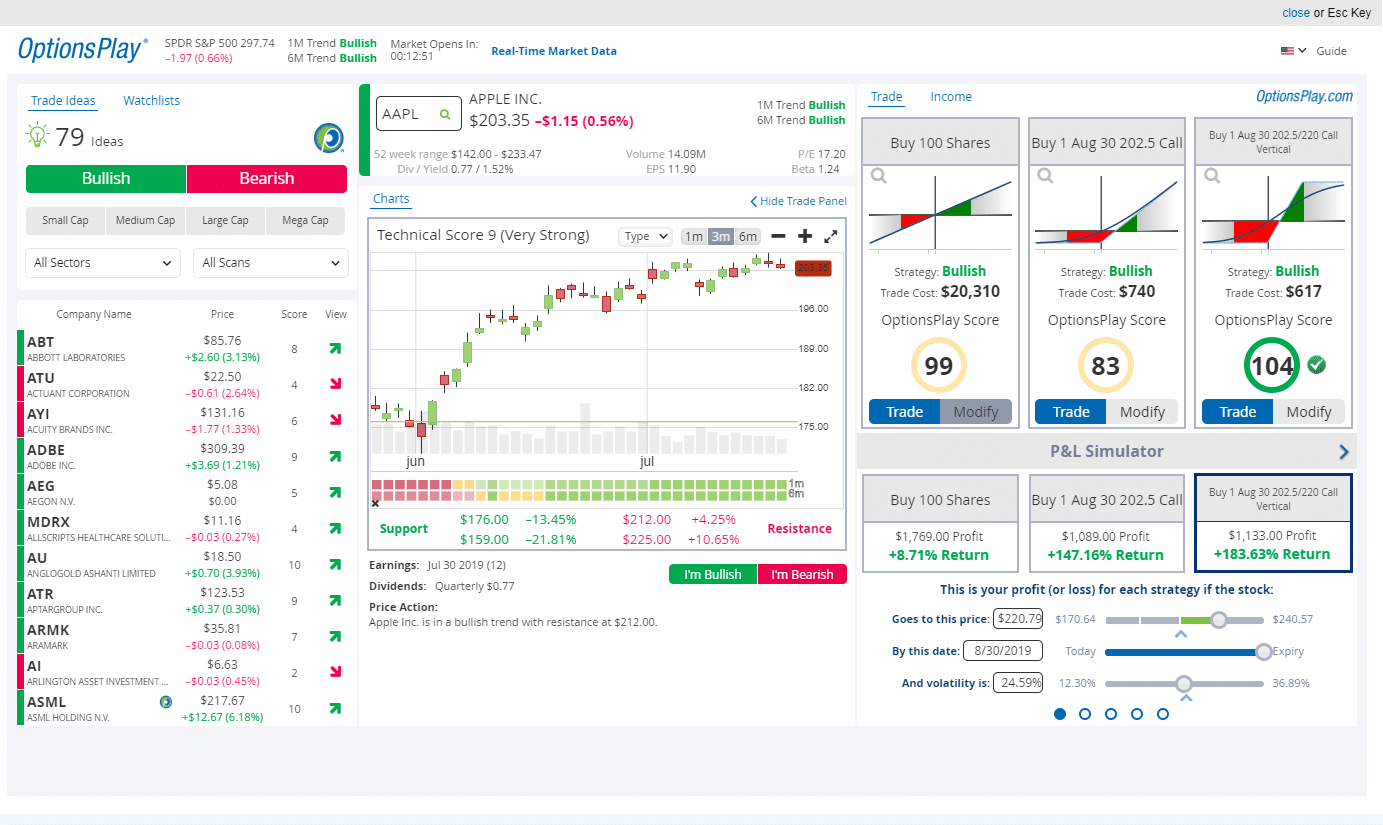

Extra Research Tools

There are professional screeners for ETFs, mutual funds, and stocks. You can use several filters, from technical indicators to company data.

The Option Wizard in the ‘Education’ menu is great. OptionsPlay.com created it, and it is a useful tool for those interested in options trading.

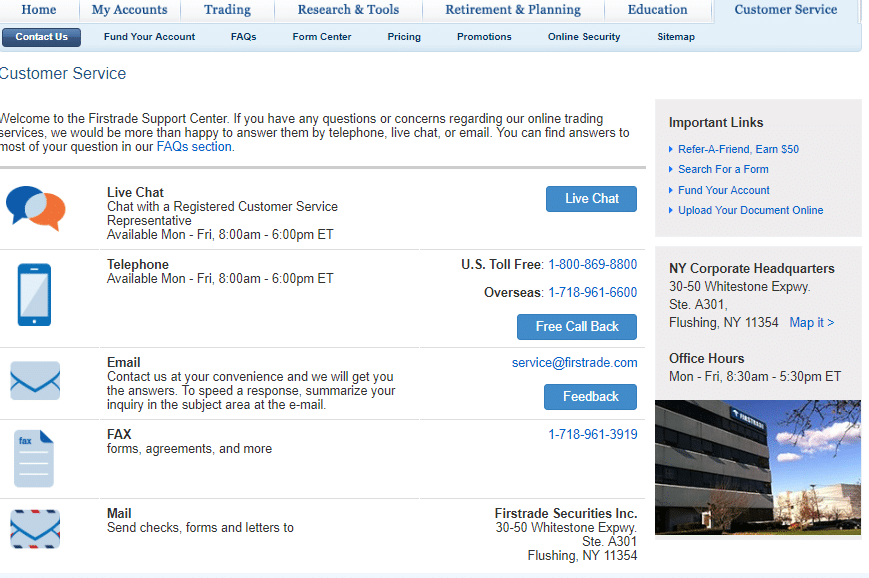

9. Customer Support

Customer service at Firstrade is good, and you will receive relevant information. It is available in Cantonese, Mandarin, and English. However, live chat and 24/7 support are not available.

Good:

- Phone Support

- Knowledgeable Answers

Bad:

- No Live Chat

- No 24/7 Availability

You can reach Firstrade via:

- telephone

- chatbot (intelligent FAQ)

Phone support is ok. We received useful answers in a short time.

The chatbot or intelligent FAQ can answer standard questions like ‘What Firstrade’s fees?’.

The email has a slower response rate, but the answers are relevant.

The downside is that 24/7 support is not available. You can only reach them between 8:30 am and 5:30 pm EST, from Monday to Friday.

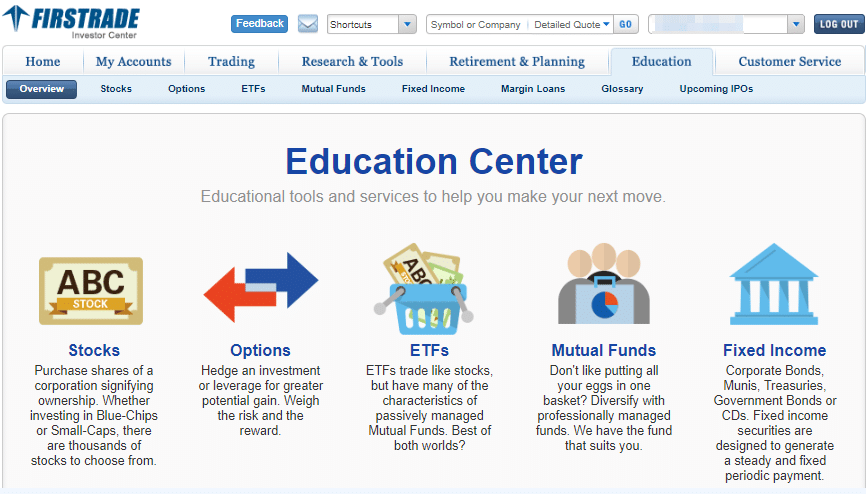

10. Education

Firstrade is an excellent choice for beginners. This broker has useful platform videos, webinars, glossary, and educational articles. The downside is that there is no demo account.

Good:

- Tutorial For Trading Platform

- Educational Videos

Bad:

- No Demo Account

The following tools are helpful:

- Platform tutorial videos

- General educational videos

- Webinars

- Quality educational articles

The content quality for archive webinars and educational videos is excellent. The data ranges from options to stock trading. The downside is that it is difficult to catch a live webinar or save the materials.

Firstrade gets you access to Ebooks and podcasts. You can find these features in the ‘Education’ menu.

11. Safety

Firstrade has top-tier licenses, like FINRA and SEC.

Also, it offers a high investor protection amount of $500,000, which includes $250,000 for cash. However, this broker does not have negative balance protection.

Good:

- Top-Tier Licenses

- High Level Of Investor Protection

Bad:

- No Negative Balance Protection

- No Banking License

- Not Featured On Stock Exchange

Firstrade Regulations

Firstrade has licenses from the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC).

Firstrade Safety

When it comes to Firstrade safety concerns, it is best to check the following:

• Protection if something goes wrong

• Background of the broker

Account Protection At Firstrade

Firstrade offers its services through Firstrade Securities, Inc. this broker has regulations from FINRA and SEC. All clients are protected by the US Investor Protection Scheme, SIPC.

The SIPC investor protection scheme protects against securities or cash loss. It has a $500,000 limit, and it includes a $250,000 limit for cash. This sum is higher than the amount in popular investor protection schemes.

SIPC doesn’t protect all investments. Mostly, it covers bonds, mutual funds, stocks, notes, other registered securities, and additional investment company shares. SIPC doesn’t protect instruments like unregistered limited partnerships, fixed annuity contracts, unregistered investment contracts, currency, interests in gold and silver, or other commodity options or commodity futures contracts.

Firstrade has no negative balance protection.

Background

Firstrade was established with the name First Flushing Securities in 1985. A long track record is proof for a broker’s ability to handle financial crises.

This is a safe broker due to its long track record and top-tier licenses.

Bottom Line

Firstrade is the leading discount US stockbroker with top-tier licenses.

It provides free mutual funds, options trading, ETF, and stocks. Also, it has no account or inactivity fee. It offers access to useful educational and research tools.

However, there are some drawbacks. Firstrade has no electronic wallets or debit/credit card options for transferring funds. This broker is great for those looking to trade only in the US market. However, this might not be enough for those looking for an extensive product portfolio that covers additional markets.

Customer support is only 24/5, and you can reach them via live chat.

You can try Firstrade since there is no inactivity fee, and other costs are low.

Compare Fidelity With Other Brokers