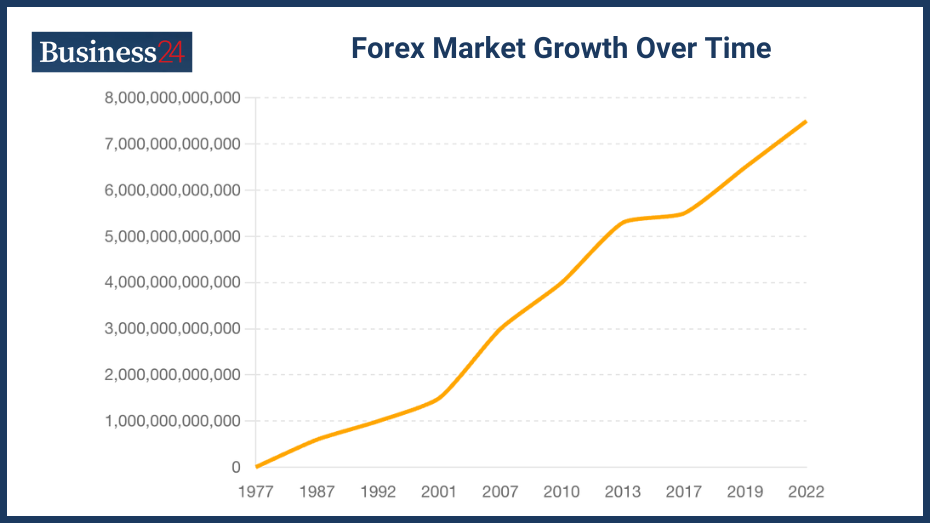

Forex scams involve deceptive practices aimed at defrauding traders by promising high returns with little risk. More than $6 trillion worth of value is traded in the Forex market, which has limited regulatory accountability. This lucrative nature makes the market a hotbed of Forex-related scams.

According to the Commodities and Futures Trading Commission (CFTC) of the USA, a sharp uptick in forex scams has been witnessed in previous years. Here is a complete guide on Forex scams and how to avoid them.

What is Forex Trading?

Forex trading is the global, decentralized exchange of currencies.

Forex trading, sometimes called FX trading, involves profiting from the exchange of different national currencies. It is one of the largest exchange markets in the world, and trillions of dollars worth of currency are exchanged daily.

Two ways in which companies/individuals engage in Forex trading:

- Hedging involves companies moving around their money in different currencies to protect themselves from monetary fluctuations and instability.

- Speculation involves attempts to make a profit by moving money around favorable trading positions.

Scams can occur in both hedging and speculation.

What Are Forex Scams?

Forex scams deceive traders to siphon funds through false promises.

Forex scams involve fraudsters tricking investors or even other brokers into giving their investments to make big profits. Since nobody willingly gives their money away, scammers use a range of hoodwinks and dirty strategies to lure victims. Common giveaways of a forex trading scam include:

- Unregistered/unregulated brokers promising guaranteed profits

- Completely automated/AI-based trading with no downsides

- Hidden fees that wipe out any gains that were made by the exchange activity

- Unsolicited emails creating an environment of FOMO (Fear Of Missing Out)

What Are the Common Types of Forex Scams?

Broker scams, misleading signals, and fake investment management are prevalent.

Forex scams can potentially result in the loss of massive amounts of funds. Common types of Forex scams include:

- Broker scams involve unregistered brokers promising huge Returns on Investment (ROI) with no risks involved. Dealing with unlicensed brokers is a problem because they aren’t under the ambient of the law. You will have limited legal recourse if these unregistered brokers run away with your funds. It is always advisable to deal with reputable, licensed brokers.

- Misleading/Fake Signal Selling: Signal selling involves fraudsters attempting to sell you information regarding the market’s immediate future. They claim the latest “AI-based analytical tools” to predict the market, and their “signals” are always accurate. They can make you join Telegram or Discord channels for a fee. Victims are tempted by the lure of profits, and they are obliged to pay hefty fees for this shady information.

- Fake Investment Management: Scammers can pretend to become investment managers and offer to take over your trading accounts. They can either drain your account of your funds or engage in risky trades. Either way, you can lose all of your investment.

- Forex Trading bots: Scammers may pitch you automated trading solutions using an AI-based trading bot. While trading bots are being used by professional traders, the process isn’t completely automated, and some human input is required. Last, you don’t need to hand over your money to a third party for this purpose. Always use a reliable software company with a perfect track record to provide you with a trading bot. Even then, understand it well enough because bots can be part of elaborate trading scams as they can be easily programmed to cause damage.

- Social media gurus/Expert Advisors: Social media influencers posing as “top forex traders,” especially on Instagram, showcase an extravagant lifestyle to show you how successful they are and why you should follow them. They often sell expensive courses worth thousands of dollars that add little value.

How Can You Spot Forex Scams?

Spot scams by noting unrealistic returns, high-pressure sales, and lack of transparency.

Forex scams are generally built around the promise of massive returns with little or no downside/risks involved. Common identifying patterns of forex scams include:

- High-Pressure Sales Tactics: These scammers use compulsive tactics with you and force you to make a rash decision. They create a false sense of urgency to access your funds, and you lose your hard-earned money. Never give in to these high-pressure sales tactics.

- Unrealistic Returns: Forex trading is a lucrative market overall, with more than $6 trillion traded daily. However, the trading margins are small overall and rarely exceed 10% in a single trade, even in extreme circumstances. So, promises of unrealistic are always a dead giveaway of a forex scam.

- Lack of Transparency: Professional forex brokers are always upfront about their markup and fees. Some brokers try to hide their fees, but they only show up once a transaction is completed. These hidden fees can eat away your profits and leave you with only peanuts. Always select brokers with an impeccable record who don’t hide information.

What Regulatory Insights and Protections Are Available for Forex Traders?

Regulatory bodies ensure brokers adhere to fair, transparent trading practices.

Forex trading isn’t covered by an international watchdog. Regulatory protections and compliance for forex traders differ from country to country. Each state has its top forex regulating authority, and the scope of its power also varies.

The purpose of regulation is to offer protection from financial risks in the market, including scams. Regulatory protections available for forex traders include:

- Set standards: They include regular audits and spot checks to keep a level playing field for everyone.

- Mandated Transparency: Forex traders are required by law to be fully transparent about their fees, trading activity, and earnings. If a trader holds back information regarding fees, they can be sued in a court of law.

- Measures Against Market Manipulation: The Forex market is often dominated by big names, and that is fine, but some of them can gang up together and use their resources for market manipulation purposes. Regulations ban organized collusion to inflate the price of a currency.

- Preventing Big Losses: Regulations are in place to avoid losses that go below your initial investment. A negative balance sheet can start a chain reaction that destroys entire economies, so it is important to stop it in the very beginning.

Other country-specific regulations are also present. They change over time, but the promise is the same: safeguard traders and their investments.

How Can You Protect Yourself from Forex Scams?

Use regulated brokers, seek extensive education, and be wary of too-good-to-be-true offers.

To protect yourself against forex scams, you need to follow these steps:

- Avoid Unrealistic Opportunities: Forex trading has smaller margins than other sectors, so it is easy to weed out unrealistic opportunities. If a broker promises returns too good to be true, they are probably not viable, and you are probably looking at a scam.

- Avoid Unregulation Brokers: Unregulated brokers are prevalent in many parts of the world. However, because they aren’t registered with the authorities, the individuals can prove tricky to handle in a court of law or by law enforcement agencies.

- Seek Extensive Education: Engage in formal or informal education to learn more about forex trading. Like other broker activities, there are new developments in the forex market and new scammers. If you keep yourself educated, you can easily identify a scam.

What Should You Do If You’ve Been Scammed?

Report scams to authorities and explore legal avenues for fund recovery.

If you are being scammed out of funds by a forex trader, follow these steps:

- Cease Further Transactions: Immediately halt all trading activity and further deposits to the scammer. Start gathering all evidence of transactions, including the money trail.

- Report the Scam to the Relevant Financial Authorities: You can use an official portal to submit a complaint to your country’s top forex regulator.

- Report Identity Theft: If scammers have been using your identity to execute trades in your name, you can report it to the government’s top identity theft reporting center like this one in the USA.

Essential Definitions Related to Forex Trading Scams

Understanding key terms is crucial in navigating and avoiding forex scams.

What is the definition of Forex Trading?

Forex trading is the business of exchange of currencies in hopes of making a profit. It is used as a speculative investment or a hedging strategy.

What is the definition of a Forex Scam?

A Forex scam is when a fraudster uses criminal tactics to take your valuable funds from you. It may be with the lure of guaranteed, unrealistic profits, undeclared fees, or through fake bot trading.

What is the definition of a Broker Scam?

A broker scam is when a trader uses deceptive tricks to lie to you to reduce your profits and increase his own margins. They include hidden fees, manipulated/spreads, and unprofitable/unsuitable trade recommendations.

What is the definition of Signal Selling?

Signal selling is the practice of selling market movement intelligence to other brokers. They are often used by scammers who pretend to know more than they actually do. Signal selling needs to be taken with a pinch of salt.

What is the definition of a Regulatory Body?

A regulatory body is a government organization responsible for enforcing rules on a certain aspect of human activity. They include environmental, social, economic, and legal regulators.

What Are the Most Frequently Asked Questions About Forex Scams?

Includes questions such as:

What is bad about forex trading?

Forex trading is decentralized, and there is no central reporting authority to help you if you are scammed. The decentralized nature promotes scams and other associated risks.

How exactly does scamming work?

Scams involve tricking users into unfavorable trading positions or straight-out theft of funds.

Can a scammer make money?

Yes, scammers can make a lot of money by tricking unsuspecting users. These con artists engage in billions of dollars worth of illegal activity each year.

How to spot a forex scammer?

A forex scammer can be spotted by their

Can I trust Forex?

Forex trading is a profitable business, but like other sectors, it carries considerable risk, and you need to beware of it.

Is forex gambling?

Forex has some similarities with gambling, but profit can be made with skill and knowledge of the markets in the former, while gambling is mostly about luck. Forex is also much less riskier than gambling overall.

How do you know if you are chatting with a scammer?

The scammer will use every tactic in their playbook to coerce you into an unfavorable position and use FOMO to force a rash decision.

What are common scammer phrases?

“Act now, or you’ll regret it later,” “This is too good of an opportunity to miss,” “Your money will be doubled in an hour,” and “This is a limited-time offer to double your mon.

Can a scammer be tracked?

A scammer can be tracked if they are registered with the local regulator. Unregistered brokers are much harder to track.

What Resources and Further Reading Are Available for Forex Traders?

Books

- Currency Trading for Dummies by Kathleen Brooks and Brian Dolan

- Forex Trading: The Basics Explained in Simple Terms by Jim Brown

- Trading in the Zone by Mark Douglas

- Market Wizards by Jack D. Schwager

- The Little Book of Currency Trading by Kathy Lien

Online Courses

- Babypips School of Pipsology

- Coursera Forex Courses

- Udemy Forex Courses

- Forex.Academy

Websites and Forums

News and Analysis

Tools and Software

- MetaTrader 4/5

- TradingView

- Forex Economic Calendar

Regulatory Bodies

- National Futures Association (NFA)

- Financial Conduct Authority (FCA)

- European Securities and Markets Authority (ESMA)

Blogs and Podcasts

What Are the Key Takeaways from This Guide?

Forex scams can be avoided through education, regulation checks, and skepticism of unusual promises.

Forex scams can easily be avoided through proper education, healthy skepticism, and training your ear to identify fraudulent patterns. Trading takes time and patience, and if a broker promises massive returns with no downsides, it is probably a scam. Withholding crucial information, especially regarding broker fees, is also an immediate red flag.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.