Page Summary

Apple Inc. (AAPL) is a popular tech company and is the most profitable company in the world. It designs and manufactures smart devices, including smartphones, computers, and wearables. Steve Jobs founded Apple in 1976, and it went public in 1980 with an initial public offering (IPO) at $22 per share. AAPL is available on the NASDAQ Global Select Market.

Apple (AAPL) is one of the five best-performing American companies. Amazon, Netflix, Meta (Facebook), and Alphabet (Google) are its main competitors. AAPL is a valuable stock because it has a strong presence on the market. Many investors in the UAE include Apple in their portfolios. This article discusses how to buy Apple shares in the UAE.

List Of The Best Brokers For Apple Shares:

- eToro Review UAE 2025 – Best overall broker

- FP Markets – Top MetaTrader broker

- FXPro – Popular broker for buying Apple shares

- AvaTrade Review UAE 2025 – Competitive fee policy with low spreads

- LiteFinance – For low-budget and beginner UAE traders

| RANK | BROKER | GENERAL | PLATFORM SCORE | BEST FOR | WEBSITE |

|---|---|---|---|---|---|

| #1 | eToro Review UAE 2025 | Excellent social trading features | 4,5/5 | Best overall broker | Official website

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. |

| #2 | FP Markets | Many educational tools | 4,5/5 | Top MetaTrader broker | Official website |

| #3 | FXPro | For traders at all levels | 4,1/5 | Popular broker for buying Apple shares | Official website |

| #4 | AvaTrade Review UAE 2025 | Free courses and videos | 4,9/5 | Competitive fee policy with low spreads | Official website |

| #5 | LiteFinance | Minimum deposit cost of $1 | 4,1/5 | For low-budget and beginner UAE traders | Official website |

eToro Review UAE 2025

BEST FOR TRADING: Social Copy Trading Forex

TRADER LEVEL: Beginners

Nr. OF CURRENCY PAIRS: 49 Major, Minor and Exotic

MAX LEVERAGE: 1:30

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

FP Markets

Min Deposit: 0

Fees: 4.8

Assets available: 3.1

Total Fees:

FXPro

Min Deposit: $100

Fees: 3.6

Assets available: 2.9

Total Fees:

AvaTrade Review UAE 2025

BEST FOR: Low Fixed Spreads

TRADER LEVEL: Average and Advanced

Nr. OF CURRENCY PAIRS: 55 forex and 44 forex options

MAX LEVERAGE: 1:400

Min Deposit: $100

Fees: 4.9

Assets available: 4.9

Total Fees: 0.9 pip

1. eToro Review UAE 2025 – Best overall broker

Min Deposit: $100

Fees: 4.2

Assets available: 4.0

Total Fees: Low

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

eToro is the leading stockbroker for buying Apple shares in the UAE. It has an impressive reputation and portfolio. It offers equity investments, forex pairs, crypto coins, and stocks. Popular digital assets available at eToro are Tesla, Netflix, and Apple.

This brokerage firm has a virtual trading account. It is an impressive learning tool for both beginner and advanced traders. Virtual trading lets you test different stock trading strategies with live stock market prices. The demo account at eToro is a valuable learning tool if you want to learn about Apple stock price fluctuations.

UAE investors choose eToro’s services because of its trading fees. It doesn’t charge a commission fee and has competitive minimum deposit fees. eToro offers top social trading tools and stock trading platforms. It provides access to a comprehensive portfolio and many funding options.

51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

2. FP Markets – Top MetaTrader broker

FP Markets is a top MetaTrader broker for buying Apple shares in the UAE. It is a secure stockbroker with a license from the ASIC. FP Markets offers many educational tools, including beginner stock trading videos.

FP Markets has a comprehensive portfolio with access to forex and CFD trading services. It offers free-of-charge deposits and withdrawals. FP Markets is a good fit for both new and advanced traders. It provides training tools and advanced trading videos.

75.31% of retail CFD accounts lose money

3. FXPro – Popular broker for buying Apple shares

FxPro is a popular online broker for buying Apple shares. It has many tradable assets, including cryptos, futures, commodities, forex pairs, and stock indices. FxPro has many account tiers for UAE traders. It offers access to a valuable learning center.

This online broker has expensive trading fees, and it offers discounts for active traders. FxPro has many learning tools, including forex education and stock trading videos. We recommend it for traders at all levels.

75.18% of retail CFD accounts lose money

4. AvaTrade Review UAE 2025 – Competitive fee policy with low spreads

AvaTrade is a top online broker for buying Apple shares in the UAE. It has a competitive fee policy with low spreads. AvaTrade offers many learning tools, including free courses and videos. It provides many social trading tools and access to MT4.

This online broker has many platforms for stock trading in the UAE. It offers leading day trading tools on MT4. We recommend AvaTrade for new UAE traders who want to learn more about AAPL stock price movements.

71% of retail CFD accounts lose money

5. LiteFinance – For low-budget and beginner UAE traders

LiteFinance is a good choice for buying Apple shares. It offers reliable forex and CFD trading. LiteFinance stands out because of its trading fees. It has a minimum deposit cost of $1. We recommend it for low-budget and beginner UAE traders.

This online broker has a license from CySEC and uses industry-leading safety protocols. LiteFinance platforms are reliable and offer 50 built-in indicators and research tools. It supports many payment methods, including PayPal, Neteller, and bank transfers.

How We Chose The Best Brokers For Apple Shares?

We choose the best exchanges to buy Apple Shares based on several criteria including Fees, Account, Withdrawal and Deposit. We commit to offering help to all UAE traders. Our goal is to help beginner and advanced traders make intelligent choices with their money. This focus is the reason why we share both strengths and weaknesses.

Fees: A simple fee structure is essential for a good stock trading experience. Some AAPL brokers in the UAE have a transparent fee structure; others don’t. Check our in-depth stock reviews to read more about UAE stockbrokers and fees.

Account: UAE online brokers have different account tiers. Some stock trading platforms request a minimum deposit fee. Others don’t have an initial deposit requirement for new accounts. Our in-depth account reviews offer details about UAE accounts and payment methods.

Deposit and withdrawal: Withdrawing and depositing funds has to be simple. Funding a brokerage account is a process that takes longer with some brokers. Some brokerage firms don’t have a minimum deposit fee. Read our platform reviews to learn more about deposit and withdrawal policies in the UAE.

Products and markets: Online brokers in the UAE have different asset and market coverage. It is best to select a trading platform with a comprehensive portfolio. Read our in-depth reviews for details on investments, financial markets, and UAE brokers.

Trading platforms: A reliable stock trading platform has a simple design. Choose a broker with intuitive platforms and services. The stockbrokers in our reviews are secure. But some might be challenging for beginner UAE traders. Read our comprehensive platform reviews for more details on UAE stockbrokers.

Customer support: Customer service contributes to your stock trading success. Secure online brokers offer live chat, phone, and email support.

Safety: A trustworthy stock trading platform has top-tier licenses. It uses industry-leading safety protocols and follows strict rules. Our in-depth reviews discuss stock trading safety in the UAE.

How To Buy Apple Shares In The United Arab Emirates?

To buy Apple shares in the United Arab Emirates, you need to use an online broker. The top platforms we recommend are eToro, FP Markets, FxPro, AvaTrade, and LiteFinance. eToro is the top social trading broker with secure stock trading platforms. FP Markets is a safe broker with competitive spreads and CFD trading services. AvaTrade is an excellent fit for new traders because of its reliable learning center.

Apple (AAPL) is a popular investment in the United Arab Emirates. We recommend you use eToro to buy AAPL in the UAE. It is a trustworthy online broker with secure platforms. eToro offers impressive stock and CFD trading services. Here are the steps you need to follow to buy AAPL with eToro:

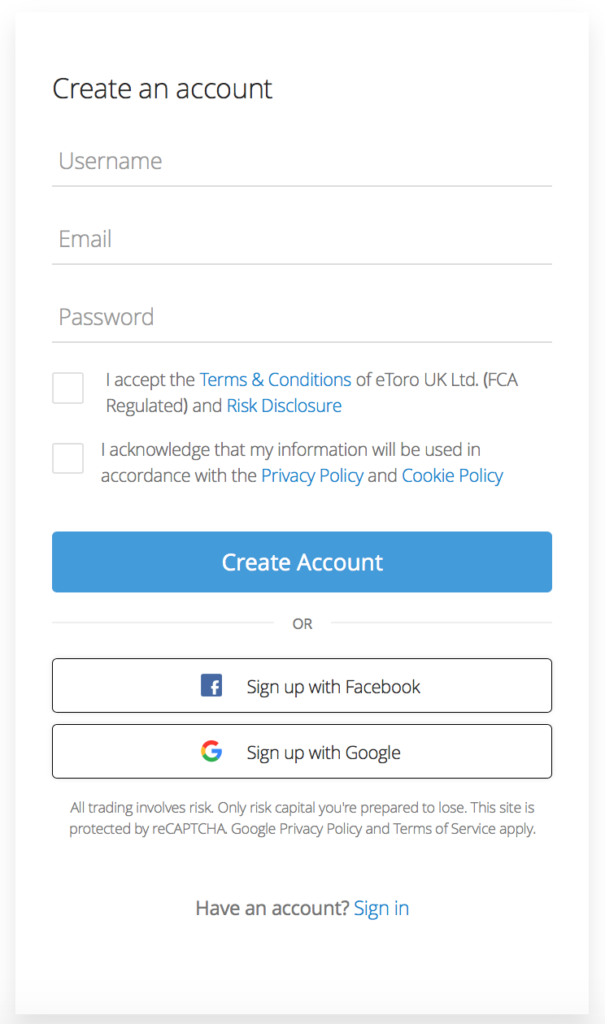

- Sign up: Accessing eToro’s official website is the first step for UAE traders. There you will find a straightforward sign-up form to open a new brokerage account.

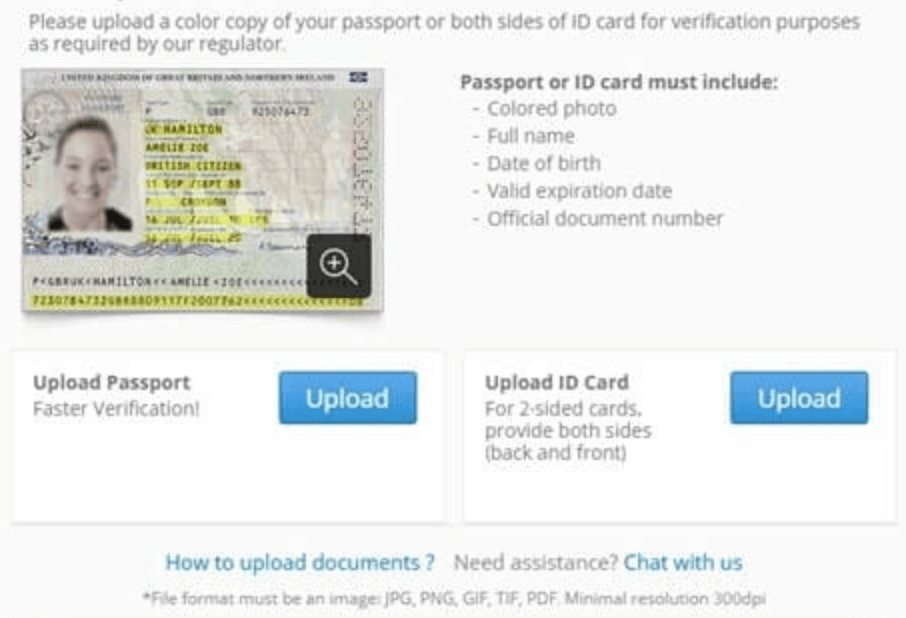

- Submit a valid ID: eToro is a well-established online broker and follows strict Know Your Customer (KYC) rules. Traders in the UAE have to pass account verification before transacting AAPL. It is necessary to upload a valid I.D., such as a passport or driver’s license.

- Make your first deposit: The next step after passing account verification is to make your first deposit. Select a funding option that suits your trading needs and experience. UAE residents have different payment methods available, including credit and debit card transactions.

- Buy Apple stock: Type “AAPL” into the search bar to look up Apple’s price. Click on its ticker and start buying or selling AAPL.

Where To Buy Apple Stock In The United Arab Emirates?

To buy Apple stock in the United Arab Emirates, you should use an online broker and the leading platforms we recommend are eToro, FP Markets, FxPro, AvaTrade, and LiteFinance.

Buying Apple Shares With eToro

eToro is the leading stockbroker for buying Apple shares in the UAE. It has an impressive reputation and portfolio. It offers equity investments, forex pairs, crypto coins, and stocks. Popular digital assets available at eToro are Tesla, Netflix, and Apple.

This brokerage firm has a virtual trading account. It is an impressive learning tool for both beginner and advanced traders. Virtual trading lets you test different stock trading strategies with live stock market prices. The demo account at eToro is a valuable learning tool if you want to learn about Apple stock price fluctuations.

UAE investors choose eToro’s services because of its trading fees. It doesn’t charge a commission fee and has competitive minimum deposit fees. eToro offers top social trading tools and stock trading platforms. It provides access to a comprehensive portfolio and many funding options.

- Commission-free trading and access to mutual funds,

- Features many popular cryptos, stocks, and forex,

- Regulated by the FCA,

- Valuable mobile app,

- Offered in many countries,

- Demo brokerage account,

- Retail investor accounts

- It has high spreads,

- It lacks smaller stocks and cryptocurrencies

Buying Apple Shares With FP Markets

FP Markets is a top MetaTrader broker for buying Apple shares in the UAE. It is a secure stockbroker with a license from the ASIC. FP Markets offers many educational tools, including beginner stock trading videos.

FP Markets has a comprehensive portfolio with access to forex and CFD trading services. It offers free-of-charge deposits and withdrawals. FP Markets is a good fit for both new and advanced traders. It provides training tools and advanced trading videos.

- Many payment methods available, including bank account transfers, PayPal, and credit/debit card funding,

- Access to learning tools,

- Forex and CFD trading

- Limited assets portfolio,

- Limited professional stock trading tools

Buying Apple Shares With FxPro

FxPro is a popular online broker for buying Apple shares. It has many tradable assets, including cryptos, futures, commodities, forex pairs, and stock indices. FxPro has many account tiers for UAE traders. It offers access to a valuable learning center.

This online broker has expensive trading fees, and it offers discounts for active traders. FxPro has many learning tools, including forex education and stock trading videos. We recommend it for traders at all levels.

- Versatile proprietary platforms with intuitive interfaces,

- Learning tools available,

- Many payment methods available, including PayPal and bank account transfers

- Expensive trading fees,

- Limited asset availability

Buying Apple Shares With AvaTrade In The UAE

AvaTrade is a top online broker for buying Apple shares in the UAE. It has a competitive fee policy with low spreads. AvaTrade offers many learning tools, including free courses and videos. It provides many social trading tools and access to MT4.

This online broker has many platforms for stock trading in the UAE. It offers leading day trading tools on MT4. We recommend AvaTrade for new UAE traders who want to learn more about AAPL stock price movements.

- Competitive fees with cost-free platforms,

- Access to many tradable assets,

- Top-tier licenses from ASIC

- It only offers CFD stock trading, without access to traditional stocks,

- It doesn’t provide news or other market research data

Buying Apple Shares With LiteFinance

LiteFinance is a good choice for buying Apple shares. It offers reliable forex and CFD trading. LiteFinance stands out because of its trading fees. It has a minimum deposit cost of $1. We recommend it for low-budget and beginner UAE traders.

This online broker has a license from CySEC and uses industry-leading safety protocols. LiteFinance platforms are reliable and offer 50 built-in indicators and research tools. It supports many payment methods, including PayPal, Neteller, and bank transfers.

- Intuitive stock trading platforms,

- Automatic withdrawals,

- Integrated social trading tools

- Limited trading tools,

- Limited research tools,

- Average customer support

How To Buy Apple Shares Using eToro?

If you want to buy Apple shares in the UAE, we recommend using eToro’s services. This brokerage firm has an outstanding reputation and offers trustworthy stock trading platforms. eToro is the top social trading brokerage firm with valuable stock trading platforms. Here is a step-by-step guide on buying AAPL with eToro.

Step 1: Create An eToro Stock Trading Account

The first step for traders in the UAE is to open a stock trading account with eToro. Their main website offers a simple sign-up form for residents of the United Arab Emirates. Investors have to submit their full name, address, date of birth, contact information, and source of income.

Step 2: Pass eToro Account Verification

The next step is passing account verification. The trading limit at eToro is $2,000. After this, it is necessary to verify your account. Traders have to upload proof of residence and a copy of their I.D. All UAE investors must pass account verification. eToro is a secure broker that follows strict KYC rules.

Step 3: Select A Funding Method

After passing account verification, you have to choose a payment method. eToro has different funding solutions for traders in the United Arab Emirates. Choose a funding option that suits your stock trading experience. After choosing a payment method and funding your account, the next step is to buy AAPL.

Step 4: Buy AAPL

When your funds appear in your account, eToro allows you to start your first “buy.” Click on the AAPL symbol and choose the number of shares you want to buy. Click “Submit,” and your trade will complete shortly.

What Is Apple?

Apple is a world-leading tech company. It is a top selection for UAE traders at all levels. Apple is a top-performing company listed on the NASDAQ stock exchange.

AAPL stock is available in the United Arab Emirates. If you want to invest in Apple, you have to use an online stock trading account. There are two ways for buying Apple in the UAE: shares or CFDs. Shares are a good fit for long-term investors. CFD trading provides flexibility and versatility. It allows you to use leverage and short sell. Check our in-depth reviews for more details on UAE stock trading strategies.

Why Should UAE Traders Buy Apple Shares?

UAE traders should buy Apple because of its stock market performance. AAPL is a leading growth stock and has the potential for outstanding revenue gains. It is one of the leading tech stocks available in 2022. The market capitalization of AAPL in 2021 was $2.901 T. We recommend AAPL stock to advanced UAE investors. Read our asset reviews for more details on stock trading and price fluctuations.

How Much Do Apple Shares Cost?

The cost of Apple shares varies depending on market conditions. The stock price for Apple was $166.23 in March of 2022. Stock trading platforms in the UAE might charge commission fees for buying AAPL. Our in-depth platform reviews discuss Apple stock trading fees and price fluctuations.

Buying AAPL Using BTC

UAE investors have the option of buying AAPL using Bitcoin (BTC). Leading online brokers like eToro let you fund your account with BTC. Investors convert BTC to a fiat currency with eToro’s services. After this, they buy AAPL using that fiat currency. Our in-depth stock trading reviews offer information on online stock trading payment options.

Buying Apple Shares Safely In UAE

If you want to buy Apple shares safely in the UAE, you have to choose the services of a trustworthy online broker. Traders diminish their stock trading risks by using highly-regulated platforms. eToro is a trustworthy broker that implements industry-leading safety protocols. Traders in the UAE receive access to top social trading tools and stock trading platforms.

The Risks Of Buying Apple Shares

Buying Apple shares comes with some risks. Digital assets experience price fluctuations depending on stock market conditions. Traders who want to avoid losing money start with small stock trades. APPL is an excellent investment, but its trading strategy might be challenging for new traders. If you invest in AAPL and its price suddenly drops, you risk losing funds. Remember that risks are higher if you choose leverage trading.

CFD trading platforms offer leverage services with AAPL. Leverage is attractive and might generate impressive profits. But it increases the risk of monetary losses, too. Beginner UAE traders should not use leverage. Read our in-depth broker reviews for more details on stock trading and risks in the UAE.

Selling Apple Stocks In UAE

Selling Apple stocks in the UAE is straightforward. You need to use an exchange or stockbroker like eToro. You’ll get access to reliable payment methods at eToro. eToro is a popular choice for selling Netflix stock in the United Arab Emirates. Read our in-depth asset reviews for more details on selling Apple stocks in the UAE.

Summary

Apple is a leading stock. United Arab Emirates traders invest in APPL with trustworthy platforms and online brokers. Apple is a popular choice for advanced and active UAE investors. These stocks are safe and rewarding, but you need to know where and when to buy them. It is best to use a secure online broker like eToro to buy AAPL in the UAE.

FAQ

Are There Any Safety Risks For UAE Traders?

Stock trading comes with risks. Apple stock is safe and legal in the UAE. Traders have to use a brokerage firm or exchange with top-tier licenses. The top licenses for online trading platforms are the FCA, ASIC, and CySEC. The stockbrokers in our reviews are secure and offer excellent trading platforms.

How Much Money Do I Need To Buy AAPL?

The money you need to buy Apple depends on the platform you select. Buying APPL stock on eToro has a minimum deposit requirement of $50. The exact fees depend on a platform’s limitations. Our in-depth UAE platform reviews offer insights on minimum investments.

How To Sell Apple Stock In The UAE?

Traders who want to sell Apple stock in the UAE need to use an online broker. For example, if you choose the online broker eToro, you’ll receive access to a secure platform and a valuable portfolio. There you have to click on a Sell button. The best strategy for increasing your profits is with capital gains. A capital gain comes from selling assets at a higher price than you initially paid.

Has AAPL Split Its Stock?

Yes. APPL split its stock five times:

In 2020, it split on a 4-for-1 basis

In 2014, it split on a 7-for-1 basis

In 2005, it split on a 2-for-1 basis

In 2000, it split on a 2-for-1 basis

In 1987, it split on a 2-for-1 basis

Is A Stock Split A Good Sign?

Yes. Stock splits show a company is growing and profitable. It reveals it has the potential for generating profit over the long term. Making shares more affordable for new investors is the main benefit of a stock split. Investors choose to buy stocks when they split because of the lower prices.

Is It Better To Buy Before Or After A Stock Split?

Whether you buy before or after a stock split is a personal choice. The value of a company doesn’t change during a stock split. There is no direct investment value advantage when buying shares before/after stock splits. Remember that temporary price changes may occur because of the stock split. Usually, prices experience a quick increase in price followed by a sharp drop shortly after the split.

What Is A Tech Stock?

A tech stock represents an asset investment in a technology company. Apple is one of the top tech stocks in 2022. Its main competitors are Amazon, Meta (Facebook), and Netflix. Our in-depth reviews discuss asset availability in the UAE.

What Is A FAANG Stock?

A FAANG stock refers to the top five American technology stocks in 2022: Apple, Netflix, Amazon, Meta (Facebook), and Alphabet (Google). These stocks are popular because of their outstanding market performance. Our in-depth stock trading reviews discuss investment strategies and stock growth.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.