Page Summary

Index funds are financial instruments that track the value or performance of a group of bonds or stocks. Index funds represent a specific sector or geographical market. They are operated by index fund managers who make sure the index funds perform the same as the index they are tracking. You invest in index funds by picking an index, choosing the right fund for your index, and buying index fund shares.

This guide breaks down the steps to invest in index funds in UAE, which are the most popular index funds and what are their pros and cons.

1. Choose an Index

The first thing to do is determine in what kind of sector, market, or companies you want to invest in. When you find an index to invest in like the Dow Jones Industrial Average, you will need to find out which index fund tracks its performance the most accurately. Examples of the most traded index funds are:

- S&P 500 – The S&P 500 tracks the performance of the 500 biggest American companies

- FTSE 100 – The FTSE 100 follows the performance of the 100 biggest UK companies.

- Dow Jones Industrial Average – measures the performance of the 30 largest publicly traded companies from different sectors in the USA.

2. Choose the Right Index Fund

When you have chosen an index to invest in like the Dow Jones Industrial Average, you will need to find out which index fund tracks its performance the most accurately. If there are multiple index funds available for your chosen index, you will need to find out which index fund tracks the performance of the index the closest and which one has the lowest costs. You should also figure out whether the index fund has any limitations or investing restrictions. Apart from these things, you should know whether or not the fund provider has other interesting index funds available.

3. Buy Into The Index Fund (Purchase Index Fund Shares)

Once you have answers to these questions, you open a brokerage account that offers this index fund. An alternative is to invest in a mutual fund that provides access to the fund. We recommend comparing the costs and features of different brokers before signing up with a particular one. Although you can sometimes invest directly via the index fund company, having all your investments in one place with a broker can give you a better overview and gives you a central place from which you arrange everything.

Popular Index Funds For UAE Investors

The best performing index funds for UAE investors are listed below.

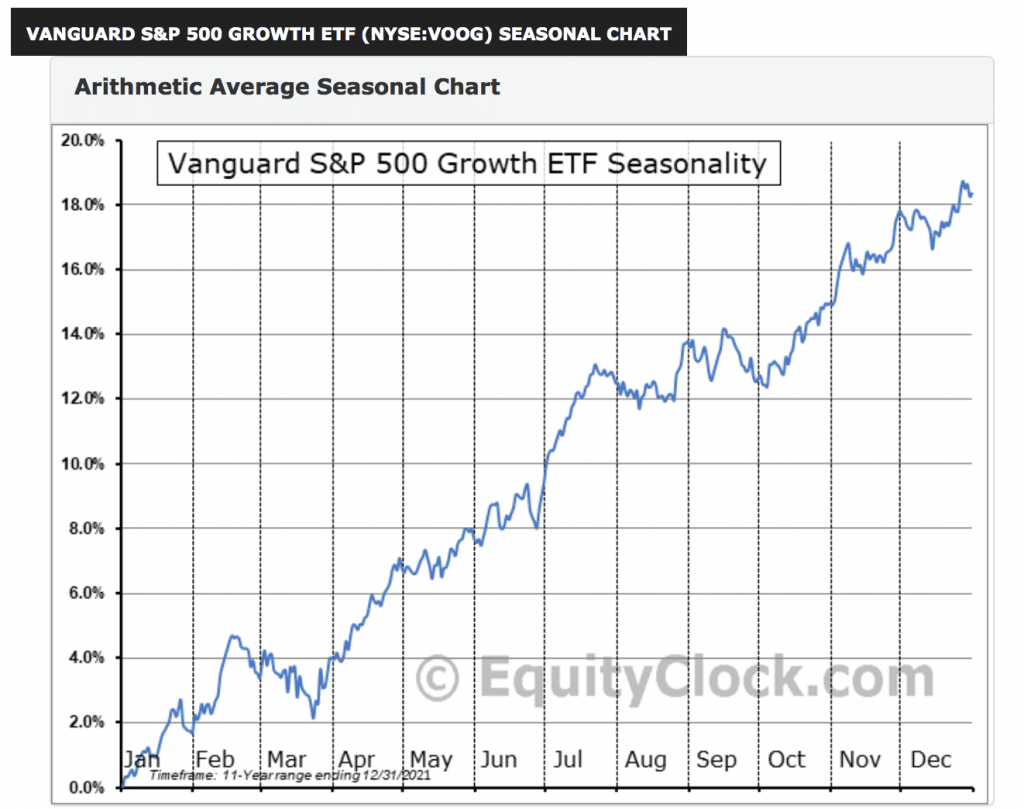

1. The Vanguard S&P 500 ETF tracks the performance of the 500 largest US-based companies.

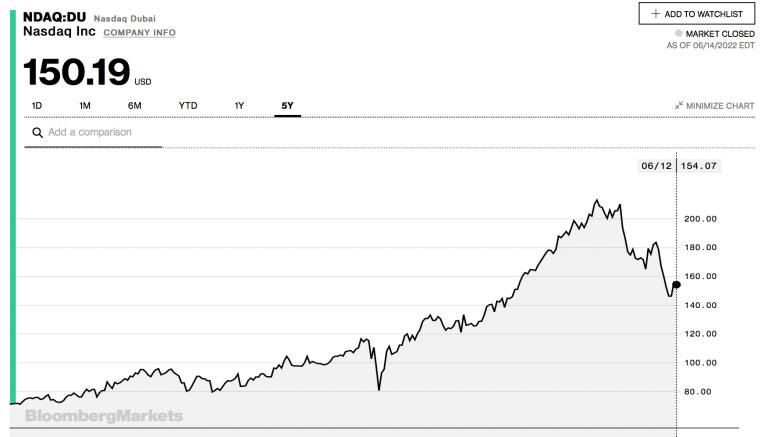

2. The NASDAQ Dubai tracks the performance of the largest technology companies in the UAE

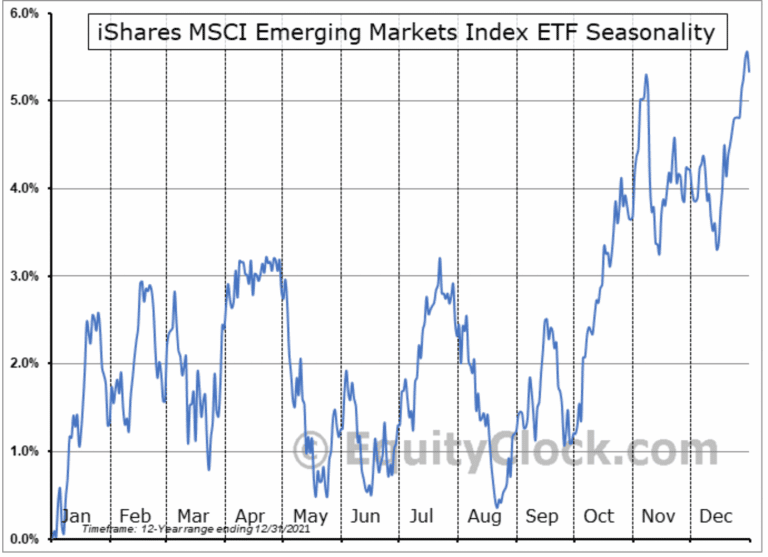

3. The Global X MSCI Next Emerging & Frontier ETF tracks the performance of high-growth emerging markets and excludes slower-growing emerging markets like Brazil, Russia, India, China, and Taiwan.

4. The iShares MSCI UAE ETF index fund tracks the results of large and mid-cap UAE equities.

Top UAE Index Funds Compared

Key Features of the most popular index funds in UAE are compared in the table below

| Ticker Symbol | Index Fund | Category | Expense Ratio | 5-Year Performance |

| VOO | Vanguard S&P 500 ETF | USA Large Cap Equities | 0,03% | +13,36% |

| NDAQ:DU | NASDAQ Dubai | National large Cap Equities | 0,20% | +75,71% |

| EMFM | Global X MSCI Next Emerging & Frontier ETF | Emerging Markets | 0,63% | +1,80% |

| UAE | iShares MSCI UAE ETF | Emerging Markets | 0,59% | +18,58% |

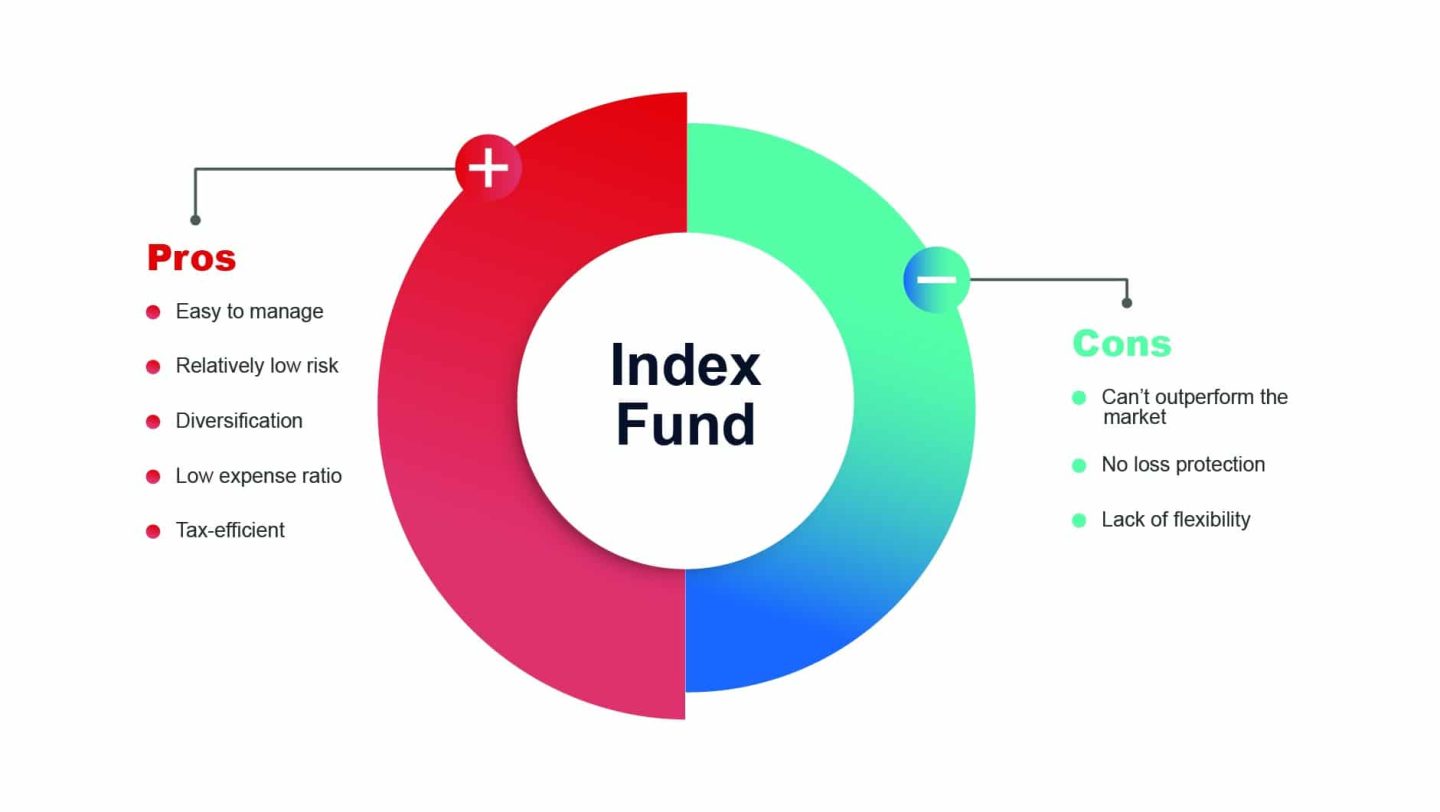

Why Should You Invest in Index Funds? (Pros and Cons)

The most common reasons why UAE investors invest in index funds are:

- They are easy to understand and to invest – Index funds are easy to understand because once you know the target index of the index fund, you know what you are investing in and what kind of returns you can expect.

- They have lower fees – Index funds are cheaper to manage than mutual funds because the composition of the target index is known and no active management or rebalancing is required. This is reflected in the expense ratio of index funds, which are lower than mutual funds. They also have lower turnovers and no style drift.

- They are more tax efficient – Fund managers buy and sell index funds less often compared to mutual funds, saving on capital gains tax charges.

- They have lover risk exposure – Index funds have lower risk than other financial instruments because they track the value of multiple stocks and don’t fluctuate a lot.

- They generate decent returns – The S&P 500 is one of the world’s best index funds that nets around 10% yearly returns.

Why You Should Not Invest In Index Funds?

The simplicity and “hands off” investing of index funds comes with a few downside which include the following:

- Index Funds never beat the market performance – Index funds will never outperform the market because they only track market performance. Because of that you will lose money when the market goes down in general without having any form of loss protection.

- Index Funds don’t have any kind of stop loss protection – With index funds you invest in an entire market or sector and when that sector or market goes down as a whole, your investment decreases in value.

- Index Funds are a basket of different stocks – You are investing in a index funds as a whole and it happens that it contains multiple stocks that you don’t want to see in your portfolio.

Think Index Funds are not the right thing for you? Check out our guides on how to invest in mutual funds, ETFs, stocks, futures and gold.

How to Get Started With Index Funds in UAE

You get started investing in index funds in the UAE by opening an account with one of the UAE brokers or via a financial advisor. We recommend signing up with eToro, AvaTrade, or Saxo Bank to start trading index funds. Each of these brokers offers low-cost ETF and mutual fund trading, excellent customer service, and a wide range of available assets. If you don’t have the time to invest in index funds yourself, you can do this via a financial advisor. Check out our list of best financial advisors in the UAE.

Summary

Index funds are a great way to diversify your portfolio, lower your risk and trading fees, and grow your capital over the long term. Everyone can get started with index fund investing and it doesn’t require a lot of research. They outperform most individual stocks and are easy to acquire via online trading platforms like eToro.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.