Page Summary

Investing in mutual funds is a popular way for UAE citizens to grow their wealth and diversify their investment portfolio. Unexperienced traders tend to buy shares form mutual funds instead of buying stock directly, because of the professional management, great liquidity, diversification and the lower risk involved.

In this guide, we go over the definition of mutual funds, how to get started as a newbie and when is it a great choice to invest.

What Are Mutual Funds?

Mutual funds are investment packages created and professionally managed by an asset management company consisting of multiple securities like stocks (equity securities), bonds (dept securities), short term dept securities and other financial instruments. Mutual funds are pooling money from different investors in order to purchase securities. When you invest in mutual funds, you invest in the asset management company’s portfolio. It is a good way to diversify your investments and spread your risk.

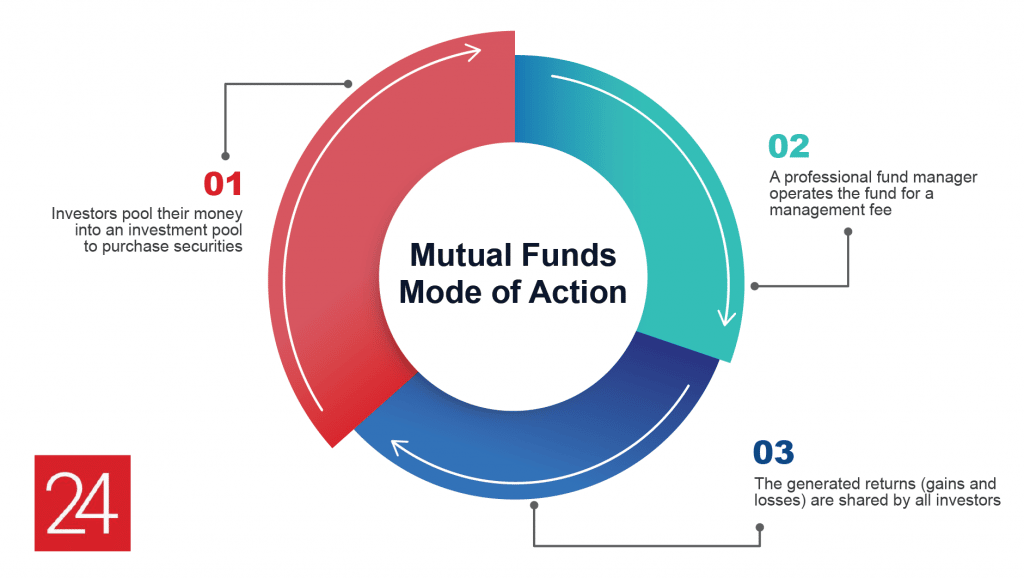

How do Mutual Funds Work?

Mutual funds are managed by fund managers who invest in shares on behalf of their clients. Every day the fund management company determines the price of their managed shares. This is called the Net Asset Value.

Different Types of Mutual Funds Based on Asset Classe

Mutual funds are categorised based on the underlying assets which they invest in. Based on the investment mutual are classified as: money market funds, bond or fixed income funds, stock or equity funds and hybrid funds. We can further break them down into open-end funds, closed-end funds and unit investment trusts which can all be passively managed (index funds) or actively managed.

Below we break down different mutuals funds based on their underlying asset class.

1. Stock Funds

Stock funds or equity funds are a type of funds that invest in companies. Income funds pay good dividends, growth funds have higher financial returns than other funds, sector funds are shares in specific industries, and index funds are shares in all listed companies. Stock funds are sorted by the size of invested companies (small-cap, mid-cap, and large-cap). The market capitalization of a company is calculated by multiplying the share price by the total amount of shares.

2. Bond Funds

Bond funds are funds that hold debt and pay a fixed return rate. There are government bonds, corporate bonds, certificates of deposit (CDs), and high-yield bonds. Because bonds pay fixed returns they are also called fixed-income funds. Whenever a bond expires, which is called ‘reaching maturity date’, investors receive their invested amount back. Whenever interest rates increase, the value of bonds decreases as investors receive the lower interest rate on them still. If interest rates decrease, the opposite is the case. Bonds are considered safer investments than most other forms of investments because they produce fixed income.

3. Money Market Funds

Money market funds are short-term corporate, commercial bank, and government debt-backed investment vehicles. They are highly liquid, low-risk, low-return, and part of short-term investment strategies.

4. Hybrid Funds

Hybrid funds, asset allocation funds, or balanced funds, spread risk among multiple asset classes. Hybrid funds diversify in both stocks and bonds but can include investments in other assets as well.

The most common hybrid funds are:

- Commodity Funds: are funds that invest in commodities like gold and oil.

- Target Date Funds: Target date funds are mixes of short-term debt-backed financial instruments.

Related: Best mutual funds in UAE

5. Index Funds

Index funds replicate market indexes like the S&P 500, Dow Jones Industrial Average, or NASDAQ Composite Index and are often considered long-term investment strategies. Find out more about investing in index funds in our guide.

6. Commodity Funds

Commodity funds are funds that invest in commodities like gold and oil rather than in stocks, indexes, or bonds.

7. Target-date Funds

Target-date funds are mixes of short-term debt-backed financial instruments that meet a certain investment goal in a specific year. The asset allocation of target-date funds adjusts automatically when this date is nearing. In the beginning, the fund takes more risks than later on. Target-date funds can be part of both long-term and medium-term investment strategies. It is possible to invest in target-date funds through IRA accounts (individual retirement accounts) in the USA.

What Can You Expect to Pay On Fees and Expenses for Mutual Funds?

When investing in mutual funds you pay the asset management company a one-time fee and a ongoing fee for their services. You pay commissions on the shares bought by the mutual fund and a redemption fee when you sell your shares within a certain time frame. Mutual funds also charge management fees that you need to pay for managing your investment.

Best Mutual Funds in UAE

Available in major currencies like US dollars, euros, and sterling, the top mutual funds in the UAE offer diverse investment opportunities in the region’s vibrant market.

- Shelton NASDAQ-100 Index Direct (NASDX): This fund mirrors the performance of the largest non-financial companies on the NASDAQ, focusing on tech giants.

- Voya Russell Large Cap Growth Index Fund (IRLNX): Invests in large-cap U.S. equities, aiming for long-term growth with a focus on high-growth potential companies.

- Fidelity NASDAQ Composite Index (FNCMX): Tracks the NASDAQ Composite Index, investing primarily in tech and non-financial sectors.

- Voya Russell Large Cap Index Port I (ILRX): Mirrors the Russell Top 200 Index, focusing on large-cap U.S. equities with a reasonable cost advantage.

- Fidelity 500 Index Fund (FXAIX): Tracks the S&P 500, offering exposure to a broad range of large-cap U.S. equities.

- Fidelity Global Dividend Fund: Focuses on global dividend-paying companies with strong performance, including in emerging markets.

- Fundsmith Equity Funds: Invests in global equities, focusing on high-performing businesses with sustainable growth potential.

- Fidelity Emerging Market Funds: Targets companies in rapidly growing emerging markets with a focus on strong market positioning and ESG characteristics.

- Schroder Mid Cap US Fund: Avoids tech giants, focusing on medium-sized U.S. companies with solid management and high growth potential.

- Invesco Perpetual Asian Fund: Invests in Asian and Australasian companies, excluding Japan, with a focus on technology and financial services sectors.

How to Invest In Mutual Funds in UAE?

The most common way to invest in mutual funds in UAE is through a online broker like AVAtrade or Saxo Bank. You can also invest in mutual funds through UAE banks or financial advisors.

1. Invest Using a Online Broker (Trading Platform)

If you are confident enough you can invest in mutual fund through a online brokerage using their trading platforms and accounts. The best online brokers to invest in mutual funds in UAE are:

Saxo Bank

Min Deposit: $5000

Fees: 4.7

Assets available: 4.9

Total Fees:

69% of retail investor accounts lose money when trading CFDs with this provider.

Saxo Bank is a Danish investment bank that operates globally, offering bonds, stocks, mutual funds, and ETFs. UAE investors can open a Saxo Bank with an initial investment of $10,000 or more (37,000 AED). One of the biggest advantages of investing in mutual funds through Saxo Bank is that they only charge management fees. There are no hidden fees or commissions and Saxo Bank has Sharia-compliant swap-free mutual funds available for Islamic investors.

You can invest yourself in 250 different mutual funds through Saxo Bank from $10 each or have one of Saxo Bank’s professional money managers manage your account for you. For the full review click here.

69% of retail investor accounts lose money when trading CFDs with this provider.

Interactive Brokers

Min Deposit: $0

Fees: 4.9

Assets available: 4.9

Total Fees:

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Interactive Brokers is one of the few regulated mutual funds brokers in the United States operating globally. It is founded in 1978 and has over $10,48 billion in capital. As UAE investor you can open an account with them from $1 and have access to over 45,000 mutual funds of which 17,000 are commission-free. Interactive Brokers charges no custody fees and has a transparent commission model on mutual funds in place, with fees being $14,95 or 3% of the trade value, whichever of the two is less. Fidelity Investment is one of the oldest brokers that offer access to over 3500 different funds with the lowest fees in the industry. For the full review click here.

All trading involves risk. More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Fidelity

Fidelity is a world-class broker with over 70 years of experience in mutual funds, bonds, stocks, and other short-term investments. With Fidelity, you can build up a strong portfolio by having access to over 10,000 mutual funds from both Fidelity and other brokerage firms. You can use the Mutual Fund Evaluator tool to easily filter funds based on your personal investment goals, performance criteria, and fund characteristics. Experienced long-term investors can pair professionally managed asset allocation funds with automated RMD withdrawal services to take the guesswork out of required minimum distributions for retirement accounts with Fidelity Simplicity RMD Funds. You can start investing in mutual funds with Fidelity with any amount. For the full review click here.

There are many other brokers outside of our top 3 that offer access to mutual funds. You can check our full list of the best trading platforms for mutual funds in UAE here.

2. Invest Using a UAE Bank

You can invest in mutual funds using a UAE or international bank.

You can check out the best UAE banks here.

Below we break down the best UAE international banks offering to invest in mutual funds:

#1. HSBC

HSBC offers UAE investors a wide range of diversified mutual funds from across the globe, including emerging markets. Professional HSBC fund managers rebalance the funds regularly. HSBC has a premium service called HSBC World Selection Portfolios available for investors that can commit a minimum of $50,000.

#2. Abu Dhabi Commercial Bank (ADCB)

ADCB has fixed income, real estate, equity, commodities, and hedge fund mutual funds available to invest in that are all approved by the Securities and Commodities Authority (SCA). You can choose to invest in mutual funds yourself or consult an ADCB investment advisor to help you with asset allocation and the diversification of your portfolio.

#3. Emirates NBD

With Emirates NBD’s InvestDaily you can set up a systematic savings plan that helps you invest in mutual funds. You can choose to invest weekly, monthly, or quarterly, withdraw your earnings and investments at any time and get started with low amounts.

Conclusion

Investing in mutual funds in UAE is a great decision if you are looking to diversify your investment portfolio, increase your liquidity, get professionals to manage your investments, and to profit from economies of scales.

The most common way to invest in mutual funds is through online brokers or banks offering mutual fund investment services.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.