If you’re interested in investing in Initial Public Offerings (IPOs) through the Dubai Financial Market (DFM), follow these easy steps:

Step 1: Request a NIN (National Investor Number)

Before subscribing, you need a National Investor Number (NIN). If you don’t have one, you can easily obtain it using the DFM app. Here’s what you need:

- Valid Emirates ID

- Bank account statement or an iVestor card (you can apply for this while requesting a NIN)

The process takes just a few minutes, and you’ll receive your NIN instantly via SMS. If you already have a NIN, skip this step.

Step 2: Start Subscribing to IPOs

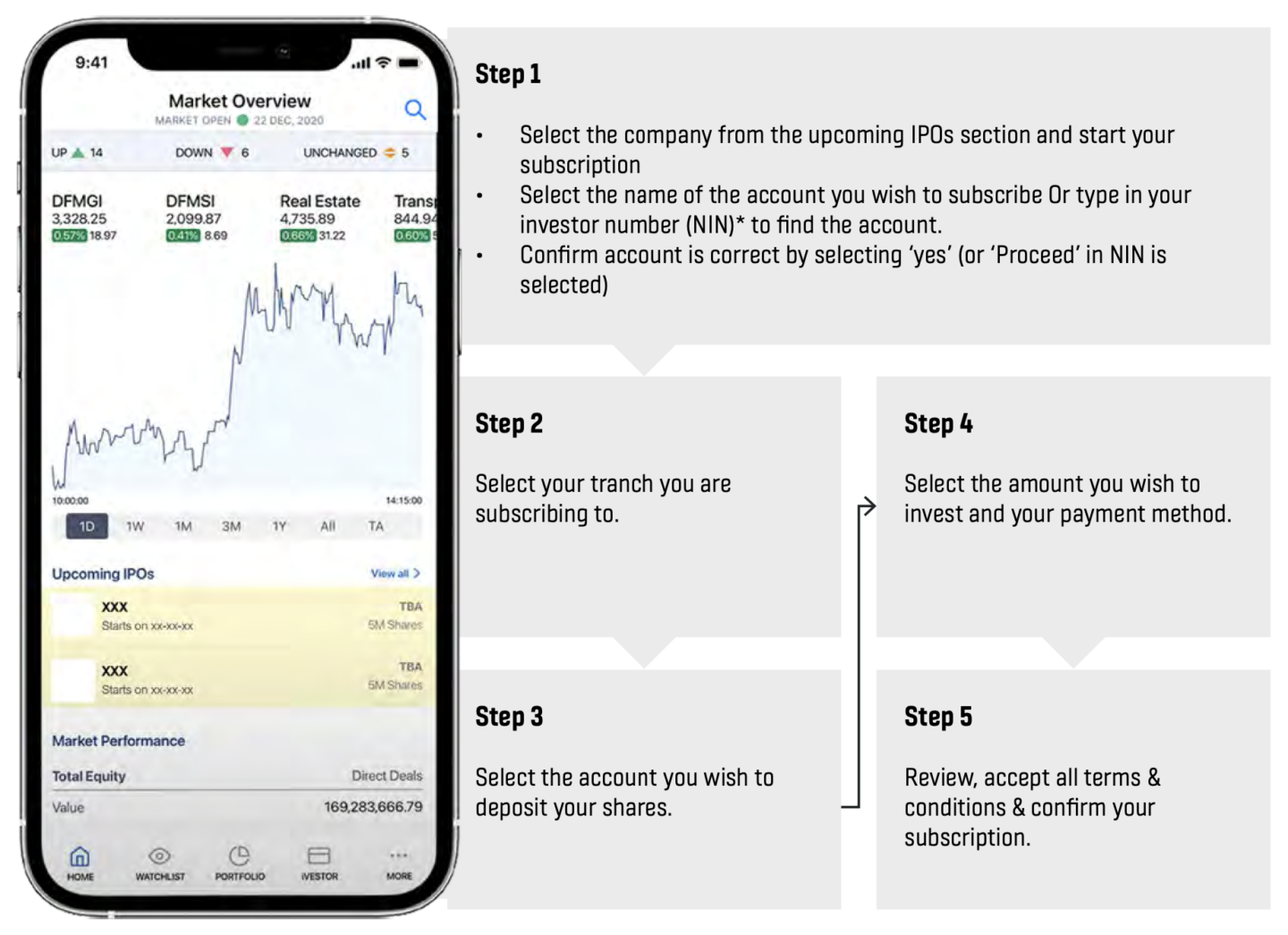

Once you have your NIN, you can subscribe to IPOs using the DFM app or their IPO subscription platform. Here’s how:

- Choose an IPO from the upcoming list.

- Select your account using your NIN.

- Confirm your account details.

- Choose the tranche you want to subscribe to and select the amount to invest.

- Pick your payment method (iVestor card or online banking).

- Review and confirm your subscription.

iOS app: https://apps.apple.com/ae/app/dfm-dubai-financial-market/id997641752

Google Play Store: https://play.google.com/store/apps/details?id=com.DFM

Step 3: Monitor Your Subscription

After subscribing, you can track your investment within the DFM app or platform.

How to check IPO allotment status

- Visit the Issuing Company’s Website: IPO allotment information is typically posted on the website of the company or bank managing the IPO. They may have a dedicated section or a link to check the status of your application.

- Use the Registrar’s Website: Some IPOs in the UAE are handled by financial registrars like Al Maryah Community Bank or other specific entities. You can visit the registrar’s website, where you may need to enter details such as your application number or Emirates ID to check the status.

- Check via the Bank or Broker: If you applied through your bank or stockbroker, they usually offer a way to check the allotment status through their online portal, app, or by contacting customer service.

- Dubai Financial Market (DFM) or Abu Dhabi Securities Exchange (ADX): For companies listed on these exchanges, you can also check the status through their platforms, if provided.

- Email or SMS Notification: Some IPO processes may also notify applicants of their allotment status via email or SMS after the finalization.

Ensure you have relevant details like your Emirates ID, application number, and investor number when checking the allotment.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.