To trade cryptocurrency, you need to have an account in exchange and a crypto wallet where you can secure your crypto keys, which will give you access to your crypto holdings.

After cryptocurrencies became popular, they became a new instrument for trading. Cryptos, especially Bitcoin, will become one of the most traded assets in the world in 2024.

Cryptocurrency is digital money, without any physical presence, traded from one person to another. Decentralization has made cryptocurrencies popular, and in the future, we can see more and more adoption of cryptos.

What is Cryptocurrency Trading?

Cryptocurrency trading is buying and selling digital assets on exchanges specifically designed for this purpose, such as trading stocks on stock exchanges. On these exchanges, you can speculate the price with your analysis and profit from the price movements.

However, the difference between traditional asset trading and crypto trading is that cryptocurrencies operate on a decentralized blockchain network. For example, in stock, you hold shares of the companies, but in cryptos, you hold a block of the network. Traditional markets operate with centralized authorities dictating trading hours and regulations, while Crypto markets operate 24/7.

As compared to other assets, crypto trading is relatively new; the first recorded Bitcoin transaction took place in 2009. The cryptocurrency market has witnessed phenomenal growth, with hundreds of new digital assets emerging alongside established players like Bitcoin and Ethereum, and is still evolving.

What are the Basics of Cryptocurrency Trading?

Blockchain technology is the main part of cryptocurrency trading. It is like a digital ledger or record book that is shared across a network of computers. Blockchain is used in cryptocurrencies like Bitcoin to keep track of transactions, but it can also be applied to many other areas where secure and transparent record-keeping is important.

There are no specific defined categories in types of cryptocurrencies, but they can be divided based on their use cases and underlying technology, like utility tokens, stablecoins, privacy coins, security tokens, and meme coins.

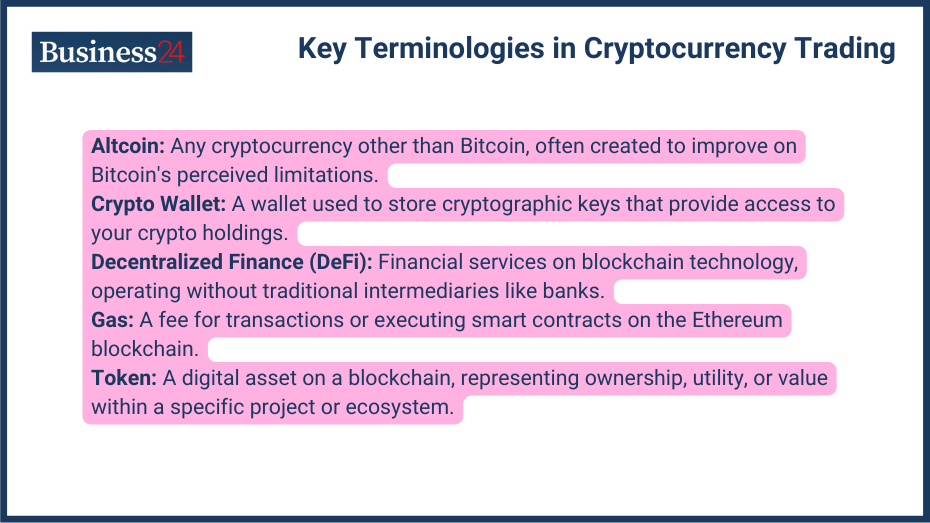

Key Terminologies in Cryptocurrency Trading

- Altcoin: Any cryptocurrency other than Bitcoin, often created to improve on Bitcoin’s perceived limitations.

- Crypto Wallet: A cryptocurrency wallet is used to store the cryptographic keys that give access to your crypto holdings.

- Decentralized Finance (DeFi): Financial services built on blockchain technology that operates without traditional intermediaries like banks.

- Gas: A fee to conduct transactions or execute smart contracts on the Ethereum blockchain.

- Token: A digital asset created on a blockchain, often representing ownership, utility, or other value within a specific project or ecosystem.

Is trading crypto a good idea?

Totally depends upon you; for an experienced trader who knows the volatility and setups, trading In crypto is a good idea, but for a beginner, it is not a good idea to put a lot of money and trade due to high volatility. The crypto market is known for its high price fluctuations; while these fluctuations offer opportunities for substantial profits, they also expose you to the potential for big losses.

Successful trading, whether in crypto or any other asset, requires a solid understanding of technical analysis, charting tools, and various trading strategies. Also, trading is a long-term endeavor, so make sure you have time to commit to crypto trading.

How to Get Started with Cryptocurrency Trading?

Follow the given process to start in cryptocurrency trading:

- Choosing a Cryptocurrency Exchange: You can transfer cryptocurrencies peer to peer, but it will cause liquidity and time problems; that is why there are different crypto exchanges. These platforms act as intermediaries, connecting buyers and sellers. While choosing a crypto exchange, consider whether it meets your needs and helps you achieve your goal. You can check on points like security, user interface, tokens supported, trading fees, and regulatory compliance if there are any.

- Setting Up a Trading Account: After choosing an exchange, you’ll need to create a trading account. This typically involves providing personal information, completing identity verification (KYC), and setting up two-factor authentication for security purposes.

- Completing KYC and Verification Processes: You have to apply for a KYC check on these exchanges so you can trade on them. KYC is a standard regulation in most countries that requires financial institutions to verify the identity of their customers. You can submit any government-issued IDs and proof of address documentation.

- Depositing Funds & Trade: After the KYC check and verification are completed, you have successfully opened your trading account. Now, you can deposit the funds and start trading in your account. Most exchanges allow deposits through various methods, including bank transfers, debit/credit cards, and other cryptocurrencies. Choose the one you are suitable for.

How do you trade crypto for beginners?

The most important point for beginners who are starting out in crypto trading is that to start small, don’t put a lot of money into it until you gain experience and confidence in your methods. You can use virtual accounts; many exchanges offer demo accounts with virtual funds, allowing you to practice trading strategies and familiarize yourself with the platform without real money involved.

For trading, you have to learn different risk management techniques to safeguard yourself from huge losses. Also, other techniques like diversification are important. Your Trading decisions should be based on logic and analysis, not emotions like fear or greed.

You can find many educational resources online and through exchanges, such as tutorials, articles, and video courses. You have to learn technical analysis, charting tools, and fundamental analysis techniques so you can excel in trading.

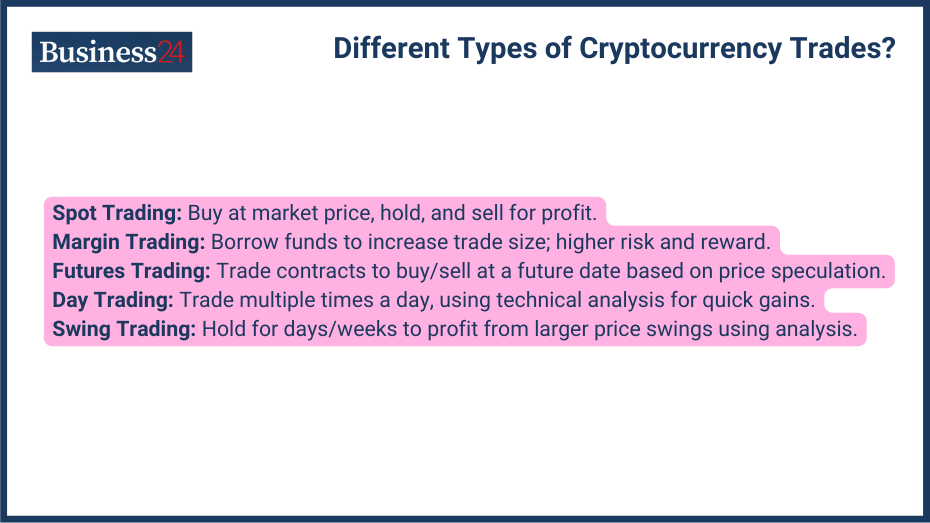

What are the Different Types of Cryptocurrency Trades?

Different types of cryptocurrency trading:

Spot Trading

Spot trading, also known as cash trading, is the most straightforward and easy method. You buy cryptocurrencies at the current market price, expecting them to trade higher, hold them in your wallet, and sell them later for a profit when the price increases.

Margin Trading

Margin trading is leverage trading, so if you are low on funds, you can use margin trading. Margin trading allows you to borrow funds from the exchange so you can increase profits. But keep in mind that it can also increase losses.

Futures Trading

Futures contracts are trading instruments based on the spot of the asset. Futures contracts are agreements to buy or sell a cryptocurrency at a specific price on a predetermined future date. These contracts allow you to speculate on future price movements and potentially profit from them if your analysis is correct.

Day Trading

Most famous among traders is the day training. Day trading involves opening and closing multiple positions within a single trading day, capitalizing on short-term price fluctuations. Day traders rely heavily on technical analysis to identify profitable trading opportunities. Day trading requires more effort and more time than any other method.

Swing Trading

Those who do not have much time to trade and can’t sit in front of a screen all the time can go for swing trading. Swing traders hold positions for a few days or weeks, aiming to profit from larger price swings. Swing traders typically use a combination of technical and fundamental analysis to identify trading opportunities.

How to Perform Fundamental Analysis?

There is not much in the crypto space for fundamental analysis like in stocks; you can analyze the company’s revenue, profit and loss, etc, but there are a few things you can check before investing in crypto:

- Analyzing Whitepapers and Projects: Whitepapers of the crypto projects outline the project’s vision, mission, technology, and roadmap. You can get all the information about the project in the whitepaper, and before investing in any crypto, you must read the whitepaper for a better understanding.

- Evaluating Market Trends: As I have said earlier, the crypto market is still evaluating and the trends change according to the evaluation in the crypto space. So, it is important that you Assess the project’s adoption rate by users, businesses, and other crypto projects to indicate its potential for future growth.

- Assessing Team and Community: The founders, team, and vision behind the launch of any crypto are very important points because a strong team and community make a token much more investable. Check team’s experience and track record in technology, finance, and blockchain can provide insights into the project’s potential for success.

- News and Events Impact: The recent news in crypto ETFs has impacted the crypto market; news and events like these impact crypto big time, so make sure you are updated with each update.

How to Perform Technical Analysis?

Here are some of the basics of the technical analysis:

- Understanding Price Charts and Graphs: For a trader, whether he uses technical analysis or fundamental analysis in trading, price charts and graphs are very important. Technical charts depict the historical price movements and trading volume over time and these charts can be analyzed using various indicators and drawing tools.

- Key Technical Indicators: Every trader has different methods of trading, but one thing common in them is the use of some technical indicators like volume, RSI, Moving averages, MACD, etc. Technical indicators are mathematical calculations based on price and volume data that help identify trends, overbought/oversold conditions, and potential turning points in the market.

- Using Trading Tools and Software: There are various trading tools and software that can help you in trading. Advanced tools like algorithm technology help in trading faster, and trading simulators can help you forward test new strategies and setups.

What are the Risk Management Strategies?

The cryptocurrency market has immense potential rewards but also carries inherent risks. Management risk should be the first job of a trader. Here are some of the risk management strategies you can use:

- Setting Stop-Loss and Take-Profit Levels: These are automatic orders for the levels at which you want to execute the trade. A stop-loss order automatically sells your cryptocurrency holding at a predetermined price if the market turns against you. This helps limit losses if the price falls sharply. Similar to stop-loss orders, take-profit orders automatically sell your holdings when the price reaches a specific target price, locking in your profits.

- Diversifying Portfolio: Putting all the money into a single script increases the risk much more. Diversification will help you mitigate risk by reducing the impact of price fluctuations in any single cryptocurrency on your overall portfolio.

- Avoiding Overtrading: Due to anger over previous losses or greed for making more money, traders usually start overtrading, and this generally results in big losses and high trading charges. Stick to your trading plan and avoid making impulsive decisions based on fear or greed.

- Managing Emotional Decisions: Trading can be emotionally charged, especially during volatile market conditions. Trading takes time, discipline, and a commitment to continuous learning. Don’t chase quick profits or get discouraged by losses. Focus on developing a sound trading strategy, managing risk effectively, and remaining patient throughout the market cycles.

What are the Common Trading Strategies?

Some of the common trading strategies are:

- HODLing (Hold On for Dear Life): This is a long-term strategy in which you buy and hold cryptocurrencies for an extended period, expecting them to rise in the long term. This approach is suitable for those who believe in the future of blockchain technology and specific crypto projects.

- Scalping: Scalping is a strategy that takes advantage of small, quick price changes within a single day. Scalpers use technical analysis and fast execution to make tiny profits from many trades throughout the day. This approach demands a lot of time, advanced technical skills, and a high tolerance for risk because the market moves quickly.

- Arbitrage: Arbitrage involves taking advantage of price discrepancies between different crypto exchanges. For example, if a cryptocurrency is priced higher on one exchange than another, an arbitrageur can buy it on the lower-priced exchange and sell it on the higher-priced exchange for a quick profit. However, arbitrage opportunities are rare and often fleeting, requiring constant monitoring and quick execution.

- Trend Following: Trend following is an old strategy but very useful. In this strategy, traders trade in prevailing market trends, buying cryptocurrencies during uptrends and selling them during downtrends. Technical analysis plays a crucial role in identifying these trends and potential entry/exit points.

- Contrarian Strategies: Contrarian traders go against the prevailing market sentiment. They may buy cryptocurrencies when the market is bearish (downward trend) and sell them when the market is bullish (upward trend). This strategy can be risky and requires a deep understanding of market psychology and contrarian indicators.

What are the Legal and Regulatory Considerations?

There are a lot of legal and regulatory changes happening continuously, and as a crypto trader must be aware of them.

- Understanding the Regulatory Environment: Regulations regarding cryptocurrencies vary significantly by country. Some countries have implemented comprehensive regulatory frameworks, while others are still developing their approach.

- Compliance with Local Laws: As a cryptocurrency trader, you’re responsible for complying with the laws and regulations in your country. These laws may dictate how you can trade, report your earnings for tax purposes, and store your cryptocurrencies.

- Tax Implications and Reporting: Cryptocurrency trading is generally considered a taxable event in most countries. It’s essential to understand the tax implications of your trading activities and report your capital gains or losses to the relevant authorities.

- Ensuring Exchange Security and Safety: Cryptocurrency exchanges are prime targets for hackers. Choose reputable exchanges with robust security measures, including two-factor authentication, multi-signature wallets, and regular security audits. It’s generally recommended to avoid storing large amounts of cryptocurrency on exchanges and transfer them to secure personal wallets for long-term storage.

What are the Tools and Resources for Cryptocurrency Trading?

- Trading Platforms and Exchanges: Without exchanges, you cannot buy, sell, and trade cryptocurrencies. Trading platforms and exchanges are a must for a trader.

- Wallets and Storage Solutions: Crypto wallets are essential for storing your cryptocurrencies securely. Different wallet types cater to various needs, such as hardware wallets for offline storage and mobile wallets for easy accessibility.

- News and Information Sources: The biggest impact on the crypto market happens because of the news and events. Various events like regulations, developments, and scams hugely affect the crypto market.

- Trading Bots and Automation: Trading bots are automated software programs that execute trades based on pre-defined parameters. While these tools can be helpful for implementing specific trading strategies, they should be used with caution and proper understanding.

What are the Benefits and Challenges of Cryptocurrency Trading?

Benefits

- Potential for High Returns: The cryptocurrency market is highly volatile, giving opportunity for better returns while trading, but also, due to high volatility, chances of losses also increase.

- Accessibility and Liquidity: Cryptocurrency markets operate 24/7, offering greater accessibility compared to traditional stock markets. Additionally, some cryptocurrencies boast high liquidity, allowing for easier buying and selling.

- Decentralization: Cryptocurrencies operate on decentralized blockchain networks, offering an alternative to traditional financial systems controlled by central authorities. This decentralization appeals to some traders seeking greater control over their assets.

Challenges

- Market Volatility: The cryptocurrency market is notoriously volatile, with prices experiencing rapid and unpredictable fluctuations. This volatility can be exciting for some but stressful for others and poses a significant risk to your capital.

- Security Risks: Cryptocurrency exchanges and wallets can be targets for hackers. It’s crucial to prioritize security measures to protect your digital assets.

- Regulation Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving. This uncertainty can pose challenges for traders and may impact the market’s overall stability.

Can you make $100 a day with crypto?

There’s no guaranteed answer to this question. While some traders might achieve this feat, it’s not a realistic expectation for beginners. The cryptocurrency market is volatile, and making consistent profits requires skill, experience, and effective risk management. Focus on building your knowledge, developing a sound trading strategy, and prioritizing risk management before aiming for specific daily profits.

FAQs

Q: What are the best cryptocurrencies to trade?

There’s no single “best” cryptocurrency. Most traders prefer Bitcoin, but there are a lot of other options available.

Q: Is it too late to invest in cryptocurrency?

No, the crypto market is still in its initial phases. While other assets have been here for centuries, cryptocurrency are here for 15 years only.

Q: How much money do I need to start trading crypto?

As a beginner, you are recommended to start small so you don’t have to worry about the starting capital.

Q: Are there any free cryptocurrency trading courses?

There are numerous online resources that offer free educational materials on cryptocurrency trading, including courses, tutorials, and articles.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.