Page Summary

More of us are diversifying our income streams to include financial trading. It is becoming more popular to buy and sell cash instruments and derivatives to make money. The online trading industry is growing but if you are new to this you are not alone. In this article we will help you get your bearings and give you an overview of how to trade on IQ Option.

Financial markets are chaotic. Millions of individuals and companies are trying to make money. Even governments trade for profit. This means that the prices of instruments are always fluctuating. A market that moves a lot is called a volatile market. They bring more opportunities for profit, but also increased risk. Traders are always searching for ways to reduce their risk and increase their reward. IQ Option meets to this need better than most of the brokerages out there.

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

IQ Option: Platform Basics

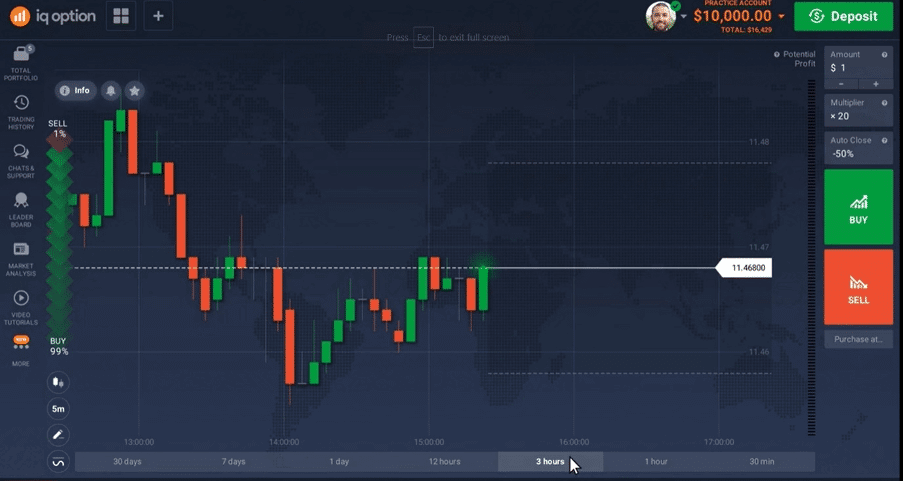

So let’s take a look at the platform basics. In the figure above, the main trader room window shows the chart of an asset. Below the chart, you can see the time interval panel. This allows you to view the price change of the chosen asset for each period. You can also zoom in or out of the chart and focus on the current price.

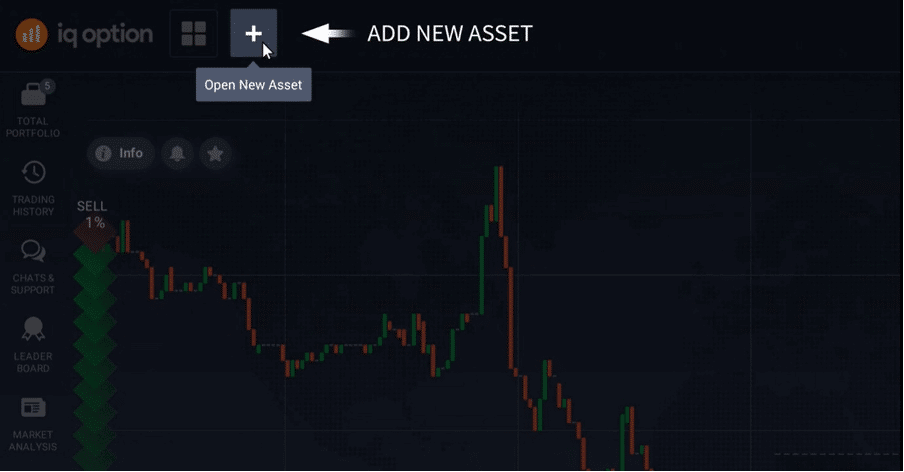

To select a trading instrument, click on the trading instrument in the top-left corner of the chart. To add an asset, click on the plus icon in the upper panel.

On the right-hand side panel, you can specify the amount of your investment by clicking the amount. Just below it, there is a leverage button which is available for stocks, crypto, forex, commodities, and ETFs. Leverage is used to borrow extra funds from a broker. Then you will see red and green buttons, which correspond to the price direction of an asset.

On the left-hand side of the chart, the technical analysis menu is located.

There are four sections:

- chart type

- time interval

- graphical tools

- indicators

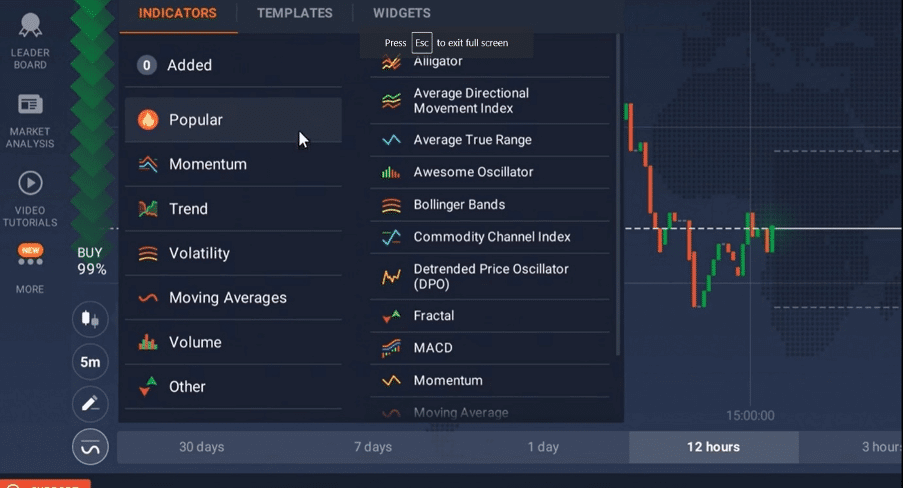

By clicking on the chart type icon, you can select a chart type. Click on the graphical tools icon to select additional tools for drawing and creating technical analysis elements. These include trends, and support and resistance lines. By clicking on the indicators icon, you can set up and apply various technical indicators that will help you perform a market analysis.

Here you can also customize various widgets to improve trading efficiency. The panel on the left-hand side of the chart window consists of several sections.

Total portfolio shows all your active and pending positions. You can rank the positions by instrument type and see the statistics on all your active positions. In trading history you can keep track of all the deals you have made, see how much you have invested and what results you have made.

Video tutorials is a section where you can find all IQ Option’s including educational videos, news digests, reviews, etc.

Trading the news

Markets are influenced by many factors. These can be divided into economic, financial, and political. News can change a market situation in a moment. If the news is positive, currency rates or stock prices normally goes up. If the news is negative, the market goes down. So what news should follow? Economic reports are a good place to start, covering employment, retail sales and other data. Financial news has most of an impact on stock prices. If a company’s financial figures are worse than forecast, its shares go down in value. Elections, revolutions, impeachments and other events that cause political instability affect the markets. Terrorist attacks, national disasters, influence markets too. Bear in mind that a market’s reaction to news usually lasts between 30 minutes and 2 hours. But news has had an impact for days after its publication. Use IQ Option’s smart news feed to use news to optimize your trading experience.

How to manage your emotions

The ups and downs of trading put traders’ emotions to the test. One false move and you could lose or gain everything. As a result, traders often experience greed, fear, excitement, nervousness, conviction, and overconfidence. Each brings its own challenges. Managing them separates the pros from the also rans. Regardless of whether they are negative or positive, emotions inhibit decision making.

Overcome fear and nervousness by reducing the amounts you are trading. Lowering your stakes will put you under less pressure. You can avoid stress by sticking to your plan and not entering a trade that deviates from your strategy. Conviction and excitement are your friends. You should feel both before entering any trade. Manage greed and overconfidence by staying disciplined and applying strong risk management techniques. However, seeing the bigger picture is also important. If trading were easy, then everyone would be doing it. Expect slow and steady progress, with plenty of ups and downs along the way.

Stick to the plan

Once you have worked out your trading strategy, stick to it. Although you may want to give up when results start going against you, resist the temptation. You will always have variance and you need to give your plan time to succeed. A strategy’s success is measured by how well it is applied and that is down to you! Trading is far too complex a subject to cover in depth here. So it’s up to you to read articles, watch videos, and get your hands dirty! Use IQ Option’s free demo account to practice trading all the instruments available. Familiarise yourself with the excellent tutorials available on their site. Check the market overviews on the IQ Option blog. Read up on all their FAQs – if you are still unsure on a question, online support is available when you log in.Good luck and we wish you a happy and successful trading experience!

- IQ Option vs Plus500

- IQ Option vs eToro

- IQ Option vs Expert Option

- IQ Option UAE

- IQ Option vs IG

- IQ Option vs Pepperstone

- IQ Option vs TD Ameritrade

- IQ Option vs AVAtrade

- IQ Option vs XM

- IQ Option vs IC Markets

- IQ Option vs Degiro

- IQ Option vs Axitrader

- Withdraw money from IQ Option

- Is IQ Option a scam?

- IQ Option demo account

- How to trade with IQ Option?

General Risk Warning: “The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose”

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.