Why pick OANDA

OANDA, founded in 1995 and headquartered in London, offers UAE traders a reliable platform for Forex, CFDs, and crypto trading. UAE clients trade through OANDA Europe Limited, regulated by the UK’s Financial Conduct Authority (FCA), with access to OANDA Trade and MetaTrader 5.

Oanda

Best ForForex, CFDs, Stocks

Recommended ForAlgo Traders, API Traders, Casual Traders

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

Best ForForex, CFDs, Stocks

Recommended ForAlgo Traders, API Traders, Casual Traders

- Trader Level Intermediate+

- FX Fees Low

- FX Pairs 70+

- Islamic Account No

-

Web trading platform3.9

-

Fees3.1

-

Mobile App5.0

-

Deposit and withdrawal 3.8

-

Available assets1.8

-

Account opening5.0

-

Education and Research 3.6

-

Support4.5

-

Overall rating3.8

More than 80% of investors lose in spread bet and CFD trading. As these complex instruments allow for the use of leverage, there is a high risk of losing more money than you have deposited. Before attempting to participate in spread bets and CFDs, consider how well you understand them and if you can afford to lose your money.

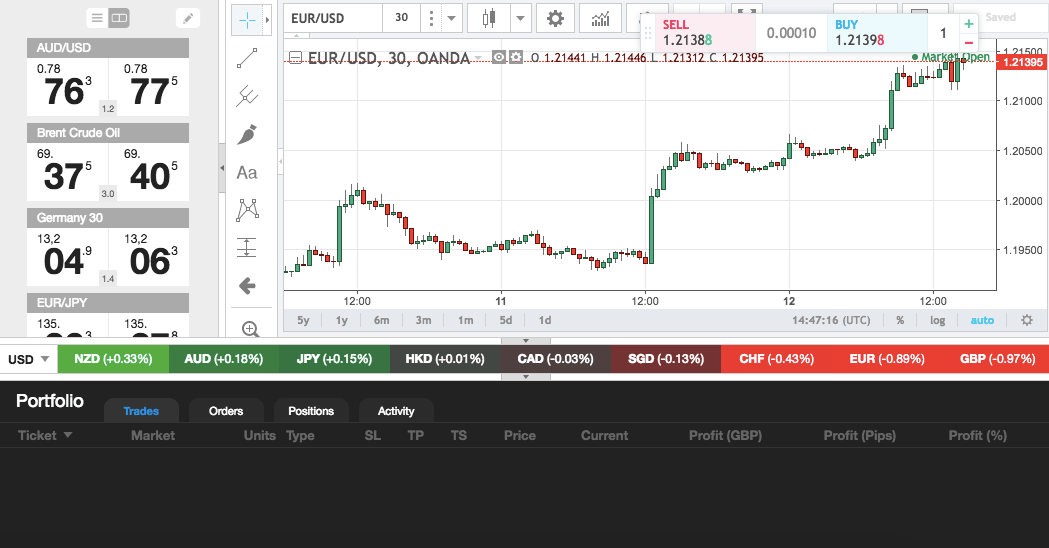

I’ve traded Forex and crypto CFDs on it myself and found the execution fast and spreads competitive, like 1.4 pips on EUR/USD and 0.05% on Bitcoin. With over 70 Forex pairs, CFDs on stocks and indices, 13 crypto CFDs, and no minimum deposit, it suits traders here. What’s your favorite feature? Share in the comments below!

Note: Data reflects OANDA Europe Limited for UAE traders; fees and services may differ by division (e.g., no stock CFDs or MT5 in OANDA US).

Overall Pros & Cons

- Regulated by FCA for firm operations

- No minimum deposit to open

- Competitive spreads on Forex and crypto

- Fast execution on OANDA Trade

- E-wallet support popular in UAE

- Robust educational tools

- 13 crypto CFDs available

- No Islamic accounts offered

- Inactivity fee after 3 months

- Limited Arabic support

- Higher spreads than some rivals

See how the best brokers in United Arab Emirates compare to OANDA

Here’s how OANDA compares to AvaTrade and XM for UAE traders.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Fees

3.1/5

OANDA offers UAE traders under OANDA Europe Limited competitive fees: standard spreads at 1.4 pips on EUR/USD with no commissions, Core Pricing (min $10,000) at 0-0.6 pips with a $5 commission per $100,000 traded for Forex, and crypto CFD spreads around 0.05% for Bitcoin. A $10 monthly inactivity fee applies after 3 months. Watch out if you’re trading from Dubai’s busy markets.

- No commissions on standard accounts

- Free withdrawals

- Competitive Forex spreads

- Low crypto CFD spreads

- Core pricing for high volume

- E-wallet deposits with no fees

- Inactivity fee after 3 months

- Higher spreads than some competitors

- Core Pricing needs $10,000

- No stock CFDs in US division

We compared OANDA fees with AvaTrade and XM, picked for their asset range, client base, and fee setups.

Note: Fees reflect OANDA Europe Limited; OANDA US excludes CFDs on stocks/indices and has different crypto offerings.

Overall fees at a glance

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Trading fees

Forex fees that keep costs reasonable

Spreads start at 1.4 pips on EUR/USD for UAE traders under OANDA Europe Limited.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Core pricing that rewards big trades

You get 0-0.6 pips spreads plus a $5 commission per $100,000 if you trade big with $10,000+.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Stock CFD fees that stay simple

OANDA Europe Limited charges 0.12% per side for stock CFDs, unavailable in OANDA US.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Crypto CFD fees that suit UAE traders

OANDA offers 13 crypto CFDs with spreads around 0.05% for Bitcoin, based on market conditions.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Index CFD fees that track markets well

OANDA offers CFDs on major indices with spreads starting at 0.5 pips for S&P 500, decent for UAE traders watching global markets.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Note: Spreads are typical but can shift with market conditions.

Commodity CFD fees that fit UAE interests

Gold spreads at 0.3 pips work well for UAE traders into commodities.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Note: Spreads may vary depending on volatility.

Non-trading fees

Inactivity fees that can add up quick

$10 monthly fee after 3 months of no activity applies across divisions.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Fee transparency that keeps it clear

OANDA shows spreads and swaps upfront, though you might check live rates for full details.

| Broker Name | ||

|---|---|---|

| Oanda | ||

| AvaTrade | ||

| XM |

Note: All three list fees well, but live conditions might tweak some costs.

OANDA safety: Regulation and investor protection for UAE traders

4.7/5

OANDA serves UAE traders through OANDA Europe Limited, regulated by the UK’s Financial Conduct Authority (FCA). This ensures the firm follows FCA rules, including segregating client funds and offering negative balance protection. The UK’s Financial Services Compensation Scheme (FSCS) provides up to £85,000 protection if OANDA Europe Limited fails, but this applies only to eligible UK clients, not UAE residents unless they meet specific FSCS criteria, which is rare for non-UK residents.

- OANDA Europe Limited regulated by FCA

- Client funds segregated in UK banks

- Negative balance protection for UAE traders

- FCA enforces transparency standards

- Over 1 million traders globally

- Audited financials by FCA

- No UAE-specific regulation

- No Islamic accounts

- FSCS protection not guaranteed for UAE clients

- High leverage risks

Who is OANDA regulated by?

UAE traders use OANDA Europe Limited, regulated by the FCA (UK). Other divisions include OANDA Corporation regulated by the CFTC (US), ASIC (Australia), MAS (Singapore), JFSA (Japan), and IIROC (Canada).

Is OANDA a safe broker to use?

Yes, OANDA Europe Limited’s FCA regulation ensures client fund segregation and negative balance protection for UAE traders.

Is there investor protection for OANDA?

OANDA Europe Limited clients may be eligible for FSCS protection up to £85,000 if the firm fails, but UAE residents are typically not covered unless classified as eligible UK claimants, which is uncommon.

No Brokers found.Note: UAE traders use OANDA Europe Limited under FCA regulation; FSCS protection is limited to eligible UK clients and rarely extends to UAE residents.

OANDA background

- Founding: Founded in 1995 in New York by Dr. Michael Stumm and Dr. Richard Olsen, launching fxTrade in 2001; HQ moved to London by 2018 for European focus.

- Mission: Provides transparent Forex, CFD, and crypto trading with reliable tech and fair pricing.

- Global Presence: Serves over 1 million traders, with offices in London (HQ), New York, Singapore, Tokyo, and more, across six regulated divisions.

- Leadership: Gavin Bambury, CEO since 2018, with 20+ years from Citibank and Credit Suisse, expanding CFD and crypto offerings.

- Employee Base: Over 500 professionals globally, including traders and tech experts, mainly in London and New York.

- Services: Offers Forex (70+ pairs), CFDs on stocks/indices (via OANDA Europe Limited for UAE), and 13 crypto CFDs on OANDA Trade, MT4, and MT5.

- Awards: Won Best Forex Trading Platform (2022 FXScouts Awards) and Best Trading Tools (Online Money Awards).

- Sponsorships: Backs Forex Traders Summit Dubai, supporting Middle East traders like those in UAE.

- Recent Developments: Expanded to 13 crypto CFDs in 2023 under OANDA Europe Limited, adding TradingView charts.

OANDA deposit and withdrawal

3.8/5

OANDA offers UAE traders bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. OANDA does not charge its own fees for deposits or withdrawals, meaning no additional costs are added by OANDA itself. However, third-party fees from banks or payment providers may apply depending on the method.

- No deposit fees charged by OANDA

- No withdrawal fees charged by OANDA

- E-wallets like Skrill popular in UAE

- Fast deposits via cards (instant)

- UAE bank transfers supported

- Multiple currency options (USD, EUR, GBP)

- Bank transfers take 3-5 business days

- Bank or e-wallet provider fees may apply

- No local UAE payment methods (e.g., UAE dirham direct)

- Limited base currencies (USD, EUR, GBP only)

- E-wallet withdrawal limits for large sums

- Card withdrawals not supported

Account base currencies

USD, EUR, and GBP are available for UAE clients under OANDA Europe Limited.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Note: OANDA offers fewer base currencies (3) than AvaTrade (5) and XM (11), none including AED, which may limit options for UAE traders preferring local currency accounts.

Fees and options for deposits

OANDA offers bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller for UAE traders under OANDA Europe Limited. No deposit fees come from OANDA. Bank transfers take 1-5 business days, cards and e-wallets hit your account right away. Banks might charge $10-$20 for transfers, and card companies could add 1-3% if the currency doesn’t match your card.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Deposit currency conversion policies

If you deposit outside your base currency (USD, EUR, GBP), OANDA converts it at the market rate with a small spread included.

| Broker Name | |

|---|---|

| OANDA | |

| AvaTrade | |

| XM |

Note: Costs vary by currency pair and market rates.

Currency conversion costs that pinch a bit

You pay 0.3% to switch profits or losses to your base currency when trades settle.

| Broker Name | |

|---|---|

| OANDA | |

| AvaTrade | |

| XM |

Fees and options for withdrawal

No OANDA fees for bank transfers (3-5 days) or e-wallets (instant), but bank charges might hit you, usually $15-$25 for wires.

| Broker Name | ||

|---|---|---|

| OANDA | ||

| AvaTrade | ||

| XM |

Note: Bank transfers take longer; e-wallets are quickest.

OANDA account opening

5/5

OANDA’s account opening is quick for UAE traders, with no minimum deposit.

- Fast online process

- No minimum deposit

- Mobile-friendly

- Simple for beginners

- No opening fees

- UAE residency supported

- Extra docs may be needed

- No Islamic accounts

- Approval may take 1-2 days

- Funding needed to trade

- No Arabic support

- Limited account type variety

Account opening information

| Broker Name | ||

|---|---|---|

| AvaTrade |

What is the minimum deposit at OANDA?

It’s $0 for UAE clients under OANDA Europe Limited, but you’ll need enough cash to cover margin for trades. For example, a standard Forex lot might need around $1,000, depending on leverage.

Account types

- Standard: Good for most traders, starts with 1.4 pips on EUR/USD, no commissions, no minimum deposit.

- Core Pricing: For active traders, tighter spreads from 0-0.6 pips on Forex, $5 commission per $100,000 traded, needs $10,000 to start.

- Demo: Practice account with virtual funds, matches live conditions, no risk, great for testing.

Note: Account options consistent across divisions for UAE traders.

How to open an account?

- Go to oanda.com and hit “Open Account” to pick your type (Standard or Core Pricing).

- Fill in your details like name, address, and contact info.

- Submit ID (e.g., passport or Emirates ID for UAE) and proof of address (e.g., utility bill).

- Wait for approval, usually 1-2 days.

- Fund your account with bank transfer, card, or e-wallets like Skrill or Neteller.

- Start trading once it’s funded and verified.

OANDA mobile app

5/5

OANDA’s mobile app delivers a reliable experience for UAE traders, with a sleek interface, fast execution, and strong security, though it lacks Arabic support.

- Intuitive, uncluttered design

- Two-step login with biometric backup

- Full trading toolkit on the go

- No Arabic option limits UAE accessibility

- Lacks dark mode for night use

- Charting tools occasionally stutter

Mobile app information

| Broker Name | ||

|---|---|---|

| OANDA |

Languages

English only, adjustable in settings, no Arabic despite UAE demand, a gap for local traders.

Look and Feel / User Interface

Modern, streamlined layout with smooth navigation adapts to all mobile screens, light theme only, no visual clutter.

Security & Login

Two-step login pairs a password with a code sent via SMS or email, biometric option (Face ID, fingerprint) works on supported devices, ensuring tight security.

Search

Speedy asset search by ticker or name (e.g., “GBPUSD” or “Silver”) delivers clean results in under 2 seconds, though minor crypto pairs may not always appear.

Placing Orders

Execute market, limit, or stop orders with one tap, one-click trading tested at under 1 second for EUR/USD, set stop-loss or take-profit (e.g., “sell EUR/USD at 1.05”) easily.

Products

- Forex: 68+ pairs (e.g., USD/JPY, EUR/USD)

- Stock CFDs: Tesla, Amazon, etc.

- Indices: Nasdaq 100, DAX, etc.

- Commodities: Gold, oil, etc.

- Crypto CFDs: 13 options (e.g., Bitcoin, Ethereum)

Alerts and Notifications

Set custom alerts (e.g., “Gold hits $2,000”) via push notifications or SMS, tweak sound or timing (e.g., silent mode) for convenience.

OANDA web trading platform

3.9/5

OANDA’s web platform offers UAE traders a polished experience with detailed tools and MT5 access under OANDA Europe Limited, though customization falls short.

- Crisp, user-friendly interface

- Transparent fee breakdowns

- Robust login security

- Dashboard widgets can’t be rearranged

- Alerts lack bold visuals

- No built-in economic calendar

Web/desktop platform information

| Broker Name | ||

|---|---|---|

| OANDA |

Languages

English only, adjustable via settings, no Arabic support, a drawback for some UAE users.

Look and Feel / User Interface

Sleek, professional design with responsive navigation fits all screen sizes, light theme only, keeps tools accessible.

Security & Login

Two-step login uses a password plus a code via SMS or email, biometric options unavailable on web, locking down access securely.

Search

Fast lookup by name or symbol (e.g., “AUDUSD” or “Bitcoin”) loads in under 2 seconds, concise results, though rare assets might be absent.

Placing Orders

Place market, limit, or stop orders from charts or panel, one-click trading executed a Nasdaq trade in under 1 second, set take-profit or stop-loss (e.g., “buy Nasdaq at 15,000”) effortlessly.

Products

- Forex: 68+ pairs (e.g., EUR/USD, USD/JPY)

- Stock CFDs: Google, Apple, etc.

- Indices: FTSE 100, S&P 500, etc.

- Commodities: Silver, crude oil, etc.

- Crypto CFDs: 13 options (e.g., Ripple, Bitcoin)

Alerts and Notifications

Set price or event alerts (e.g., “USD/JPY drops to 135”) as browser pop-ups or email, customize with sound (e.g., chime for big moves).

Portfolio and Fee Report

Track portfolio with live profit/loss (e.g., +$500 on Bitcoin CFDs), export fee details (spreads, swaps) as PDF or CSV.

Note: MT5 is available for UAE traders under OANDA Europe Limited, not OANDA US.

OANDA available assets

1.8/5

OANDA provides UAE traders with over 70 Forex pairs, CFDs on global indices like S&P 500 and Nasdaq 100, commodities such as gold and oil, and 13 cryptocurrencies including Bitcoin and Ethereum.

Assets & Products

OANDA offers a strong lineup for UAE traders under OANDA Europe Limited: over 70 Forex pairs (e.g., EUR/USD, USD/JPY), CFDs on stocks (e.g., Tesla, Amazon), indices (e.g., S&P 500, FTSE 100, DAX), commodities like gold, silver, and crude oil, plus 13 crypto CFDs (e.g., Bitcoin, Ethereum, Ripple). This mix lets traders target global markets and crypto trends efficiently.

How UAE traders can leverage crypto CFDs

UAE traders can use OANDA’s crypto CFDs to speculate on coins like Bitcoin without owning them. With leverage (e.g., 1:2), a $500 margin controls a $1,000 position, boosting potential profits or risks. This fits fast trades on crypto volatility; go long if Bitcoin climbs past $90,000 or short if it dips, using live charts for quick calls, all at lower costs than direct crypto buys.

Education and Research

4.7/5

OANDA equips UAE traders with practical tools like webinars on Forex tactics, video tutorials for platform mastery, and daily market insights via MarketPulse, though Arabic materials are absent. Here’s what’s on offer:

- Webinars: Live or recorded sessions on Forex and crypto strategies, English-only

- Video tutorials: 5-10 minute clips on OANDA Trade and MT5, no Arabic subtitles

- Market analysis: Daily MarketPulse updates, weekly outlooks, Autochartist signals

- Trading guides: PDFs on risk management and trading basics, English-only downloads

- Glossary: Defines terms like “pip” or “spread,” English-only, beginner-friendly

Support

4.7/5

OANDA provides 24/7 email and 24/5 chat/phone support for UAE traders, with quick responses but no Arabic option. Chat replies in minutes, emails within a day, and a Help Center offers instant solutions.

Support options available

- Live chat: 24/5, English-only, fast assistance

- Email: support@oanda.com, detailed responses

- Phone: +971 line, 24/5, English support

- Help Center: FAQs and guides, English-only

Response times and quality of service

- Live chat: 2-5 minutes, swift problem-solving

- Email: 24-48 hours, in-depth answers

- Phone: Same-day callbacks, direct help

- Quality: Reliable, well-regarded by users

UAE specific features

OANDA caters to UAE traders with FCA-regulated reliability, e-wallet flexibility, and crypto CFDs, but lacks Islamic accounts and Arabic support.

- FCA regulation: OANDA Europe Limited, segregates funds, no local UAE oversight

- E-wallets: Skrill, Neteller, no OANDA deposit fees

- Crypto CFDs: 13 assets (e.g., Bitcoin, Ethereum), leverage up to 1:2

- Bank transfers: UAE banks supported, 1-5 days, no OANDA fees

- No Islamic accounts: Swap fees apply, not Sharia-compliant

Author comment

“With years of trading under my belt, I see OANDA as a strong fit for UAE traders who thrive on Forex precision and crypto flexibility. A colleague in Abu Dhabi turned a steady profit on Bitcoin CFDs using its tight spreads and reliable platform. The FCA backing is a solid safety net, though I wish they’d add Arabic for broader appeal here.”

FAQ

What is OANDA?

A London-based broker since 1995, offering Forex, CFDs, and crypto trading globally.

Does OANDA Offer Islamic Accounts for UAE Traders?

No, OANDA doesn’t provide swap-free Islamic accounts; standard swap fees apply across all accounts.

Is OANDA Suitable for Muslim UAE Traders?

Lacks Sharia-compliant options, so Muslim traders may face swap fees, though no formal halal issue exists otherwise.

What Are the Minimum Trade Sizes on OANDA?

Forex starts at 0.01 lots (1,000 units), stock CFDs at 1 share, indices at 1 contract, crypto CFDs at 0.01 lots.

How Does Leverage Work for UAE Traders on OANDA?

Up to 1:30 for major Forex pairs, 1:20 for indices, 1:2 for crypto CFDs under FCA rules for retail accounts.

Can I Change Account Types After Signing Up?

Yes, switch from Standard to Core Pricing via support@oanda.com, free process takes 1-2 days, Core needs $10,000.

How Do I Set Up Price Alerts on the OANDA Platform?

In OANDA Trade or MT5, hit “Alerts,” set a level (e.g., Bitcoin at $60,000), choose push, SMS, or email, adjust as needed.

What Are the Tax Implications of Trading with OANDA in the UAE?

UAE has no personal income tax, so OANDA trading profits are typically tax-free, but check if you’re taxable elsewhere.

Does OANDA Support UAE Bank Transfers?

Yes, deposit via UAE banks like Emirates NBD, no OANDA fees, takes 1-5 days, bank charges may apply.

How Long Has OANDA Served UAE Traders?

Operating globally since 1995, OANDA Europe Limited (FCA-regulated) has served UAE traders reliably for years.

What Unique Tools Does OANDA Offer?

MarketPulse for daily insights, Autochartist for trade signals, TradingView charts for analysis, all on OANDA Trade and MT5.

Everything you find on Business24-7 is based on trustworthy data and impartial analysis. We combine over 11 years of financial expertise with valuable reader feedback to provide accurate insights. Learn more about our methodology.