Our pip value calculator will tell you the value of a pip in the currency you want to trade. Use it to learn if a trade is worth the risk and how to manage risks.

What is a pip

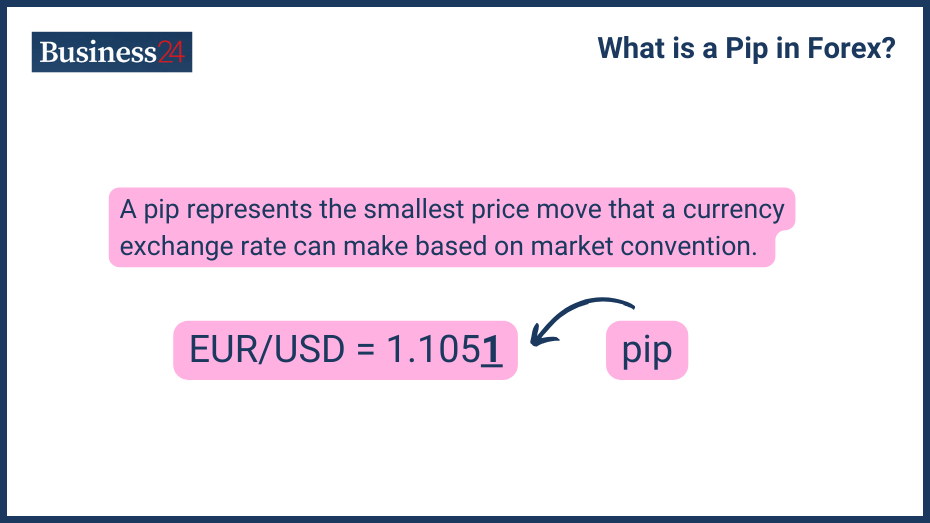

Pip, or a percentage in point, is the basic unit used for all Forex calculations. It is used to measure the smallest possible change in value in currency pairs. It shows how much a particular currency has appreciated or depreciated against another currency.

One pip is equal to one movement in the fourth decimal point in a trading pair or 1% of 1%.

For example, if the GBP/USD pair moves from 1.2000 to 1.2002, it shows an increase of 2 pips.

The USD/JPY pair is unique in this regard, as a pip is measured at 0.01 for this particular correlation. In all other pairs, it is 0.0001.

How do you calculate pip?

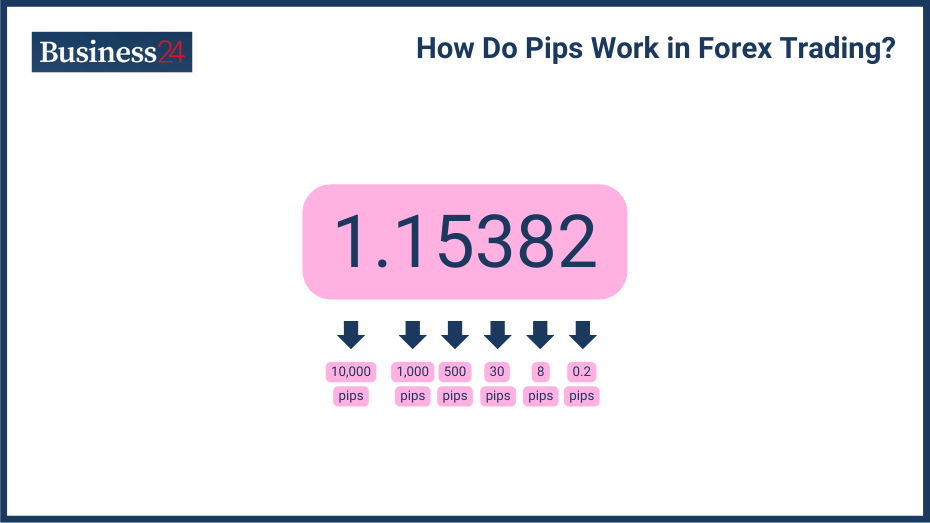

All currency pairs while trading against the USD have a pip value of 0.0001 apart from USD/JPY (pip 0.01).

However, if the trading pairs involve currency pairs other than USD (non-USD quote currency), a pip can change.

For example, if we have a trading pair of Chinese Yuan (CNY) and Australian Dollar (AUD) or AUD/CNY, the pip becomes

Value of Trading Pair 0.0001

4.8 0.0001 = 0.00048

Importance of Understanding Pip Values in Forex Trading

Pip values have an important role in the Forex market. They include:

Comparing Spreads

Pip values are used for calculating the spread of any forex pair. Spread is defined as the difference between the buy (quote) and sell (bid) price. It is essentially the profit margin of a Retail Forex trader if the exchange rate remains constant. It is measured in pips. Using this standardized unit traders can compare spreads of different brokers and select the one best suited for their needs.

Measuring Profits and Losses in Trades

If a currency moves in a certain direction, the value of a trader’s holdings changes. They can move in either direction, and the investor can end up making a profit or a loss. Pips provide a standardized calculation for these upsides and downsides.

Considering a standard lot (100,000 units) for the GBP/USD pair and it gains six pips from 1.21 to 1.2106, the profit will be:

100,000 0.0006 = $60.

Managing Risk

Another primary purpose of pip calculations is to calculate, manage, and mitigate risk associated with the Forex market. Pip calculations can help you set reasonable profit targets for a particular time and avoid big losses because of sudden market conditions. For this, traders need to calculate the pips a currency needs to gain before they can cash in on the profits or put a stop-loss order in place to avoid financial setbacks.

Forex Strategy:

Pips are used in Forex analysis across the board, including reading currency pair charts and their technical analysis. They are an important cornerstone of currency comparisons.

Removing Confusion:

Pip, being a standardized unit, eliminates the possibility of confusion in currency pairs. Rather than having different units for price measurement, the market placed consensus on this fundamental change in value.

How Pip Calculators Work

Explanation of Pip Value Calculation

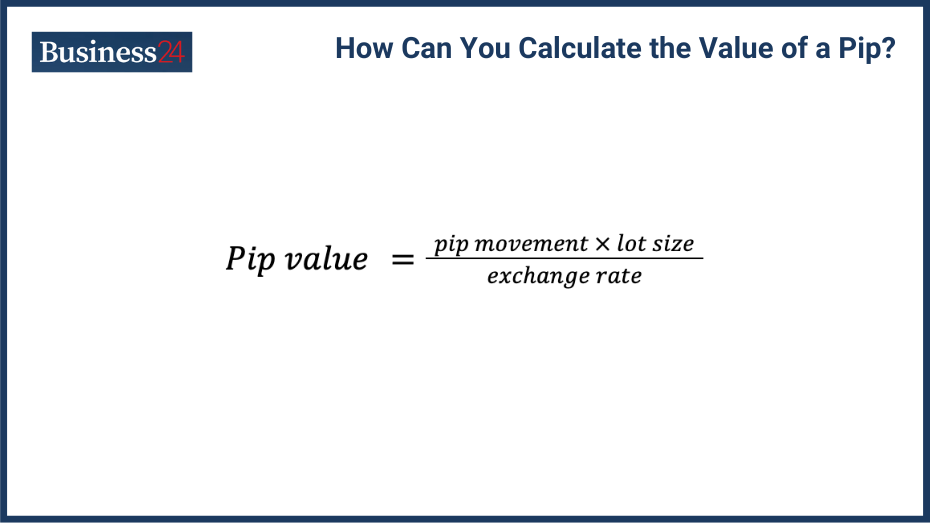

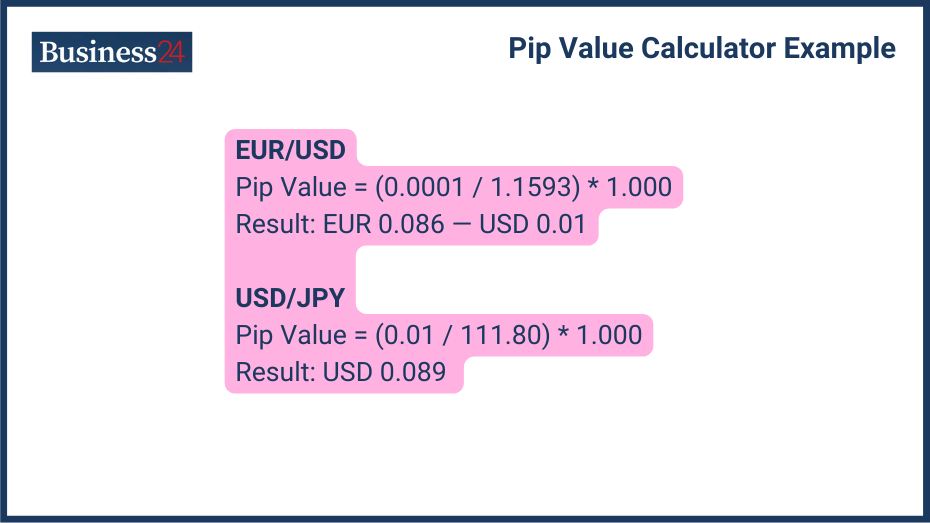

All currency pairs while trading against the USD have a pip of 0.0001 apart from USD/JPY (pip 0.01). However, when it comes to pip value, you need to divide one pip by the latest exchange rate between the two currencies and multiply it by your lot size.

Pip Value= Value of on pipExchange Ratelot size

Steps to Use a Pip Calculator

Pip calculations can get tricky over time as traders have to keep track of countless trading pairs and their price movements in pips. It is recommended that professional traders use pip calculators for this purpose.

To use pip calculators, one needs to put in the lot size and select the trading pair. The rest of the calculation will be handled by the calculator. It makes things much easier for the trader.

Examples of Pip Calculation for Different Currency Pairs

If we have a EUR/USD trading pair that is currently trading at 1.12 and the lot size is standard, i.e., 100,00

Pip Value= 0.00011.21100,000= 8.26

It basically means that for every 0.0001 price movement, your 100,000 EUR lot will appreciate or depreciate by 8.26.

Pip value calculations get trickier if we have trading pairs without USD involvement. In that scenario, the pip changes. For example, if we have a trading pair of Chinese Yuan (CNY) and Australian Dollar (AUD) or AUD/CNY, the pip becomes

Value of Trading Pair 0.0001

4.8 0.0001 = 0.00048

Types of Pip Calculators

Standard Pip Calculators

These are entry-level pip calculators, and they are generally free. To use them, you need to input the lot size, currency pair, and account currency. There are different ways to look at pip value, and you can convert the pip value into any currency you like. But, standard pip calculators have certain limitations.

Fractional Pip Calculators

A fractional pip calculator goes one step beyond a standard pip calculator by allowing traders to track even smaller price movements, aka pipettes. A pipette is considered 1/10th the size of a standard pip up to the fifth decimal place or 0.00001.

This fractional approach allows traders to operate with even tighter spreads and have more precise calculations of these profits and losses.

Advanced Pip Calculators with Customizable Inputs

Professional/advanced pip calculators have several advantages over standard and fractional alternatives. Additional features often include:

Margin Calculation:

Margin trading is a major part of modern Forex trading. Advanced pip calculators allow Forex traders to integrate your leveraged positions into the data and calculate the effect of even minute movements in the exchange market. This is especially helpful while calculating risk mitigation techniques like avoiding margin calls.

Position Size Flexibility:

Professional pip calculators allow complete flexibility in lot sizes. You aren’t bound by smaller or larger lot sizes, and you can select the exact level of exposure to the market.

Live Market Updates:

Several advanced calculators allow traders to view and integrate live market prices directly into intricate pip calculations. This eliminates the hassle of manually handling your account.

Profit/Loss Calculations

Advanced calculators sometimes offer anticipated entry and exit point calculations for Forex traders. If you specify these prices along with your lot size, it can help calculate your profits and losses automatically. This can be especially useful for reducing risk management, including stop-loss trades.

Previous Data

Some calculators allow you to study and incorporate historical data of a currency pair. This is especially useful for handling backtesting trading strategies and mirroring past successful trading positions.

Applications of Pip Calculators

- Risk Management in Forex Trading

Just like with other markets, risk is inherent in Forex trading. Pip calculators can help traders manage risk by:

- Setting appropriate stop-loss orders

- Exposure to the market

- Position sizing

- Avoiding margin calls

- Profit and Loss Estimation

Pip calculators, especially the advanced options available in the market can help traders calculate exact profits/losses. Even the slightest movement of the exchange pair can be tracked and analyzed.

- Strategy Planning and Execution

Pip calculators are useful for carrying out the following:

- Position Size Testing

- Backtesting strategies of historical price action

Features of Leading Pip Calculators

User Interface and Ease of Use

The user interface is extremely end-user friendly. It is easy to navigate and go through the different menus to update/add inputs and get instant calculations.

Supported Currency Pairs

These calculators allow a wide range of trading pairs available in the market, something not easily accessible only a decade or so ago.

Integration with Trading Platforms

Calculators can seamlessly integrate with top Forex trading platforms through APIs. Most of the top brokers offer a range of pip calculators as part of the trading experience on their platforms, but they also allow third-party integrations, which is great for more advanced traders.

Additional Tools (e.g., Margin Calculators, Profit Calculators)

You can bring margins and leverage into the equation with these pip calculators. They allow you to calculate the margin needed for your profitability/loss mitigation goals and avoid margin calls.

Comparative Analysis of Popular Pip Calculators

ForexTime (FXTM) Pip Calculator

Overview and Features

ForexTime (FXTM) is a powerful, yet beginner-friendly Forex trading platform. It offers a forex pip calculator for traders operating on its platform. A basic version is also available for free.

How to Use FXTM Pip Calculator

To use the FXTM pip calculator, you need to go to the FXTM website and find its pip calculator. Once you have selected it, you will need to input:

- Preferred account currency

- Select trading pair

- Lot Size

Then, hit calculate. It also offers a Gold-USD (XAUUSD) trading pair as well.

MyFXBook Pip Calculator

Overview and Features

MyFXBook offers a pip calculator option for its traders. It allows traders to calculate the pip value of different trading pairs.

How to Use MyFXBook Pip Calculator

To use the MyFXBook pip calculator, users need to:

- Input account currency

- Select trading pair

- Lot size

- Number of pips.

CashBackForex Pip Calculator

Overview and Features

CashBackForex is a Forex trading platform. It offers a pip calculator for traders. In addition to the pip calculator, it offers a useful explanation of pips and their use in Forex trading.

How to Use CashbackForex Pip Calculator

To use CashBackForex’s pip calculator, traders need to access its website and search for the pip calculator. Once in the pip calculator UI, select:

- Trading pair/Instrument

- Account Currency/Deposit Currency

- Trade size/Lot

- Pip Size

Benefits of Using Pip Calculators

Enhanced Accuracy in Trading Calculations

Pip calculators allow improved accuracy in Forex trading calculations. As spreads get tighter, the requirement for precise profit/calculations is greater than ever.

Improved Risk Management

Pip calculators allow traders to grasp the risk associated with the Forex market much more effectively. They can use this knowledge to prepare for any potential downsides.

Better Decision Making for Traders

Traders need to be able to make effective decisions. There are too many trading pairs and variables involved in the Forex market. Pip calculators help traders gain a clearer picture of the market and take appropriate decisions.

Educational Resources and Further Reading

Guides and Tutorials on Using Pip Calculators

Detailed Guide on Trade that Swing

Guide on O’Reilly Media

Detailed YouTube video of Raynor Teo

Articles on the Importance of Pip Calculations

Detailed article on Forex Academy

Webinars and Video Tutorials

Detailed YouTube video of Raynor Teo

Frequently Asked Questions

How much is 50 pips in dollars?

It depends on the trading pair. If we take a EUR/USD pair with an exchange rate of 1.15, 50 pips would be 0.00575 USD.

How much are 100 pips in dollars?

It depends on the trading pair. If we take EUR/USD pair with an exchange rate of 1.15, 100 pips would be 0.0115 USD

How much is a 0.01 lot size pip worth?

It depends on the trading pair. If we take the EUR/USD pair with an exchange rate of 1.15, the pip value would be 0.0865.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.