Page Summary

The minimum deposit amount helps you decide which broker suits your needs best. Plus500 has a minimum deposit fee of $100. The deposit fee varies depending on the funding option and accounts you opt for.

This article discusses the specifics of minimum deposit amounts at Plus500.

Fees & Funding Options

The Plus500 minimum deposit varies depending on the deposit method you opt for. Funding via electronic wallets comes with a $100 fee. If you choose wire transfers, the minimum deposit increases to $500.

Mminimum Deposit Comparison

| Plus500 | ActivTrades | Spreadex | |

|---|---|---|---|

| Minimum deposit | $100 | $500 | $0 |

The standard transfer time depends on the funding options. Plus500 allows you to choose between online wallets and wire transfers. Wire transfers are the fastest, followed closely by online wallets.

- No deposit fee

- Several account base currencies

- None

Currencies

All trading accounts come with a base currency. The number of base currencies at Plus500 is 16. This is important since you’ll have to pay a currency conversion fee if you deposit in a different currency than the base currency of your trading account.

Base Currencies Comparison

| Plus500 | ActivTrades | Spreadex | |

|---|---|---|---|

| Number of base currencies | 16 | 4 | 4 |

Plus500 supports major currencies and some less common ones. The best way to save money on the conversion fee is to use a multi-currency digital bank account.

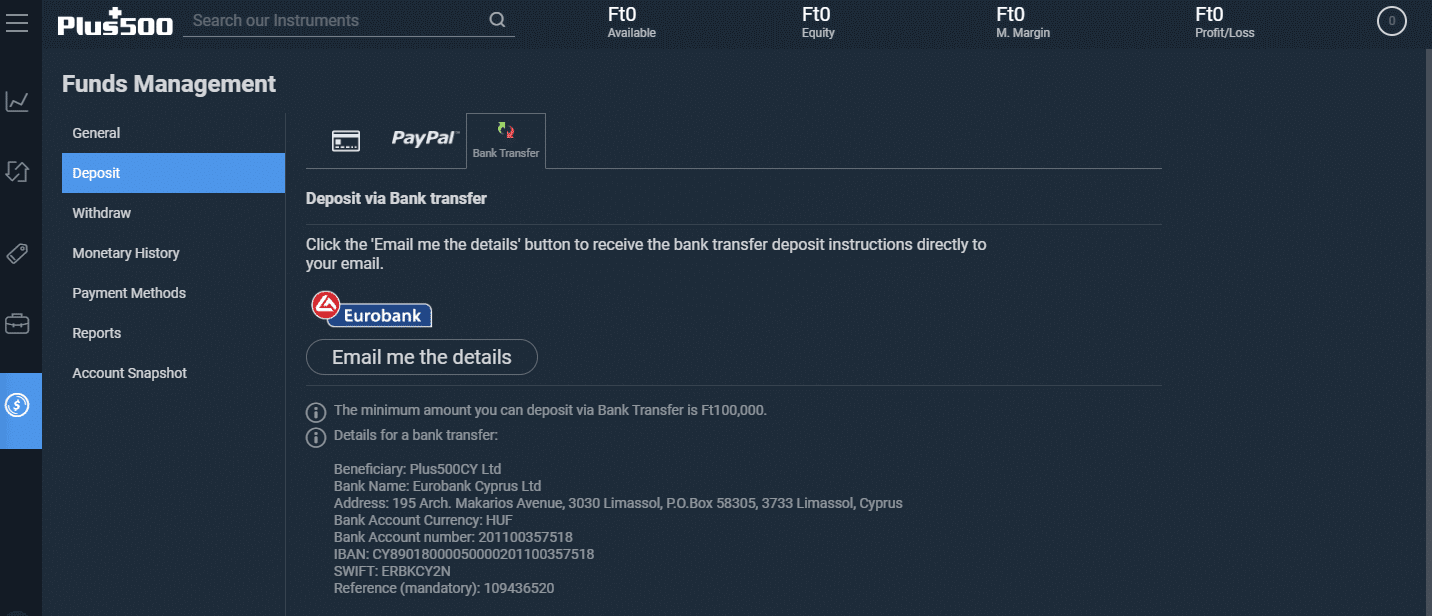

Sending The Minimum Deposit

The general process of funding your Plus500 account is simple. You have to open a brokerage account and verify your information. Afterward, sign in to your account and choose one of the deposit methods. Check your transaction and start the funding process. Usually, you’ll receive an email confirmation, and your deposit will show in your account in a couple of days.

Final Verdict

Plus500 has a smooth minimum deposit process. However, beginners might find it challenging since not all steps are straightforward. Learn more about the funding process at Plus500 from our in-depth reviews.

Disclaimer: Forex and CFDs are complex leverage-based products, which carry a high level of risk. These complex products are over-the-counter derivatives and are not suitable for everyone. You must consider whether you understand how these products work and whether you can afford to take the risk of losing your capital. Investing in these products does not provide any entitlement, right or obligation to the underlying financial instrument. The profit and loss are determined by the price movement of the underlying and can expose you to the high risk of losing your capital rapidly. 82% of retail investor accounts lose money when trading CFDs with this provider.

Plus500 compared to other brokers:

Plus500 Review

Plus500 Insights

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.