Within this guide, our experts will break down all you need to know about scam brokers in the UAE. Additionally, they will provide you with a list of fake trading websites to avoid. Scam brokers can often be detected through a lack of regulation, inability to withdraw funds, unrealistic promises, trade or order book manipulation, and general transparency.

Each of these indicators are red flags that indicate unreliability that could lead to being scammed. With many forex brokers showing some of these indicators, it may be difficult for retail and professional traders to differentiate between a real and scam forex broker.

To aid beginner and experienced traders alike in their trading journey and avoid these scams, our team of experts has reviewed multiple forex brokers and trading platforms and assessed their regulatory adherence, withdrawal complications, trading platform manipulations, transparency issues, and overall unrealistic promises.

This comprehensive guide will enlist all brokers traders should steer away from and examples of common trading and broker scams. Use the list and tips below to avoid forex broker scams altogether.

Regulated and Trustworthy Forex Brokers

To ease your process in finding the best and most trustworthy forex brokers, rather than scam and unregulated brokers, our experts have compiled a list of the top 10 forex brokers that excel in their trustworthiness, level of regulation, and overall reliability.

Our List of Trusted Forex Brokers UAE 2024

Our list of trust forex brokers UAE 2024 includes, in no particular order:

- AvaTrade

- eToro

- MultiBank

- Plus500

- IC Markets

- ActivTrades

- Interactive Brokers

- IQ Option

- XM

- Pepperstone

Our List of Top Forex Trading Scams UAE 2024

Our experts have compiled a complete list of online brokerage firms that will likely cause losses or scam you out of your hard-earned funds if you trade with them. Each of these brokers is considered highly unreliable and, in some cases, straight-up scams.

Our list of top forex trading scams in UAE 2024 includes, in no particular order:

- 24FX

- 24options

- 4XP

- 770Capital

- Absolute Markets

If you want to avoid forex trading scams in the UAE in 2024, you should always check our scam forex broker list before opening an account, depositing funds, and starting trading with a broker, trading platform, or other trading-related service.

Forex trading has become extremely popular, leading to significant scamming and fraudulent activity within the industry. Forex scams come in many types, sizes, and forms but often involve false advertising about trading conditions, returns, or outright theft.

Although scam forex brokers look legit at first glance, they use many business models and trading strategies that are considered highly unethical and, in some cases, illegal.

Tips to Avoid Forex Trading Scams in 2024

Tips to avoid forex trading scams in 2024 include:

- Do not trust promises of guaranteed profits – Not a single licensed and regulated forex broker does this as they are not allowed to by their financial regulator(s).

- Check the forex broker’s license by visiting the broker’s website or checking with the official financial regulator’s websites.

- Do not disclose your credit card information to any broker. Only fill in your credit card information at official, trusted, reliable, licensed, and regulated brokers and never to anyone else.

- Do not talk to unknown people on the phone about investments – Never talk to unknown people over the phone about investments.

- Use forex trading software – from trusted providers like MT4, MT5, AvaTrade, eToro, Plus500, MultiBank, or IC Markets.

How to Identify Forex Trading Scams?

There are a few common ways to easily identify forex trading scams, including but not limited to:

- High-profit promises – Traders should always be wary of high-profit promises. Remember the saying: ‘’If something is good to be true, it probably is.’’

- Promises of riskless or low-risk opportunities – There are no riskless opportunities in trading or investing.

- Unregulated or unlicensed brokers or financial products – You should never trade with an unregulated or unlicensed broker, trading platform, or other financial product.

- Unprofessional company practices – Such as cold-calling (potential) clients, offering to place trades in their names, unlawfully charging users’ credit cards to make deposits, or not paying out withdrawal requests.

- Dubious business models, trading tools, or trading strategies – The best forex brokers only use reliable business models, trading tools, and strategies, such as the MetaTrader suite, cTrader, true b-book trading, hedging, and scalping.

- Fake user reviews, ratings, and claims on their websites – Be aware that some brokers pay individuals and marketing agencies to create fake user reviews and ratings and that some brokers make false claims on their websites.

- Missing SSL certificates – If a broker does not have a valid SSL certificate, one should not trade with its trading platform for security reasons.

Who are the Scammers in the Forex Market?

There are several types of forex scammers, often falling into one or multiple of the following categories:

- Unregulated brokers that aim at beginner traders. These scam brokers operate as so-called ”boiler rooms” that are set up to collect as many funds in client deposits as possible before instantly disappearing at one point (rug pull).

- Ponzi pyramid scheme forex scams that use deposits made by new clients to pay the withdrawal requests of existing clients until this no longer works. Most forex scammers that conduct this scam promise their victims high, consistent returns.

- Forex bucket shops are brokers that conduct illegal trading activities by taking the opposite side of a user’s trade and profiting from it if the user loses. These forex scam brokers are called bucket shops because they “bucket” their users’ trades rather than executing them on the real, live financial markets.

- Fake trading or phishing websites – Forex scammers act as real, legitimate brokers or collect unsuspecting traders’ personal and banking details to rob them or sell their data later.

- So-called ”fincluencers” and ”gurus” advertising foolproof trading methods or that sell expensive seminars, courses, software, signals, or other financial products.

Other forex scams include bid/ask spread scams, withdrawal frauds, ”trading bot” scams, signal providers, fake Expert Advisors, and others.

Signs You Might be Dealing With Forex Scammers or a Forex Scam

Forex scams are becoming more common lately, and even the most experienced trader can fall victim to them. When participating in the forex market, spotting potential forex scam red flags is paramount. Our experts highly advise you to stay on the lookout for the following:

Boasting with forex trading lifestyle images

Social media channels are rife with images, videos, posts, and other content portraying ‘’successful’’ traders living exorbitant lifestyles, including spending a lot of money, driving fancy cars, and living or traveling to exotic locations.

Exorbitant Guaranteed Profit Claims

Whenever forex brokers, trading platforms, or services promise higher-than-normal returns with little to no risk, this should ring all alarm bells. There is no single investment that is entirely risk-free, including forex trading. Whenever exorbitant guaranteed profit claims are made, be sure to remember the saying: ‘’If something sounds too good to be true, it probably is.’’

Requests for Deposits Upfront

Never transfer any funds to a broker, trader, or other forex service claiming they can consistently make you money, especially when they use high-pressure sales techniques. Some forex scammers might offer exclusive trading signals and other forms of insider information.

Remember that trustworthy and reliable forex brokers will never ask you for any funds up front and have transparent commission and fee structures in place. Additionally, reputable forex firms do not promise returns that are too good to be true.

Common Forex Scams Nowadays

There are many forms of forex scams going on nowadays, with the most common ones being:

- Forex Mutual Fund (PAMM Scams) – PAMM or Percentage Allocation Money Management Forex scams involve fraudsters pooling investors’ money to manage them. The fund managers lack qualifications and aren’t overseen by any regulatory institution. These Forex mutual fund PAMM scams can result in significant losses for those unaware of their inner workings or existence.

- Forex Trading Signal Scams – Trading signals are buy-and-sell recommendations from so-called signal providers that aim to make users execute trades at specific dates, times, and prices. Although there are trustworthy forex signal providers, these are rare, and fraudulent services using excessive marketing and fake testimonials are rampant nowadays. The forex trading signals might not be of great quality or simply copied from a different source or multiple sources.

- Expert Advisor or Trading Robot Scams – Automated trading software, also called Expert Advisor software, often promises facile profits with minimal risk. Forex scammers sell automated forex trading robots that underperform or do not work, defrauding users of their deposited funds and racking up commissions for the connected (fraudulent) broker(s).

- Guaranteed Returns Forex Scams – Guaranteed returns in the forex world are one of the oldest forex scams known. The scammers claim that they have some trading strategy, system, or software that guarantees a certain amount of profit, which can never be true as there is no such thing as guaranteed returns in forex trading.

- Forex Price Manipulation Scams – Fraudulent forex brokers may conduct market manipulation and trigger stop-loss and take-profit orders earlier than they should, making traders’ profits unprofitable. Our experts highly recommend trading with regulated and licensed brokers that charge low, transparent spreads, commissions, and other trading and non-trading fees.

- ‘’Holy Grail’’ Forex Scams – Several forex scammers claim to have found a consistently profitable trading strategy that works nearly perfectly. Most scammers sell forex educational courses, software, or seminars to beginner and inexperienced traders. Trading and investing always involve risk, and there is no winning strategy that always works.

- Extremely High Leverage Forex Scams – There are scam and rogue forex brokers that offer beginner traders extremely high leverage ratios. These traders think they will quickly amplify their gains, but their losses will also be magnified. When looking at a forex broker’s terms and conditions, always check their stances and policies on leveraging and margin.

- Client Funds Kept in Unsegregated Bank Account Scams – Legitimate forex brokers keep their clients’ funds segregated from their operating funds. Scam and rogue brokers who don’t do this risk or use their clients’ funds to fund their business operations.

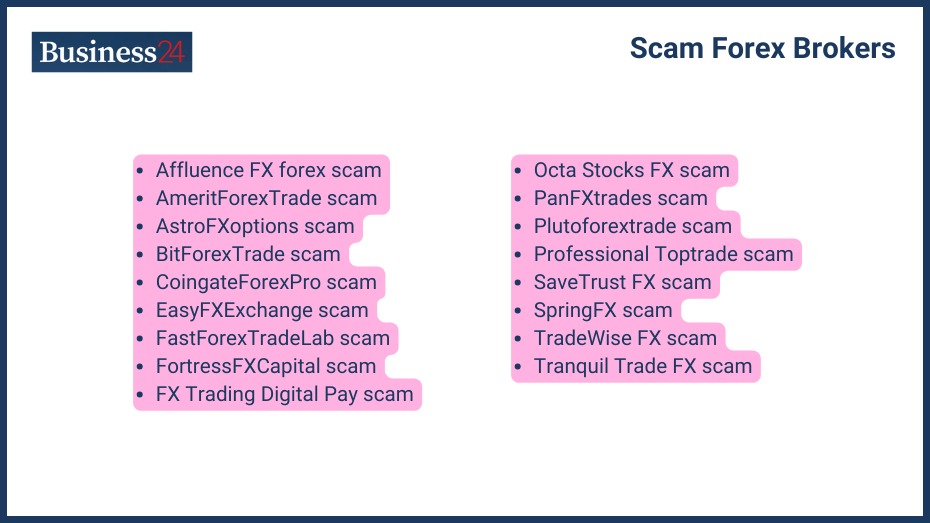

Blacklist of Scam Forex Brokers 2024

Below, our experts will provide you with our list of scam forex brokers, updated for 2024. We have done extensive research and due diligence about these brokers and trading platforms, allowing our visitors to make well-informed decisions before signing up, depositing, and trading with a broker, service, or platform.

Scroll below and we have provided an overview of their fraudulent terms and conditions to see exactly how they scam their users. Additionally, you can review their customer feedback and complaints, along with any company dissolves information. Here is the complete list followed by the detailed review.

- Affluence FX forex scam

- AmeritForexTrade scam

- AstroFXoptions scam

- BitForexTrade scam

- CoingateForexPro scam

- EasyFXExchange scam

- FastForexTradeLab scam

- FortressFXCapital scam

- FX Trading Digital Pay scam

- Octa Stocks FX scam

- PanFXtrades scam

- Plutoforextrade scam

- Professional Toptrade scam

- SaveTrust FX scam

- SpringFX scam

- TradeWise FX scam

- Tranquil Trade FX scam

The AffluenceFX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

AffluenceFX promised its users minimum profits of tens of thousands of dollars a month and an astonishing 98% win rate. From the broker’s website, you see that it claims that traders can just sit back, do nothing, and watch their trading capital grow. These claims are usually big red flags, indicating you are dealing with a forex scam.

AffluenceFX isn’t regulated by any financial regulator and has been flagged on the FCA warning list. Naturally, our experts do not recommend opening an account, depositing funds, and trading with AffluenceFX.

The AmeritForexTrade Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

AmeritForex claimed that users could generate a significant return on their investment and that they are guaranteed the aforementioned funds. These exaggerating claims damage the forex industry and are, in most cases, a scam.

AmeritForex is not regulated by any Tier-1, 2, 3, or 4 financial regulators or watchdog, and our experts certainly do not recommend signing up, depositing, or trading with the broker.

The AstroFXoptions Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

AstroFxOptions used to claim that traders would instantly start making money whenever they would start trading on its trading platform. There were several ‘’investment plans’’ available, each guaranteed too-goo-to-be-true returns.

A licensed, regulated, and trustworthy broker would not claim guaranteed and significant profits. AstroFXOptions is not regulated by any financial regulator and is on the FCA warning list; our experts strongly advise traders not to sign up, deposit, or trade with this broker.

The BitForexTrade Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Just like AstroFXoptions, BitForexTrade claims to guarantee high weekly and monthly returns at thousands of percent. All these imaginary profits are so-called ‘’guaranteed’’ and ‘’high ROI’’.

In most cases, these claims are red flags that show traders that they are probably facing a forex scam. BitForexTrade is not regulated by any financial regulator and is listed on the FCA’s warning list for unauthorized market-making and offering brokerage and investment services.

The CoinsgateForexPro Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the CFTC Watchlist. |

| Unbalanced Claims | Yes |

CoinsgateForexPro promises traders and investors guaranteed profits as high as $4,000 weekly by trading with $500. Again, this claim should be an obvious red flag and indicate that you are facing a forex scam. Currently, it is on the CFTC’s RED watchlist, so our experts highly discourage you from opening an account with them.

The EasyFxExchange Scame

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

EasyFxExchange tells traders and investors to invest ‘’whatever money they can’’ to ‘’easily make money online trading forex.’’ The broker guarantees daily gains of over 100% and states users who have invested a couple of hundred dollars are now multi-millionaires.

EasyFxExchange is not regulated or licensed by any financial regulator and has recently been added to the FCA’s watchlist. For this reason, our experts do not recommend signing up or trading with EasyFxExchange.

The FastForexTradeLab Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

FastForexTradeLab made highly doubtful claims that traders and investors could make between 80% and 90% guaranteed daily profits using their system. The broker offered several trading accounts that advertised significant introductory bonuses with a high leverage ratio.

Ever since these kinds of business practices were discovered, FastForexTradeLab has been listed on the FCA watchlist for unlicensed brokerage business practices.

The FastSecureFX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

FastSecureFX is another broker that advertises ‘’consistently profitable’’ trades and offers several account types to traders and investors looking to auto-trade or copy-trade the financial markets. One of the most significant red flags indicating that FastSecureFX is a scam broker is that the profit claims increase as the potential user’s first deposit does.

Additionally, FastSecureFX is an unregulated and unlicensed broker featured on the FCA regulator watchlist. For this reason, our experts do not recommend trading with them or purchasing any of their offered accounts.

The ForexCapitalGain Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the CFTC Watchlist. |

| Unbalanced Claims | Yes |

ForexCapitalGain joins a long list of scam forex brokers by encouraging users to ‘’invest’’ in one of their offered packages that guarantee a certain amount of profit yearly (APY). On top of this, the broker falsely stated that it was licensed and regulated by the CFTC.

Logically, our experts do not recommend trading or ‘’investing’’ in or with ForexCapitalGain.

The ForexTradePlatform Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

ForexTradePlatform is another scam forex broker that claims to place over 90% profitable trades for its users on complete auto-pilot. Again, minimum expected profits are promised, and these claims are obviously extreme red flags, indicating a forex scam.

ForexTradePlatform is an unregulated forex broker that is featured on the FCA wanted list as of the writing of this scam forex brokers guide. Naturally, our experts do not recommend opening an account with them.

The FortressFXCapital Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

FortressFXCapital advertised for a significant amount of time with ‘’profitable working conditions’’ for all its users. Included in this promise were guaranteed profits. These are obvious red signals that one is dealing with a forex scam, combined with the fact that FortressFXCapital is operating unregulated and unlicensed and on the FCA’s warning list, our experts do not recommend trading with them.

The FX Trading Digital Pay Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

FX Trading Digital Pay was one of those scam forex brokers that claimed it could reduce your overall risk rating and provide you with guaranteed returns, either as a trader or long-term investor. The broker promised that users’ accounts would grow overnight and gain significant returns.

FX Trading Digital Pay has always been an unregulated broker and has recently been added to the FCA watchlist, indicating one shouldn’t open an account, deposit, or trade with this broker.

The Octa Stocks FX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Octa Stocks FX promised its clients guaranteed profits and easily attainable ‘’bonus targets’’.The broker gave the impression that users could only win using their trading platform. Additional false claims were those of having insured clients’ funds, which wasn’t the case.

Since then, OctaStocks FX has been on the FCA warning list. Our experts do not recommend trading with this broker.

The panfxtrades Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

panfxtrades was a forex trading service provider that falsy promised guaranteed trading profits and claimed to be a 100% reliable broker. We highly recommend checking the validity of a broker or trading platform’s license before you decide to open a demo or live account with it.

Additionally, Pandafxtrades appears on the FCA warning list, indicating that it is a scam forex broker from which one should avoid at all costs.

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Plutoforextrade was a forex and CFD broker that claimed traders and investors could make significant profits within as little as 48 hours. Plutoforexctrade also claimed users could not lose money despite not having any regulatory license in place.

Ever since more traders and investors discovered it, the firm has been listed on the FCA warning list, and traders should avoid trading with it.

The Professional Toptrade Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Professional Toptrade is a forex and CFD broker that provides users with multiple accounts that are ‘’guaranteed to make a profit.’’ Additionally, our experts found their advertised 80-90% profitability win rates to be exceptionally high.

Another red flag is the fact that Professional Toptrade advertises to everyone and states that new users do not need prior experience trading the financial markets at all. Professional Toptrade is an unregulated broker on the FCA warning list, and we recommend trading with them.

The Savetrust FX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Although the name suggests otherwise, Savetrust FX is a crypto investment services program that guarantees certain profits through leveraged day trading. It fails to adhere to the strict promotion of CFD products by not telling its users about the involved risks or asking for their prior trading experience.

Another illegal practice by Savetrust FX is promising its users a guaranteed weekly income. The broker is currently completely unregulated and on the FTC warning list, indicating it cannot be trusted.

The SpringFX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

SpringFX is an investment strategies firm that claims to sell risk-free trading products. One should not use trading software, brokers, or platforms promising risk-free trading results. One particular red flag, in this case, is the usage of higher guaranteed percentage returns the higher one would deposit.

Spring has never been regulated and is one of the forex brokers that currency is on the FCA warning list.

The TradeWise FX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

TradeWise FX is a forex broker that targets beginner traders, promising them forex trades with an 80% to 90% probability of being profitable. Like the other scam forex brokers on our list, TradeWise FX advertises guaranteed profits, is unregulated, and is currently on the FCA watchlist.

Trusting any forex firm, software, or service that claims a high profitability rate over the short or long term is inadvisable.

The Tranquil Trade FX Scam

| Tier-1 Licenses | 0 |

| Tier-2 Licenses | 0 |

| Tier-3 Licenses | 0 |

| Tier-4 Licenses | 0 |

| On Regulator Watchlist | Yes, on the FCA Watchlist. |

| Unbalanced Claims | Yes |

Tranquil Trade FX was another forex broker that thought selling trading accounts with guaranteed profits was a good idea. In addition, it operated without a valid regulatory license and thus ended up being listed on the FCA warning list.

Our experts do not recommend signing up, depositing, or trading with Tranquil Trade FX.

The Reasons Why Forex Brokers are Regulated and What You Should Know

Earlier in this guide, our experts covered forex broker regulations. However, in this part, they will outline the reasons forex brokers are regulated in the first place and what you should know before entering the wonderful world of the financial markets.

The global foreign exchange (forex) markets have a legislative framework that defines each market participant as a certain regulatory company. So-called financial regulators oversee the international currencies and stock markets and their participants.

These financial regulators check whether brokers are licensed and conduct business properly within the forex markets and whether they comply with the strict rules set out by the particular financial regulator.

Note that most scam forex brokers on our list aren’t regulated as they are illegally operating in the first place. Although forex bucket shops and pyramid schemes can be used legitimately within the trading space, they are considered fraudulent by financial regulators.

The level of a broker’s regulation says a lot about a broker and can be used to gauge its reliability and trustworthiness. Each financial regulator has its own way of overseeing the markets and its participants.

Great forex brokers are fully transparent, have enough cash flow and capital to handle their client’s trades, deposits, and withdrawals, have multiple licenses, and have technically superior trading platforms.

In the trading world, we separate Tier-1 regulators from Tier-2 and Tier-3 regulators based on whether they oversee local or international markets. Some of the most prominent forex market financial regulators are:

- FCA – The Financial Conduct Authority regulates the UK financial markets and participants.

- CySEC – The Cyprus Securities and Exchanges Commission regulates the European financial markets and its participants.

- ASIC – The Australian Securities and Investments Commission oversees the Australian and Oceanic financial markets and its participants.

- DFSA – The Dubai Financial Services Authority regulates UAE and Dubai-based forex market participants.

- IFSC – The Belize International Financial Services Commission is an offshore financial regulator that oversees all financial activity in Belize.

- FSC – The Mauritius Financial Services Commission ensures that all financial market transactions are conducted fairly in Mauritius, another popular offshore forex brokerage firm jurisdiction.

- SCB – The Securities Commission of the Bahamas oversees all financial activity in the offshore banking haven.

- MAS – The Monetary Authority of Singapore is the Central Bank of the country, promoting economic growth and overseeing its financial center.

Brokers featured in our list may offer, lease, or sell services that deceive traders and investors, falsely claiming regulation by non-existent regulators. Always confirm the actual existence of any regulator and authenticate the legitimacy of their licenses and logos.

How to Test if a Forex Broker is Reliable in 2024

There are multiple ways to test whether a forex broker is reliable in 2024. Examples include asking yourself whether the broker is regulated, whether it is a widely known name or an unknown broker, whether the chat support responds quickly, and whether you can find positive feedback about the broker online and offline.

The 5 Criteria of Scam Forex Brokers

Five criteria determine whether a forex broker can be trusted, including lack of regulation, unrealistic promises, withdrawal issues, manipulation of trading platforms, and a general lack of transparency.

- Lack of Regulation – Most scam forex brokers lack any form of regulation, meaning that they are not overseen by financial regulators like the Financial Conduct Authority (FCA), the Cyprus Securities and Exchanges Commission (CySEC), or the Australian Securities and Investments Commission (ASIC).

- Unrealistic Promises – Scam forex brokers usually make unrealistic promises, claiming their users can outperform the markets if they invest or trade with them.

- Withdrawal Issues – Most rogue brokers try to find all sorts of excuses for not processing their users’ withdrawal requests.

- Manipulation of Trading Platforms – Scam brokers often use flawed trading technology, manipulating users based on what they see on the trading platforms. This leads to unrealistic pricing, slippage, and larger-than-usual losses in general.

- Lack of Transparency – Scam forex brokers are often not transparent, hiding crucial trading fees, performance, and platform information from their users.

The Top 10 Regulated Forex Brokers in UAE and Dubai in 2024

Our experts have selected 10 top-tier regulated forex brokers classified as the best in their category. Each broker has been thoroughly tested and received positive feedback from our experts and clients.

We advise trading with a licensed and regulated broker only to avoid becoming a victim of a forex scam.

| Broker | Regulated by | Minimum Deposit | Our Review | Start Trading |

| AvaTrade | ASIC, FSCA, FSA, FFAJ, FSRA, ISA, DFSA | $100 | Read Review | Open Account |

| eToro | CySEC, FCA, DNB, AMF, DASP, OAM, MFSA, ADGM, FSRA, ASIC, FSAS, FinCEN, SEC | $100 | Read Review | Open Account |

| MultiBank | ASIC, AUSTRAC, BaFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC | $50 | Read Review | Open Account |

| Plus500 | CySEC, FCA, ASIC, MAS | $100 | Read Review | Open Account |

| IC Markets | CySEC, ASIC, FSA | $200 | Read Review | Open Account |

| ActivTrades | FCA, CSSF, SCB, CMVM | $0 | Read Review | Open Account |

| Interactive Brokers | SEC, FINRA, NYSE, FCA, CFTC | $1 | Read Review | Open Account |

| IQ Option | CySEC | $10 | Read Review | Open Account |

| XM | ASIC, CySEC, IFSC | $5 | Read Review | Open Account |

| Pepperstone | FCA, BaFin, CySEC, ASIC, DFSA, CMA, SCB | $0 | Read Review | Open Account |

Frequently Asked Questions About Fake Trading Websites in UAE

Our experts regularly receive questions about fake trading websites. As we want our guides to be as inclusive as possible, we shall answer these questions in the section of our Scam Brokers: List of Fake Trading Websites UAE (2024) below.

Are there fake forex brokers?

Yes, there are definitely fake forex brokers. For this reason, we recommend doing extensive due diligence and contacting the Securities and Commodities Authority (SCA) to check the validity of a broker’s license.

Is forex trading banned in the UAE?

No, forex trading is not banned in the UAE. It is completely legal for UAE- and Dubai-based residents to trade in international foreign currency markets.

Which brokers are not legit?

Our experts have identified the brokers 24FX, 24options, 4XP, 770capital, and Absolute Markets as unlicensed.

What to do if you get scammed by a forex broker?

If a forex broker has scammed you or think you have been, you should file a complaint with the Securities and Commodities Authority (SCA).

For Admitad 08.05.2024

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.