A bond yield represents the return an investor earns from a bond. In simple terms, it is the return on the capital invested by the investor.

Definition of Bond Yields

A bond is a loan to a government or private entity (issuer) over a fixed period. The interest on a bond is called a coupon rate, and bond investors receive it regularly over time until the bond matures and they get back their original money.

Bond yield is the promised return on investment an investor gets when they hold a bond for the stipulated time period. It is basically a measure of the annualized return rate if investors hold a bond till its maturity date.

Importance of Bond Yields in Finance

Bond yields are important metrics for both issuers and investors who are operating in the bond market. Each of them views the bond yield differently so a successful bond is subjective.

For issuers:

- The issuers want to have as low an interest rate as possible to reduce the bond’s upkeep. This helps reduce borrowing costs and makes things competitive among issuers.

- Bonds help improve the government’s credit perception. International monetary organizations keep a close tab on the country’s credit history and its ability to successfully carry out borrowing activities with the help of bonds.

For investors:

- From a lender’s point of view, bond yield needs to be as high as possible to maximize returns. However, the government’s job is to keep it as low as possible so they both achieve a compromise based on the market conditions and other factors.

- Bond yield performs inversely to interest rate changes. When interest rates increase, the appeal of existing bonds lowers and vice versa. Bond market investors need to be aware of the outlook of interest rates around the world and make decisions accordingly.

- Investors don’t always go for a bond with the highest yield. At times, the bond with a higher yield is riskier so it all comes down to the risk tolerance and strategy of the investor.

- For most investors, bonds are a means to an end and not an ultimate investment instrument. They can help provide small yet guaranteed passive returns for investors, and the original amount is protected for a certain amount of time. However, due to the uncertain economic situation, bonds can also come under threat.

How Bond Yields Work

Basic Concepts of Bond Pricing and Yields

Bond pricing is defined as the price a new buyer has to pay to get hold of a bond in the secondary market. Bonds, like other financial instruments, can be bought or sold in the markets as investors seek to diversify their exposure to the bond market. Because of the fluctuating interest rates, bond pricing is dynamic overall.

Factors affecting bond prices include:

- Prevailing interest rates inversely affect the bond prices. These rates are set by the country’s central bank. If they increase, the bond price actually comes down as capital holders can invest in new bonds with higher interest rates than in these examples. When interest rates fall, the price of existing bonds increases as they are now more valuable because of the higher fixed rate. When bond prices fall, they are at a discount, and if they rise, they are considered to be at a premium.

- Credit Score: Every country or company has its own credit score as well. This affects bond pricing considerably as high-risk bonds even with higher yields aren’t viewed well by the market.

- Bonds with longer maturity periods are often considered more risky because of the increased risk of exposure to interest rate fluctuations. To compensate for this, the issuer often has to pay a higher interest rate.

Yield to Maturity (YTM) Explained

YTM, in simple terms, is an Internal Rate of Return (IRR) for your involvement with the bond. It takes into account all the periodic payments as per the coupon rate and the face value repayment (your principal investment).

YTM is dynamic as bonds change hands all of the time, and because of interest rate fluctuations, the bond pricing can also change significantly. If the bond is changing hands at a discount because of increasing interest rates, YTM is higher as investors receive higher coupon rates and also the full face value. However, if the interest rate decreases, YTM will be lower than the agreed coupon rate, and you forgo full face value at the end of the bond, so you get to receive higher returns for the rest of the maturity period.

Current Yield vs. YTM

Current Yield is defined as the annualized rate of return for a bond. It basically is the ratio of the coupon rate and the current value of the bond in the market. Current Yield is a short-term way of looking at things and is more suitable for such players.

YTM, on the other hand, considers the rate of return for the entire length of the maturity period remaining on the bond. It also takes into account the principal investment, i.e., the value the original bond investor paid for the financial instrument. The face value doesn’t change with time, and YTM is a useful measure of bonding.

Factors Affecting Bond Yields

Bond yields are dependent on a variety of factors. They include:

Interest Rates and Monetary Policy

Both current yields and YTM are affected directly by a state’s interest rates. If interest rates remain static for long times, yields remain generally steady as well. If the policy rate increases, the yields on new bonds become more attractive, thus rendering older bonds and their lower coupon rates less feasible. Rate cuts, on the other hand, can render existing bonds more lucrative and trigger a decline in yields on new bonds.

Inflation Expectations

The primary indicator for any changes in bond yields is the interest rate. But, the interest rate itself depends on several closely related factors like inflation rate and employment figures. Interest rates are increased to control inflation in a country and they render older bonds less feasible. On the other hand, a rate cut is fueled by low inflation figures and bond yield increases because of that, rendering older bonds more valuable.

Credit Risk and Credit Ratings

While bonds are generally considered a much safer bet for capital players, the risk of issuer default, even if low, is considerable. Governments in the developing world often have higher coupon rates/yields and that attracts bond investors but the risk is present there. On the other hand, issuers with better credit standing have low yields but they have a better credit rating overall.

Economic Indicators

Several key indicators are also important factors that affect bond yields. They include:

- Supply and demand: The sudden increase in the supply of new bonds will affect older bonds and their yields negatively. Similarly, a sudden decrease in the supply of new bonds will affect existing bonds more positively.

- Liquidity: As a general rule, bonds with greater acceptability in resale have greater liquidity. This means that they have plenty of buyers from around the globe, while bonds with lower acceptability have low liquidity, which means they are more difficult to trade across the counter. Liquidity also affects bond yields.

The Yield Curve

Definition and Importance of the Yield Curve

A yield curve is a useful tool to compare bonds with different maturity rates. To keep things simple, the credit ratings of the bonds are kept similar and the focus is on finding the future of bonds in comparable markets.

A yield curve is plotted on the graph with maturity on the X-axis and yield on the Y-axis. The slope of the yield curve can help predict future economic activity, inflation, and interest rates in countries.

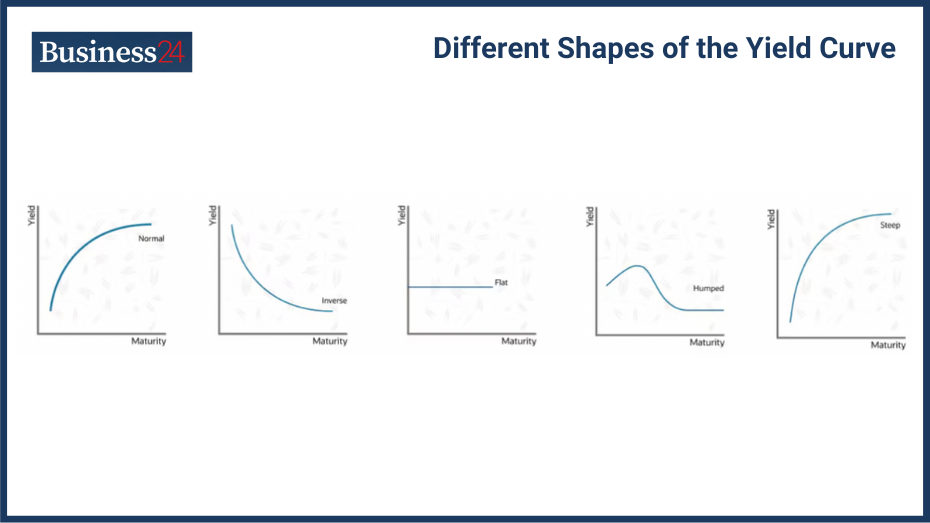

Different Shapes of the Yield Curve:

A normal yield curve or a positive yield curve is when yields continue to increase with time as the maturity draws nearer. The basic idea of this type of curve is short-term yields are lower and long-term yields are higher. This is what is normally observed in the bond markets and a sign of a stable outcome. Long holdings should result in higher yields and short-term holding should result in smaller yields.

Inverted Yield Curve

An inverted yield curve is entirely opposite to a normal yield curve. In this scenario, the short-term yield is actually bigger than the long-term yield. This is not a normal situation and a big cause of concern for investors as to why is the bond market behaving like this. It normally happens when bond investors are worried about the future of the economy or worse, a potential financial crunch situation.

Flat Yield Curve

A flat yield curve is when the upward curve of the slope flattens out considerably so there is not a lot of difference between holding it for the short-term or the long-term. This kind of yield behavior in the bond market is when either the market is entering volatility with short-term yields rising or long-term yields declining or both happening at the same. The upward slope in this case flatlines considerably and that is where it got its name.

Factors Influencing the Shape of the Yield Curve

The shape of the yield curve is influenced by:

- Change in policy rates by the government

- The overall economic situation

- Liquidity risk

Types of Yield Curves

Spot Yield Curve

The spot yield curve is witnessed in the case of a zero-coupon bond. This is a type of bond in which no periodic payments are made to the bond’s buyer. Instead, a lump sum payment is made at the end of the maturity date. This is why the yield is only applicable at the end of the bond’s time period.

Forward Yield Curve

This is a different kind of yield curve as it compares a bond’s short-term yields against long-term yields. This means that instead of looking at it from a maturity perspective, it tries to determine directly whether it is feasible to go in on the long-term or the short-term.

Par Yield Curve

A par yield curve is the relationship between a bond’s eventual value at maturity and its maturity. It is used in fixed-income scenarios. The market price remains the same as the actual value of the bond at maturity.

Zero-Coupon Yield Curve

The zero coupon yield curve as the name suggests is used to understand a zero coupon bond. It is basically the relationship between the spot rate and a bond’s maturity. It is basically the measure of the IRR an investor will receive if they decide to buy the bond.

The Role of the Yield Curve in Economic Analysis

Yield Curve as an Economic Indicator

Yield curves are important economic indicators and often come in handy for economists while predicting the future of the economic situation.

Relationship Between Yield Curve and Economic Cycles

In a normal scenario, a positive or normal yield curve is witnessed, but if things start to get problematic, we might see a flatline curve before the graph is forced downwards as investors get nervous.

Predicting Recessions with the Yield Curve

Perhaps the most important giveaway of a recession is the presence of an inverted yield curve for bonds. This is when investors start panicking and selling bonds at discount rates, jeopardizing the curve’s normal existence. This usually starts with challenging economic indicators and outlooks.

Practical Applications of Yield Curves

Bond Investment Strategies Based on the Yield Curve

Depending on the type of the yield curve, investors can plan their strategies accordingly.

Risk Management and Portfolio Diversification

While bonds are a generally safe bet, the biggest risk associated with them is default. This is when issuers are unable to achieve their bond commitments.

In a normal yield curve scenario, investors can employ the following strategies:

- The total return approach disregards short-term bond prices and focuses on eventual gains for capital appreciation. By strategically selecting strong bonds with predictable outcomes, investors can increase their worth methodically.

- The immediate-term approach uses a medium-term approach by focusing on 3-7-year bonds with healthy returns.

- The laddered approach involves mixing bonds of various maturities and creating a ladder in which returns are received periodically. This eliminates some time-bound risk for regular returns.

In a flat yield curve, investors can use the following strategies:

- Short-term bonds involve investing in situations with less than three years of maturity. This is done to minimize risks to interest rate volatilities, especially when they increase and negatively affect the contemporary bond market.

- High-quality bonds involve bonds issued by the highest-ranking authorities including stable governments. These offer much lower coupon/interest rates but at least they are secure.

- Alternatives include moving beyond the bond market and investing in other financial instruments.

In an inverse yield scenario, investors can use the following strategies:

- Exercise caution in the bond market as a recession could lead to significant losses or even risk of defaults.

- Inflation-protected instruments from treasuries as they guarantee some gains despite the overall market situation.

Case Studies and Real-World Examples

Historical Analysis of Yield Curves During Different Economic Periods

Normal yield curves showcase healthy economic growth over time. The American economy grew steadily during the 80s and the 90s, and a normal yield curve was observed during this time. Bond investors had a busy two decades as the economy grew like clockwork. However, the situation can change over time.

The US recession of 1990 and 2008 witnessed inverse yield curves and resulted in major problems in the bond market. Investors rushed to get their investments out but many of them failed resulting in a government bailout for the banks.

Impact of Monetary Policy Changes on the Yield Curve

In every country there is a central bank that determines the monetary policy or interest rate. They use this rate to influence the bond market which in turn directly affects the overall economy. Lowering interest rates improves the bond market and the yield curve improves while a high interest rate can decimate the existing bond market and create uncertainty for the future.

Tools and Resources for Analyzing Bond Yields

Online Yield Curve Tools and Calculators

Popular tools for yield curve analytics include:

- DailyFx

- Treasury Curve Tracker on iOS

- Fioria Apps Reference Library

Software and Applications for Bond Analysis

Educational Resources for Further Learning

Additional Resources and Further Reading

Recommended Books and Articles on Bond Yields and Yield Curves

Bond Pricing and Yield Curve Modeling: A Structural Approach by Riccardo Rebonato

Article on ACCA Global

Article on Investopedia

Online Courses and Tutorials

Courses on Udemy

Courses on Coursera

Research Papers and Market ReportsEFFECTS OF BOND’S INTEREST RATE, RATING, AND MATURITY TIME TOWARD BOND’S YIELDS by Manajemen Bisnis

Analysis of Long-Term Bond Yields Using Deviations from Covered Interest Rate Parity by Gab-Je Jo

Are high bond yields good or bad?

In principle, higher yields are lucrative in bonds. However, investors have to keep in mind that higher yields may come with higher default risks and their entire investment could be wasted.

Is bond yield the same as interest?

Bonds offer passive returns like interest but they are fundamentally different from each other. Bond yield signifies the passive returns accrued plus the principal amount as maturity progresses. Interest is only the gains made through lending activities.

Why do bond prices fall when yields rise?

When yields rise, the bond prices fall and vice versa because the coupon rate remains the same. Secondary bond markets fluctuate as investors move money in and out of the system.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.