A cryptocurrency wallet is a software program that stores your cryptocurrency keys and lets you access your coins. Discover how crypto wallets work.

A crypto wallet is a software program that allows you to store your cryptocurrency keys so you can access your coins whenever you want. In traditional wallets, you store physical cash, but the crypto wallet does not hold your cryptocurrency itself; it only holds the cryptographic keys that grant access to your cryptocurrency holdings on the blockchain.

Cryptocurrency and blockchain technology have changed the financial landscape, and crypto-wallets play an important role. In this guide, we will discuss crypto wallets in detail, so if you are a beginner in the crypto world, you have come to the right place.

What is the Definition of a Crypto Wallet?

You can say a crypto wallet is a medium to reach your crypto. It is like a device or software that stores your cryptographic keys. Cryptographic keys help you access your crypto to send or receive them.

When you buy crypto, for example, Solana, you get two keys, a public and a private; you can share the public key, which is like an account number for your cryptos, and the private key is like a password to your account. Your crypto wallet works as the storer of these keys. You can send or receive crypto in your account with the help of these keys.

Another important thing is that if you lose your private key, you will lose your coins. Don’t share it with anyone, and keep it safe. There are mainly two types of crypto wallets: online and offline; under offline crypto wallets, we have hardware and paper wallets, and under online crypto wallets, we have mobile, web, and desktop wallets.

Types of Crypto Wallets

Types of crypto wallets are:

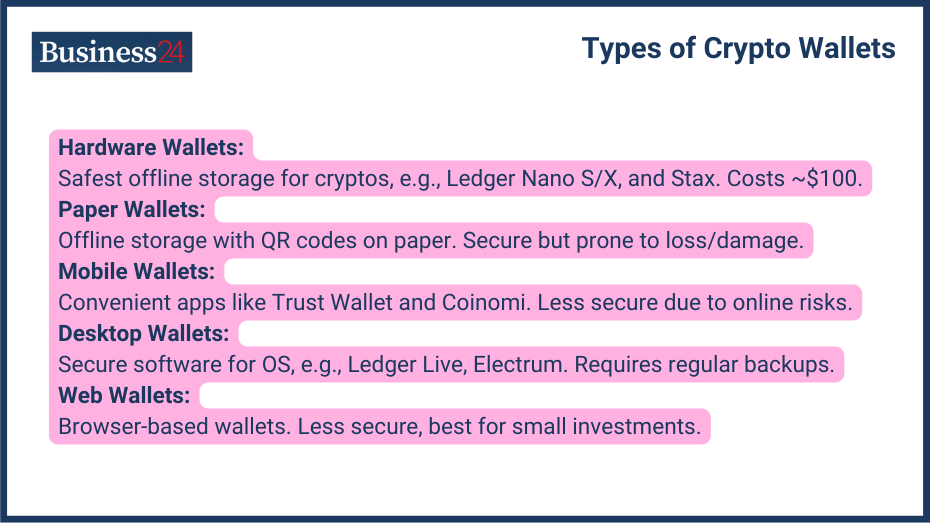

Hardware Wallets

Hardware wallets are considered the safest form to store your private keys or indirectly to store your cryptos. Hardware wallets are considered safe because they are not connected to the internet, reducing the risk of hacks.

Hardware Wallets look like USB drives. This device doesn’t need a battery and can connect to a PC, allowing you to use it with desktop apps. It costs $100 but provides great security. Popular hardware wallets are Ledger Nano S, Ledger Nano X, and Ledger Stax.

Paper Wallets

Paper wallets are another form of cold. It is a physical document containing your public and private keys printed in QR code format. They offer offline storage but can be vulnerable to loss, damage, or theft if not stored properly.

They were famous as offline crypto wallets before the hardware wallets came into play. With a paper wallet, you are not allowed to send partial funds. A paper wallet can be used as an offline wallet, but precautions are necessary.

Mobile Wallets

These are the most used crypto wallets because of their easy access and low cost, but they are considered less secure because of online hacks and scams. A mobile wallet is a digital application you can install on your mobile device. These are good for daily operations but must be used more carefully. Some examples are Trust Wallet and Coinomi.

Desktop Wallets

Desktop wallets are software packs that can be installed on operating systems. Instead of keeping cryptocurrencies on an exchange, use desktop wallets for bitcoins. If you are using an online wallet, desktop wallets are the best in terms of security and have become more popular over time.

Desktop wallets are user-friendly, provide privacy and anonymity, and don’t involve third parties. Regular computer backups are necessary. Popular desktop wallets are Ledger Live, Bitcoin Core, Electrum, etc.

Web Wallets

Crypto web wallets are digital wallets that allow you to store, manage, and transact cryptos through a web browser. These are less secure and should be used for small investments.

Do I own my crypto on Ledger?

Yes and no, because in the ledger, you own the crypto keys, not the coins. Crypto keys will lead you to your coins! Ledger wallets simply store your private keys. You retain complete ownership and control of your digital assets.

How do I get my crypto Ledger?

How to Get Your Crypto on Ledger:

- Purchase a Ledger Device: Choose the hardware Ledger model that you want according to your needs.

- Download and Install Ledger Live: After you have purchased the ledger device, you have to install Ledger Live to manage your ledger device.

- Set Up Your Ledger Device: Set up your ledger device and private pin for security.

- Transfer Crypto to Your Ledger Wallet Address: The Ledger will generate a unique address for each cryptocurrency you want to store. Send your cryptocurrency from an exchange or another wallet to this address.

Is it worth getting a Ledger for crypto?

Definitely! Getting a Ledger device will cost you some money, but it is worth the investment. Ledger devices are the safest crypto wallets and are less prone to hacking and scams.

How Does a Crypto Wallet Work?

Crypto wallets use a combination of cryptographic keys and addresses to ensure secure storage and transfer of your digital assets. Crypto wallets generate a unique public address for each cryptocurrency you want to receive. This address is where you would send cryptocurrency from an exchange or another wallet. Your private key is used to sign the transaction, prove ownership, and authorize funds to be transferred from your wallet.

When you initiate a cryptocurrency transaction, your wallet uses your private key to cryptographically sign the transaction. This signature verifies your ownership and authorization for the transfer. The transaction is then broadcast to the blockchain network for miners to validate and add it to the public ledger.

Also, It’s important to understand that cryptocurrencies themselves are not stored within the wallet. Your wallet stores the cryptographic keys that grant you access to your holdings on the blockchain.

What are the Benefits of Using a Crypto Wallet?

Benefits of using a crypto wallet:

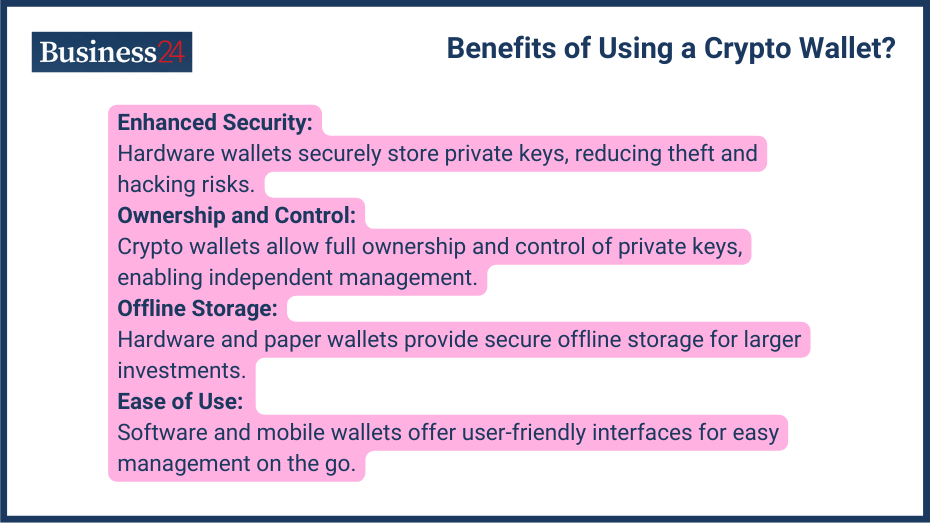

- Enhanced Security: Crypto wallets, especially hardware wallets, offer a significant security advantage compared to online storage options. By securely storing your private keys, they significantly reduce the risk of theft or hacking.

- Ownership and Control of Private Keys: With a crypto wallet, you retain complete ownership and control of your private keys. This empowers you to manage your cryptocurrency holdings independently without relying on third-party providers.

- Offline Storage (Cold Wallets): Hardware wallets and paper wallets are used for offline storage, also known as cold storage; these offer an additional layer of security by keeping your private keys isolated from the internet. These are highly secure compared to other wallets and can be used for mid to large investments.

- Ease of Use and Accessibility: Many software and mobile wallets offer user-friendly interfaces, making it convenient to manage your cryptocurrency holdings on the go!!

What are the Risks and Challenges of Using a Crypto Wallet?

Risks and challenges associated with using crypto wallets:

- Potential for Loss or Theft of Private Keys: Once you lose your private key, you cannot access to your crypto again. It is a risk with crypto wallets that you might forget your private keys or get scammed if you share them.

- Hardware Failure and Recovery: Hardware wallets can malfunction or be damaged, and recovery can be difficult. So, make sure you understand the recovery process for your specific hardware wallet model in case of such an event.

- Security Risks of Online Wallets: Online wallets are convenient but pose a higher security risk as you entrust your private keys to a third-party provider. For larger cryptocurrency holdings, use hardware wallets.

- Complexities for Beginners: Understanding cryptographic keys and wallet functionalities can be challenging for beginners. Start with small amounts and educate yourself before venturing into larger investments.

What are the Best Practices for Securing a Crypto Wallet?

There are always risks associated with crypto wallets. Here are some practices you can use to secure your crypto wallet:

- Creating Strong Passwords: Create unique and complex passwords for your wallet and associated applications so they can save you from theft and scams. Also, do not use a single password for many platforms.

- Enabling Two-Factor Authentication (2FA): Activate 2FA on your wallet and any exchange accounts you use. This adds an extra layer of security by requiring a second verification code when logging in.

- Regular Backups of Wallet Data: For software wallets, create regular backups of your wallet data and store them securely offline. This allows you to recover your funds in case of device failure.

- Safe Storage of Recovery Phrases: Hardware wallets typically use recovery phrases to restore access. Write down your recovery phrase and store it securely offline in a fireproof and w

What are the Key Features to Look for in a Crypto Wallet?

Here are the key features you should look for in a crypto wallet:

- User Interface and Experience: An easy interface is good for beginners as well for smooth operations. Choose the crypto wallet that provides a good interface.

- Compatibility with Multiple Cryptocurrencies: Check whether the wallet you are choosing supports all kinds of cryptocurrencies and whether the specific one you want to buy is the same.

- Security Measures and Protocols: Look for wallets that have robust security features like offline storage, multiple PIN verification steps, and two-factor authentication.

- Customer Support and Community: Reliable customer support and a strong community around the wallet can be valuable resources for troubleshooting and staying informed.

How to Choose the Right Crypto Wallet?

- Assessing Personal Needs and Preferences: Write down your needs and preferences and look for the crypto wallet that fulfills your needs. Also, consider your technical expertise, the amount of cryptocurrency you plan to hold, and how you intend to use it.

- Comparing Different Wallet Types: Evaluate the pros and cons of hardware wallets, software wallets, online wallets, and paper wallets to determine which aligns best with your needs.

- Evaluating Security and Ease of Use: Find a balance between good security features and a user-friendly interface. Hardware wallets offer the highest security but might have a steeper learning curve for beginners.

- Considering Costs and Fees: Hardware wallets involve an upfront purchase cost, while software and online wallets are generally free. Some wallets might charge transaction fees.

What are the Common Misconceptions About Crypto Wallets?

Some misconceptions about crypto wallets:

- Confusion Between Wallets and Exchanges: Crypto wallets store your private keys, while crypto exchanges are platforms for buying, selling, and trading cryptocurrencies. You can transfer your cryptocurrency holdings from an exchange to your personal wallet for safekeeping.

- Myths About Wallet Security: Not all wallets are created equal. Hardware wallets offer the highest level of security by storing your private keys offline. Online wallets are generally less secure as they involve entrusting your keys to a third party.

- Misunderstanding Cold vs. Hot Wallets: Cold wallets, like hardware wallets and paper wallets, provide offline storage for your private keys, maximizing security. Hot wallets, like software and mobile wallets, are connected to the internet and offer convenience but come with a slightly higher security risk.

What are the FAQs about Crypto Wallets?

FAQs

Q: Can I have multiple crypto wallets?

A: Yes, you can have multiple crypto wallets to suit your different needs. For example, you might use a hardware wallet for long-term holdings and a mobile wallet for everyday transactions.

Q: What if I lose my phone with my mobile crypto wallet?

A: If you enabled strong passwords and 2FA, unauthorized access to your wallet is unlikely. However, losing your phone means losing access to that specific wallet. If you have a backup of your wallet data, you can restore it on another device.

Q: How do I recover my cryptocurrency if I lose my hardware wallet?

A: Hardware wallets typically use recovery phrases to restore access. If you have securely stored your recovery phrase, you can use it to recover your funds on a new hardware wallet device.

Q: What are some good practices for managing my crypto wallet?

A: Here are some tips:

* Never share your private keys with anyone.

* Update your wallet software regularly for security patches.

* Be cautious of clicking on suspicious links or downloading untrusted files, especially those related to your crypto wallet.

* Consider using a multi-signature wallet for an additional layer of security.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.