A standard lot is equal to 100,000 units of the base currency in a forex trade. It is one of the four lot sizes. The other three are mini-lot, micro-lot, and nano-lot.

For a trader who wants to trade in forex, it is very important for him to know the basic terminologies and key mechanics of the buying and selling process.

Like other assets, forex is not traded in a single amount; it is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. A “lot” is a unit measuring a transaction amount.

With this comprehensive guide, you will know everything about forex lots, their types, calculations, and how to use them.

What is a Forex Lot?

In forex trading, you don’t directly buy or sell physical currencies. Instead, you trade contracts representing a standardized unit of currency; this unit is called a lot. Going by the definition, A lot is a standardized unit of measurement used to describe the volume or size of a particular trade in the forex market.

The value or the amount of a lot is determined by an exchange or a market regulator. This helps ensure that everyone trades a specific amount, so they always know exactly how much of an asset they’re dealing with when they open a position.

A Lot serves two primary purposes:

- Standardization: It simplifies the transaction and makes it easy to compare between different currency pairs because every trader knows how much currency a lot presents. We can say a lot about uniformity in the forex market.

- Manageability: Forex transactions involve vast sums of money. Lots allow traders to participate in the market with manageable units, preventing the need for enormous capital to open positions.

What are the Types of Forex Lots?

There are various types of forex lots available for the different kinds of traders:

- Standard Lot: You will see the standard lot mostly as it is a traditional lot and is traded by professional traders. It represents 100,000 units of the base currency in a currency pair. For example, in USD/EUR, a standard lot size will be $100,000 multiplied by the exchange rate of the pair; at the time of writing, the pair is trading at $0.931, so the 1 standard lot will cost $93,100.

- Mini Lot: A mini lot is one-tenth of a standard, equivalent to 10,000 units of the base currency. If you are a beginner trader and want to start with smaller accounts, a mini lot is an option for you. For an exchange rate of $0.931 of pair USD/EUR, a mini lot will cost $9310.

- Micro Lot: A micro lot is smaller than a mini lot, representing one-hundredth of a standard lot or 1,000 units of the base currency. I believe micro lots are perfect for absolute beginners or those testing new trading strategies with minimal risk.

- Nano Lot: Some brokers offer nano lots, the smallest unit, typically representing 100 units of the base currency. These are ideal for practicing trading strategies with minimal capital commitment.

What is the Calculation of Lot Size?

Normally, you don’t have to calculate the lot size because it is available on the broker’s trading platform. However, you have to calculate how many lots you have to buy, and there are specific criteria you can follow to calculate the lot sizes you want to buy.

There are two main aspects to consider when calculating lot size:

- Position Size: The position size you want to make or the amount of currency you want to buy or sell. This is important and will help you in managing the risk.

- Account Size and Risk Tolerance: Risk is the most important thing for a trader. Always consider your available capital and risk tolerance when determining position size. It’s generally recommended to risk a small percentage of 1-2% of your account on any single trade.

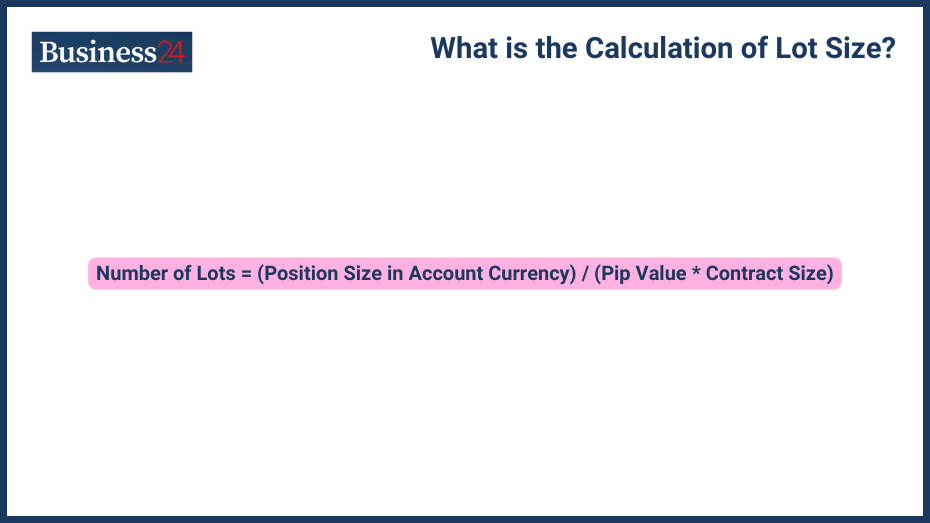

The formula for calculating lot size:

Number of Lots = (Position Size in Account Currency) / (Pip Value * Contract Size)

- Pip Value: This is the smallest price movement in a currency pair (typically 0.0001 for most major pairs).

- Contract Size: This refers to the units of the base currency per lot (e.g., 100,000 for a standard lot).

Example :

I’m a trader with a $10,000 account, and my risk tolerance is 2%, and I want to trade EUR/USD. I decide to risk $200 per trade. With a pip value of 0.0001 and a standard lot size of 100,000 EUR, the calculation would be:

Number of Lots = ($200) / (0.0001 * 100,000) = 0.02 lots

Since most brokers don’t allow fractional lots, I might round up to 0.01 mini lot (1,000 EUR) to maintain their desired risk level.

Factors Influencing Lot Size:

- Account Size: If you have a small account, it’s obvious you cannot make a big position, so account size influences the lot size. Traders with larger accounts can make bigger positions and potentially use standard lots. Conversely, beginners or those with limited capital might opt for mini or micro lots.

- Risk Tolerance: As I said, before anything, your risk should be managed.

Aggressive and experienced traders can use larger lot sizes for potentially higher profits, while risk-averse or beginner traders might choose smaller lots to limit potential losses. - Trading Strategy: Different strategies also influence the lot size. Scalping strategies often involve smaller positions and potentially benefit from micro or mini lots. Conversely, swing trading might utilize larger positions, making standard or mini lots more suitable.

What is the Impact of Lot Size on Trading?

Understanding each impact makes your trading perfect, and understanding lot size will impact your risk management and other requirements:

- Risk Management: It is direct that a larger lot has the potential for bigger profit as well as bigger losses; lot size directly affects your potential risk on each trade. Choosing the right lot size allows you to control your risk and avoid risking much on a single trade.

- Profit and Loss Calculations: As the risk calculation is important, so is the risk-reward calculation, and lot size can help you calculate profit and loss. Your profit or loss per pip movement is determined by the lot size and the pip value of the currency pair.

- Leverage and Margin Requirements: Forex brokers offer leverage, allowing you to take a larger position than your account balance. However, leverage is a double-edged sword. While it can increase profits, it also can increase losses. The lot size you choose influences your margin requirement (the minimum amount needed to hold a leveraged position).

What are the Benefits of Different Lot Sizes?

- Flexibility in Trading: When you have different options, you can play with different strategies and risk management. With different lot sizes, you have the ability to adapt to your account size and goals. For beginners, there are micro and mini lot sizes, while experienced traders can use standard lots.

- Control Over Exposure: Lot sizes empower traders to manage their risk exposure. Smaller lots are ideal for limiting potential losses, while larger lots can be used for potentially bigger gains, provided the trader has the risk tolerance and capital to handle them.

- Tailoring to Trading Strategies: As I said, different lot sizes allow you to trade different strategies with different risk management and risk-reward profiles. Scalpers who take frequent small profits might benefit from micro or mini lots. Swing traders holding positions for longer periods might utilize standard or mini lots.

What is the Comparison of Lot Sizes?

Advantages and Disadvantages of Each Lot Size:

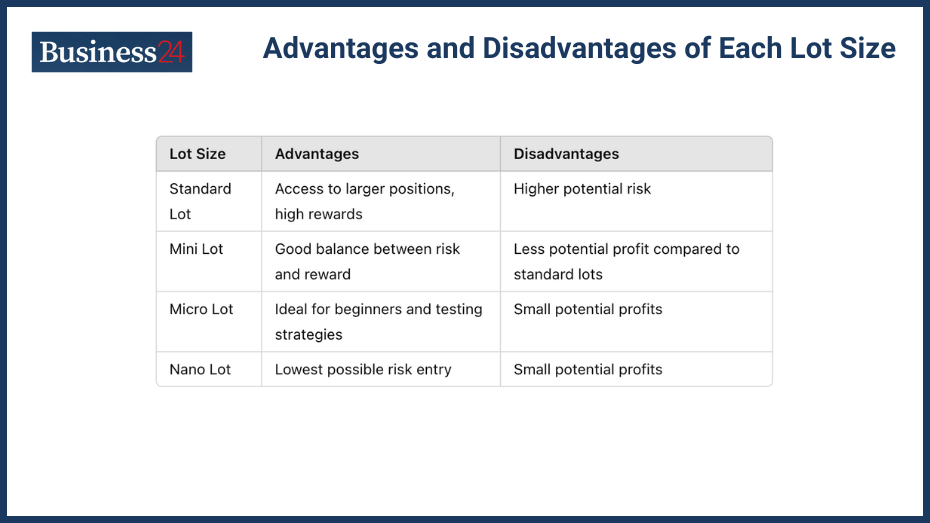

| Lot Size | Advantages | Disadvantages |

| Standard Lot | Access to larger positions so high-risk rewards can be achieved | Higher potential risk |

| Mini Lot | Good balance between risk and reward | Less potential profit compared to standard lots |

| Micro Lot | Ideal for beginners and testing strategies | Small potential profits |

| Nano Lot | Lowest possible risk entry | Small potential profits |

Suitability for Different Trader Profiles:

- Beginners: If you are reading this article, it is highly probable that you might be a beginner, and for beginners, the right information is very necessary. Micro or mini lots are well-suited for beginners due to their lower risk profile. Scalpers focusing on frequent small gains may also use micro or mini lots.

- Conservative Traders: If you are a conservative trader and prioritize risk management, you might prefer mini or standard lots in smaller quantities.

- Aggressive Traders: Experienced traders with higher risk tolerance usually use the standard lot, which requires a big account for trading and high experience to manage the trades.

What are the Practical Applications of Lot Sizes in Forex Trading?

Different traders with different risk tolerance and account sizes require different lot sizes. A beginner trader with a small account cannot trade a standard lot likewise, a highly experienced trader with a big account size would not like to trade a micro or mini lots. So, having options to choose different lot sizes is very important and a must for smooth trading.

How to Choose the Right Lot Size:

While choosing a lot size, you have to consider different factors:

- Account Size: According to your account size you have to choose the lot size. If you are starting out, you can choose smaller lot sizes.

- Risk Tolerance: You have to prioritize risk management and choose a lot size that aligns with your risk tolerance. A common approach is to risk a small percentage, usually 1-2% of your account on each trade.

- Trading Strategy: Lot sizes depend on the strategy, too. Scalpers might prefer micro or mini lots, while day or swing traders can use standard or mini lots depending on their strategy and risk appetite.

- Market Volatility: During volatile market conditions, you might want to risk less so you can choose the lot size accordingly.

These factors can influence your lot size selection. You might be comfortable using a slightly larger lot size in a market with a working strategy or a less volatile market for potentially higher profits. You must use smaller lot sizes to limit potential losses during volatile periods.

Remember, there’s no “one-size-fits-all” approach to lot sizes!! You can only make the right choice depending on your individual circumstances and trading goals.

How much is one lot in XAU/USD?

One standard lot in XAUUSD is equivalent to 100 troy ounces of gold. However, you must understand that this refers to the contract size, not the value.

The price of gold fluctuates, so the value of 1 lot (100 ounces) will change accordingly. To determine the exact value at a given time, you’d need to multiply the current price of gold per ounce by 100.

Some forex brokers offer mini and micro lots for XAUUSD. These represent fractions of a standard lot. A mini lot is typically 10 ounces of gold, and a micro lot is usually 1 ounce of gold.

What does 0.01 lot size mean?

A 0.01 lot size means one-hundredth of a standard lot. In most currency pairs, it translates to 1,000 units of the base currency; a 0.01 lot size is known as a micro lot. This lot size accounts for 1,000 base currency units in every forex trade, determining the amount of a particular currency. For example, a 0.01 lot in EUR/USD would represent 1,000 EUR.

How many shares is one lot in forex?

Forex trading doesn’t have shares. Forex trading works with currency pairs. Lots represent standardized units of currency in a forex contract. So, one lot can be 10,000 or 1,000 units, depending on the type of lot chosen.

How many lots is $1000 in forex?

Again, this question can’t be answered directly because the number of lots you can purchase with $1000 depends on the currency pair, lot size (standard, mini, micro), and the current exchange rate. You’ll have to consider these factors and use the lot size calculation formula mentioned earlier to determine the number of lots.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.