A real estate investment trust (REIT) is a publicly traded company that owns, operates, or finances income-producing properties.

Definition and Purpose

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate. They allow individual investors to earn a share of the income produced through commercial real estate ownership without actually having to buy, manage, or finance any properties.

REITs are often traded on the stock market, and just like stocks, they announce dividends/returns on a periodic basis. This is a more liquid option for real estate investors as they can enter/exit the market at a fast pace. This is in contrast to regular real estate investments, which can take a lot of time.

Types of REITs

Equity REITs: Own and manage rent-producing real estate. They directly manage ownership of properties. Rent payments from tenants provide a source of passive income for equity REIT investors. Any improvement in the valuation of the underlying property is also reflected in the stock price of the REIT.

Equity REITs are divided into the following types:

- Residential REITs

- Industrial REITs

- Healthcare REITs

- Office REITs

- Retail REITs

Mortgage REITs (mREITs): Provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities. Their focus is on real estate debts rather than actual real estate itself. Their earnings consist of interest payments on these debts. They are generally considered less dividend-friendly than equity REITs.

Other types of REITs include:

Hybrid REITs: Combine the investment strategies of both equity REITs and mortgage REITs. These are much less common overall.

Another way of classifying REITs is to consider listing. Most REITs are publicly traded on stock exchanges, but some are privately managed. They aren’t traded on public exchanges.

What sector is a REIT in?

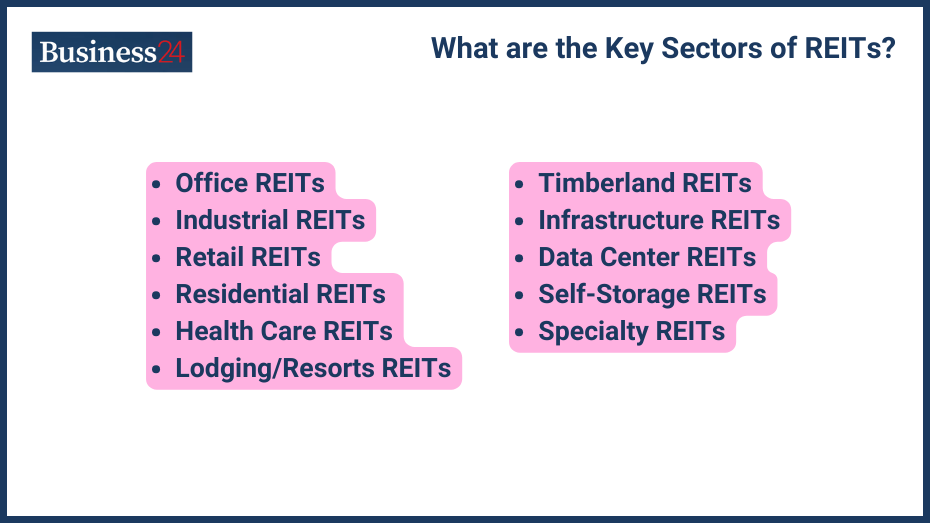

REITs aren’t associated with one sector as they are involved in the real estate economy, which is a unique asset class in itself. However, depending on the type of real estate exposure, they can be divided into further sectors.

What are the Key Sectors of REITs?

Office REITs

Office REITs focus on building, managing, and owning office complexes. They range anywhere from massive metropolitan skyscrapers to small suburban office parks. They generate income for their investors by renting out to professional tenants with different operating capacities.

Key features of office REITs include:

- Tenants: They can range from large corporate groups to small startups.

- Location: As with commercial real estate, location is key here. Office REITs focus on popular destinations like Central Business Districts (CBDs) or suburban areas depending on the overall strategy.

- Dividends: Office REITs redistribute a large chunk of their income back to their investors. The primary source of income is rent.

Some benefits of Office REITs include:

- Consistent Income: Office REITs provide regular income in the form of dividends to their investors.

- Potential for Appreciation in Value: Commercial office space has the potential for healthy appreciation over the years.

- Diversification: Office REITs, like other real estate investment instruments, are used for diversification purposes in addition to conventional investments like stocks, bonds, or commodities.

Some risks associated with office REITs include:

- Occupancy Risk: If office spaces remain vacant for a period of time can result in reduced dividends for investors.

- Management Risk: The quality of an office space depends on its management team. If they are up to the task, the REIT investors will benefit from it, and if they aren’t, investors will suffer.

- Economy Risk: Interest rates and the health of the larger real estate economy directly impact office REITs. A contracting economy and high interest rates can negatively impact the rental income and in turn, the dividends of investors.

Industrial REITs

Industrial REITs include owning and managing industrial properties. These properties are used by tenants in their business operations, which include storage, distribution, and production of goods and services.

Types of properties industrial REITs are interested in:

- Warehouses: These are huge storage facilities for raw materials, finished products, and other kinds of inventory.

- Distribution centers: These are used by delivery companies to receive, pack, sort, and ship goods to retailers or buyers.

- Small-scale Manufacturing: These facilities may include small-scale manufacturing setups and production lines.

- Order Fulfillment Centers: These are used by e-commerce initiatives for efficient handling of customer orders and ensure timely deliveries.

Benefits of Industrial REITs include:

- Long-term Lease: REITs promise long-term dividends as they often secure leases for 10-year or even longer periods. This helps provide a stable income.

- Growth Potential: As demand for finished goods increases with time, the demand for industrial REITs will only grow with time.

- Emerging sectors: Strong emerging sectors like e-commerce benefit a lot from industrial REITs. This provides a great potential for expansion.

Some risks associated with industrial REITs include:

- Occupancy risks: If Industrial REITs are overbuilt, it can lead to lower occupancy and affect rental income.

- Construction risks: Industrial REITs require a lot of infrastructure investment, and tenants may or may not come.

- Economic sensitivity: Industrial REITs are heavily influenced by the economic situation. High interest rates and a slowing economy can result in lower occupancy rates and even risk of default of long-term tenants.

Retail REITs

Retail REITs specialize in owning and maintaining commercial properties like shopping malls. They include a wide range of properties where retail services are provided to consumers.

The types of properties include:

- Shopping Malls: These include multi-storey shopping complexes with different brands and specialty shops.

- Big Chains: These are large retail shopping outlets from big-box companies ranging from home improvement, and electronics, to groceries.

- Freestanding Retail Properties: These are stand-alone facilities like restaurants, drug stores, or real estate offices.

Benefits of Retail REITs include:

- Relatively High Occupancy Rates: Retail REITs generally have better occupancy statistics.

- Potential for Growth: The retail sector is growing at a fast pace. If Retail REITs adapt accordingly, they can secure better dividends and price appreciation for their investors.

- Diversification: Retail REITs can easily diversify since the value of a single property is generally less than other competing REITs. There is a reduced risk of overly depending on a single tenant.

Some risks associated with Retail REITs include:

- E-commerce Threat: The rise of online shopping or e-commerce has negatively affected some sectors of Retail REITs and continues to shape others. It will continue to affect it.

- Oversupply: An oversupply of retail properties can result in lower rental values and lower occupancy statistics.

- Economic Sensitivity: The Retail sector is also tied to the overall economy. High interest rates and a slowing economy can negatively impact Retail REITs and their dividends.

Residential REITs

Residential REITs focus on a variety of housing-related ventures. They include managing and investing in residential properties for rental purposes.

Types of Residential REITs include:

- Prefabricated Homes: These are cheaper housing options in which Residential REITs own land and install manufactured homes on it for rental purposes.

- Student Hostels: These include purpose-built student housing facilities close to universities or apartment complexes converted for student use.

- Family Housing: These are individual residential units built to cater to the needs of single families.

- Apartment Complexes: These are multi-story residential complexes owned and maintained by residential REITs. They can range from high-rise luxury apartments to economy garden apartments.

Benefits of Residential REITs include:

- Strong Demand: There is a consistent demand for housing units, especially around cities.

- Steady Income: Strong demand can result in steady income for Residential REITs. It provides a regular income stream for investors.

- Appreciation Potential: Rental residential properties have a tendency to appreciate strongly with time, resulting in potential gains for Residential REITs.

Some risks associated with Residential REITs include:

- Vacancy Risk: Oversupply of residential units can result in vacancy risks as there is an imbalance between supply and demand.

- Regulatory Risks: Regulations around rent control and eviction can impact the income stream of Residential REITs. Many governments are coming up with these plans as housing remains a crisis in many cities around the world.

- Economic Risks: Economic slowdowns can negatively impact the rental values of residential properties. Individuals and families may struggle to pay rent on time, resulting in vacancy risks and reduced dividends for investors.

Health Care REITs

Healthcare REITs invest and manage specific properties that cater to the needs of the healthcare industry. These properties play vital role in the provision of medical care for patients.

Types of healthcare REITs include:

- Hospitals and Medical Office Buildings: These include clinics, diagnostic services, testing labs, teaching hospitals, and other outpatient departments.

- Senior Housing: These include nursing facilities and other assisted living setups for senior citizens.

- Medical Research Facilities: These elaborate facilities support the research and development of healthcare and life sciences, including drug testing.

Advantages associated with Healthcare REITs include:

- Demographic Trends: The population is aging, which means that there will be constant demand for nursing homes and healthcare facilities since older demographics are more prone to illnesses.

- Long-term Leases: Healthcare REITs often get to sign long-term leases with care providers. This provides a steady source of income for its investors.

- Unaffected by Economic Situation: The healthcare sector is the least affected by the economic situation. People get sick, and they require care under any circumstances.

Some risks associated with Healthcare REITs include:

- Government Regulation: Any changes in government regulation can negatively impact the profitability of Healthcare REITs.

- Oversupply: Overbuilding healthcare facilities with little profitability can squeeze profit margins and reduce dividends of investors.

- Insurance Battles: Reimbursement from insurance companies or governments is a tricky and constant battle for healthcare providers. This can affect these companies’ ability to pay rent.

Lodging/Resorts REITs

These REITs focus on the investment and management of properties related specifically to the hospitality and leisure industry. The goal here is to profit from the income-producing properties of this space.

Types of hospitality REITs include:

- Hotels: These include luxury resorts, destination wedding venues, and vacation rentals. REITs try to profit from these lucrative businesses.

- Timeshare Properties: Some of these lodging REITs may invest in timeshare properties, including ones offering fractional ownership in vacation destinations.

- Recreational/Sporting Properties: REITs operating in this space may invest in facilities like ski slopes, golf courses, recreational/water parks, and convention centers.

Several advantages of lodging/resort REITs include:

- Strong Profitability Statistics: The luxury/hospitality sectors are known to have strong profitability statistics as compared to other sectors. This can result in increased profitability for REIT investors.

- Diversification: Lodging REITs offer a big opportunity for funds to diversify their investments across the globe in well-known tourist destinations.

- Exposure to the Luxury Segment: The luxury segment can be exposed through investments in high-end hotels and tourist destinations. They are known to be resilient in the face of economic uncertainty.

Key Risks associated with resort REITs include:

- Seasonal Nature: Many tourist destinations while being profitable suffer from considerable seasonal variations. Ski resorts are only fully operational in the winter while golf resorts are closed at that time in cold climates.

- Economic Risks: Leisure travel is directly impacted by economic downturns. While some high-end sections remain aloof, others suffer a lot.

- Disaster Risks: Certain geographical destinations are prone to natural disasters. Some ski resorts are at risk of avalanches and snow storms that hamper travel, while tropical destinations are prone to flooding and storms.

- Competitive Environment: The hospitality sector has witnessed strong competition among service providers. This can result in reduced profitability.

Timberland REITs

Also known as Forestry Real Estate Investment Trusts, the focus of these investments is to own and manage the economic opportunity of forests. Vast tracts of land are used for growing and reaping timber.

Timberland REIT revenue streams include:

- Timber Cutting: There is a steady demand for lumber and other wood-based products for furniture and other industries.

- Carbon Credit Offsetting: If deforestation is not the goal of a Forestry REIT, they can become carbon credit offsetters by selling the carbon emissions absorbed by the growth of the forest over the years. This has become a very lucrative opportunity after recent climate accords.

- Ethical Hunting Permits: A limited number of trophy hunting permits can be sold for huge sums of money to wealthy enthusiasts. They tackle illegal hunting activities while generating dividends for investors.

Benefits of Forest REITs include:

- Land-based Asset: Forest REITs are tangible assets within a real registry. This can act as a possible hedge against inflation.

- Steady Income: These timberland REITs can offer a steady revenue stream once the system is up and running. Demand for wood products and carbon credits isn’t likely to slow down any time soon.

- Diversification: This is a useful opportunity for diversification in a crucial sector of the economy which is often forgotten.

Key risks associated with Timberland REITs include:

- Price Fluctuations: The value of timber fluctuates, which affects the revenue stream considerably.

- Environmental Regulations: Forestry-related economic activities have been subject to intense environmental scrutiny over the years. Even the carbon credit industry is volatile overall.

- Natural/Man-made Disasters: Forest fires, insect attacks and other natural disasters are common in this sector and can cause a lot of damage for these REITs.

- Long-term Capital Engagement: Forests grow slowly over time. While the ROI can be huge, this can be a challenge as investors’ capital is stuck for a long period of time.

Infrastructure REITs

Infrastructure REITs focus on the investment and management of critical energy and communication infrastructure of a country. Previously, most of it was state-owned but now, much of the world has moved to a public-private partnership model. These include power plants, telecommunication towers and road networks.

Types of infrastructure REITs include:

- Telecommunication REITs: These include telecom-related investments like cell towers, fiber optic networks, and even satellites.

- Energy REITs: These include Oil and gas pipelines, thermal power plants, and even electricity transmission lines.

- Road Network/Transport REITs: They include bridges, flyovers, toll roads, and sometimes even rail networks.

Some benefits of infrastructure REITs include:

- Cash Flow Stability: Infrastructure REITs offer stable income streams compared to riskier REIT endeavors.

- Inflation Hedging: Many infrastructure facilities have a permanent place in the economy, and their importance cannot be understated. This is why they are a hedge against inflation.

- Diversification: Infrastructure REITs offer a unique diversification opportunity for investors as they get to have a share in the country’s running.

Some risks associated with infrastructure REITs include:

- Limited Investment Opportunities: Due to government policy, infrastructure REITs have a limited set of investment opportunities.

- Government Policy Changes: The regulatory climate is dynamic and affects the profitability of infrastructure REITs considerably.

- Interest Rate Sensitivity: The valuation and profitability of these REITs are heavily subject to interest rates set by the government. Many of these REITs rely on debt financing so at one point it may not remain viable.

Data Center REITs

These are specific REITs to cater to the growing demand for data centers. These are very profitable at the moment and benefit digital sectors like AI and IT.

Services required for these massive data centers include:

- Power Supply: These data centers require unhindered power to run their critical systems.

- High-speed Internet Connectivity: High-speed internet connectivity is a must for these data centers.

- Physical Security: On-site security is needed to avoid breaches.

Benefits of being involved in the data center sector may include:

- Steady, long-term Revenue: Data centers often lease land for the long term, thus providing REITs with a steady revenue stream.

- Strong Demand: The demand for large data storage centers is only going to increase with time.

- Less Competition: Due to the high entry price point, entry for new competitors is tricky, thus making the space prone to less competition.

Risks associated with data center investments may include:

- Technological Advancements: Technological advancements can require a rapid upgrade of hardware, which is a massive added cost.

- Security Breach: Security breaches are common due to cyber-attacks, and data center operators sometimes have to provide compensation to victims.

- Economic Sensitivity: A downturn in the economy can lead businesses to fail, resulting in less reliance on huge databanks.

Self-Storage REITs

Self-storage REITs involve investment and management of storage facilities. These units can comprise buildings with storage units of various sizes. They can be refrigerated or non-refrigerated, depending on the requirements of the end user.

They include:

- Residential Storage Units: These are for individuals with requirements for extra storage of smaller/personal belongings that perhaps don’t fit into their living quarters for the time being.

- Commercial Storage Units: These are units for managing larger-scale inventory like seasonal produce, meat, or machinery.

Benefits of self-storage facilities include:

- High Demand: There is a lot of demand for these storage facilities, especially at certain times of the year. This is even during the times of economic downturns.

- Self-storage facilities require minimal maintenance compared to other real estate endeavors like office spaces or even residential complexes.

Some risks associated with self-storage REITs include:

- Interest Rates: High interest rates can affect self-storage facilities because they rely on debt financing.

- A severe economic downturn can cause plenty of problems for self-storage facilities.

Specialty REITs

Invest in properties that do not fit into other categories, such as prisons, theaters, or amusement parks.

There are other investment opportunities for Real Estate Investment Trusts (REITs) that don’t fall under any of these categories. They include:

- Private Prisons

- Amusement Parks

- Cinemas/theaters

What is the largest REIT by sector?

Some well-known REITs dominate certain sectors. They include:

- Equity Residential (EQR) dominates the residential REIT space

- Prologis (PLD) dominates the Industrial and Office REIT sectors

- Marriott International dominates the hospitality REIT sector

- Equinix (EQS) dominates the data center REIT market

- Public Storage (PSA) dominates the self-storage market

What are the categories of REITs?

Categories of REITs include:

- Residential REITs

- Industrial REITs

- Healthcare REITs

- Office REITs

- Retail REITs

What are the Benefits of Investing in REITs?

- Dividend Income: REITs typically pay high dividends.

- Diversification: They provide diversification benefits as their performance is not highly correlated with other asset classes like stocks and bonds.

- Liquidity: Publicly traded REITs are easily bought and sold on major stock exchanges.

What are the Risks of Investing in REITs?

- Market Risk: Prices can be volatile and influenced by economic changes.

- Interest Rate Risk: REIT prices can be affected by changes in interest rates.

- Operational Risk: The performance of REITs is influenced by the quality of management and the performance of their underlying properties.

What are the Ways to Invest in REITs?

- Direct Purchase: Buying shares of publicly traded REITs through a brokerage account.

- REIT Mutual Funds and ETFs: Investing in funds that specialize in REITs.

- Private REITs: Direct investment in private REITs, which are not publicly traded and are less liquid.

What are Some Educational Resources and Tools?

Books and Articles: Comprehensive guides on investing in REITs.

Real Estate Investment Trusts: Structure, Analysis and Strategy by Parsons and Garrigan.

Investing in REITs: Real Estate Investment Trusts by L.Block.

REIT Guide on Investopedia

A Beginner’s Guide to REITs

Online Courses: Tutorials and structured courses for learning about REIT investment strategies.

Complete the REIT course on Udemy

Financial Tools: REIT screening tools and investment calculators.

Return on REIT calculator

Suntec REIT Calculator

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.