CFD (Contract for Difference) trading usually involves using leverage, which allows traders to control a larger position with a relatively small amount of capital.

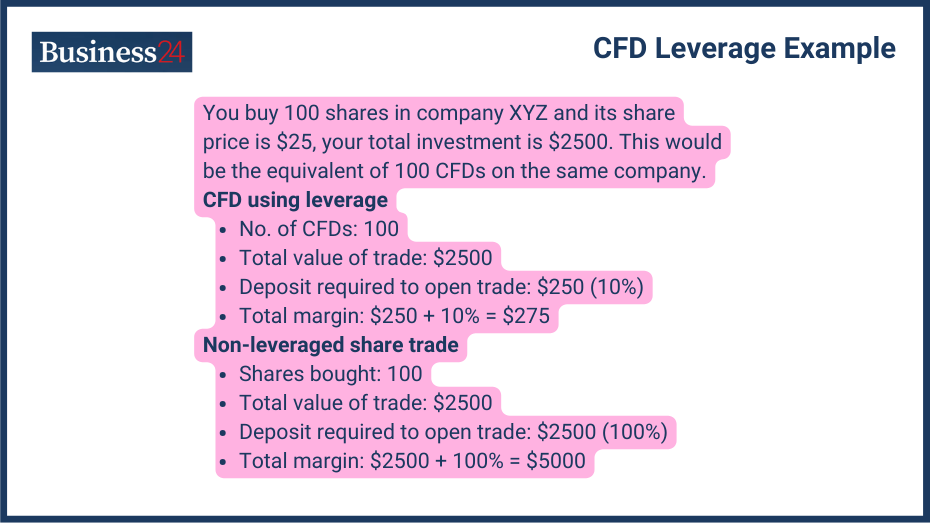

Instead of paying the full value of the asset, traders only need to deposit a fraction of the total value, known as the margin. CFD is a financial agreement allowing traders to speculate the underlying asset’s price without owning it. You can use CFDs to speculate the price of any known asset, from stocks and cryptocurrencies to commodities. It allows investors to profit from the difference in price between the opening and closing values. For CFD, investors need to put down a margin, and that is all. The value of the margin is variable and depends on the CFD issuer. It ranges anywhere from 1-20% of the underlying asset’s value.

What is Leverage in CFD Trading?

Definition:

Leverage is a mechanism that enables traders to gain exposure to larger positions than what their capital would normally allow. For example, a leverage ratio of 50:1 means that for every $1 in the trader’s account, they can control $50 worth of assets. Leverage is used in all sorts of trading activities like the stock market, forex, CFD, futures and commodities. However, leverage does increase risk significantly so traders have to be careful while using it.

Function:

By using leverage, traders can potentially increase their returns on investment. However, it also magnifies potential losses, making risk management crucial. In a CFD setting, the effect of leverage is as pronounced as other trading sectors, if not more. With a much smaller upfront capital investment, traders, especially beginners, can have a piece of the action. However, leverage trading comes with heavy baggage, and there are many cautionary tales in which traders wipe out their entire worth in a matter of hours because of the underlying asset’s unpredictable price movement.

What are the Benefits and Risks of Leverage?

Benefits:

Leverage allows traders to access markets that would normally be out of their reach. There are capital requirements that act as market barriers for investors. Leverage cushions these barriers significantly and allows smaller players to enter the frey.

Potential for Higher Returns:

If your market predictions turn out to be correct, you can pocket magnified gains from your trades. If you agree to do a CFD trade for an asset worth $1000 with a 10x leverage, you will just need to have $100 to fully participate in it. If the index appreciates by 15%, you will reap a profit of $150 or around 150% of its initial investment.

Risks:

Leverage trading is always considered high risk due to the possibility of major losses. A small, even insignificant change in the spot price can magnify itself and wipe out your investment. For example, if you buy $1000 worth of CFD of a certain underlying asset on a 10x leverage. You paid only $100 for this move. However, instead of the market going above, it starts posting losses and loses 15% of its value. It will result in a margin call for your account, which means that all of your initial investment is gone, and you need to deposit more money to continue trading on that platform.

Margin Calls: If the market moves against a trader’s position, they may be required to deposit additional funds to maintain the position. A margin call is a minimum level set by the broker and is a major bearish indicator of a market. If a trader’s account undergoes a margin call, the broker will require them to deposit more money to continue the same CFD position. If they don’t, the broker will be forced to sell the CFD at the latest price point, and the entire investment will be gone. Therefore, it is always advisable to play with reasonable leverage, which usually results in much lower margin calls, so there is enough room for the trader to play.

What is the Margin in CFD Trading?

Definition: Margin is the amount of money required to open and maintain a leveraged position. It acts as a security deposit to cover potential losses. Margin requirements vary from broker to broker and underlying assets.

Types: Initial margin (to open a position) and maintenance margin (to keep the position open).

There are two types of margins required to remain engaged in a CFD position:

- Initial Margin: This is the upfront capital you need to deposit to start a CFD position. Its value generally varies from 1-20% of the CFD position. Less volatile assets like top forex currency trading pairs have a generally lower margin threshold. Volatile assets like cryptocurrencies, stocks, and commodities generally have a high margin requirement. They can reach as high as 20%.

- Maintenance Margin: The maintenance margin comes into pay only in the case of a margin call. This is when the market has moved against your prediction, and the margin which acts as your security has been compromised in a margin call. The only way to continue with this trading position is to deposit more money in the form of a maintenance margin. It is often 50-75% of the initial margin requirement. If you still believe the market can recover, then you can transfer the required maintenance margin, and you will remain in the game. If you cannot do so within the stipulated time, your CFD position will be liquidated, and your loss will be permanent.

How Does Margin Work?

Margin Requirements: Vary by market and asset class, often expressed as a percentage of the full trade size.

Margin requirements are the percentage amount a trader needs to deposit to be able to engage in a leveraged position. They typically range anywhere between 1-20% of the value of the underlying asset. When it comes to CFDs, margin requirements vary considerably because of the different risk tolerances of brokerage firms. A major forex pair like EUR/USD generally has a much lower margin requirement from 2-5%, while stocks of a smaller, volatile company or crypto may require up to 20% as margin. There are certain regulatory requirements in place as well. They effectively require certain minimum margin requirements for sectors as a safety net for traders. They vary from country to country.

Margin Call: If the value of the trader’s account falls below the maintenance margin requirement, they will need to deposit more funds or close positions to avoid liquidation.

If the value of the trader’s leveraged position falls below the margin requirement set by the broker, it results in a margin call event. The trader is then required to transfer more funds in the name of maintenance margin. Failure to do so will end your position with considerable losses and bring more volatility to the market.

Can you trade CFDs without leverage?

Trading CFDs without leverage involvement is possible, but they are not readily available to all brokers due to their low popularity among the trading community.

Here are possible reasons behind this:

- CFDs are intrinsically primed for leveraged trading: This is because traders never own the asset itself and they are playing with the difference between the price levels at two points in time. They allow traders to speculate and they can choose the level of speculation with the help of leverage.

- Similarity with spot trading: If a user isn’t interested in leverage trading through CFDs, it would be better to stick to regular stock trading without CFD involvement. It is much less volatile, but there are plenty of gains to be made there.

- Brokers aren’t inclined to offer non-leveraged CFDs because it is simply not profitable enough for them. With leveraged trades, there is a considerable profit margin and low risks because of the margin requirements. If the market is bullish, the broker is in profit, and if the market is bearish, the broker can be in profit with the right margin requirements. So, offering a non-leveraged, less risky CFD is not in their interest. They want traders to take risks so they can profit from their activity.

Some brokerages may give the option of a 1:1 leverage option which essentially removes leverage altogether. However, it is important to note that a spot-stock trading option might be better overall.

Key Concepts in Leverage and Margin

- Initial Margin: The upfront cost to open a position. Initial margin is the amount deposited as a security to starting trading CFDs or any other derivatives-based financial instrument. It ranges anywhere between 1-20% of the value of the underlying asset.

- Maintenance Margin: The minimum equity required to keep the position open. This is the additional amount that needs to be deposited in the event of a margin call. If this amount isn’t paid to the broker, the position will be liquidated and the trader’s losses will be permanent.

- Margin Call: A broker’s demand for additional funds to maintain a position. A margin call is when market losses force the broker to require additional margin from the trader in the form of a maintenance margin. If a trader doesn’t up their stake with this additional margin amount, the position is liquidated.

- Stop-Out Level: The level at which positions will automatically close if margin requirements are not met. A stop-out level is a pre-margin call in which the broker halts a trader’s position due to losses. It often occurs way before a margin call. It is initiated by a broker as a safety net. During the Stop-Out process, the broker will pause a portion or entirety of your open CFD positions. They then try and recover loaned leverage trading funds from the broker’s positions. Stop-Out is used to protect insolvency issues and stop traders from owing more money than they even deposited in the first place. Considering the volatility associated with leverage trading, it is a useful option for a broker.

Practical Examples and Strategies

Using Leverage:

Here is a practical example regarding leverage trading in CFDs. Let us suppose you have Nvidia Stock (NVDA), which is trading at $125 per share. You have estimated that the NVDA stock is going to appreciate in value in the near future. However, you only have $125 with you. There are two options for you:

Without Leverage:

Trading without leverage isn’t common with CFDs as they are derivatives of the original asset, and the primary purpose here is to allow margin trading. Without leverage, you need to:

- Select a suitable broker

- Transfer your funds to the broker app

- Buy one share of NVDA stock-based CFD

- If the stock rises to $140, you will pocket $15

With Leverage:

To trade with leverage, you need to follow these steps:

- Select an appropriate broker

- Transfer funds to the broker app

- With a 20% margin requirement from the broker, you can get $600 worth of NVDA stock CFDs.

- If the stock rises to $140, you will pocket $75, which is 5x of your profits without leverage.

- However, if the stock drops to $110, you will lose $75 out of the $125 investment. With a 50% stop-out in place, your position will be paused, and you will be an inch closer to a margin call. This is why leveraged trading positions need to be undertaken with extreme care.

Risk Management: Setting stop-loss orders and closely monitoring margin levels to mitigate risks.

Since leveraged CFD trades are so risky, it is important to engage in effective risk management against downsides. Follow these important steps:

- Only select the kind of margin you know you can cope with as greed is in human nature and it will try and compel traders to have as high a margin as possible. However, reason compels traders to dial the margin down, at least at the very start.

- Traders can use stop-loss trades. They liquidate a trader’s position if the price falls below a certain figure. It automatically cuts down on a trader’s losses.

- You need to manage risk tolerance effectively. First, assess your risk tolerance levels and act accordingly.

- It is important to diversify your investments across various CFDs and other financial instruments. This way, wild price swings in one sector cannot wreck your entire capital.

- Beware of any margin calls from your broker as the price may fall below a certain level and you will be required to immediately provide additional margin in the form of maintenance. If you miss this moment, your position might be liquidated and your losses will be permanent.

Educational Resources and Tools

Books and Articles: Guides on leveraging and margin in CFD trading.

Useful books on CFD trading include:

- Making Money from CFD Trading by Katharine Davey

- Contracts for Difference: A Master Trader’s Guide to CFDs by Katharine Davey

- CFDs Made Simple: A Straightforward Guide to Contracts for Difference Success by Peter Temple

Useful articles include:

Online Courses: Tutorials on effective use of leverage and margin:

Trading Simulators: Platforms to practice leveraged trading without financial risk:

- Forex.com Simulator

- Trading212 Simulator

FAQ

What is 5x leverage CFD?

5x leverage in CFD is when you can magnify your market position by five times or 500%. Leverage is useful as it makes small amounts matter for traders, but it is also extremely risky because of the 5x increase in risk.

What is the best leverage for $10?

For beginners, a smaller margin of 2x or 3x may be enough, as $10 is such a small amount to trade with. Traders can move to higher leverage later on.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.