Forex trading, also known as foreign exchange trading or simply FX trading, is the global marketplace for exchanging national currencies against one another.

With a daily trading volume exceeding $6 trillion, it is the largest and most liquid market in the world, offering unparalleled opportunities for traders. But what exactly is Forex trading, and how does it work?

In this guide, we’ll introduce and explain the world of Forex trading by looking at its fundamental concepts, key players, and essential strategies.

Whether you’re a novice trader looking to understand the basics or an experienced trader seeking to refine your skills, this post will provide valuable insights into the Forex market.

What is Forex?

Forex, or foreign exchange, is the global marketplace for trading national currencies against one another.

The forex market is the largest in the world with over $6 trillion worth of value traded every day.

The forex market is used by businesses for hedging purposes or for speculation by individuals and organizations for profiting from price movements of certain currency pairs.

History of Forex

The forex market has existed since the arrival of Gold coinage in Lydia in the 6th century BC. Silver and Gold coins formed the backbone of the primitive forex market.

The more standardized form of forex trading started with the advent of paper money in the 15th and 16th centuries. Back then, the Gold standard was enforced by states, but in practice, paper money started to become increasingly important as it guaranteed payment in Gold and was easy to manage for traders.

However, the modern forex market started after World War II. The Bretton Woods Monetary Conference was conducted by the then G3 countries, which included the United States, the UK, and France.

They deployed a new World Order with the Dollar as the reserve currency. All other national “fiat currencies” would be valued with the greenback as a yardstick. The Dollar itself was tied to Gold back then, and all other currencies were valued with respect to it.

However, in 1971, the Gold standard was dropped entirely, and the US currency rose to become the dominant player in the forex market. All other currencies followed suit. In 1985, the power of the USD was curtailed slightly, allowing other major currencies to perform just as well.

The Role of Forex in Global Finance

The forex market was initially viewed as necessary to facilitate cross-border trade. This was especially needed as the Gold standard eroded with time, and there was no way to determine the foreign exchange rate apart from a free market trading situation. With time, the forex market’s role in global finance has only grown.

The forex market, like any other trading activity, is based on supply and demand. If a country’s currency is in high demand, it means that the market values its government’s actions and economic opportunity, and vice versa. The rise of multinational companies has also resulted in significant hedging activity, which has brought even more popularity and importance to the forex market.

How Does Forex Trading Work?

Forex trading involves buying one currency while simultaneously selling another in pairs based on market predictions. The basic idea is to buy at a lower price and sell at a higher level to make a profit.

However, they are exchanging one currency for another. This is why the concept of trading pairs is so important in the forex market.

Understanding Currency Pairs

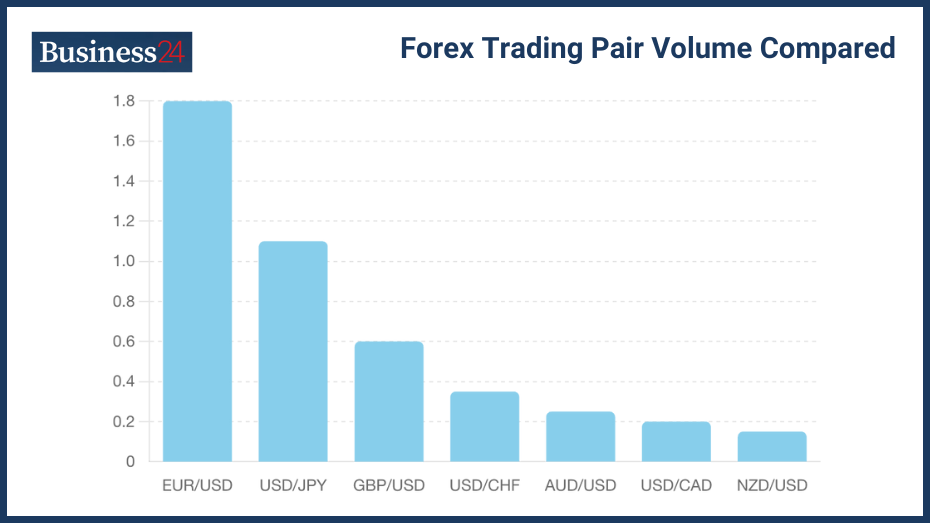

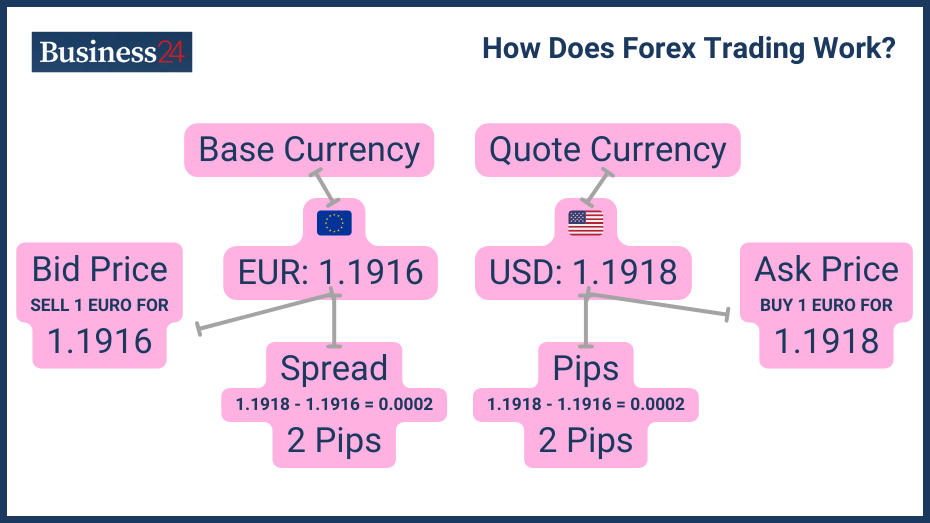

Trading pairs involve two currencies, each denoted by a three-letter notation like EUR, USD, HKD, etc. Each trading pair tells us the value of one currency relative to another. For example, GBP/USD is a popular forex trading pair. The first currency, GBP, is called the base currency, and the second is called the quote currency. If GBP/USD is 1.26, it means the base currency is 1.26 times the value of the quote currency. Traders use the fluctuations of these exchange rates to make a profit.

Major currency pairs include GBP/USD, USD/JPY, USD/CAD, USD/CHF, EUR/USD and AUD/USD. Minor pairs include some of these other popular currencies with each other with USD involved. Exotic pairs include the currencies of emerging economies worldwide relative to a major currency like USD, EUR, or GBP.

The Mechanics of Forex Trades

A spread is the monetary difference between the buying and selling price of an exchange pair. It is the broker’s margin in the business. It is usually measured in pips since a spread is a relative term. A pip is the smallest unit used to measure the spread on a forex trading pair. For example, if the GBP/USD pair is buying for 1.2602 and selling for 1.2600, the spread is 2 pips. If an exchange pair’s spread is big, then there is a considerable margin for the broker, making it lucrative. Spread is usually generous for exotic pairs involving emerging market currencies because of high demand.

Leverage trading is when you wish to trade for far more money than your own capital. It is risky, but it is far more lucrative than spot trading. You can trade with up to 100:1 leverage, meaning if you have $1, you can essentially conduct trades of up to $100. The rest of the money, i.e., $99 in this case, is put up by the broker, but if you lose, you can move into a negative balance. Leverage or margin trading is a risky enterprise and should only be undertaken by experts.

What Are the Forex Market Hours and Trading Sessions?

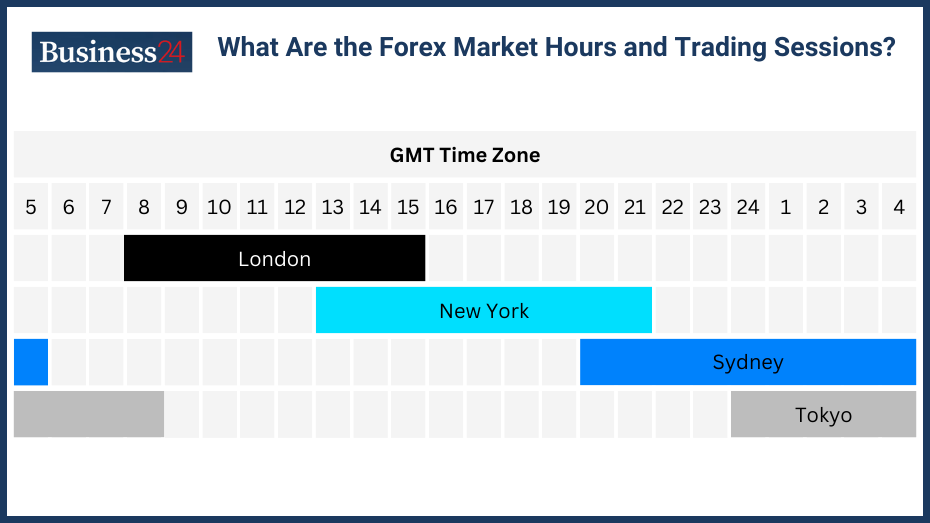

The Forex market operates 24/7 and is divided into major trading sessions that correspond to the world’s financial markets opening in cities like London, Sydney, New York, and Tokyo. They essentially cover all four corners of the globe.

Forex market hours are subjective as they cover all four major trading sessions around the globe. Local forex markets operate from 5 PM Sunday to 5 PM Friday. Busiest sessions are when two or more trading sessions overlap, like Tokyo and Sydney, New York, and London. Trading is closed over the weekends for retail traders, but electronic trades between brokers continue even during this time.

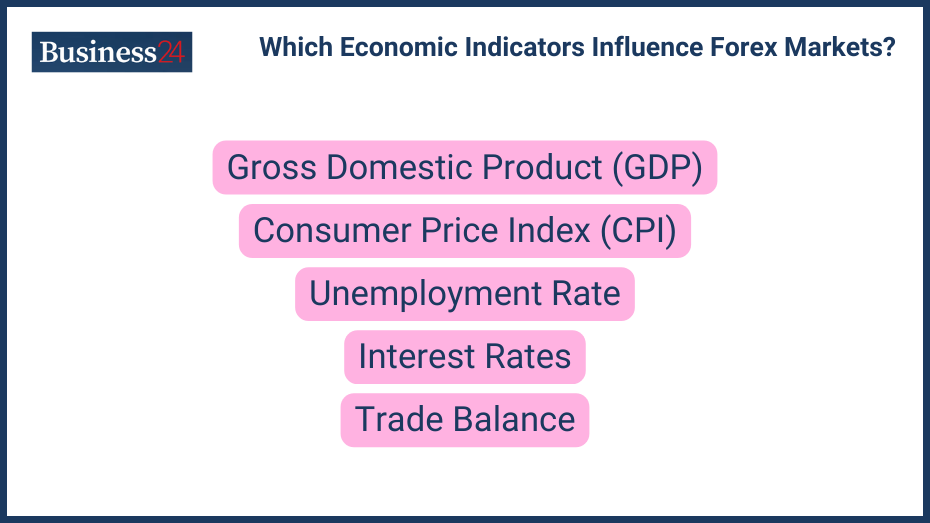

Which Economic Indicators Influence Forex Markets?

Economic indicators such as inflation rates, employment figures, and central bank decisions profoundly affect the Forex market. The centralized fiat economy revolves around these 3 major indicators. First of all, the Department of Labor prepares the rate of unemployment in the country, which is followed by the determination of the rate of inflation. The Central Bank then adjusts the interest rates after taking several economic indicators into consideration, especially the inflation rate and the unemployment statistics. If the interest rates are high, there is less capital in the markets, which creates demand for the native national currency. If the interest rates are low, there is surplus cash in the system that creates an additional supply of the currency in the markets, thus bringing its value down in its top trading pairs.

Who Are the Major Players in the Forex Market?

The Forex market includes a diverse range of players, from central banks and financial institutions to individual traders. Here are their roles:

Role of Central Banks

The central banks control the interest rates in the country. This means that they practically control the supply and demand of the national currency by lowering or increasing the rates.

Individual Traders and Their Influence

Retail traders represent the largest share of the forex market. However, the size of their transactions is relatively small. Large commercial banks and hedge funds make it difficult for retail investors to remain profitable.

Why Trade Forex?

Traders choose the Forex market for its liquidity, 24/7 trading hours, and the extensive leverage offered. Forex has the largest liquidity of any market, regularly going above $6 trillion on a daily basis. So, even with a much smaller trading margin, there is still a lot of money to be made here.

Advantages of Forex Trading

Advantages of forex trading include:

24-hour market: Even with markets closing down on the weekend, it is still the only conventional market that operates 24 hours a day. This means there is less lean time and more opportunities to make profits.

Highest Liquidity: The forex market has the highest liquidity of any market since it quite literally deals with currencies. There are significant numbers of market players and they keep the money flowing.

Two-way market: Traders can make money when a particular currency pair is moving up, down, or even remaining stuck in a narrow range.

Risks Involved in Forex Trading

Risks associated with forex trading include:

- Volatility: Forex is a volatile market overall and presents a double-edged sword for traders. On the one hand, it can be used to generate healthy profits while on the other hand, it can result in considerable losses.

- Leverage Risk: Leverage trading brings massive risks of its own as you can magnify your market position by borrowing from a broker. Even small price fluctuations can have a profound effect on your positions, even resulting in negative balance sheets.

- Scams: Forex, just like other markets is prone to all kinds of frauds and tricks like dealer scams, hidden fees, and guaranteed profits. Traders need to be aware of them.

- Skill Requirement: Forex trade is a highly skilled enterprise and traders need to have top-notch fiscal capabilities and intelligence to make it happen.

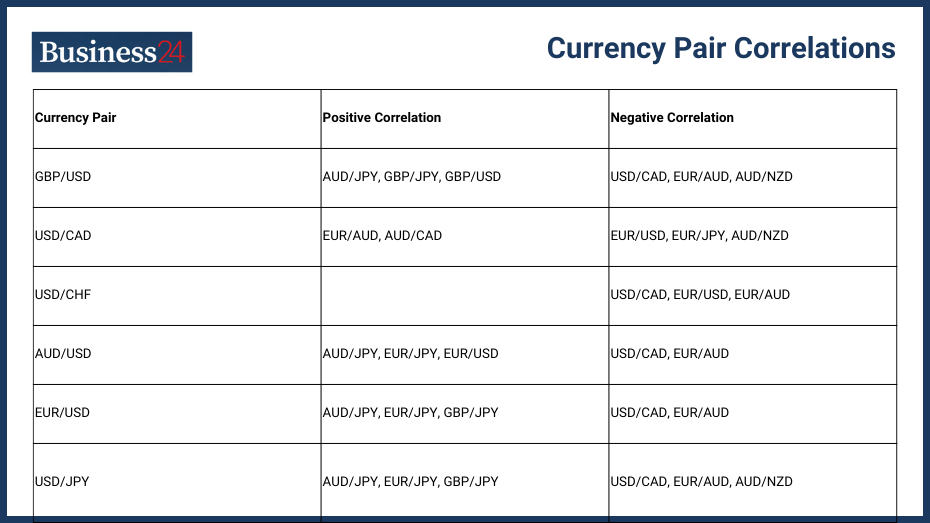

What are Currency Correlations, and How Do They Impact Trading?

| Currency Pair | Positive Correlation | Negative Correlation |

| GBP/USD | AUD/JPY, GBP/JPY, GBP/USD | USD/CAD, EUR/AUD, AUD/NZD |

| USD/CAD | EUR/AUD, AUD/CAD | EUR/USD, EUR/JPY, AUD/NZD |

| USD/CHF | USD/CAD, EUR/USD, EUR/AUD | |

| AUD/USD | AUD/JPY, EUR/JPY, EUR/USD | USD/CAD, EUR/AUD |

| EUR/USD | AUD/JPY, EUR/JPY, GBP/JPY | USD/CAD, EUR/AUD |

| USD/JPY | AUD/JPY, EUR/JPY, GBP/JPY | USD/CAD, EUR/AUD, AUD/NZD |

Understanding currency correlations helps traders manage risks and spot trading opportunities by analyzing the relationships between different currency pairs. Currency pairs can exhibit a range of correlations with each other and can even decouple depending on the market conditions.

Currency correlations include:

- +1 for perfect correlation: If one pair rises, the other follows it, and vice versa.

- -1 for perfect negative/inverse correlation: One pair moves in the opposite direction of the trend of the other.

- 0 for no correlation: This is when two currency pairs are operating completely independently of each other.

What are Key Risk Management Techniques in Forex?

Effective risk management techniques are crucial in Forex trading to protect traders from significant losses. The first is to identify the risk associated with a particular trading activity. The next step is to assess the magnitude of the risk.

- Once a risk factor has been identified and assessed, you follow these steps:

- Risk Coverage: You can transfer the risk to a third party, like an insurance company

- Risk Avoidance: You can avoid risk entirely if the potential downsides are troubling.

- Risk Mitigation: You can take steps to reduce some of the risks associated. If there is a lot of downside potential, you can use stop loss orders to mitigate the risk.

How Does Psychology Affect Forex Trading?

Psychological factors play a critical role in trading decisions, influencing how traders react to market movements and manage their trades. They include:

- Bias: Traders are most prone to confirmation bias and loss aversion. They need to trade based on data and market indicators rather than learn to take healthy risks.

- Emotional control: Traders need to keep their emotional struggles in check, or that can result in serious losses. Typical emotional challenges include fear, greed, and impulsive decision-making.

How to Get Started with Forex Trading?

Starting with Forex trading involves educating oneself on market dynamics, setting up a trading account, and developing a risk management strategy. With modern platforms, these steps have become much easier.

Before you can start trading, you need to select a forex broker.

Choosing the Right Forex Broker

Criteria for selecting a Forex broker that suits your trading style and needs.

Selecting a suitable forex broker is a crucial part of forex trading. You need to keep the following aspects in mind:

- Regulatory Approval: The forex broker needs to have full regulatory approval and shouldn’t be on the wrong side of the law in its previous dealings.

- Spread: Spread aka the difference between buying (ask) and selling (bid) needs to be adequate enough for you to make a profit.

- Trading Hour Window: While forex is a 24/7 market, brokers have limitations of their own so you need to find out which one suits you the best.

- Number of Forex Markets Available: Forex is all about worldwide trading, and there are four major markets, including Sydney, Tokyo, London, and New York. Choose the broker with the best exposure possible.

- Deposits and Withdrawal Capability and History: The broker should be able to process deposits and withdrawals effectively. Its operational history should be void of major scandals, especially when it comes to withdrawals.

Developing a Trading Plan

Forex trading requires a comprehensive trading plan with both long-term and short-term goals. While risk is an important component of forex, there should be a risk management strategy in place.

What Essential Definitions Should You Know About Forex?

What is the definition of a Currency Pair?

A currency pair is the ratio between the price of two currencies. The larger currency is generally the written first, followed by the smaller one but that is not the rule.

What is the definition of Leverage in Forex?

Leverage in forex allows investors to trade with more money than their own capital. It is a risky approach to forex trading, and brokers may allow up to 100:1 leverage.

What is the definition of a Pip?

A pip is the smallest unit to measure the spread of a trading pair between its buying and selling price. Its value is 0.0001.

What is the definition of Spread in Forex?

In forex, the spread is the numerical difference between the buying and selling price of a trading pair. It is measured in pips.

What is the definition of a Forex Broker?

A forex broker is a trader who makes money through the exchange of foreign currencies.

What is the definition of Margin in Forex?

Margin is the amount of money deposited to engage in leverage trading. You can use margin with a broker and call for a larger position.

What is the definition of a Lot in Forex trading?

When it comes to forex trading, a lot is a standardized unit of amount of currency. The standard lot has 100,000 units, Mini Lot has 10,000, Micro 1000, and Nano 100 units.

What is the definition of Technical Analysis in Forex?

Technical analysis is used by forex traders to try and predict the future price of a trading pair using past price action.

What is the definition of Fundamental Analysis in Forex?

Fundamental analysis focuses on the underlying socio-economic, political, and financial indicators to try and predict the future of a country’s currency. If a country’s economic indicators are doing well, its currency may strengthen, and fundamental analysis can help forex traders remain ahead of the curve.

What are the Most Frequently Asked Questions About Forex?

How does forex make you money?

Forex is a two-way market in which you can make money if a trading pair is going down or up. You can go long or short to make a profit or simply earn profits by pocketing the difference between the selling and buying price.

What is forex vs stocks?

Forex is the trade of currencies, while the stock market is the trade of company shares. Forex is a much bigger market than stocks, but the latter has better safeguards in place.

Is forex good for beginners?

Forex is complex and risky, so beginners need to be careful when indulging in it.

Is forex riskier than stocks?

In general terms, forex is considered riskier than stocks because of its decentralized nature and inconsistent regulations. Forex scams are difficult to prosecute as well.

How do I turn $100 into $1000 in forex?

You can use 10:1 in margin/leverage trading but it carries substantial risks. To turn a 10x profit, you need to be a professional trader who understands the market dynamics and is willing to take the risks that come with it.

Is forex gambling?

Forex is similar to gambling in some ways, like unpredictability and short-term focus, but they are very different as Forex offers real use cases by enabling businesses to operate while gambling is only a recreational, risky endeavor.

Can forex make you a millionaire?

If you work hard and make intelligent, knowledgeable decisions, you can become a millionaire or even a billionaire while trading forex.

Conclusion: Is Forex Trading Right for You?

Forex trading offers significant opportunities but requires an understanding of market factors and personal risk tolerance. The forex market is a two-way situation in which money can be made when a trading pair is moving in either direction. You go long to make money when the market is going up, and you go short when the market is going down. You pocket the difference between the buying and selling price when the market is stagnant. Forex trading operates 24/7, but its retail investment is closed during the weekend, and a major bulk of the activity occurs in four trading sessions in New York, London, Tokyo, and Sydney.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.