Page Summary

Those of you who are new to trading are probably just as unfamiliar with all the brokers out there. There is now a plethora of choices available, which unfortunately means room for fraud and other unsavory actors. There are, however, some examples of brokers that are doing things the right way, one of which is IQ Option. If this is the first time you have heard about IQ Option, then you are in the right place. Here we explain some key information to get you clued up, including what IQ Option is and how to get started with trading there. For the full review of IQ Option check this article here.

IQ Option in a Nutshell

Set up back in 2013, IQ Option is a brokerage that provides its users with a broad range of instruments to trade. These include CFDs on stocks, forex, cryptocurrencies, and CFDs on ETFs, indices, and commodities.

You only need to deposit $10 to get started, with the minimum trade set at just $1. It’s a safe place to do that too, and there is something to be said for there being safety in numbers. The platform has around 80 million registered users.

How to Get Started on IQ Option?

“RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK”

Signing up is the obvious first step. That means providing personal details including your name, address, and email address, among other data, not to mention means of identification so you pass their know-your-customer (KYC) requirements. Once you’re set up, you can take full advantage of all the services available to you.

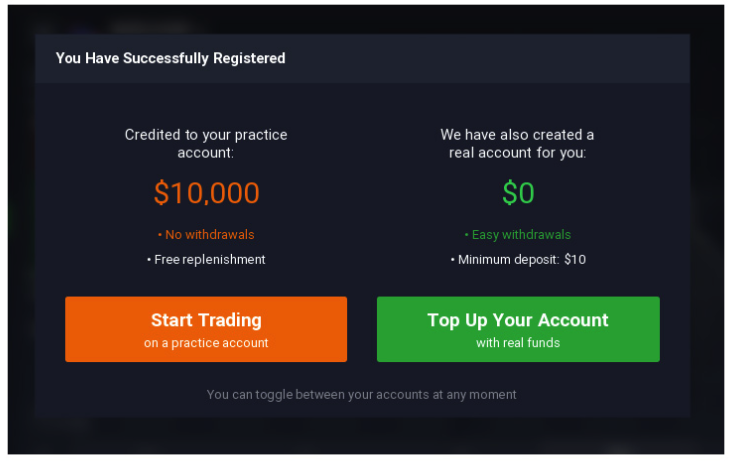

Your first port of call should be IQ Option’s demo account, so you can get used to contract-for-difference (CFD) trading if you are new to it. It is far better to get accustomed to a new platform in a safe environment where you are not putting any of your money at risk. Available on desktop or app, you get $10,000 of virtual money to trade, giving you plenty of scope to try out assets and which strategies to use.

Use the information resources available to you, starting with IQ Option’s excellent tutorial videos. They cover the following areas:

- Basics – covering FAQs about IQ Option

- Options Trading – educational content on everything you need to know

- CFD Trading – tips and tricks on how to optimize your CFD trading strategies

- Margin Trading – understand how to use margin trading safely and effectively

- Technical Analysis – how to use technical indicators when you trade

- Fundamental Analysis – explainers on how to trade using the financial calendar and news as the basis

- Market News – real-time updates on the state of the world’s stock markets

- Crypto Digest – all the latest info on what’s happening in the world of cryptocurrency

- About Us – go into more detail about what IQ Option is and its role as a multinational brand

Next, check out the IQ Option blog. With blogs published once or twice a week, there’s a steady stream of high-quality content at your fingertips. Delve into the That’s Interesting section to read articles on subjects ranging from the Black Friday effect to how to choose the best trading strategy for your needs.

Another nice section focuses on Trading Tips. Their article on trading with the Elliott Wave Theory is a great way to unravel the complexities of this method. Market analysis is provided too, with subjects touching on which tech stocks are worth checking out and the influence of the US elections on the markets, to name but a few.

How Much Money Can I Make?

Well, the most important thing to realise is that you can lose all of your money if you do not take the time to do your research and understand your risk and trading strategy. Any gains you make on trading or investment are dependent on your approach and knowledge. With so many variables in place, it is important to be comfortable with what you are doing – and that requires learning. Try to trade as much as possible in the virtual trading arena to limit the chances of you getting into the red.

General Risk Warning: “The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose”.

Check out our other articles on IQ Option to learn more.

- IQ Option vs Plus500

- IQ Option vs eToro

- IQ Option vs Expert Option

- IQ Option UAE

- IQ Option vs IG

- IQ Option vs Pepperstone

- IQ Option vs TD Ameritrade

- IQ Option vs AVAtrade

- IQ Option vs XM

- IQ Option vs IC Markets

- IQ Option vs Degiro

- IQ Option vs Axitrader

- Withdraw money from IQ Option

- Is IQ Option a scam?

- IQ Option demo account

- How to trade with IQ Option?

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.