In finance, margin is a loan provided by the broker to an investor to purchase an investment. It allows you to leverage your buying power, controlling a larger investment position with a smaller amount of your own capital. It’s a double-edged sword that can increase your gains as well as your losses.

With margin, you have to deposit a partial amount of the total investment, and the rest is lent to you by the broker.

If you have less capital but want to make bigger positions, margin can help; you just have to pay a small upfront amount. Also, due to less capital, you might miss out on potential investment opportunities; margin allows you to invest in opportunities that might otherwise be outside your budget.

What is a margin example?

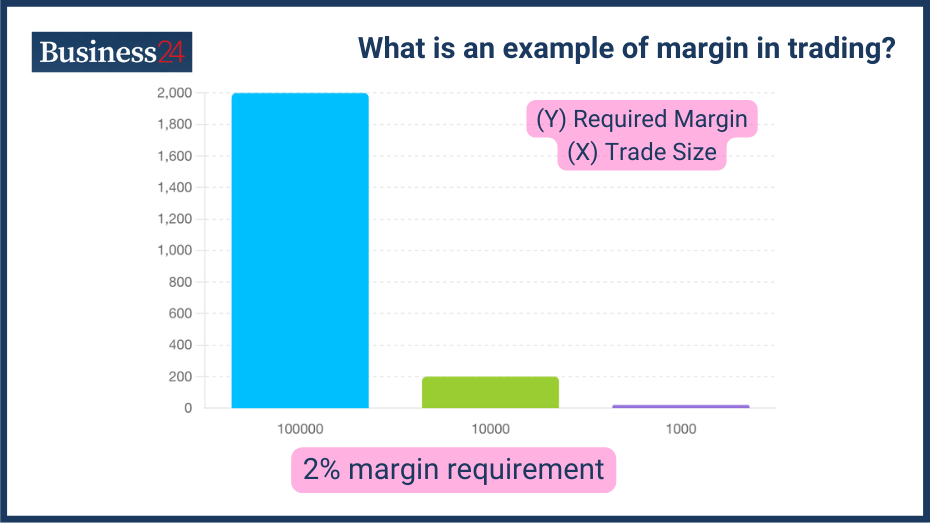

Let’s say you want to buy 100 shares of a company or any other asset trading at $100 per share. The total cost would be $10,000, but with a 25% initial margin requirement, you will have to deposit only $2,500 of your capital. The broker would lend you the remaining $5,000 to complete the purchase.

What is the History of Margin?

The history of margin dates back to the 1800s. The concept of margin trading emerged with commodity exchanges. Investors used margins to buy and sell agricultural goods like wheat and cotton. In the 20th century, Margin regulations were introduced to curb excessive speculation and prevent market crashes.

The Federal Reserve Act of 1913 established initial margin requirements for stock purchases. After technological advancements came in 2000, there was a rise in margin trading activity in the latter half of the 20th century.

Key Historical Events Affecting Margin Trading

- 1929 Stock Market Crash: The uncontrolled and excessive use of margin is often blamed for contributing to the severity of the 1929 stock market crash. This led to stricter regulations to prevent similar occurrences.

- 2008 Financial Crisis: Margin has a key role in one of the key events in the financial history of the world. The subprime mortgage crisis exposed the risks associated with excessive leverage, including in margin trading.

What is Margin Trading?

In very simple terms, a margin account lets you trade, paying a partial amount of the total amount needed to trade. You need a margin account to participate in margin trading, which differs from a standard brokerage account. Brokers typically require a minimum account value to qualify for a margin account.

Once approved, you can borrow funds to purchase various assets, including stocks, bonds, and ETFs (depending on the broker’s policy).

Steps to Open a Margin Account

- Search for a brokerage firm; different brokerage firms have different requirements and provide different features and benefits, so check everything before choosing a broker.

- Maybe you have to open a standard account first, then apply for a margin account.

- Again, different brokers have different margin requirements. Check them so you don’t face any problems later on.

- Deposit funds to meet the initial margin requirement for your desired investment. After depositing the minimum funds required, you can start trading.

Common Terms in Margin

- Initial Margin: The minimum percentage of your own capital required to be deposited upfront for a margin purchase.

- Maintenance Margin: The minimum equity level you must maintain in your margin account is expressed as a percentage of the total value of your margin position. You’ll receive a margin call if your account falls below this level.

What are the Benefits of Margin?

Increased Buying Power

Margin is one of the most important tools for an investor if used wisely and with experience. Margin will allow you to buy a larger investment position than you could not with your own capital. This can be advantageous if you believe the investment will increase in value.

Potential for Higher Returns:

Margin increases your buying power, which means that by paying a partial upfront, you can buy more; this directly increases the chances of potentially higher returns.

Margin should be used only where you are confident and have experience in the markets. You have to use margin to buy shares of a company experiencing rapid growth. The stock price increases significantly, and you can sell for a good profit, even after repaying the margin loan and interest.

What are the Risks of Margin?

This is one of the big factors or I should say the other side new investors and traders dont look at. It is true that you have the opportunity for potentially higher profits with margin but higher losses are equally possible. So, it is very important to know the risk associated with margins.

Potential for Amplified Losses

As I mentioned, there is an equal chance of higher profits and losses. If the investment price falls, your losses are magnified due to the leverage. You could even owe more than your initial investment.

Margin Calls and Their Implications

- Margin Call: You have to keep a maintenance margin on your position if you take a margin call. If the value of your margin position falls below the maintenance margin requirement, your broker will issue a margin call. You must deposit additional funds or sell some of your holdings to bring your account back above the minimum equity level. It happens more often with beginners who have less knowledge and less capital.

- Failing a Margin Call: If you do not add funds or sell some of your holdings on the issued margin call, your broker can forcibly sell your holdings to recover the loan if you fail to meet a margin call. This can result in selling your assets at a potential moment or situation where you don’t want to sell your position, which can lead to losses.

Case Studies of Margin Losses

One example of margin trade gone wrong is in 2013, when a trader named Bill experienced a significant loss, shedding $100,000 in just one day due to margin trading. Bill had taken out a substantial loan from his brokerage firm to invest in a stock known for its volatility. Unfortunately, his investments were wiped out when the stock market plummeted, and he lost everything. This situation is a cautionary tale about the risks of margin trading with unstable stocks.

What is Margin Interest?

When a broker lends you money to take a margin trade, he charges interest on them, known as margin interest. The broker charges interest on this borrowed money as long as it remains outstanding in your account. Different brokers charge different amounts, and interest rates can vary based on the brokerage and the amount borrowed.

Margin interest is calculated daily on the outstanding loan amount (debit balance) in your margin account. The interest rate is shown as an annual percentage rate (APR), but you are charged daily based on the current rate.

You can calculate the interest on your margin with the formula:

Daily Interest = (Outstanding Loan Balance x Daily Interest Rate) / 365

Interest rates for margin trading differ from one brokerage to another and are usually higher than the typical rates for loans or credit cards. Brokers might also provide tiered interest rates, meaning the more money you borrow, the lower the interest rate. You have to search for what is compatible with your margin interest, and you will also have to look at the features and benefits a broker provides.

Tax Implications of Margin Interest

Margin interest is considered a tax-deductible investment expense. You can deduct the interest paid on your tax return, potentially reducing your overall tax liability. However, you should consult with a tax advisor for specific guidance.

What are Margin Requirements?

There are set margin requirements set by the broker and the authorities and determine the minimum amount of your own capital you need to invest upfront (initial margin) for a margin purchase. The remaining amount is financed by your broker. Higher initial margin requirements indicate a safer position for the broker, as you have more “skin in the game.”

Variation by Brokerage and Asset Type:

Brokerage Differences: Different brokerages have set their own minimum margin requirements, often ranging from 50% to 75% for stocks and even higher for more volatile assets like options.

Asset Class Variations: Also, the margin provided depends on the asset you are trading or investing. Typically, stocks have lower requirements compared to options or futures contracts due to their high volatility.

Regulatory Requirements

In the UK, margin accounts are regulated by the Financial Conduct Authority (FCA), which applies several requirements for the safeguarding of investors.

- Investors must keep initial and maintenance margin requirements, which dictate the minimum percentage of equity they must maintain to open and sustain trading positions.

- If an account’s balance falls below the required level, a margin call is issued, necessitating additional funds or the closing of positions.

- The FCA also sets leverage limits, such as a maximum of 30:1 for major currency pairs and 2:1 for cryptocurrencies, to curb excessive risk.

- Additionally, brokers must keep client funds separate from company funds and provide explicit risk warnings to clients about the potential losses in margin trading.

What is the Role of Leverage in Margin Trading?

Simply put, leverage means using borrowed money to increase the possible returns from an investment with increased buying power. It helps investors to get high market exposure or asset exposure while investing less money. Essentially, leverage can increase both the potential gains and the risks of losses.

The benefit of the leverage is that it allows you to take bigger positions with small capital, which directly increases your chances of increased profit. Leverage allows you to magnify potential gains if the investment performs well.

Leverage Ratios in Margin Accounts

The leverage ratio is the extent to which you are leveraging your buying power. It’s calculated by dividing the total value of your margin position by the amount of your own capital invested.

For example, if you buy $5,000 worth of stock with a 50% initial margin requirement ($2,500 of your capital and $2,500 borrowed on margin), your leverage ratio is 2:1. This way, you can control a position twice the size of your initial investment.

What are Margin Strategies?

Conservative vs. Aggressive Margin Use

- Conservative: As a beginner, you should use margins very conservatively. Use margin strategically for a specific investment opportunity, maintaining a low leverage ratio and keeping a significant portion of your portfolio uninvested on margin.

- Aggressive: Experienced investors can use an aggressive approach. With this approach, you can use a higher leverage ratio, potentially increasing risk but also magnifying potential returns. It’s suitable only for experienced investors with a high tolerance for risk and a well-defined risk management strategy.

Risk Management Techniques

- Stop-Loss Orders: Stop-loss orders can help you from big losses while trading with margin; if you are not able to exit the trade, it can move in the opposite direction very fast, stop loss orders save you from such events.

- Position Sizing: You can blindly put all your money in a trade. Strategically allocate a small percentage of your total capital to each margin trade, typically 1-5%, depending on your risk tolerance and strategy.

- Diversification: Spread your margin investments across different asset classes and industries to control risk from any single market movement.

Using margin can be risky, but if you use it carefully, it can help diversify your investments. This means you can afford to spread your money across a wider variety of assets that might usually be too expensive, which could improve the balance between risk and reward in your portfolio.

What does a margin of 5% mean?

5% margin means you only need to pay 5% of the amount required to buy the investment, rest will be covered by your broker. For example, let’s say you are buying shares worth $1,000, with 5% margin requirement, you will only have to pay $50, and the remaining 95% will be covered by your broker.

What are the Regulatory and Market Dynamics Affecting Margin?

Margin trading is highly risky, and regulatory bodies have tight rules and regulations for their operations. Regulatory bodies like FINRA (Financial Industry Regulatory Authority) and the SEC (Securities and Exchange Commission) play a critical role in safeguarding investors and maintaining market stability by:

Setting Minimum Margin Requirements: FINRA establishes minimum initial and maintenance margin requirements for different asset classes. This helps prevent excessive leverage and potential market meltdowns.

Monitoring Brokerage Practices: Regulatory bodies look after brokerages to ensure they comply with margin regulations and protect investor interests. This includes ensuring brokers assess customer suitability for margin accounts and implement risk management procedures.

Responding to Market Volatility: Regulatory bodies can make changes in required situations; they may adjust margin requirements in response to periods of high market volatility. They can increase requirements to curb excessive speculation and protect investors during turbulent times.

Also, with the regulatory bodies, market conditions impact margin trading. During bull markets, with generally rising asset prices, brokerages may loosen margin requirements, making it easier for investors to access leverage. As markets decline, brokerages may tighten margin requirements to safeguard investors.

Final Thoughts and Recommendations

Key Takeaways

- Margin is a loan provided by a broker to purchase investment, increase buying power, and increase potential profit.

- Risk management techniques like stop-loss orders, position sizing, and diversification are essential for reducing risk.

- With different market conditions, regulatory bodies play a crucial role in establishing margin requirements and overseeing broker practices.

Expert Tips for New Margin Traders:

- Start Small: I highly recommend that, as a beginner, you start with a small portion of your capital to gain experience and understand the risks before venturing larger.

- Prioritize Risk Management: When starting small, you should also prioritize your risk management. You have to implement a robust risk management strategy that includes stop-loss orders, position sizing, and diversification.

- Educate Yourself: Education and learning from others are very important in trading, reading books and risk control from books and articles.

FAQs and Additional Resources

Q: What is the difference between a margin call and a margin violation?

A margin call is a notification from your broker that your account’s minimum required balance has fallen below the maintenance margin requirement. You must deposit additional funds or sell holdings to bring your account back into compliance.

A margin violation occurs if you fail to meet a margin call within the specified timeframe. The broker can then forcibly sell your holdings to recover the loan.

Q: Can I lose more than my initial investment with margin trading?

Yes, this is the key risk of margin trading. Leverage not only increases your potential gains but also your potential losses. If the investment price falls significantly, you could owe more than your initial investment to cover the loan.

Additional Resources:

- FINRA Margin Rules: https://www.finra.org/rules-guidance/key-topics/margin-accounts

- SEC Margin Requirements: https://www.federalreserve.gov/supervisionreg/legalinterpretations/margin_requirements_archive.htm

- Investor.gov Margin Trading Information: https://www.investor.gov/

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.