The total market value of a company’s outstanding shares and assets. Also known as “market cap.

Market capitalization, also known as market cap, is a financial metric used to determine a company’s total worth or value. It represents the total dollar market value of all the company’s outstanding shares or any other asset. In simpler terms, it’s the total amount investors will pay for all the company’s shares if they want to buy all the shares of the company at the market price.

Market Cap = Outstanding shares*market price of 1 share

Market cap plays an important role in the financial market; with market cap, you can compare different companies from different industries. Investors and analysts rely heavily on market cap to make investment decisions and assess the overall health of the company.

What does market cap tell you?

Market capitalization is the first thing an investor wants to know about the company because the size of the company is very important in investing. Market cap offers valuable insights into a company’s size, growth potential, and investor sentiment.

A higher market cap generally indicates a larger and more established company with a longer track record. These companies tend to be more stable and less volatile; however, the growth potential in most cases is capped because of their already large size.

Market cap can also suggest a company’s potential for future growth because smaller companies like a micro cap or small cap often have higher growth prospects because of their small size but also carry greater risk. Market cap reflects the collective opinion of investors about a company’s future. A rising market cap signifies investor confidence, while a declining market cap may indicate growing concerns.

What is the Calculation of Market Capitalization?

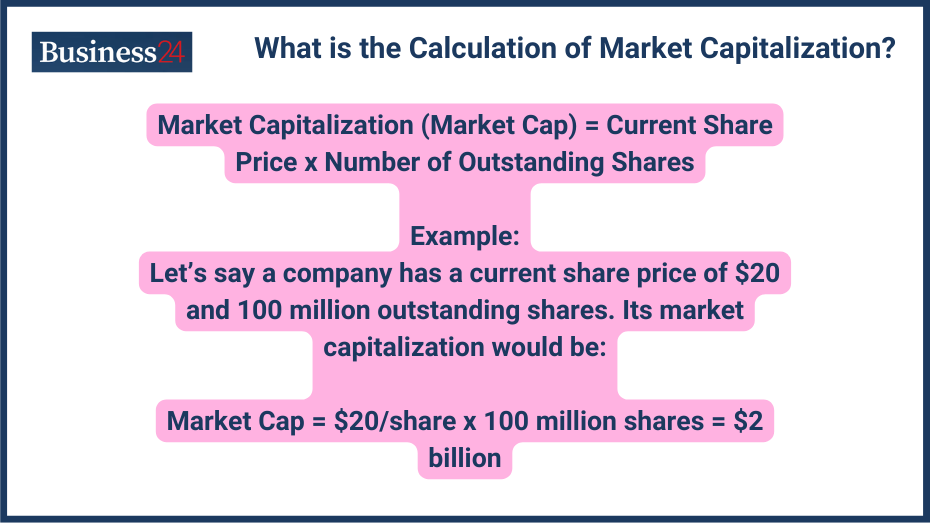

Calculating the market cap is a very simple process, not rocket science! Here’s the formula:

Market Capitalization (Market Cap) = Current Share Price x Number of Outstanding Shares

Example:

Let’s say a company has a current share price of $20 and 100 million outstanding shares. Its market capitalization would be:

Market Cap = $20/share x 100 million shares = $2 billion

Detailed Calculation Steps:

- Find the current share price of the company’s stock; you can find the price very easily on financial sites, through brokers, or on exchange.

- Determine the number of outstanding shares. You can find this in the company’s financial statements or investor relations sections of their website.

- Multiply the current share price by the number of outstanding shares to get the market capitalization.

What are the Types of Market Capitalization?

Based on the size of the company, they are categorized:

Large-Cap: Large caps are companies that are big in size exceeding $10 billion, and also well-established companies. They are stable with lower growth potential but may offer more regular benefits like dividends. Some examples of large caps are Apple, Microsoft and Amazon.

Mid-Cap: Mid cap are the companies that fall between large-cap and small-cap, with market caps ranging from $2 billion to $10 billion. They offer a less risky but balanced approach between the stability of large caps and the growth potential of small caps.

Small-Cap: Small-cap companies have market caps between $250 million and $2 billion. They offer higher growth potential but also come with greater risk due to their smaller size and potentially less established track records.

Micro-Cap: The smallest cap in the market is known as micro cap with a size less than $250 million. They carry the highest risk but also have the potential for explosive growth.

Mega-Cap: This unofficial category refers to the largest companies in the world with market caps exceeding $2 trillion.

Is a higher market cap better?

It depends on the individual; if you think you have less risk appetite and dont want much volatility, you should go for a large cap. But if you have a high risk appetite and want an investment that can show exponential growth you can choose smaller cap companies with high growth potential. The ideal market cap for you depends on your investment goals and risk tolerance.

Is the market cap the same as the price?

No, market cap and share price are not the same. The market cap represents the total value of all outstanding shares, while the share price is the price of a single share.

What are the Factors Affecting Market Capitalization?

Every movement of a share price affects the market capitalization, and there are various factors that affect the market cap of a company:

- Stock Price Movements: As I said, the price movement change is the most direct factor that affects the market cap. Fluctuations in a company’s share price will cause the market cap to rise or fall accordingly. Positive news, earnings reports, or overall market trends can trigger price movements.

- Share Issuance and Buybacks: When a company issues new shares for any reason, like dilution or anything else, it increases the number of outstanding shares, diluting the value of each individual share and lowering the market cap. Share buybacks reduce the number of outstanding shares, which can increase the value per share and boost the market cap.

- Market Sentiment and Economic Factors: Market sentiment and economic factors like bull or bear market or recession directly affect the business’s earnings which affects the market price of share affecting the market cap of a company.

What is the Role of Market Capitalization in Investing?

I’m saying it again: market cap is the first thing an investor wants to see while analyzing a company because:

- Portfolio Diversification: By market cap, you can know the size of the company, whether it is a small cap or a large cap. For a balanced portfolio, it is important to diversify in all the sizes of a company, and the market cap helps assess the size of a company.

- Risk Assessment Based on Market Cap: We can say that market cap is a general indicator of risk. Large-cap are well-established companies having a good track record so they have smaller rish but also capped growth potential. Smaller companies are the companies that are in their growth phase and have the potential to become the large cap but also carry high risk as they do not have a well-established record.

- Influence on Investment Strategies: Understanding market cap helps investors choose suitable investment strategies. Value investors might focus on undervalued companies within specific market cap segments, while growth investors might prioritize high-growth potential in smaller companies, even with the associated risk.

What are the Advantages of Understanding Market Capitalization?

Market cap offers several benefits for investors:

- Quick Valuation Method: Market cap tells the size of a company, and valuation can be determined easily by the size and profitability factors. The market cap of a company is easily available, and investors can use it to compare companies.

- Indicator of Company Size and Stability: Market cap gives a general idea of a company’s size and its position within the market. Larger market caps often indicate more established and potentially more stable companies, while smaller companies are less stable and can be risky.

- Guide for Portfolio Allocation: By considering market cap alongside other factors, investors can make decisions about how to allocate their investment capital across different company sizes and risk profiles.

What are the Limitations of Market Capitalization?

While valuable, the market cap has limitations as a standalone valuation metric:

- Not a Comprehensive Valuation Method: It is not always the case that the large-cap has less risk or is highly stable; only assessing market cap doesn’t consider factors like future growth potential, assets, or liabilities.

- Impact of Market Volatility: As I have mentioned earlier, every price tick change affects the market of a company that, in the short term, does not reflect a company’s true underlying value.

- Comparison with Other Valuation Metrics: Market cap doesn’t tell the whole story. Investors should consider other valuation metrics like price-to-earnings ratio (P/E ratio) or price-to-book ratio (P/B ratio) for a more complete picture.

What is the Impact of Market Capitalization on Company Operations?

Market cap does not impact a company’s operation much, but in some cases, it can impact the operations:

- Investor Perceptions: A high and rising market cap is a sign of an investor’s confidence, which attracts partnerships and good talents. While a declining market cap

A high market cap can signal strong investor confidence, which can attract new partnerships, talent, and positive media attention. Conversely, a declining market cap may raise concerns and potentially limit these opportunities. - Access to Capital Markets: It is easy for larger market cap companies to typically have easier access to capital through issuing stocks or bonds. This allows them to fund expansion, acquisitions, or research and development.

- Influence on Mergers and Acquisitions: Market cap plays a role in mergers and acquisitions (M&A) activity. Companies with similar market caps are often considered more compatible targets or acquirers.

What are the Historical Case Studies of Market Capitalization Changes?

You can see the changes in the market cap of many companies when they grow bigger in operations and generate profits:

Examples of Significant Market Cap Growth: Companies like Apple or Amazon have expanded their market cap exponentially with good business and higher profitability and future potentials, reflecting strong investor confidence in their long-term growth potential.

Cases of Decline and Market Repercussions: Companies facing scandals or negative events can see their market cap plummet. This can lead to financial difficulties, loss of investor confidence, and even potential bankruptcy.

What are the Comparisons Between Market Capitalization and Other Metrics?

- Market Cap vs. Enterprise Value (EV): Enterprise value is more calculation tha just calculating the company’s total equity value. Enterprise value also factors in the company’s debt, cash holdings, and other non-operating liabilities. For better analysis, you will need these calculations.

- Market Cap vs. Earnings: Market cap reflects the total market value of a company, while earnings represent the company’s net profit. A commonly used ratio, the price-to-earnings ratio (P/E ratio), compares market cap to earnings and helps assess a company’s valuation relative to its profitability.

- Market Cap vs. Revenue: Revenue represents the total income generated from sales of a company. Market cap doesn’t directly consider revenue, but some investors look at the price-to-sales ratio (P/S ratio) to compare a company’s market cap to its revenue and assess its valuation based on sales performance.

What is market cap vs net worth?

Market cap is the total worth of the company calculated by multiplying a company’s outstanding shares by the market price of a share. Meanwhile, net worth is the total value of a company’s assets minus its liabilities. Net worth represents the actual value of a company, taking into account everything it owns and owes; net worth is total assets minus total liabilities.

Final Thoughts and Recommendations

Key Takeaways

- Market capitalization is a fundamental metric used to know a company’s total worth calculated by outstanding shares multiplied by one share’s market price.

- Market cap helps assess company size, growth potential, and investor sentiment.

- Understanding market cap is crucial for portfolio diversification, risk assessment, and investment strategy formulation.

Expert Advice for Investors:

- Investors can use the market cap as a starting point for company comparison and initial valuation assessment.

- Only market cap is not sufficient for analysis; look for other financial metrics and conduct thorough research before making investment decisions.

- You can diversify your portfolio across different market cap segments to manage risk.

FAQs and Additional Resources:

Q: What is a good market cap to invest in?

A: There’s no single answer to the question of market cap for investment! It depends upon the individual’s goals and risk appetite. Large-cap companies offer stability, while smaller companies offer growth potential with higher risk.

Q: How does the stock market affect the market cap?

A: In good market conditions, stock prices rise, which directly increases the market cap. Rising markets often lead to rising market caps, while downturns can cause them to decline.

Q: Where can I find market cap information?

A: It is very easy to find market cap information; you can find it on financial websites, stock exchanges, and company filings.

Disclaimer

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto assets are complex and carry a high risk of volatility and loss. Trading or investing in crypto assets may not be suitable for all investors. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.